Market Definition

The market includes systems that use electrical cables to maintain or increase the temperatures of pipes, tanks, and other equipment. These systems comprise heating cables, sensors, control units, and insulation materials that work together to prevent freezing and maintain process temperatures.

Applications of electric heat tracing span across industries oil and gas, chemicals, food and beverage, and pharmaceuticals industries, where precise temperature control is crucial.

Electric heat tracing ensures fluid viscosity, prevents blockages, and supports safe operations in cold environments. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Electric Heat Tracing Market Overview

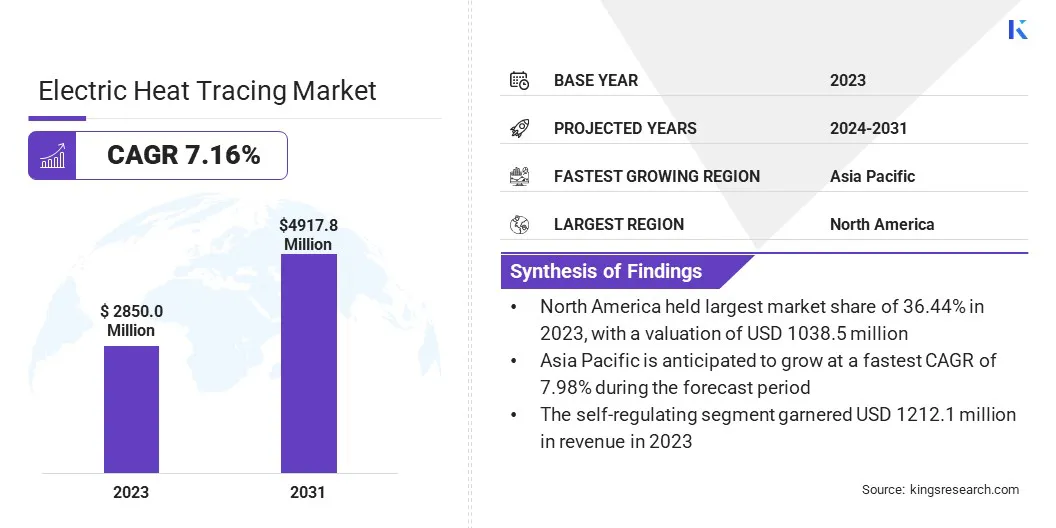

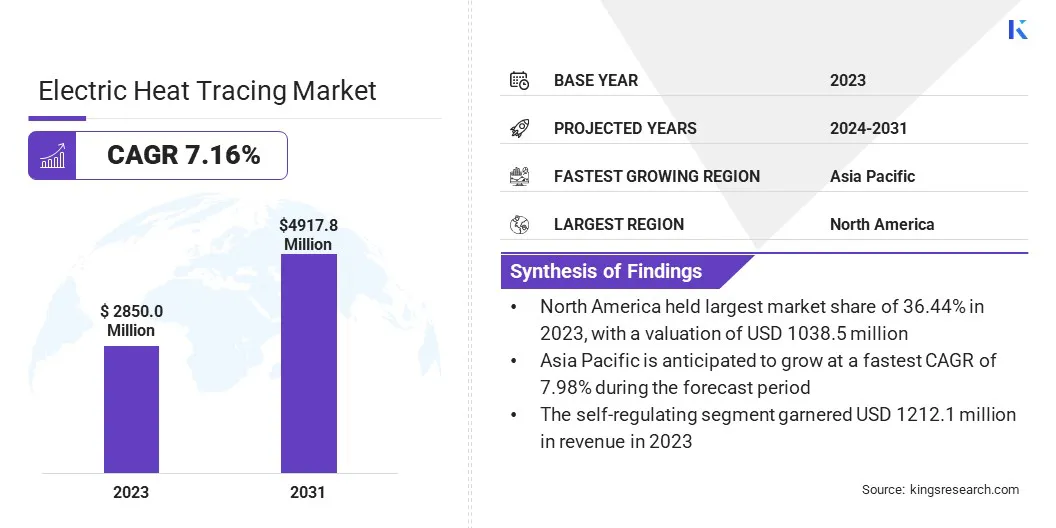

The global electric heat tracing market size was valued at USD 2,850.0 million in 2023 and is projected to grow from USD 3,030.1 million in 2024 to USD 4,917.8 million by 2031, exhibiting a CAGR of 7.16% during the forecast period.

The expansion of oil and gas infrastructure is a key factor driving the growth of the market, as these industries require reliable systems for temperature maintenance and freeze protection. Advancements in self-regulating heating technologies are further enhancing product efficiency, boosting market demand, and providing long-term solutions.

