Market Definition

The double sided battery market involves the development and commercialization of batteries that utilize double-sided electrodes for energy storage and discharge.

Unlike traditional batteries, which store and release energy from a single electrode, double-sided batteries enable the use of both sides of the electrode, thereby increasing energy density and overall efficiency. This design improves the battery's performance by offering higher energy storage capacity, longer lifespan, and faster charging times.

Double Sided Battery Market Overview

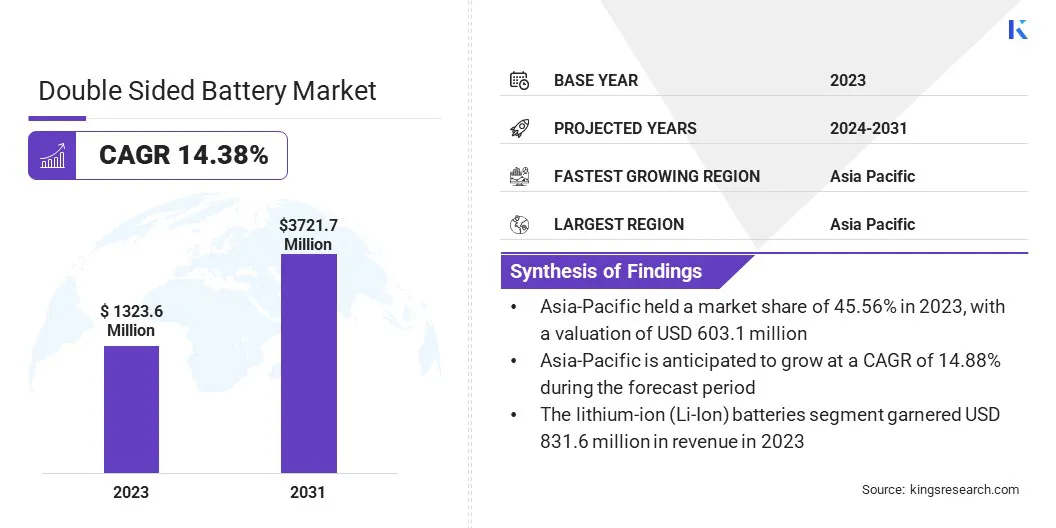

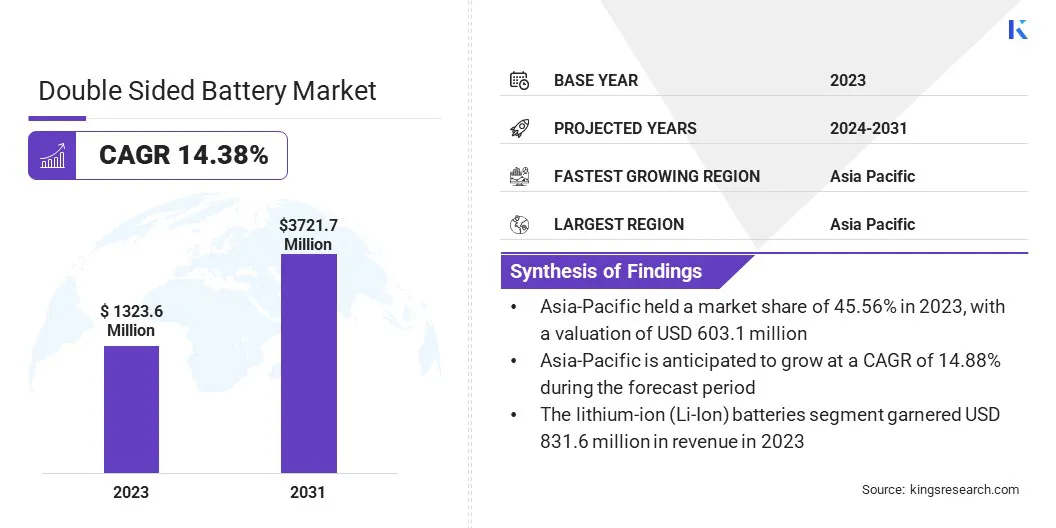

The global double sided battery market size was valued at USD 1323.6 million in 2023 and is projected to grow from USD 1453.4 million in 2024 to USD 3721.7 million by 2031, exhibiting a CAGR of 14.38% during the forecast period.

This growth is attributed to the increasing demand for high-performance energy storage solutions, particularly in sectors such as EVs, renewable energy storage, and portable electronics. The advantages of double-sided batteries, including higher energy density, faster charging capabilities, and longer lifespan, position them as a promising alternative to conventional energy storage systems.

