Market Definition

The direct lithium extraction (DLE) technology services market encompasses the development, implementation, and support of advanced technologies designed to extract lithium directly from brine or clay deposits in a more efficient and environmentally sustainable manner compared to traditional methods such as evaporation ponds.

DLE technologies utilize a range of chemical, physical, and electrochemical processes to isolate lithium from natural resources, enabling faster extraction and higher purity.

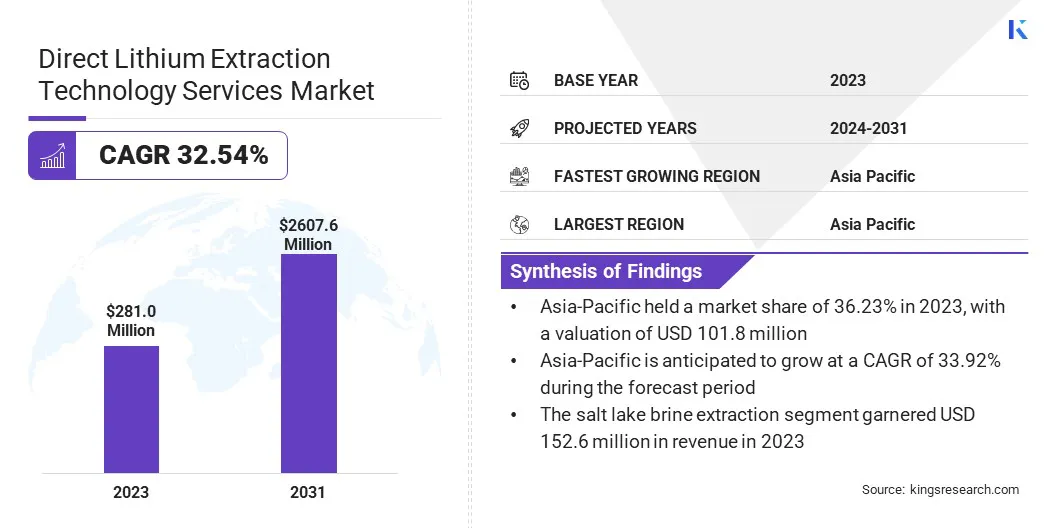

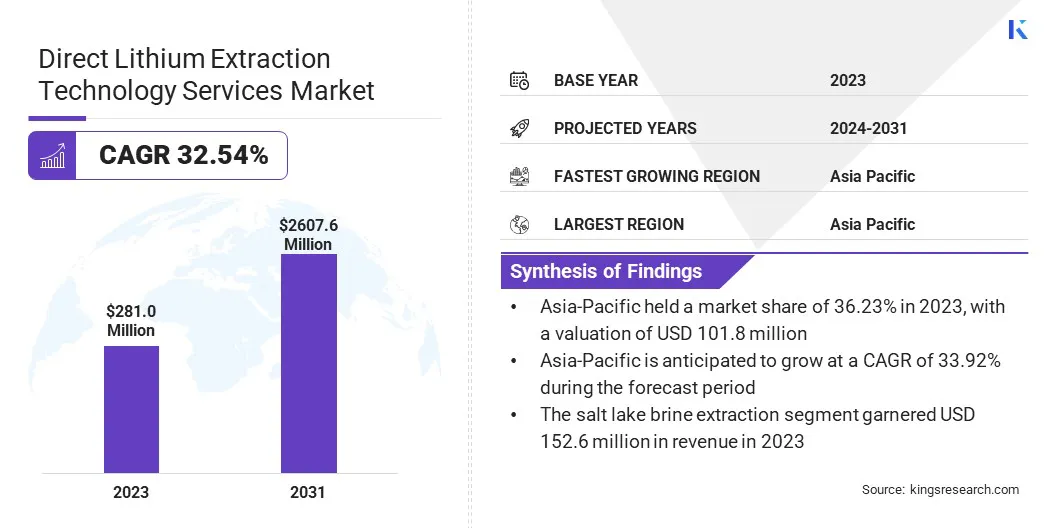

The global direct lithium extraction technology services market size was valued at USD 281.0 million in 2023 and is projected to grow from USD 363.0 million in 2024 to USD 2,607.6 million by 2031, exhibiting a CAGR of 32.54% during the forecast period.

