Elastomer Coated Fabrics Market Size

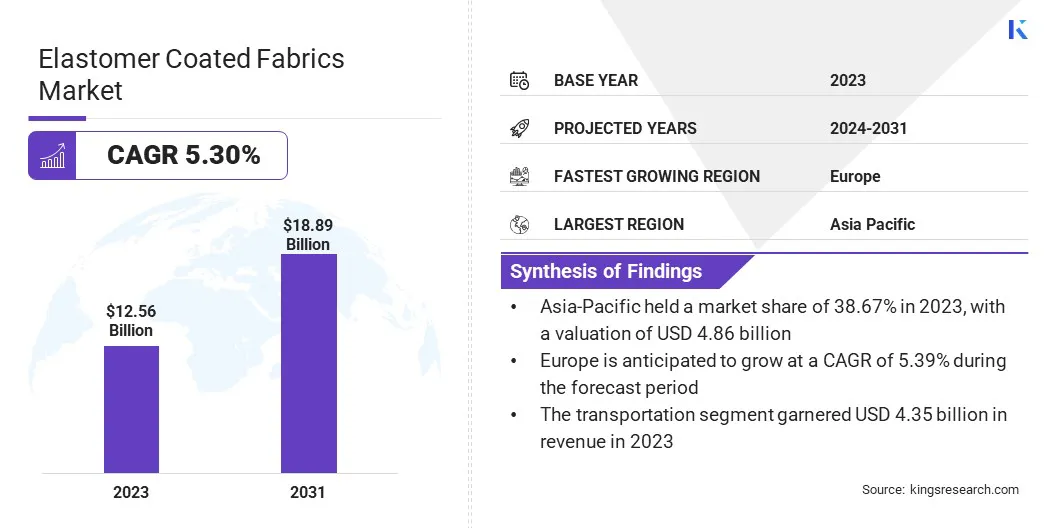

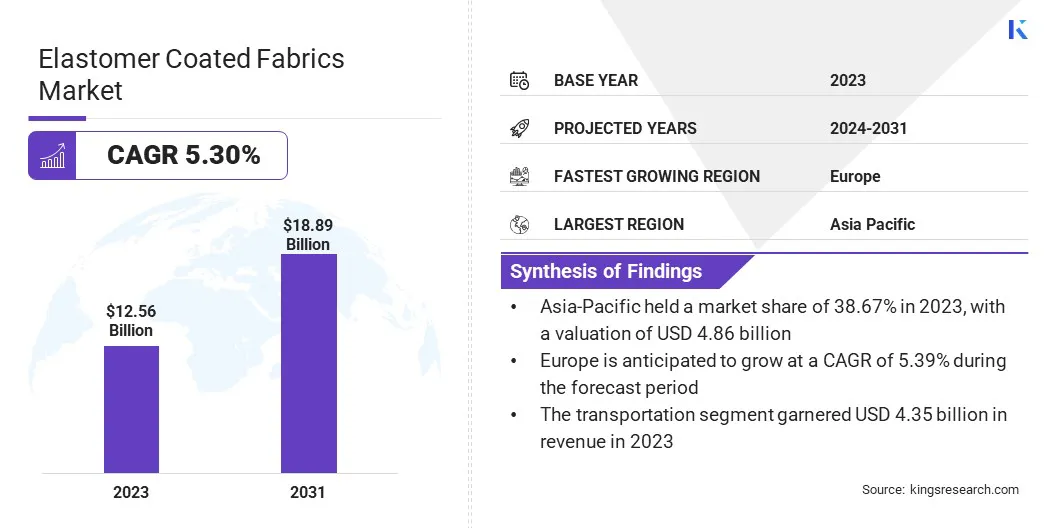

The global Elastomer Coated Fabrics Market size was valued at USD 12.56 billion in 2023 and is projected to grow from USD 13.16 billion in 2024 to USD 18.89 billion by 2031, exhibiting a CAGR of 5.30% during the forecast period. The market is expanding due to their expanding applications in the automotive, healthcare, and industrial sectors.

This growth is attributed to the durability and flexibility of these materials. Innovations in material technology are enhancing performance, while the rising demand for sustainable solutions is prompting the development of eco-friendly coatings. Additionally, the growing need for high-quality protective materials and advancements in manufacturing processes are fueling market growth and broadening application areas.

