Market Definition

The market involves autonomous and semi-autonomous robotic systems designed to disinfect surfaces, air, and environments. These systems utilize technologies such as UV-C light, hydrogen peroxide vapor, and chemical sprays.

They are widely deployed in hospitals, public spaces, transportation, and industrial settings to reduce pathogen transmission and improve hygiene standards. The report highlights the key drivers influencing market growth, along with an in-depth analysis of emerging trends and the evolving regulatory frameworks shaping the industry.

Disinfection Robots Market Overview

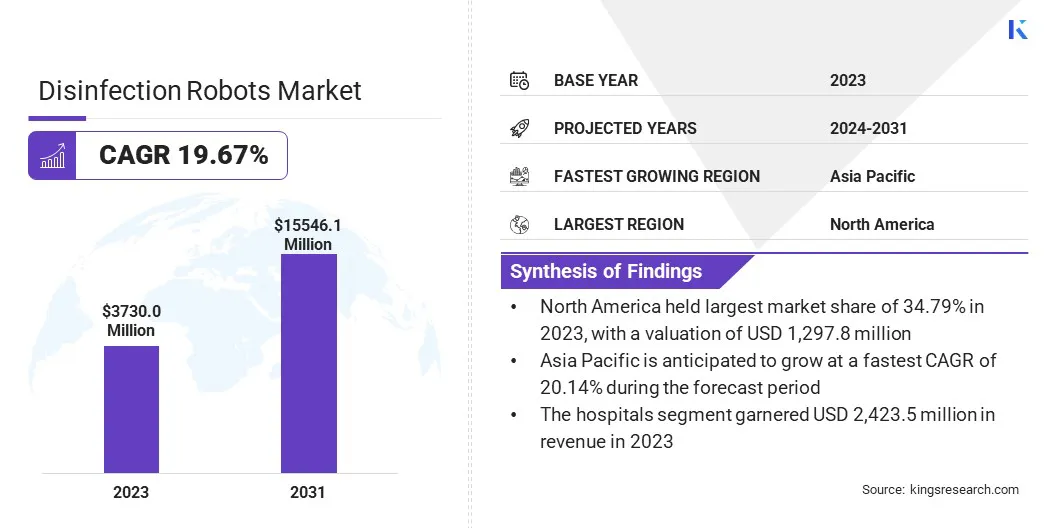

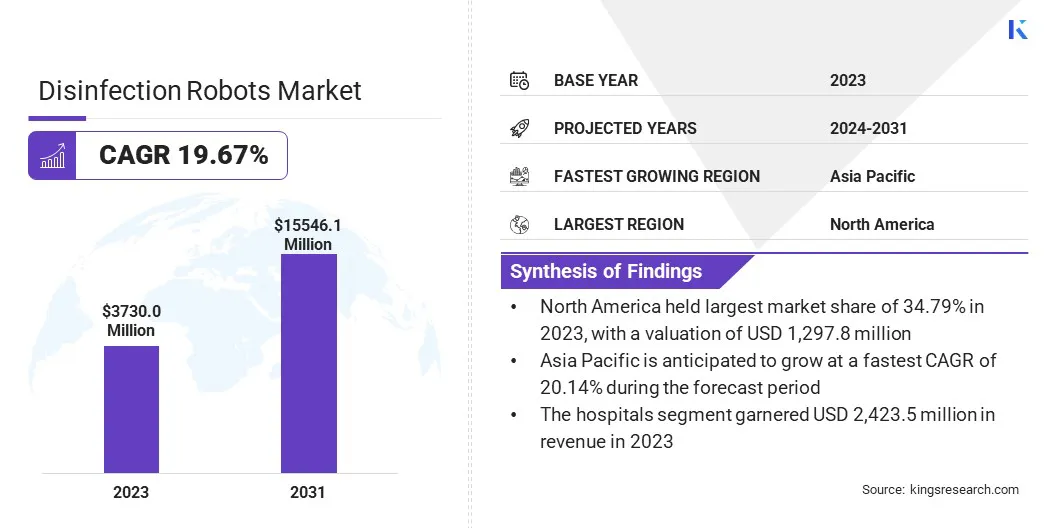

The global disinfection robots market size was valued at USD 3,730.0 million in 2023 and is projected to grow from USD 4,422.7 million in 2024 to USD 15,546.1 million by 2031, exhibiting a CAGR of 19.67% during the forecast period.

