Market Definition

The market involves the development, production, and utilization of adhesives capable of conducting electricity. These specialized materials are used primarily in sectors such as electronics, automotive, aerospace, and renewable energy sectors.

ECAs enable the formation of electrical connections between components in electronic systems and devices, serving as an alternative to traditional soldering techniques.

Electrically Conductive Adhesives Market Overview

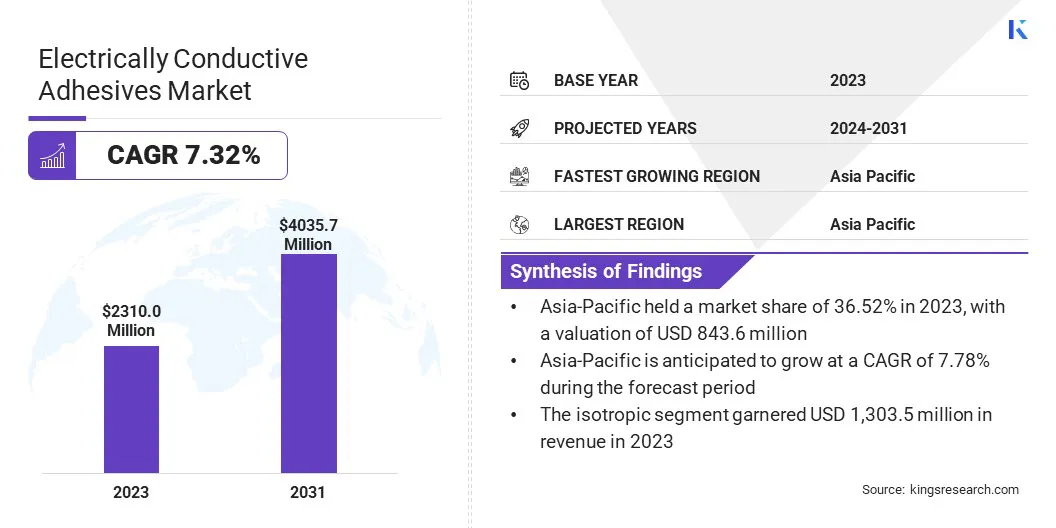

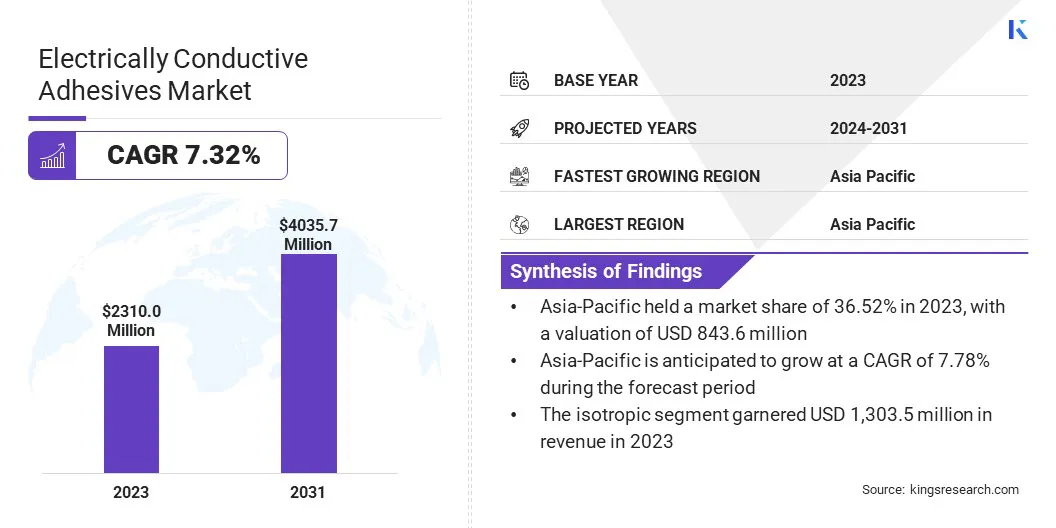

The global electrically conductive adhesives market size was valued at USD 2,310.0 million in 2023 and is projected to grow from USD 2,461.3 million in 2024 to USD 4,035.7 million by 2031, at a CAGR of 7.32% during the forecast period.

This market is driven by the increasing demand for advanced, miniaturized, and flexible electronic devices, and the need for eco-friendly and reliable alternatives to conventional soldering.

Key applications include printed circuit boards (PCBs), semiconductor packaging, solar panels, and electric vehicles (EVs), where ECAs offer significant advantages such as lower processing temperatures, material flexibility, and compatibility with heat-sensitive components.