In the scope of work, the report includes solutions offered by companies such as Continental AG, Low & Bonar, OMNOVA Solutions, Saint-Gobain, Seaman Corporation, Serge Ferrari, Sioen Industries, SRF Limited, Fenner Precision, Trelleborg, and others.

The elastomer coated fabrics market is experiencing significant growth, mainly due to the increasing demand across various industries. The rise in the usage of silicone and thermoplastic polyurethane fabrics is a key factor, particularly in the manufacturing of automotive components, including body side moldings, interiors, instrument panels, seat covers, and drive belts.

- According to SIAM (Society of Indian Automobile Manufacturers), India's automotive industry saw robust production growth during the fiscal year 2022-2023, with total vehicle production reaching 2,59,31,867 units, compared to 2,30,40,066 units the previous year. Commercial vehicle sales surged from 7,16,566 units to 9,62,468 units. This increase was primarily driven by medium and heavy commercial vehicles, which grew from 2,40,577 to 3,59,003 units, and light commercial vehicles, which saw an increase from 4,75,989 to 6,03,465 units.

These materials are highly favored for their exceptional properties, including abrasion resistance and flexibility, which enhance the durability and performance of automotive parts. Additionally, market expansion is supported by growing applications in both industrial and consumer goods, highlighting the versatile utility of elastomer-coated fabrics.

Elastomer-coated fabric is a textile that is treated with a layer of elastomer, such as natural or synthetic rubber, to enhance its performance characteristics. This coating provides the fabric with properties such as increased flexibility, durability, water resistance, and protection against environmental factors, including UV radiation and chemicals.

Elastomer-coated fabrics are commonly used in applications that require high-performance materials, including automotive interiors, medical protective gear, and industrial equipment. The coating process typically involves applying the elastomer to the fabric through methods such as dipping, spraying, or laminating, ensuring a robust bond between the two materials.

Analyst’s Review

Rising investment and strategic acquisitions are significantly propelling the growth of the elastomer coated fabrics market

- For instance, in February 2023, SURTECO North America, Inc. agreed to acquire the Laminates, Films, and Coated Fabrics Businesses from OMNOVA Solutions Inc. for approximately $260 million. This acquisition, finalized on December 13, 2022, underscores the role of strategic investments and acquisitions in fostering growth within the elastomer-coated fabric market by broadening product offerings and expanding market reach.

Increased financial investments in technology and infrastructure are stimuating market growth by enabling companies to boost production capabilities and innovate their product offerings. This investment supports the development of advanced manufacturing processes and cutting-edge materials, leading to higher-quality elastomer-coated fabrics, thereby fostering market expansion.

How do changing trends in automotive and transportation sectors affect this market?

The increasing demand for durable and flexible materials in the automotive and transportation sectors is fueling the growth of the market. These sectors require materials that withstand extreme conditions, such as high temperatures, abrasion, and chemical exposure while maintaining flexibility and durability. Elastomer-coated fabrics meet these requirements, making them ideal for applications such as seat covers, airbags, truck tarpaulins, and convertible roofs.

Additionally, the rising focus on vehicle aesthetics and interior comfort is boosting the adoption of these advanced materials. As the automotive and transportation industries continue to expand globally, the demand for high-performance elastomer-coated fabrics is expected to grow.

The development of the elastomer coated fabrics market is hindered by fluctuating raw material prices and stringent environmental regulations. Volatility in the cost of elastomers and other key inputs affect production expenses and profitability, while regulatory requirements for sustainable materials necessitate significant investment in R&D.

To address these issues, key players are diversifying their sourcing strategies and optimizing production processes to manage costs. They are further focusing on developing eco-friendly elastomer coatings and adopting sustainable manufacturing practices to comply with regulations. Strategic partnerships with suppliers and investments in innovation help stabilize supply chains and mitigate the impact of these market challenges.

Which product innovations are shaping the market?

The rising use of elastomer coated fabrics in the healthcare industry for protective clothing and medical equipment is significantly boosting market growth. Healthcare professionals require materials that offer superior protection against pathogens, chemicals, and bodily fluids, while also ensuring comfort and flexibility.

Elastomer coated fabrics provide these essential qualities, making them ideal for use in items such as surgical gowns, gloves, face masks, and medical drapes. Additionally, these fabrics are used in the production of medical equipment covers and inflatable devices, where durability and resistance to wear and tear are essential. As the healthcare industry continues to prioritize safety and hygiene, the demand for high-quality elastomer-coated fabrics is increasing.