This market is experiencing rapid growth due to the increasing awareness of hygiene and infection control in healthcare, hospitality, transportation, and public infrastructure.

The growing demand for automation and robotics to enhance efficiency and safety in healthcare facilities is driving this growth. Technological advancements and advanced disinfection methods like UV-C light and hydrogen peroxide vapor, are further enhancing the capabilities of these robots.

Major companies operating in the disinfection robots industry are ADIBOT, Xenex Disinfection Services Inc., UVC Solutions, Tru-D SmartUVC, Taimi Robotics Technology Co.Ltd., Finsen Technologies Limited, Blue Ocean Robotics, ROBOTLAB Inc., Skytron, LLC, JanyuTech, Loop Robots, Haystack Robotics, Symbotic Inc., Badger Technologies, and DreamVu.

Additionally, government initiatives promoting healthcare infrastructure improvements and infection prevention are fueling market expansion. The growing preference for contactless disinfection solutions in high-traffic areas, such as airports, shopping malls, and office spaces, is also contributing to increased adoption.

Key Highlights

- The disinfection robots industry size was valued at USD 3,730.0 million in 2023.

- The market is projected to grow at a CAGR of 19.67% from 2024 to 2031.

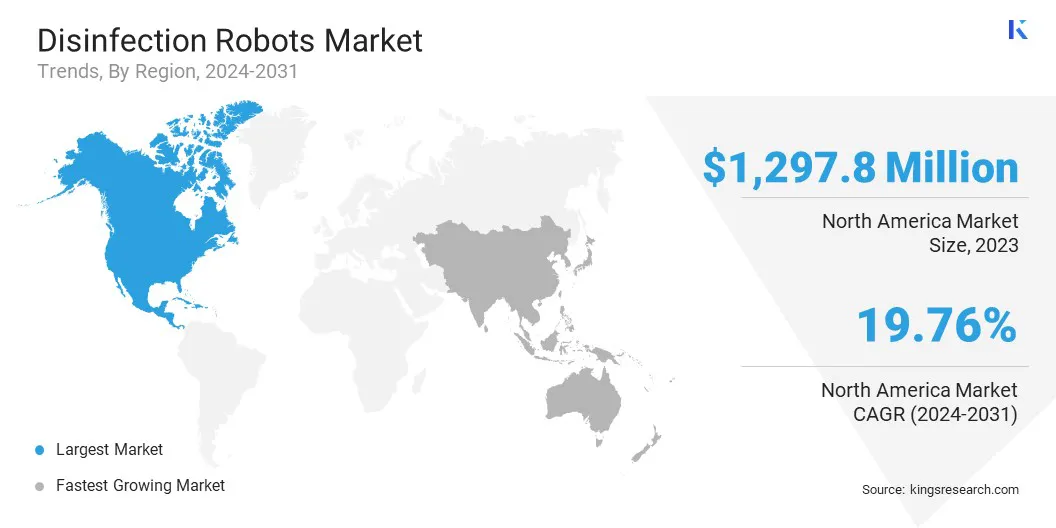

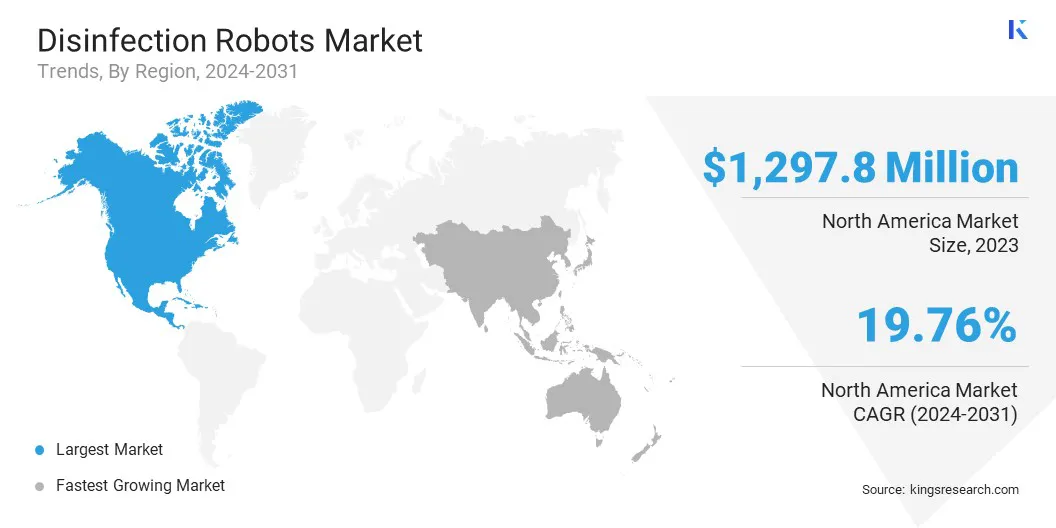

- North America held a market share of 34.79% in 2023, with a valuation of USD 1,297.8 million.