Major companies operating in the electrically conductive adhesives industry are 3M, Henkel AG & Co. KGaA, Master Bond Inc., H.B. Fuller Company, Aremco, MG Chemicals, Permabond LLC, Polytec PT GmbH Polymere Technologien, Creative Materials, ResinLab LLC, Nordson Corporation, EpoxySet, Inc., Panacol-Elosol GmbH, Parker Hannifin Corp, and Dow.

The market is supported by increasing adoption of wearable electronics, the rollout of 5G infrastructure, and expanding EV production. These trends, coupled with ongoing innovation, are expected to support sustained growth across the forecast period.

- In March 2024, Creative Materials launched a new line of electrically conductive die attach adhesives for semiconductor applications. These adhesives are engineered to offer enhanced electrical conductivity and thermal stability making them ideal for high-performance semiconductors.

Key Highlights

- The electrically conductive adhesives industry size was recorded at USD 2,310.0 million in 2023.

- The market is projected to grow at a CAGR of 7.32% from 2024 to 2031.

- Asia-Pacific held a market share of 36.52% in 2023, with a valuation of USD 843.6 million.

- The isotropic segment garnered USD 1,303.5 million in revenue in 2023.

- The silver fillers segment is expected to reach USD 1,759.7 million by 2031.

- The automotive segment is anticipated to witness the highest CAGR of 8.23% during the forecast period

- The market in Europe is anticipated to grow at a CAGR of 7.62% during the forecast period.

Market Driver

Miniaturization of Electronics

As consumer electronics, industrial devices, and communication technologies become increasingly compact the need for smaller, more efficient, and reliable components grow The trend toward smaller and more efficient electronic devices across consumer, industrial, and communication sectors is driving the demand for compact and reliable components.

Traditional soldering methods, which involve high temperatures and larger assembly requirements are not well-suited for these miniaturized electronic designs. Electrically conductive adhesives offer a practical alternative by enabling precise electrical connections without the need for heat or large amounts of space.

These adhesives support the development of smaller, more intricate devices while maintaining consistent electrical conductivity and reliable performance. By adopting ECAs, manufacturers can reduce the size of the components, create more complex circuit layouts, and integrate multiple functionalities within limited space without compromising the quality of the electrical connections.

- In June 2024, Protavic International announced the launch of its new electrically conductive adhesive, PROTAVIC ACE 10720, designed for interconnecting photovoltaic cells in next-generation solar panels.

Market Challenge

Limited Conductivity Performance

One of the primary challenges in the electrically conductive adhesives market is the limitation in conductivity performance compared to traditional soldering, particularly in high-power or high-frequency applications.

While electrically conductive adhesives are designed to offer electrical conductivity, the conductive fillers used, such as silver or carbon-based materials may not consistently achieve the same efficiency or conductivity levels as metals used in conventional soldering.

In some instances, the dispersion of conductive fillers within the adhesive may lead to uneven conductivity or resistance over time, especially under stress or in miniaturized components where high precision is required.

To address these challenges, key players rare using conductive fillers such as silver, copper, or graphene to improve conductivity. Ensuring uniform distribution of these fillers within the adhesive is critical for improving overall electrical performance. Increasing the filler content can further boost conductivity, while maintaining the balance with adhesive viscosity and strength.

Additionally, hybrid systems that combine multiple types of fillers are being utilized to achieve superior results. Advanced curing techniques such as heat or UV post-curing, are being adopted to strengthen the filler bonding and enhancing electrical pathways, thereby improving conductivity.

Market Trend

Rising Adoption in 5G and High-Frequency Applications

The growing deployment of of 5G technology and the demand for high-frequency applications are key factors driving the growth of the electrically conductive adhesives market. As 5G infrastructure continue to expand globally, there is an increasing need for advanced materials capable of meeting the performance requirements for base stations, antennas, and communication modules.

Electrically conductive adhesives are increasingly used in these applications due to their ability to provide reliable electrical connections while maintaining the integrity of high-frequency signals. These adhesives offer a stable and consistent conductive pathway, which minimizes resistance and supports the efficient transmission of signals.

Electrically Conductive Adhesives Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Isotropic, Anisotropic

|

|

By Filler Material

|

Silver Fillers, Copper Fillers, Carbon Fillers

|

|

By Application

|

Consumer Electronics, Automotive, Aerospace, Others (Medical Devices, Renewable Energy)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Isotropic, Anisotropic): The isotropic segment earned USD 1,303.5 million in 2023 due to its widespread use in general-purpose electronic applications requiring uniform conductivity in all directions.