Major companies operating in the global double sided battery Industry are AESC Group Ltd, Zeta Energy Corporation, BYD Company Ltd., Tesla, SAMSUNG SDI., Panasonic Life Solutions India Pvt. Ltd, Enphase Energy., Johnson Controls, Contemporary Amperex Technology Co., Limited., EVE Energy Co., Ltd., Gotion, Inc., SK innovation Co., Ltd, MANLY Battery, A123 Systems Corp, and GS Yuasa International Ltd.

Advancements in materials technology, coupled with a global push for sustainable energy solutions and the electrification of transportation, are expected to drive significant investments and innovations within the market.

Manufacturers and researchers are continuously engaged in optimizing double-sided battery technologies. The market is poised for substantial expansion, with new applications emerging in grid storage and other energy-intensive industries.

- In September 2024, GS Yuasa International Ltd announced a renewed sales launch for the ‘ECO.R EC’ series which integrates the high-performance batteries ‘ECO.R HIGH CLASS’ and ‘ECO.R STANDARD’ in private-use passenger cars. The new system aims to offer better performance, safety, and longer lifespan compared to previous models.

Key Highlights:

- The global double sided battery market size was valued at USD 1323.6 million in 2023.

- The market is projected to grow at a CAGR of 14.38% from 2024 to 2031.

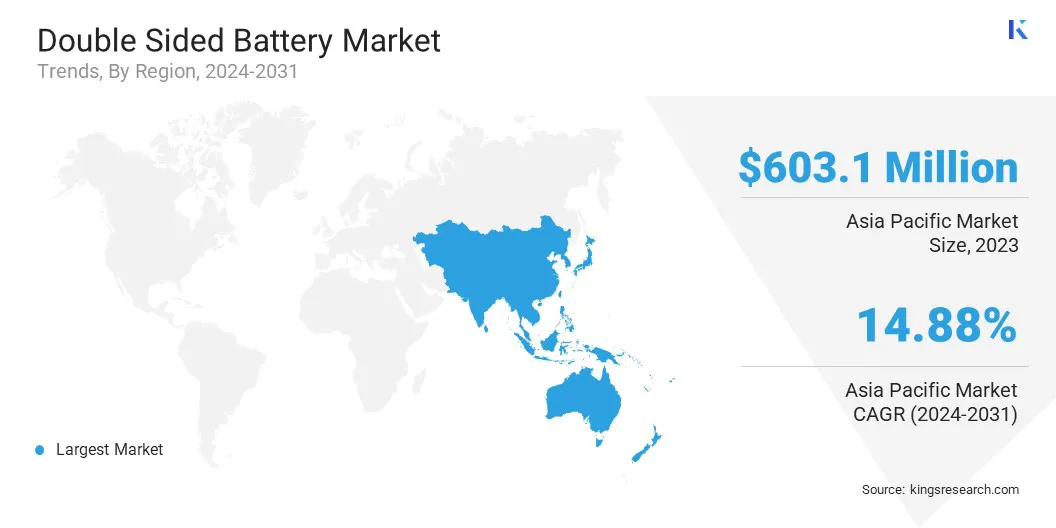

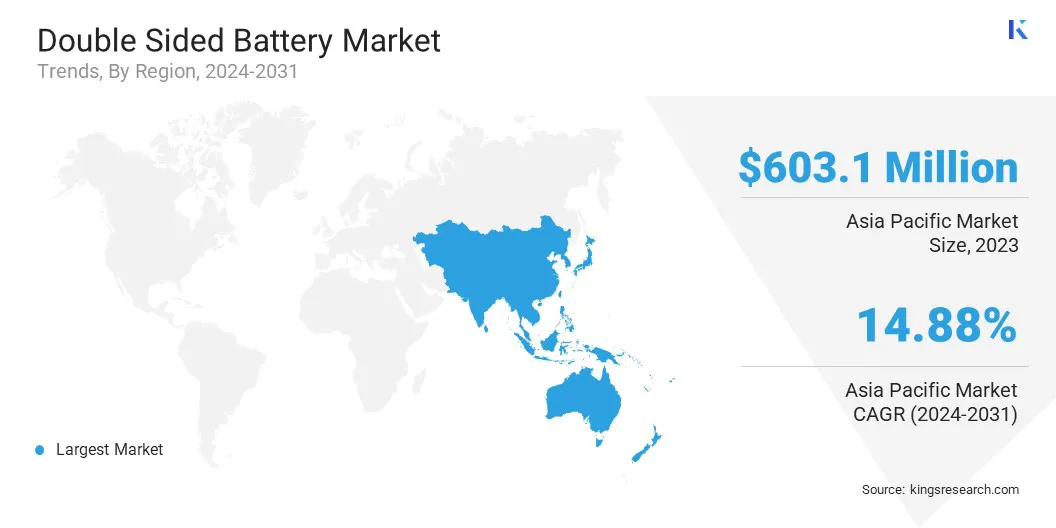

- Asia Pacific held a market share of 45.56% in 2023, with a valuation of USD 603.1 million.

