Market Definition

The market encompasses the design, manufacturing, and sale of battery-powered and hybrid-electric vessels across commercial, recreational, and government sectors.

This market includes various vessel types such as electric pontoons, yachts, ferries, and workboats, focusing on integrating advanced propulsion systems and energy-efficient technologies to enhance marine transportation.

Electric Boat Market Overview

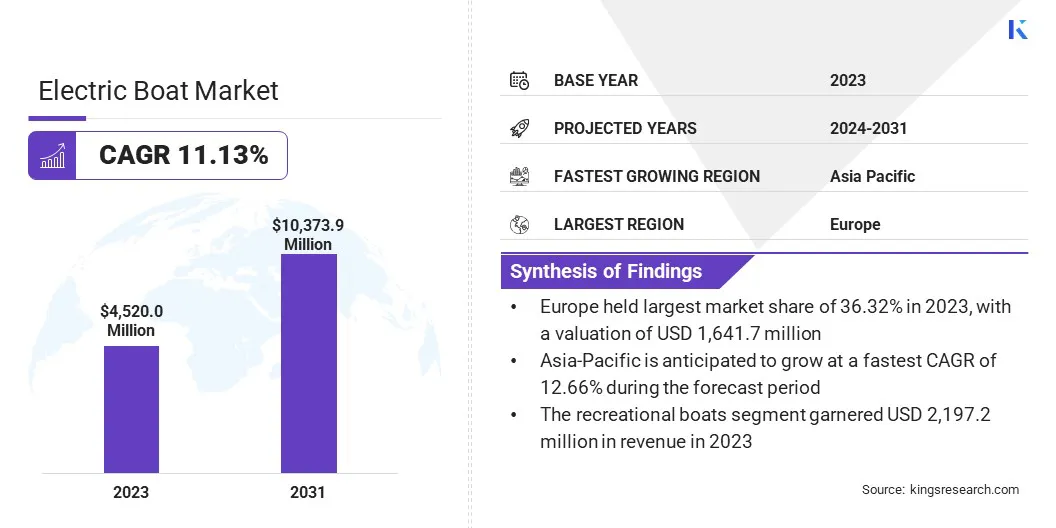

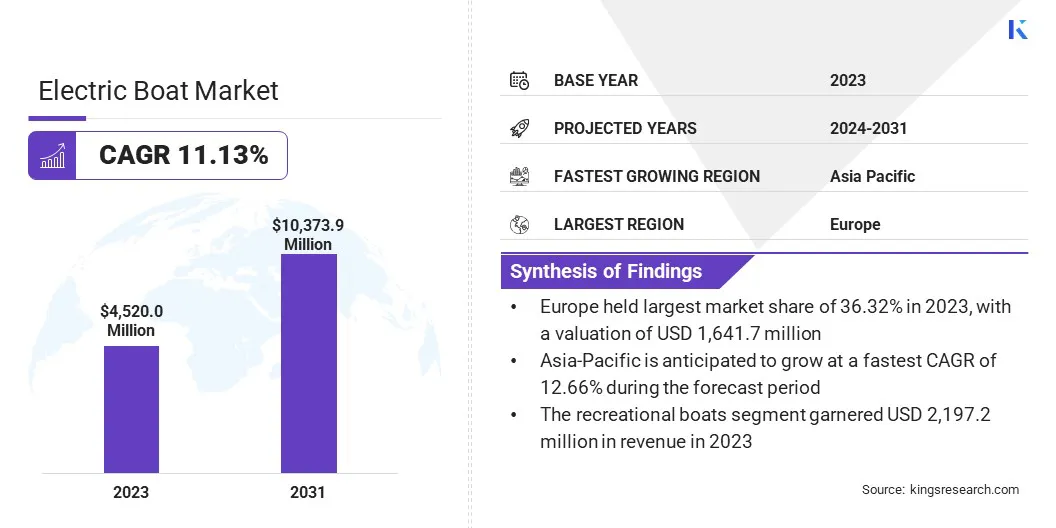

The global electric boat market size was valued at USD 4,520.0 million in 2023 and is projected to grow from USD 4,955.3 million in 2024 to USD 10,373.9 million by 2031, exhibiting a CAGR of 11.13% during the forecast period.