- By Filler Material (Silver Fillers, Copper Fillers, Carbon Fillers): The silver fillers segment held 43.12% of the market in 2023, due to silver's high conductivity, excellent thermal properties, and reliability in critical electronic applications.

- By Application (Consumer Electronics, Automotive, Aerospace, Others (Medical Devices, Renewable Energy)): The consumer electronics segment is projected to reach USD 1,568.5 million by 2031, owing to the increasing demand for smaller, more efficient, and reliable electronic devices, including smartphones, wearables, and IoT products.

Electrically Conductive Adhesives Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific electrically conductive adhesives market share stood around 36.52% in 2023 in the global market, with a valuation of USD 843.6 million. Asia Pacific’s dominance in the market is attributed to the strong presence of leading electronics manufacturers in China, Japan, and South Korea.

Rapid industrialization, a robust consumer electronics sector, and substantial investments in the automotive and renewable energy industries further support market growth.

The electrically conductive adhesives industry in Europe is projected to witness significant growth with a CAGR of 7.62% over the forecast period. This growth is supported by the region's increasing focus on technological advancements and innovation across industries.

Manufacturers in Europe are increasingly adopting electrically conductive adhesives to meet the growing demand for compact, reliable, and energy-efficient electronic devices. Smart manufacturing and automation are expanding rapidly across industries such as electronics, automotive, and telecommunication.

This growth is driving adoption of electrically conductive adhesives in applications such as circuit board assembly and semiconductor packaging. Additionally, strict regulations in the European Union regarding hazardous materials and electronic waste are pushing manufacturers to adopt environment friendly alternatives.

ECAs, which are free from harmful substances such as in or lead, are gaining traction as a compliant and sustainable solution. This trend is further accelerating their adoption across the region.

- In May 2023,Lohmann GmbH & Co. KG announced the launch of two new electrically conductive, single-sided adhesive foams: DuploCOLL® 28502 EC and DuploCOLL® 28504 EC. These products are designed for simple grounding or contacting of electronic components in applications such as e-mobility, medical technology, printed electronics, and smart homes.

Regulatory Frameworks

- The IPC (Institute for Printed Circuits) regulates the IPC-2221A standard, which sets requirements for PCB design and manufacturing ensuring they meet performance, reliability, and sustainability standards.

- The IEC (International Electro Technical Commission) regulates the IEC TS 62788-8-1:2024 standard, which provides guidelines for the use of electrically conductive adhesives in photovoltaic modules, ensuring they meet specific performance and reliability criteria for energy efficiency and durability in solar applications.

- The European Union regulates the Restriction of Hazardous Substances in Electrical and Electronic Equipment (RoHS) Directive (2011/65/EU), which restricts the use of hazardous substances in electrical and electronic equipment.

Competitive Landscape

The competitive landscape of the electrically conductive adhesives market is highly fragmented, with several global and regional players competing for market share. Key manufacturers focus on product innovation, aiming to enhance conductivity, thermal stability to meet the diverse demands of various industries.

Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their product offerings and geographic presence. The rise of automation in manufacturing processes is driving competition, as companies aim to reduce production costs while maintaining high-quality standards.

- In September 2024, Panacol introduced Elecolit 3648, a newly developed conductive adhesive designed to support advancements in perovskite-based and organic photovoltaic (OPV) cells. Elecolit 3648 addresses one of the key challenges in the commercialization and long-term reliability of organic solar cells by providing durable, flexible electrical connections.

List of Key Companies in Electrically Conductive Adhesives Market:

- 3M

- Henkel AG & Co. KGaA

- Master Bond Inc.

- B. Fuller Company

- Aremco

- MG Chemicals

- Permabond LLC

- Polytec PT GmbH Polymere Technologien

- Creative Materials

- ResinLab LLC

- Nordson Corporation

- EpoxySet, Inc.

- Panacol-Elosol GmbH

- Parker Hannifin Corp

- Dow

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In October 2024, Creative Materials Inc. introduced two new component, electrically conductive semiconductor die-attach adhesives: 110-19(SD) and 129-50LS-2. These products serve as reliable alternatives to discontinued legacy polyimide conductive adhesives, offering enhanced performance and superior durability.

- In October 2023, DuPont unveiled the Liveo™ Soft Skin Conductive Tape 1-3150, a silicone-based thermoset adhesive developed for electrical biosignal sensing and transmission. This advanced tape functions as a dry electrode for biosignal monitoring, allowing for extended patient monitoring while ensuring consistent data quality and improved comfort.

- In September 2023, DuPont officially opened its new adhesives production facility in Zhangjiagang, East China. The facility is designed to produce adhesives to support the transportation industry, particularly for lightweighting and the rapidly growing vehicle electrification sector.