- The hydrogen peroxide vapor (HPV) robots segment garnered USD 1,481.5 million in revenue in 2023.

- The semi-autonomous segment is expected to reach USD 10,083.2 million by 2031.

- The hospital segment is expected to reach USD 10,254.2 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 20.14% during the forecast period.

Market Driver

"Rising Demand for Automation and Infection Control"

The disinfection robots market is expanding rapidly due to the increasing need for effective infection control and the increasing adoption of automation in healthcare settings. Hospital-acquired infections, caused by pathogens, pose significant risk to patient safety and contribute to rising healthcare costs.

These infections are often transmitted through contaminated surfaces, which make effective cleaning and disinfection essential. Disinfection robots equipped with UV light and automated cleaning systems can efficiently target harmful microorganisms for a more thorough and consistent cleaning compared to manual cleaning.

- In October 2024, Xenex Disinfection Services highlighted the use of its FDA-authorized LightStrike+ robot in healthcare facilities to reduce pathogens like methicillin-resistant Staphylococcus aureus and C. difficile. The robot utilizes pulsed xenon UV light for whole-room microbial reduction, enhancing hospital disinfection and patient safety by preventing pathogen transmission.

In addition, the growing demand for automation in healthcare is further driving the adoption of disinfection robots. Healthcare institutions are facing challenges such as labor shortages and rising operational costs. Disinfection robots address these challenges by reducing the need for manual labor in routine cleaning tasks.

These robots can autonomously clean healthcare environments, reducing human error and ensuring standardized disinfection. The use of these robots helps healthcare providers optimize their resources, allowing staff to focus on more critical care tasks while reducing the cost associated with manual cleaning.

Market Challenge

"High Initial Investment"

A significant challenge in the disinfection robot market is the high initial investment. Disinfection robots, particularly those equipped with advanced navigation and autonomous cleaning capabilities, come with substantial upfront costs.

This includes the purchase price of the robots, installation expenses, and necessary infrastructure changes to integrate them effectively into existing systems. High capital costs can be a challenge for healthcare facilities, businesses, and commercial establishments with limited budgets.

To overcome this challenge, manufacturers are focusing on developing cost-effective solutions through modular designs and subscription-based models that reduce initial investments.

Market Trend

"Integration of AI and UV-C Technology"

The disinfection robots market is evolving with AI-powered navigation and improved UV-C technology. The integration of AI-driven navigation enhances the robots' ability to operate autonomously in complex environments, ensuring comprehensive coverage while avoiding obstacles.

Simultaneously, improvements in UV-C light efficiency contribute to faster and more thorough pathogen elimination, increasing the effectiveness of disinfection procedures. Additionally, the growing incorporation of IoT and real-time monitoring capabilities is further revolutionizing the industry.

By offering enhanced operational oversight and enabling data-driven decision-making, these innovations improve the overall effectiveness and reliability of disinfection processes.

- In December 2024, Symbotic Inc. acquired OhmniLabs to expand its automation capabilities in the healthcare sector.

Disinfection Robots Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Hydrogen Peroxide Vapor (HPV) Robots, Ultraviolet Light Robots, Disinfectant Spraying Robots

|

|

By Technology

|

Semi-Autonomous, Fully-Autonomous

|

|

By End Use

|

Hospitals, Clinics, Life Science Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Hydrogen Peroxide Vapor (HPV) Robots, Ultraviolet Light Robots, Disinfectant Spraying Robots): The hydrogen peroxide vapor (HPV) Robots segment earned USD 1,481.5 million in 2023 due to their high effectiveness in eliminating a wide range of pathogens and their widespread adoption in healthcare facilities.

- By Technology (Semi-Autonomous, Fully-Autonomous): The semi-autonomous segment held 63.96% of the market in 2023, due to its cost-effectiveness, ease of integration into existing workflows.