The market is experiencing significant growth due to the increasing demand for lithium, supported by the rising adoption of electric vehicles (EVs) and the growing need for energy storage solutions.

DLE technologies offer a more efficient and sustainable alternative to traditional lithium extraction methods, which typically involve large-scale evaporation ponds and are associated with lengthy processing times and environmental concerns.

As DLE technologies continue to improve in terms of efficiency, cost-effectiveness, and environmental sustainability, they are expected to become the preferred choice for lithium extraction in the coming years.

Major companies operating in the global direct lithium extraction technology services Industry are EVOVE, Go2Lithium, PURELI, Summit Nanotech Corporation, E3 Lithium, ADIONICS, Albemarle Corporation, Arcadium Lithium, Cleantech Lithium, Ekosolve, Energy Exploration Technologies, Eramet, INTERNATIONAL BATTERY METALS, Koch Engineered Solutions, Lilac Solutions, and others.

Market expansion is further fueled by advancements in lithium-ion battery technologies, the shift toward renewable energy, and government incentives aimed at boosting domestic production of critical minerals. Partnerships between technology providers, mining companies, and governments are likely to scale up DLE solutions globally.

- In September 2023, Go2Lithium Inc. (G2L) partnered with LithiumBank Resources Corp. (LBNK) to license its continuous direct lithium extraction technology (cDLE) for the development of LithiumBank's North American lithium brine assets. This initiative aims to make Go2Lithium the largest shareholder in LithiumBank, with the company receiing shares upon the successful achievement of certain milestones.

Key Highlights

- The global direct lithium extraction technology services market size was recorded at USD 281.0 million in 2023.

- The market is projected to grow at a CAGR of 32.54% from 2024 to 2031.

- Asia-Pacific held a share of 36.23% in 2023, valued at USD 101.8 million.

- The sorbent extraction segment garnered USD 116.1 million in revenue in 2023.

- The salt lake brine extraction segment is expected to reach USD 1,378.8 million by 2031.

- Europe is anticipated to grow at a significant CAGR of 32.94% during the forecast period.

Market Driver

"Increasing Demand for Lithium"

The growth of the global direct lithium extraction technology services market is the rising demand for lithium, supported by the rapid expansion of EVs and energy storage systems.

The transiition to cleaner energy and the drive to decarbonize transportation is increasing the demand for high-purity lithium required for EV batteries. This underscores the need for more efficient, sustainable, and scalable methods of lithium extraction, thereby positioning DLE technologies as essential to meeting the global lithium supply requirements.

- In May 2024, International Battery Metals (IBAT) and US Magnesium announced an agreement to install the world’s first modular Direct Lithium Extraction (DLE) plant. This pioneering facility will be built in the United States and aims to significantly increase the scalability and efficiency of lithium extraction from brine. The partnership highlights the growing demand for lithium, supported by the surge in electric vehicle (EV) production and energy storage solutions.

Market Challenge

"High Capital and Operational Costs"

Major challenge hindering the growth of the direct lithium extraction (DLE) technology services market is the high capital and operational costs associated with the development and scaling of these technologies.

While DLE methods offer notable advantages in terms of efficiency and sustainability, the substantial initial investment required for the construction of DLE facilities, coupled with ongoing operational expenses, presents a considerable financial burden.

This can deter some companies from adopting DLE technologies, particularly when traditional extraction methods, such as evaporation ponds or hard rock mining, remain more cost-effective in the short term.

To address these challenges, several strategies can be employed. Technological innovation, particularly through sustained R&D, can improve extraction efficiency and reduce costs.