The development of eco-friendly and sustainable elastomer-coated fabrics, stimulated by stringent environmental regulations and evolving consumer preferences, is emerging as a significant trend in the market. Manufacturers are increasingly focusing on producing coatings that minimize environmental impact.

They are using biodegradabl or recyclable materials to meet regulatory standards and reduce their carbon footprint. This shift is occuring in response to increased awareness among consumers who are prioritizing sustainability in their purchasing decisions. Innovations such as bio-based elastomers and water-based coatings are gaining immense traction, offering comparable performance to traditional materials while being environmentally friendly.

Segmentation Analysis

The global market is segmented based on application, type, and geography.

How big is the transportation segment in this market?

Based on application, the market is categorized into transportation, protective clothing, industrial, roofing, awings & canopies, furniture & seating, and others. The transportation segment led the elastomer coated fabrics market in 2023, reaching a valuation of USD 4.35 billion.

These fabrics are valued for their durability, flexibility, and resistance to harsh conditions, making them ideal for applications such as seat covers, airbags, and protective covers. The expansion of vehicle production and advancements in automotive design are fostering this demand.

Additionally, elastomer-coated fabrics enhance safety and longevity in public transportation seating and coverings. As the focus on vehicle performance and aesthetics increases, the transportation segment is projected to witness substantial growth.

What is the expected growth of silicone coated fabrics?

Based on type, the market is categorized into silicone, thermoplastic polyurethane, rubber, and thermoplastic olefin. The silicone segment captured the largest elastomer coated fabrics market share of 41.56% in 2023. Silicone-coated fabrics are ideal for demanding applications across diverse industries such as aerospace, automotive, and manufacturing.

In aerospace, they are used for insulation and protective covers, while the automotive sector benefits from their application in gaskets and seals. Industrial applications include protective gear and conveyor belts, leveraging silicone’s chemical resistance and non-stick properties. The ongoing advancements in silicone technology and increasing demand for high-performance materials are supporting the growth of the segment.

What is the market scenario in Asia-Pacific and Europe region?

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific elastomer coated fabrics market share stood around 38.67% in 2023 in the global market, with a valuation of USD 4.86 billion. The regional market benefits from a strong industrial base and ongoing technological advancements, with automotive manufacturers using these fabrics for enhanced safety and performance.

Aerospace applications further bolster this growth due to the surging need for durable, high-temperature-resistant materials. The healthcare sector's expansion further contributes to this growth, as elastomer-coated fabrics are increasingly utilized in protective clothing and medical equipment. Additionally, regulatory pressures are promoting the adoption of sustainable solutions, prompting innovations in eco-friendly materials and stimulating regional market expansion.

Europe is anticipated to witness significant growth at a CAGR of 5.39% over the forecast period. The demand for high-performance materials in Europe is bolstered by the automotive industry's rising need for advanced vehicle interiors and safety features, while the aerospace sector requires durable, temperature-resistant fabrics.

Industrial applications include protective gear and conveyor belts, supported by Europe’s rising focus on advanced manufacturing. Additionally, the market is witnessing increased demand for sustainable and eco-friendly materials due to stringent environmental regulations. Companies are investing heavily in R&D to develop innovative, high-performance solutions, establishing Europe as a major market for elastomer-coated fabrics.

Competitive Landscape

The global elastomer coated fabrics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Elastomer Coated Fabrics Market

- Continental AG

- Low & Bonar

- OMNOVA Solutions

- Saint-Gobain

- Seaman Corporation

- Serge Ferrari

- Sioen Industries

- SRF Limited

- Fenner Precision

- Trelleborg

Key Industry Development

- April, 2023 (Agreement): Trelleborg Engineered Coated Fabrics announced the signing of a distribution agreement with MMI Textiles for TACTWEAR High Abrasion Neoprene Kevlar (HANK).

The global elastomer coated fabrics market is segmented as:

By Application

- Transportation

- Protective Clothing

- Industrial

- Roofing, Awings & Canopies

- Furniture & Seating

- Others (Agriculture, Geotextiles, Medical, Sports, and more)

By Type

- Silicone

- Thermoplastic Polyurethane

- Rubber

- Thermoplastic Olefin

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America