Major companies operating in the electric heat tracing industry are nVent Electric plc, Thermon Inc., Spirax Group plc, NIBE Element Group, BARTEC GmbH, Danfoss A/S, eltherm GmbH, Emerson Electric Co., Drexan Energy Systems, Inc., Heat Trace Products, LLC, Heatizon Systems, SST Group, Urecon Ltd., Heat Tracing Systems and Tempco Electric Heater Corporation.

The market is benefiting from its growing role in renewable energy applications, including bioenergy, solar thermal systems, and geothermal plants. In biofuel production, tracing systems help in maintaining consistent temperatures in processing lines and storage tanks to avoid viscosity-related issues.

In solar thermal applications, heat tracing is applied to prevent freezing in fluid transfer systems. As the clean energy sector continues to grow, electric heat tracing is being integrated into new energy infrastructure projects globally.

Key Highlights:

- The electric heat tracing market size was valued at USD 2,850.0 million in 2023.

- The market is projected to grow at a CAGR of 7.16% from 2024 to 2031.

- North America held a market share of 36.44% in 2023, with a valuation of USD 1,038.5 million.

- The Self-Regulating segment garnered USD 1,212.1 million in revenue in 2023.

- The Freeze Protection & Process Temperature Maintenance segment is expected to reach USD 2,375.8 million by 2031.

- The Oil & Gas segment secured the largest revenue share of 31.28% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 7.98% during the forecast period.

Market Driver

Expansion of Oil and Gas Infrastructure

The expansion of oil and gas infrastructure, particularly in North America and the Middle East, requires reliable temperature maintenance solutions. Electric heat tracing systems are essential for preventing freezing and ensuring optimal flow in pipelines, especially in harsh climates.

Their ability to provide consistent and controllable heat makes them necessary for upstream and downstream operations, contributing to the growth of the market.

- As reported by Global Energy Monitor in 2023, around 69,700 kilometers of gas transmission pipelines are under construction worldwide, marking an 18% rise from 2022, with an estimated investment of USD 193.9 billion.

Market Challenge

High Initial Installation Costs

A significant challenge for the electric heat tracing market is the high initial installation costs, which can deter companies from investing in these systems. The expense associated with the equipment and installation process often makes businesses hesitant to adopt electric heat tracing, especially in industries with tight budgets.

To address this, companies are focusing on offering cost-effective solutions, including energy-efficient products that help reduce long-term operational costs. Additionally, advancements in technology are enhancing the reliability and durability of heat tracing systems, offering customers better value and encouraging wider adoption despite initial financial barriers.

Market Trend

Advancements in Self-Regulating Heating Technologies

Recent advancements in self-regulating heating technologies have enhanced the efficiency and safety of electric heat tracing systems. These systems adjust their heat output based on the ambient temperature, which reduces energy consumption and minimizes the risk of overheating. Such innovations make electric heat tracing appealing to industries seeking energy-efficient solutions.

- In November 2023, Thermon unveiled new advancements in thermal technology by introducing 400 and 480 Vac options for its high-performance HTSX self-regulating electric heat tracing product line. These upgrades offer over a 70% increase in voltage rating, expanding the range of applications for this technology. Additionally, circuit lengths have been extended by up to 110%, enabling more efficient plant designs and significantly optimizing total installed and maintenance costs for customers.

Electric Heat Tracing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Self-Regulating, Constant Wattage, Mineral-Insulated

|

|

By Application

|

Freeze Protection & Process Temperature Maintenance, Roof & Guttering De-icing, Floor Heating

|

|

By End-use Industry

|

Oil & Gas, Chemical, Power & Energy, Food & Beverage, Pharmaceutical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Self-Regulating, Constant Wattage, Mineral-Insulated): The self-regulating segment earned USD 1,212.1 million in 2023 owing to its ability to automatically adjust heat output based on temperature changes.

- By Application (Freeze Protection & Process Temperature Maintenance, Roof & Guttering De-icing, Floor Heating): The freeze protection & process temperature maintenance segment held 47.44% of the market in 2023, because of its critical role in preventing damage to pipelines and equipment in oil & gas, and chemicals industries.

- By End-use Industry (Oil & Gas, Chemical, Power & Energy, Food & Beverage, Pharmaceutical, Others): The oil & gas segment is projected to reach USD 1,646.9 million by 2031, owing to its consistent demand for temperature maintenance and freeze protection across extensive pipeline networks and processing facilities.

Electric Heat Tracing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America electric heat tracing market share stood at around 36.44% in 2023 in the global market, with a valuation of USD 1,038.5 million. The ongoing expansion of shale extraction projects across North America is significantly contributing to the growth of the market.