The development of modular and scalable DLE systems allows for the cost-effective deployment, while automation and AI-driven optimization can further reduce labor expenses.

Government incentives, such as subsidies and low-interest loans, can alleviate initial capital burdens, making DLE more economically viable. strategic partnerships between technology developers, service providers, and lithium producers can share financial and technological risks, promoting broader adoption.

Market Trend

"Advancement in Direct Lithium Extraction Technologies"

Advancements in direct lithium extraction technologies services industry are significantly enhancing the efficiency and sustainability of the lithium extraction process. A notable development is the refinement of ion-exchange technologies, which utilize specialized materials, such as resins or adsorbents, to selectively absorb lithium ions from brine while leaving other minerals behind.

Recent innovations have focused on improving the selectivity and capacity of these materials, thereby enabling faster and more efficient lithium recovery with minimal energy consumption. Membrane filtration technologies, including electro dialysis and reverse osmosis, are increasingly being adapted for lithium extraction.

These methods leverage electric fields or pressure to separate lithium ions from brine, offering greater flexibility and efficiency in handling varying lithium concentrations.

- In December 2024, Eramet announced the successful production of its first lithium carbonate from the Centenario Direct Lithium Extraction (DLE) plant in Argentina. This achievement marks a significant milestone for the company’s Centenario project, which utilizes cutting-edge DLE technology to extract lithium from brine in a more sustainable and efficient manner.

|

Segmentation

|

Details

|

|

By Type

|

Sorbent Extraction, Ion Exchange, Solvent Extraction

|

|

By Application

|

Salt Lake Brine Extraction, Deep Brine Extraction

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Sorbent Extraction, Ion Exchange, and Solvent Extraction): The sorbent extraction segment earned USD 116.1 million in 2023 due to its efficient lithium recovery, environmentally friendly process, and scalability, which makes it an increasingly preferred method for extracting lithium from brine resources.

- By Application (Salt Lake Brine Extraction and Deep Brine Extraction): The deep brine extraction segment held a share of 33.40% in 2023, attributed to its ability to access and extract lithium from deeper, high-concentration brine sources as traditional surface deposits decline.

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific direct lithium extraction technology services market captured a share of around 36.23% in 2023, valued at USD 101.8 million. This significant market share is attributed to the region's increasing demand for lithium, supported by the rapid growth of EV production and the expansion of renewable energy storage projects.

China, Japan, and South Korea are key countries in the EV and battery manufacturing sectors, highlighting the need for efficient lithium extraction technologies. Asia Pacific is home to some of the world's largest lithium reserves, with regional governments actively promoting the adoption of sustainable mining practices.

- In April 2024, GanfengLithium signed a cooperation agreement with the globally renowned lithium mining supplier, Pilbara Minerals Limited, to complete a joint Feasibility Study for a potential downstream conversion facility to produce lithium chemicals. This move strengthen their collaboration, secure a stable supply of raw materials for GanfengLithium, enhance lithium compound production capacity, and diversify the layout of lithium compound production.

Europe direct lithium extraction technology services Industry is likley to grow at a robust CAGR of 32.94% over the forecast period, driven by the increasing emphasis on sustainability and the region’s commitment to reducing its reliance on traditional lithium extraction methods.

As European nations work toward meeting ambitious carbon reduction targets and enhancing energy storage capabilities, direct lithium extraction technologies present a viable solution for tapping into domestic lithium reserves in an environmentally responsible manner.

The region’s focus on technological innovation, along with rising investments in sustainable mining practices, is fostering a favorable environment for the adoption of DLE solutions.

Partnerships between European companies and global technology providers are expected to accelerate the development and deployment of advanced lithium extraction technologies, positioning Europe as a key player in the global lithium supply chain.

- In June 2023, Imerys and British Lithium formed a joint venture to establish the UK’s first integrated producer of battery-grade lithium carbonate. Imerys will hold an 80% stake, contributing lithium mineral resources, land, and infrastructure, while British Lithium will provide its processing technology, technical team, and pilot plant for the remaining 20%.

