Market Definition

The market encompasses devices designed to detect and distinguish complex odors or volatile compounds through sensor arrays and pattern recognition systems that mimic the human olfactory process.

The electronic nose plays a vital role across sectors such as food and beverage, pharmaceuticals, and wastewater treatment and is used extensively in quality control, spoilage detection, and environmental monitoring.

Their applications also extend to medical diagnostics for breath analysis and detecting hazardous gases in industrial settings. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Electronic Nose Market Overview

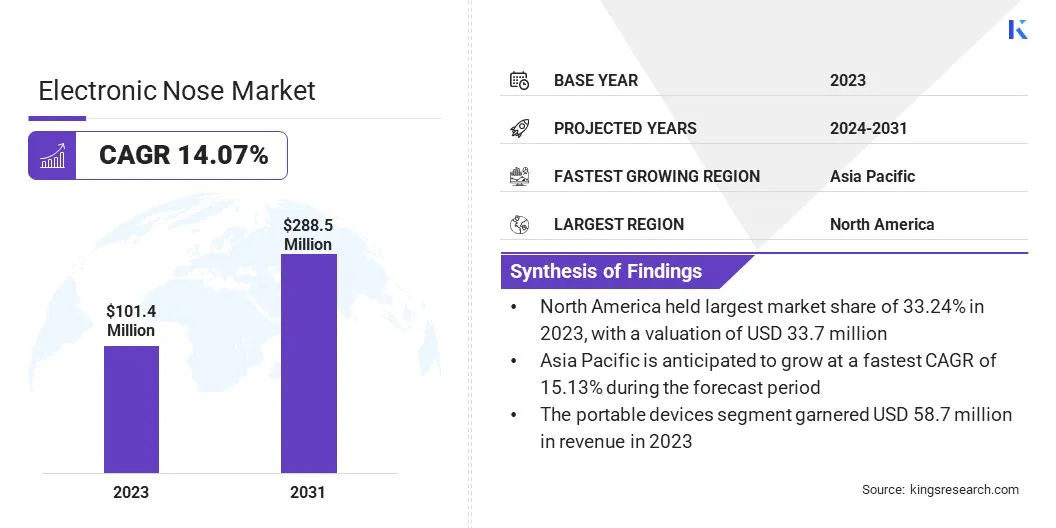

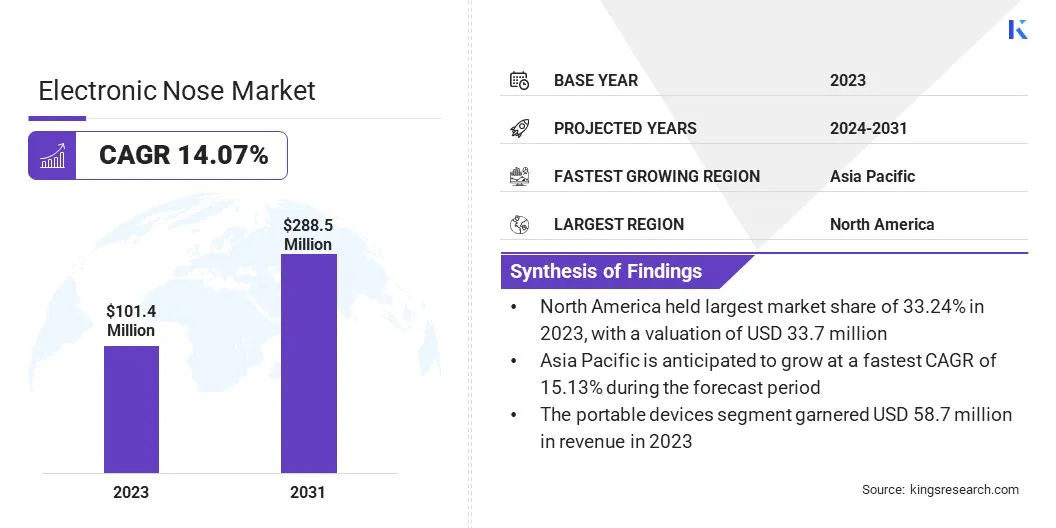

The global electronic nose market size was valued at USD 101.4 million in 2023 and is projected to grow from USD 114.8 million in 2024 to USD 288.5 million by 2031, exhibiting a CAGR of 14.07% during the forecast period.

The market is witnessing steady growth driven by its expanding use in medical diagnostics for non-invasive testing, allowing early disease detection through breath analysis.