- By End Use (Hospitals, Clinics, Life Science Companies): The hospitals segment is projected to reach USD 10,254.2 million by 2031, owing to the growing adoption of automated disinfection solutions and rising healthcare expenditures.

Disinfection Robots Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America disinfection robots market share stood around of 34.79% in 2023 in the global market, with a valuation of USD 1,297.8 million. This dominance can be attributed to its well-established healthcare sector with high adoption of automation, and stringent regulatory standards for infection control.

Moreover, the presence of leading manufacturers and continuous technological advancements with investments in R&D further strengthens the region’s position. Additionally, increasing government funding for healthcare infrastructure and infection control initiatives is driving market growth.

The rising demand for contactless disinfection solutions in commercial and public settings, such as airports, schools, and offices is further contributing to the market expansion.

- In July 2024, Sodexo partnered with UVD Robots to enhance disinfection solutions across U.S. healthcare facilities. The collaboration aims to integrate UVD Robots' autonomous UV germicidal robots into Sodexo’s Protecta program, to optimize productivity in healthcare operations.

The disinfection robots industry in Asia Pacific is expected to register the fastest growth with a projected CAGR of 20.14% over the forecast period. This growth is driven by rapid urbanization, increasing healthcare investments, and rising concerns over infection control.

Countries like China, Japan, and India are actively supporting the expansion and modernization of healthcare infrastructure, in turn, fueling the demand for automated disinfection solutions.

Additionally, the rise of infectious diseases, hygiene regulations, and increasing awareness about robotic solutions are further accelerating the adoption of disinfection robots.

Moreover, Asia Pacific hosts rapidly growing robotics and AI technology hubs, fostering continuous innovation and cost-effective solutions. This development is improving the accessibility of disinfection robots across various industries across this region, which is driving the growth of the market.

Regulatory Frameworks

- In the United States, the Food and Drug Administration (FDA) regulates disinfection robots classified as medical devices under the Federal Food, Drug, and Cosmetic Act (FDCA) when intended for healthcare use. The Environmental Protection Agency (EPA) oversees robots using chemical disinfectants to ensure compliance with public health safety standards.

- In the European Union, the Medical Device Regulation (MDR) applies to disinfection robots classified as medical devices. Robots using chemical disinfectants must comply with the Biocidal Products Regulation (BPR). Oversight may also involve national health agencies.

- In China, disinfection robots are regulated by the National Medical Products Administration (NMPA) for medical devices, while the State Administration for Market Regulation (SAMR) oversees non-medical devices.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) ensures compliance with the Pharmaceuticals and Medical Devices Law (PMDL) for disinfection robots used in healthcare settings.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates medical disinfection robots under the Drugs and Cosmetics Act.

Competitive Landscape

The disinfection robots industry is characterized by key players focusing on innovation, strategic partnerships, and expanding product offerings to maintain a competitive edge.

One of the primary strategies employed by leading companies is the continuous enhancement of robot technology, including the integration of AI, machine learning, and IoT capabilities.

These advancements improve the robots' autonomous capabilities, efficiency, and ability to operate in complex environments. Additionally, many players are diversifying their product portfolios to cater to various industries such as hospitality and transportation.

- In December 2024, HygenX Ai announced that San Gorgonio Memorial Hospital (SGMH) selected its autonomous, AI-driven UV-C disinfection robot, RAY, for the clinical disinfection of its facilities, including operating rooms, intensive care units, and patient rooms. The partnership aims to enhance infection prevention by significantly accelerating disinfection processes, reducing costs, and providing transparency through digital audits.

List of Key Companies in Disinfection Robots Market:

- ADIBOT

- Xenex Disinfection Services Inc.

- UVC Solutions

- Tru-D SmartUVC

- Taimi Robotics Technology Co.Ltd.

- Finsen Technologies Limited

- Blue Ocean Robotics

- ROBOTLAB Inc.

- Skytron, LLC

- JanyuTech

- Loop Robots

- Haystack Robotics

- Symbotic Inc.

- Badger Technologies

- DreamVu

Recent Developments (New Product Launch)

- In July 2024, OhmniLabs introduced the OhmniClean Autonomous UV Disinfection Robot, at the Breakthroughs24 conference. The robot is designed to rapidly eliminate pathogens such as MRSA, VRE, and SARS-CoV-2 with high efficacy, enhancing infection control in healthcare environments.