This expansion is driven by the increasing adoption of electric propulsion in recreational, commercial, and government vessels, as industries seek sustainable, low-emission marine solutions.

Major companies operating in the electric boat industry are BENETEAU SA, Greenline Yachts, Silent Yachts, Torqeedo GmbH, Ruban Bleu, X Shore, Duffy Electric Boat, Tyde, Q Yachts Oy, Nautique Boat Company, Inc., Candela Technology AB, Pure Watercraft, Inc., Twin Vee PowerCats Co., Vision Marine Technologies, and ElectraCraft.

Advancements in battery technology, energy efficiency, and charging infrastructure are supporting market growth, while regulatory policies promoting zero-emission transportation further accelerate adoption. Regulatory policies promoting zero-emission transportation, such as stricter emissions standards, government subsidies, and investment in clean energy solutions, are further accelerating adoption.

Leading maritime nations are implementing incentives, tax benefits, and funding for green shipping projects, boosting market penetration across recreational, commercial, and military segments. Furthermore, increasing investments in autonomous and AI-driven electric vessels are shaping the future of marine electrification, enhancing safety, efficiency, and operational automation.

- In May 2024, Mazagon Dock Shipbuilders launched electric boats in Mumbai, marking 250 years of innovation. This strengthens India’s commitment to sustainable maritime solutions amid rising global demand for eco-friendly marine technology.

Key Highlights:

- The electric boat industry size was recorded at USD 4,520.0 million in 2023.

- The market is projected to grow at a CAGR of 11.13% from 2024 to 2031.

- Europe held a share of 36.32% in 2023, valued at USD 1,641.7 million.

- The less than 20 feet segment garnered USD 1,864.5 million in revenue in 2023.

- The 5-30kW segment is expected to reach USD 5,162.5 million by 2031.

- The recreational boats segment is projected to generate a valuation of USD 5,061.0 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 12.66% through the forecast period.

Market Driver

"Increasing Environmental Concerns and Stringent Emissions Regulations"

The growth of the electric boat market is primarily driven by increasing environmental concerns and stringent emissions regulations. Governments worldwide are implementing policies to reduce carbon footprints in marine transportation, leading to rising investments in electric propulsion technologies.

Additionally, advancements in battery technology, offering higher energy density and longer operational hours, are enhancing the feasibility of electric boats for both recreational and commercial applications.

- In 2023, the EU’s total net greenhouse gas emissions declined by 37% from 1990 levels, reinforcing the shift toward sustainable transportation. Stricter emissions targets are accelerating investment in zero-emission marine solutions, boosting the adoption of electric boats and advancing electric propulsion technologies.

Market Challenge

"Limited Availability of Charging Infrastructure"

A major challenge in the electric boat market is the limited availability of charging infrastructure. Unlike traditional fuel stations, charging networks for electric vessels remain underdeveloped, particularly in marine environments. This hinders widespread adoption, particularly for long-range applications.

To address this challenge, governments and private stakeholders must collaborate to expand charging infrastructure in marinas and coastal areas. Investment in fast charging technologies, coupled with renewable energy integration, can accelerate infrastructure development. Furthermore, battery-swapping solutions can be explored to minimize downtime for commercial operators.

Market Trend

"Focus On Developing High-Performance Electric Boats"

Rising focus on developing high-performance electric boats with increased speed and range is emerging as a notable trend in the electric boat market. Smart technologies and connectivity features are being integrated into electric boats, enhancing the user experience.

Manufacturers are integrating AI-driven navigation systems and IoT-enabled remote monitoring to enhance safety and efficiency

- For instance, in September 2024, Axopar launched the AX/E brand, marking a major advancement in the market, seamlessly merging sustainability with high performance. The AX/E 22 and AX/E 25 models, developed in collaboration with Evoy, feature advanced electric propulsion, modular design, and premium craftsmanship, setting new industry standards for high-performance, zero-emission boating.

Electric Boat Market Report Snapshot

|

Segmentation

|

Details

|

|

By Boat Size

|

Less than 20 feet, 20-50 feet, More than 50 feet

|

|

By Boat Power

|

Less than 5kW, 5-30kW, More than 30kW

|

|

By End Use

|

Recreational boats, Commercial boats, Military & Law Enforcements boats

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Boat Size (Less than 20 feet, 20-50 feet and More than 50 feet): The less than 20 feet segment earned USD 1,864.5 million in 2023, primarily due to increasing demand for personal and small recreational electric boats.