Additionally, technological advancements in miniaturization are enhancing portability and integration, enabling broader application across sectors such as healthcare, food safety, and environmental monitoring.

Major companies operating in the electronic nose industry are Alpha MOS, Sensigent LLC, Aryballe, AerNos, RoboScientific, AWSensors, Electronic Sensor Technology, Plasmion GmbH, Envirosuite, The eNose Company, Brechbuehler, Odotech, Comon Invent B.V, Airsense, and Scensive Technology.

The ability of electronic nose systems to selectively detect specific chemical compounds is significantly influencing their adoption across targeted applications. Modern electronic noses use sensor arrays and pattern recognition algorithms to differentiate between structurally similar volatile organic compounds (VOCs) with high precision.

This selectivity is particularly valuable in sectors such as pharmaceuticals, where distinguishing between active ingredients and contaminants is critical, and in environmental monitoring, where trace-level detection of pollutants is required.

As industries demand more refined and application-specific analytical tools, selective chemical detection continues to be a key growth driver in the electronic nose market.

- In May 2024, a research team led by Dmitry Rinberg at New York University Langone Health introduced a bio-electronic nose. This technology harnesses the sensory precision of the mammalian olfactory system without relying on behavioral responses. The bio-electronic nose delivers highly sensitive and selective chemical detection by directly decoding olfactory signals from the brain. Leveraging machine learning algorithms, the team developed a robust chemical sensing platform using a grid electrode array implanted on the surface of the mouse olfactory bulb. This setup enables continuous monitoring of neural responses to a broad spectrum of odorants and mixtures across different concentrations.

Key Highlights

- The electronic nose industry size was recorded at USD 101.4 million in 2023.

- The market is projected to grow at a CAGR of 14.07% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 33.7 million.

- The portable devices segment garnered USD 58.7 million in revenue in 2023.

- The food & beverages segment is expected to reach USD 78.9 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 15.13% during the forecast period.

Market Driver

"Expanding Use in Medical Diagnostics for Non-Invasive Testing"

The electronic nose market is gaining traction in the healthcare sector due to its growing application in non-invasive disease diagnostics. Electronic noses are being integrated into clinical workflows for detecting respiratory and metabolic conditions through breath analysis.

Their precision in identifying disease-specific biomarkers without invasive procedures improves early detection and monitoring capabilities.

- In August 2024, researchers at the Memorial Sloan Kettering Cancer Center (USA) reported compelling results demonstrating the clinical potential of electronic nose technology in early-stage lung cancer diagnostics. The study evaluated the diagnostic performance of the E-nose in identifying clinical stage I lung cancer and assessed its potential clinical relevance.

Market Challenge

"Standardization and Calibration Complexity"

A significant challenge hindering the growth of the electronic nose market is the lack of standardized calibration protocols across different applications and environments. Variations in humidity, temperature, and background odors can affect sensor accuracy, limiting widespread adoption in sensitive fields like healthcare and food safety.

To address this, companies are investing in adaptive calibration technologies and advanced machine learning algorithms that can dynamically adjust sensor responses based on environmental changes.

Additionally, collaboration with regulatory bodies and research institutions is helping establish consistent testing frameworks and validation standards, thereby enhancing reliability and facilitating broader market acceptance.

Market Trend

"Technological Advancement in Miniaturization"

The trend of miniaturization is reshaping the electronic nose market by enabling the development of compact, portable, and wearable devices without compromising performance.

Advances in microelectromechanical systems (MEMS), nanotechnology, and sensor integration have allowed manufacturers to reduce the size and power consumption of electronic nose systems.

This has expanded their usability in field-based applications such as mobile health diagnostics, environmental sensing, and portable quality inspection in food supply chains.

- In November 2024, researchers from the University of Hertfordshire, University College London, the Francis Crick Institute, and Western Sydney University collaborated to develop an exceptionally fast and compact electronic nose. The device is capable of detecting odors within just tens of milliseconds and tracking rapid odor fluctuations at speeds comparable to those observed in mice. Its high-speed performance opens the door for integration into robot-assisted monitoring applications, particularly in industrial and environmental contexts where swift and accurate odor detection is essential.

Electronic Nose Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Embedded Sensors, Portable Devices

|

|

By End User

|

Food & Beverages, Military & Defense, Healthcare, Environmental Monitoring, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Embedded Sensors, Portable Devices): The portable devices segment earned USD 42.7 million in 2023 due to their compact design, ease of use, and increasing demand for real-time, on-site analysis across industries such as food safety, healthcare, and environmental monitoring.