Regulatory Framework

- The Occupational Safety and Health Administration (OSHA), an agency of the U.S. Department of Labor, is responsible for ensuring safe and healthy working conditions across various industries, including those involved in DLE technologies.

- The Bureau of Land Management (BLM), under the U.S. Department of the Interior, regulates lithium exploration projects on public lands through a structured process that ensures compliance with environmental standards and public engagement. In accordance with the National Environmental Policy Act (NEPA), the BLM requires that any proposed lithium exploration project undergo a comprehensive environmental review to assess its potential impacts on land use, water resources, wildlife, and local ecosystems.

- The U.S. Environmental Protection Agency (EPA) regulates the recycling of lithium-ion batteries under the Resource Conservation and Recovery Act (RCRA), ensuring that these batteries are managed in an environmentally responsible manner.

- The Environmental Impact Assessment (EIA) is a crucial process mandated by the Ministry of Environment, Forest and Climate Change (MoEFCC) in India, aimed at assessing the potential environmental impacts of projects before they are approved and implemented.

Competitive Landscape

The global direct lithium extraction technology services market is characterized by a number of participants, including both established corporations and emerging players.

To gain a competitive edge in continuously evolving market, companies are focusing on innovation, strategic partnerships, and expansion of their technological capabilities.

Established corporations are leveraging their resources to enhance existing extraction processes, improve efficiency, and reduce operational costs. Emerging players are introducing novel solutions and technologies that offer greater sustainability and scalability.

- In October 2023, EnergyX secured a strategic investment from POSCO, a leading South Korean multinational corporation in the global lithium market. This partnership aims to accelerate the commercialization of EnergyX’s cutting-edge LiTAS (Lithium-Ion Technology for Advanced Separation) system, which offers faster, more sustainable, and cost-effective solutions compared to traditional methods.

List of Key Companies in Direct Lithium Extraction Technology Services Market:

- EVOVE

- Go2Lithium

- PURELI

- Summit Nanotech Corporation

- E3 Lithium

- ADIONICS

- Albemarle Corporation

- Arcadium Lithium

- Cleantech Lithium

- Ekosolve

- Energy Exploration Technologies

- Eramet

- INTERNATIONAL BATTERY METALS

- Koch Engineered Solutions.

- Lilac Solutions

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, Evove and Altillion announced a new collaboration focused on advancing direct lithium extraction (DLE) technologies. The partnership aims to combine Evove’s cutting-edge membrane-based DLE technology with Altillion's expertise in lithium resource development to enhance the efficiency and sustainability of lithium extraction processes.

- In August 2024, E3 Lithium and Pure Lithium entered a joint development agreement aimed at producing lithium metal for battery applications in Alberta, Canada. The partnership aims to leverage E3 Lithium’s proprietary brine extraction technology to produce high-purity lithium from Alberta’s vast brine resources.

- In July 2024, Summit Nanotech and Llamara Group SpA signed a joint venture agreement for Chilean Lithium Project. This milestone marks a significant step in the company's efforts to provide a more sustainable and efficient solution for lithium extraction, while the Llamara project is set to meet the growing global demand for lithium with minimal environmental impact.

- In June 2024, Lilac Solutions unveiled its latest generation of direct lithium extraction (DLE) technology, marking a significant advancement in the company's efforts to revolutionize lithium production. The new technology utilizes a proprietary ion-exchange process designed to extract lithium from brine more efficiently and with a reduced environmental footprint.

- In September 2023, Albemarle Corporation and Caterpillar Inc. collaborated to pioneer sustainable mining technologies and operations. The partnership aims to develop innovative solutions that enhance the efficiency and environmental sustainability of lithium mining, with a major focus on the implementation of cutting-edge technologies to reduce carbon emissions and minimize environmental impact.