- By Boat Power (Less than 5kW, 5-30kW, and More than 30kW): The 5-30kW segment held a share of 46.75% in 2023, fueled by its suitability for a wide range of applications, including leisure boating and small commercial operations.

- By End Use (Recreational boats, Commercial boats, and Military & Law Enforcements boats): The recreational boats segment is projected to reach USD 5,061.0 million by 2031, propelled by the rising popularity of eco-friendly leisure boating, government incentives for sustainable marine transportation, and increasing investments by manufacturers in high-performance, user-friendly electric boats.

Electric Boat Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe electric boat market captured a substantial share of around 36.32% in 2023, valued at USD 1,641.7 million. This dominance is reinforced by strict environmental regulations, government incentives for sustainable marine transport, and strong adoption of electric propulsion in recreational and commercial sectors.

Countries such as Norway, Germany, and the Netherlands are leading due to extensive electrification efforts in waterways and rising consumer demand for eco-friendly boats.

- For instance, the EU-funded Electric Voyage project aims to revolutionize the 20-to-40-foot boat segment with its patented E-G2 electric propulsion system, delivering superior performance. Its integrated software enables full digitalization, providing real-time data insights and remote management of key operational parameters via a cloud-based platform, enhancing efficiency and operational control.

Asia Pacific electric boat industry is set to grow at a robust CAGR of 12.66% over the forecast period. This growth is fostered by increasing environmental awareness, government policies promoting green transportation, and rapid advancements in marine electrification.

Several countries, including China, Japan, South Korea, and Australia, are making significant investments in electric marine infrastructure to reduce carbon emissions and enhance sustainable tourism.

Regulatory Frameworks

- The United States Coast Guard regulates the safety, design, and operational standards for electric boats, while the Environmental Protection Agency oversees emissions and environmental compliance, including battery disposal. These agencies ensure compliance and sustainability, aligning with the increasing demand for zero-emission marine solutions.

- In Europe, the European Union (EU) and European Commission (EC) regulate the market by enforcing emissions policies and sustainability standards. These regulations boost the adoption of zero-emission watercraft, ensuring compliance, environmental responsibility, and innovation in the maritime sector.

- In Australia, the Australian Maritime Safety Authority (AMSA) regulates electric boat safety and operational standards, while the Clean Energy Regulator ensures environmental compliance. State maritime authorities oversee local boating laws, supporting the adoption of zero-emission marine solutions in line with Australia's sustainability goals.

Competitive Landscape

The electric boat industry is characterized by a large number of participants, including both established corporations and emerging players. Key market participants are actively investing in innovation and technological advancements to strengthen their competitive edge in a rapidly expanding industry.

With applications across recreational boating, commercial transport, tourism, and law enforcement, companies are continuously enhancing their electric propulsion systems, battery efficiency, and autonomous capabilities to meet evolving market demands.

As the sector experiences substantial growth, businesses are prioritizing regional market penetration, adapting their offerings to local regulatory landscapes and consumer preferences, while simultaneously scaling production and expanding distribution networks to capitalize on opportunities in global markets.

- For instance, in December 2024, Vision Marine partnered with Massimo Marine to develop the first commercial electric pontoon platform, responding to the rising demand for zero-emission marine solutions. This partnership enhances the production of high-quality electric marine products for commercial and recreational markets.

List of Key Companies in Electric Boat Market:

- BENETEAU SA

- Greenline Yachts

- Silent Yachts

- Torqeedo GmbH

- Ruban Bleu

- X Shore

- Duffy Electric Boat

- Tyde

- Q Yachts Oy

- Nautique Boat Company, Inc.

- Candela Technology AB

- Pure Watercraft, Inc.

- Twin Vee PowerCats Co.

- Vision Marine Technologies

- ElectraCraft

Recent Developments (M&A/New Product Launch)

- In July 2024, Evoy and Vita merged to lead Europe’s high-power electric marine propulsion market, leveraging combined expertise to drive innovation, sustainability, and expansion.