For instance, JAPEX (U.S.) Corp. (JUS) invested around USD 500 million between 2022 and 2024 to expand its tight (shale) oil assets in the southern United States. JUS has secured wellbore interests in tight oil projects within the Eagle Ford formation in southern Texas and plans to acquire additional wellbore interests in the Eagle Ford formation and the Woodford formation in southern Oklahoma.

The Government of Canada emphasizes that the development of shale and tight resources has reshaped energy markets across North America, creating substantial economic opportunities. Advancements in technology, along with greater efficiency in horizontal drilling and multi-stage hydraulic fracturing, are enabling access to extensive unconventional shale and tight hydrocarbon reserves throughout the region.

Shale production involves complex pipeline networks and fluid processing systems that require constant temperature maintenance to avoid freezing or blockages. With major investments in midstream and upstream operations, electric heat tracing is being increasingly adopted to enhance flow assurance, minimize shutdowns, and maintain safety across production sites operating in low-temperature environments.

The Asia Pacific market is poised for significant growth at a robust CAGR of 7.98% over the forecast period. The rapid growth of industrial and petrochemical sectors across the region significantly drives the electric heat tracing industry.

With the construction of large-scale chemical plants, refineries, and gas processing facilities, there is an increasing need for heat tracing solutions to ensure safe operation in extreme conditions. Furthermore, Asia-Pacific's commitment to renewable energy projects, including solar thermal, wind, and geothermal power, is contributing to the growth of the market.

Regulatory Frameworks

- In the U.S., electric heat tracing systems must comply with the National Electrical Code (NEC), specifically Article 427, which addresses installation requirements necessary for safety, grounding, and protection. UL standards (UL 515A and UL 515B) regulate product safety, ensuring that heat tracing systems meet safety and performance criterias for both hazardous and non-hazardous environments.

- The British Standard BS 7671 governs the installation of electric heat tracing systems in the UK, ensuring safe operation in diverse environments. For systems in hazardous zones, the EN 60079-14 standard deals with electrical equipment for explosive atmospheres and ensures compliance with stringent safety measures, particularly for industries like oil and gas.

- China’s electric heat tracing industry is governed by GB/T 16895.1-2015, which outlines the general requirements for the design, installation, and testing of heat tracing systems. Products must also meet the CCC Certification standards to ensure that heat tracing products are safe for use in industrial and commercial settings, adhering to national safety norms.

- In Japan, the JIS C 8303 standard specifies performance requirements for electric heat tracing cables. Additionally, products must comply with the Electrical Appliance and Material Safety Law (DENAN), which ensures that electrical equipment, including heat tracing systems, comply with safety and quality standards for both industrial and residential applications.

Competitive Landscape

Market players are increasingly focusing on expanding their product lines and advancing technologies to strengthen their position in the electric heat tracing market.

By diversifying their offerings and enhancing their product performance, companies are focused on meeting the evolving demands of industries such as oil, gas, and chemicals. These efforts contribute to the overall growth of the market. Further, technology upgrades enhance the reliability, efficiency, and longevity of electric heat tracing systems.

- In June 2023, nVent introduced a self-regulating heating cable, the nVent RAYCHEM XTVR, specifically designed for freeze protection and process temperature maintenance. The XTVR cables offer a minimum of 95% power retention after 10 years and boast a design life of 30 years or more.

List of Key Companies in Electric Heat Tracing Market:

- nVent Electric plc

- Thermon Inc.

- Spirax Group plc

- NIBE Element Group

- BARTEC GmbH

- Danfoss A/S

- eltherm GmbH

- Emerson Electric Co.

- Drexan Energy Systems, Inc.

- Heat Trace Products, LLC

- Heatizon Systems

- SST Group

- Urecon Ltd.

- Heat Tracing Systems

- Tempco Electric Heater Corporation

Recent Developments (M&A/Product Launch)

- In October 2024, Nibe Element acquired Proheat, a company specializing in process trace heating technology. This acquisition will strengthen the working relationship between the two businesses, transforming it into a more strategic partnership for the future. Nibe Element has obtained a controlling stake in Heat Trace Engineering Solution L.P., operating under Proheat, with plans to gradually increase its shareholding over the coming years.

- In May 2023, nVent launched the nVent RAYCHEM Elexant 5010i heat trace controller in the EMEAI and APAC regions. Built on the established legacy of the nVent RAYCHEM NGC-20 controller, which has been in use for over 15 years, the Elexant 5010i introduces features that help extend the lifespan of critical systems. This innovation also reduces waste and loweres the total installed cost.