- The lithium-ion (Li-Ion) batteries segment garnered USD 831.6 million in revenue in 2023.

- The electric vehicle segment is expected to reach USD 1542.3 million by 2031.

- The above 10,000 mAh segment is anticipated to register the fastest CAGR of 15.22% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 14.88% during the forecast period.

Market Driver

"Advancements in Battery Technology"

Advancements in battery technology are driving the development of double-sided batteries, particularly in terms of energy density, charging speed, and efficiency. Innovations such as silicon anodes and lithium-sulfur (Li-S) batteries are enhancing energy storage capabilities, while solid-state batteries offer potential for higher energy densities.

Additionally, improvements in charging speed are being achieved through the optimization of cathode and anode materials, as well as electrolyte formulations, reducing internal resistance and enabling faster charging.

These technological advancements are essential for increasing the performance, sustainability, and commercial viability of double-sided batteries in applications such as electric vehicles (EVs), renewable energy storage, and consumer electronics.

- In April 2024, Zeta Energy Corp and Log9 Materials announced a collaborative partnership to advance next-generation battery technologies. The collaboration focuses on developing high-energy density, long-lasting batteries using Log9's advanced materials and Zeta’s innovative battery systems.

Market Challenge

"Complex Manufacturing Processes"

The design and production of double-sided batteries require advanced techniques to ensure that both sides of the electrode perform efficiently and consistently over time.

This increased complexity not only raises production costs but also complicates the scaling process, potentially hindering widespread commercialization. Addressing these manufacturing challenges is essential for making double-sided batteries commercially viable and competitive with other emerging battery technologies.

Development of advanced manufacturing techniques, such as automated assembly lines, precision coating methods, and roll-to-roll processing, enhances production efficiency and scalability.

Optimizing materials for double-sided configurations, particularly durable, high-performance electrodes, can simplify the manufacturing process by reducing the technical challenges associated with electrode stability and efficiency. Focusing on materials that are easier to process and more stable over time would further improve overall manufacturing effectiveness.

Market Trend

"Integration of Double-sided Battery Technology in EVs"

Manufacturers are turning to double-sided designs to achieve higher energy density, faster charging times, and extended battery lifespans, due to the growing focus on enhancing battery performance. This innovation allows for more efficient energy storage by utilizing both sides of the electrodes, improving overall battery efficiency.

The trend is driven by the need to optimize EV performance, increase driving range, and reduce weight without significantly raising the cost or size of battery packs. Key automakers and battery manufacturers are increasingly exploring double-sided configurations in the development of next-generation EV batteries to meet regulatory requirements and further accelerate the adoption of EVs.

- In December 2023, Stellantis and Ample signed a binding agreement to establish a partnership in EV battery charging technology capable of delivering a fully charged EV battery in less than five minutes. The two partners have agreed to work toward integrating Ample’s Modular Battery Swapping solution in Stellantis EVs.

Double Sided Battery Market Report Snapshot

|

Segmentation

|

Details

|

|

By Battery Type

|

Lithium-ion (Li-ion) Batteries, Nickel-Metal Hydride (NiMH) Batteries, Solid-state Batteries, Other Advanced Battery Technologies

|

|

By Application

|

Consumer Electronics, Electric Vehicles (EVs), Energy Storage Systems (ESS), Medical Devices, Aerospace & Defense, Others

|

|

By Capacity Range

|

Below 1,000 mAh, 1,000 – 5,000 mAh, 5,000 – 10,000 mAh, Above 10,000 mAh

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Battery Type (Lithium-Ion (Li-Ion) Batteries, Nickel-Metal Hydride (NiMH) Batteries, Solid-state Batteries, Other Advanced Battery Technologies): The lithium-ion (Li-Ion) batteries segment earned USD 831.6 million in 2023, due to their widespread use in EVs, electronics, and energy storage, with double-sided designs boosting efficiency and energy density.

- By Application (Consumer Electronics, Electric Vehicles (EVs), Energy Storage Systems (ESS), Medical Devices, Aerospace & Defense, Others): The electric vehicles segment held 39.57% share of the market in 2023, due to the increasing demand for high-performance batteries to enhance driving range, reduce charging times, and support the growth of the EV industry.

- By Capacity Range (Below 1,000 mAh, 1,000 – 5,000 mAh, 5,000 – 10,000 mAh, Above 10,000 mAh): The 1,000 – 5,000 mAh segment is projected to reach USD 1273.2 million by 2031, owing to the increasing demand for medium-capacity batteries in consumer electronics, portable devices, and energy storage applications, where a balance of power and size is essential.