- By End User (Food & Beverages, Military & Defense, Healthcare, and Environmental Monitoring, Others): The food & beverages segment held 27.30% in 2023, due to its critical need for rapid, reliable, and non-invasive quality control and adulteration detection, ensuring product consistency and safety across the industry.

Electronic Nose Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America electronic nose market share stood around 33.24% in 2023 in the global market, with a valuation of USD 33.7 million. The market in North America is being propelled by increasing collaboration between top-tier medical institutions and multidisciplinary research centers focused on advancing diagnostic technologies.

These partnerships are driving the development of non-invasive sensing systems capable of analyzing exhaled breath to identify early-stage disease biomarkers. Research programs supported by federal grants are prioritizing projects that integrate machine learning with bio-sensing technologies, aiming to reduce diagnostic timelines and improve clinical accuracy.

- In February 2024, the U.S. National Science Foundation (NSF), through its Convergence Accelerator Program, granted USD 650,000 to the University of Notre Dame to advance the development of a next-generation electronic nose. Designed to serve as a proactive tool in global health defense, this innovative technology is intended to complement existing disease surveillance and prevention strategies by enabling real-time detection and monitoring of pathogens.

Asia Pacific electronic nose industry is poised for significant growth at a robust CAGR of 15.13% over the forecast period. The fast-growing processed food industry in Asia Pacific is increasingly integrating electronic nose systems for swift quality verification during production and packaging.

With regional demand for packaged goods rising, manufacturers are employing E-noses to conduct real-time aroma profiling, freshness testing, and spoilage detection. Sectors like dairy, seafood, and spice processing are actively adopting E-noses, as traditional testing methods are often too slow or inconsistent, thereby driving market growth.

- In October 2024, an IIT Kanpur-incubated startup, E-Sniff Private Limited, unveiled an electronic nose device capable of detecting adulteration in everyday food items such as ghee, oil, and spices in under 10 seconds. During its trial phase, the device demonstrated high accuracy, showcasing its potential for rapid and reliable food quality assessment.

Furthermore, agri-tech companies and research institutions are exploring the use of E-nose technology to detect early signs of disease or spoilage, optimize harvesting cycles, and monitor post-harvest storage conditions.

This trend is particularly significant in countries such as the Philippines, Indonesia, and Vietnam focusing on high-value crops and export-oriented agricultural production.

Regulatory Frameworks

- In the U.S., electronic nose devices used in environmental monitoring must comply with standards set by the Environmental Protection Agency (EPA), particularly concerning air quality and emissions. In healthcare applications, E-noses intended for diagnostic purposes would fall under the purview of the Food and Drug Administration (FDA) regulations for medical devices.

Competitive Landscape

Leading companies in the electronic nose industry are increasingly focusing on advanced R&D and forming strategic collaborations with government bodies and academic research centers to strengthen their technological capabilities.

These partnerships are facilitating breakthroughs in precision sensing, enabling devices to identify complex chemical compositions with enhanced speed and accuracy.

Such advancements are especially relevant for sectors like food quality control, industrial safety, and disease diagnostics, where real-time monitoring and early detection are critical.

These collaborative efforts also support regulatory alignment and validation through publicly funded trials and pilot programs, ultimately accelerating market adoption and expanding the role of E-nose technologies across high-impact use cases.

List of Key Companies in Electronic Nose Market:

- Alpha MOS

- Sensigent LLC

- Aryballe

- AerNos

- RoboScientific

- AWSensors

- Electronic Sensor Technology

- Plasmion GmbH

- Envirosuite

- The eNose Company

- Brechbuehler

- Odotech

- Comon Invent B.V

- Airsense

- Scensive Technology

Recent Developments (Product Launch)

- In January 2025, Ainos, Inc. introduced its groundbreaking AI Nose technology designed for integration into robotics. By enabling robots to detect and interpret scents, the AI Nose significantly enhances robotic interaction with real-world environments. This advancement opens up new possibilities for robotics applications across industrial, healthcare, and daily use settings, redefining sensory capabilities and expanding functional versatility.

- In August 2024, Alpha MOS showcased its advanced sensory analysis solutions at the AIFST24 convention, organized by the Australian Institute of Food Science and Technology. This included the HERACLES electronic nose, ASTREE electronic tongue, and IRIS electronic eye. These instruments are designed to enhance product quality and consumer satisfaction by providing precise odor, taste, and visual analyses.