Double Sided Battery Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a double sided battery market share of around 45.56% in 2023, with a valuation of USD 603.1 million. This significant market presence is primarily attributed to the region's leadership in manufacturing, technological advancements, and presence of major battery manufacturers, EV producers, and electronics companies, particularly in countries such as China, Japan, and South Korea.

The increasing adoption of EVs, rapid urbanization, and substantial investments in renewable energy infrastructure further fuel the demand for advanced energy storage solutions in the region. Asia Pacific is expected to maintain its dominant position in the market throughout the forecast period, due to advancements in research aimed at improving battery performance.

The double sided battery Industry in North America is poised for significant growth at a robust CAGR of 14.17% over the forecast period, driven by increased investments in EV infrastructure, advancements in energy storage technologies, and rising demand for high-performance batteries across various applications.

The region’s emphasis on sustainability and clean energy, supported by government policies and incentives promoting the adoption of EVs and renewable energy storage, is anticipated to further accelerate market growth.

The presence of key industry players and ongoing R&D efforts in the U.S. and Canada are contributing to the region's growing influence in the double-sided battery market. North America is poised to play a pivotal role in the expansion of advanced energy storage solutions, due to continuous innovations in battery performance and manufacturing processes.

- In February 2025, Enphase Energy, Inc. announced the launch of an expanded IQ Battery 5P product with support for both single-phase 120/208 V and split-phase 120/240 V, for new home projects in California. The IQ Battery 5P product remains fully JA12 compliant, ensuring that it meets California Title 24 requirements.

Regulatory Frameworks

- The Regulation on Batteries and Waste Batteries (CELEX:52020PC0798) proposed by the European Commission, part of the European Green Deal, aimed at enhancing the sustainability and performance of batteries across their entire lifecycle.

- The Directive 2006/66/EC on Batteries and Accumulators and Waste Batteries and Accumulators outlines the European Union's regulatory framework for the lifecycle management of batteries. It sets requirements for the design, collection, recycling, and disposal of batteries, aiming to reduce their environmental impact.

- The Toxic Substances Control Act (TSCA), administered by the U.S. Environmental Protection Agency (EPA), regulates the manufacturing, use, and disposal of chemicals that may pose risks to human health and the environment.

Competitive Landscape

The global double sided battery market is characterized by several participants, including established corporations and rising organizations, all striving to capture a large market share through technological innovation and strategic collaborations. Leading companies are focused on enhancing battery efficiency, improving energy density, and optimizing manufacturing processes to gain a competitive advantage. Significant investments in R&D are being made to explore advanced materials and manufacturing techniques that further improve the performance of double-sided batteries. Partnerships between battery manufacturers, automotive producers, and research institutions are accelerating technological advancements and facilitating the scaling up of production.

- In June 2024, TDK Corporation successfully developed a material for CeraCharge, a next-generation solid-state battery with an energy density of 1,000 Wh/L, approximately 100 times greater than the energy density of TDK’s conventional solid-state battery. TDK’s technology can be utilized in various wearable devices, such as wireless earphones, hearing aids, and smartwatches, replacing existing coin cell batteries.

List of Key Companies in Double Sided Battery Market:

- AESC Group Ltd

- Zeta Energy Corporation

- BYD Company Ltd.

- Tesla

- SAMSUNG SDI.

- Panasonic Life Solutions India Pvt. Ltd

- Enphase Energy.

- Johnson Controls

- Contemporary Amperex Technology Co., Limited.

- EVE Energy Co., Ltd.

- Gotion, Inc.

- SK innovation Co., Ltd

- MANLY Battery

- A123 Systems Corp

- GS Yuasa International Ltd.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, Stellantis and CATL announced they have reached an agreement to invest up to €4.1 billion to form a joint venture that will build a large-scale European lithium iron phosphate (LFP) battery plant in Zaragoza, Spain. Designed to be completely carbon neutral, the battery plant will be implemented in several phases and investment plans.

- In November 2024, EVE Energy, Wuhan University (hereinafter referred to as "WHU"), and the University of Debrecen in Hungary (hereinafter referred to as "UD") held a tripartite Memorandum of Understanding (MOU) signing ceremony in Wuhan, marking the official commencement of research cooperation to understand the lithium battery industry's impact on the sustainable development of Debrecen, and opening a new chapter of three-way collaboration.

- In April 2024, GS Yuasa Corporation. announced a renewed sales launch for the ECO.R HV auxiliary VRLA battery*1 series for Toyota hybrid vehicles. The new battery is designed to provide improved energy density, longer lifespan, and faster charging times, marking a significant step forward in enhancing the performance of EVs.

- In October 2023, Idemitsu Kosan Co.,Ltd. and Toyota Motor Corporation announced that they have entered into an agreement to develop mass production technology of solid electrolytes, improve productivity, and establish a supply chain to achieve the mass production of all-solid-state batteries for battery electric vehicles (BEVs).