Market Definition

The market encompasses technologies, solutions, and processes to enhance the efficiency, safety, and productivity of oil and gas operations through digital integration.

It includes activities across various stages of upstream operations, such as production optimization, reservoir optimization, drilling optimization, and other related processes that leverage digital tools for real-time monitoring, data analytics, and automation.

The market spans both onshore and offshore applications, reflecting its critical role across diverse geographical and environmental conditions in oil and gas operations. The report presents an overview of the primary growth drivers, supported by regional analysis and regulatory frameworks expected to impact market development over the forecast period.

Digital Oilfield Market Overview

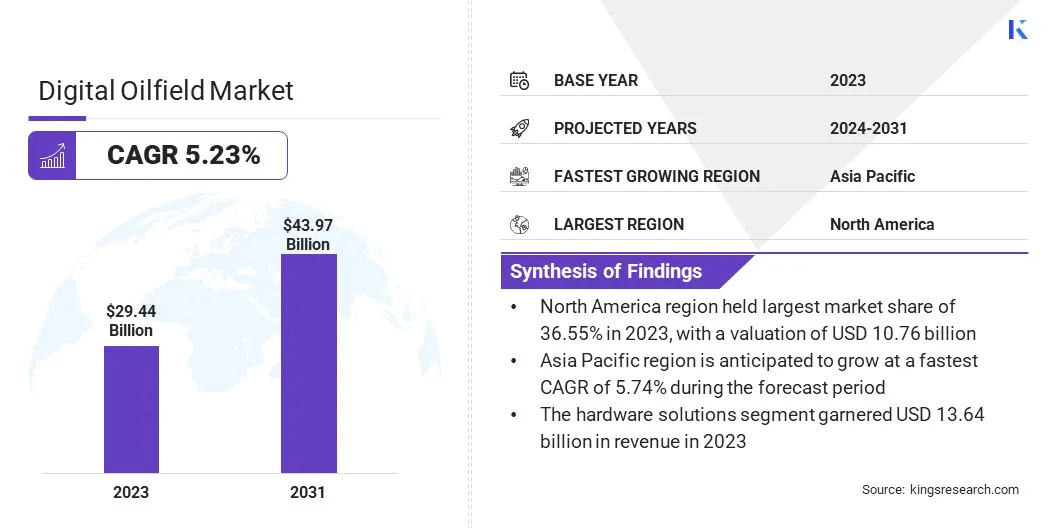

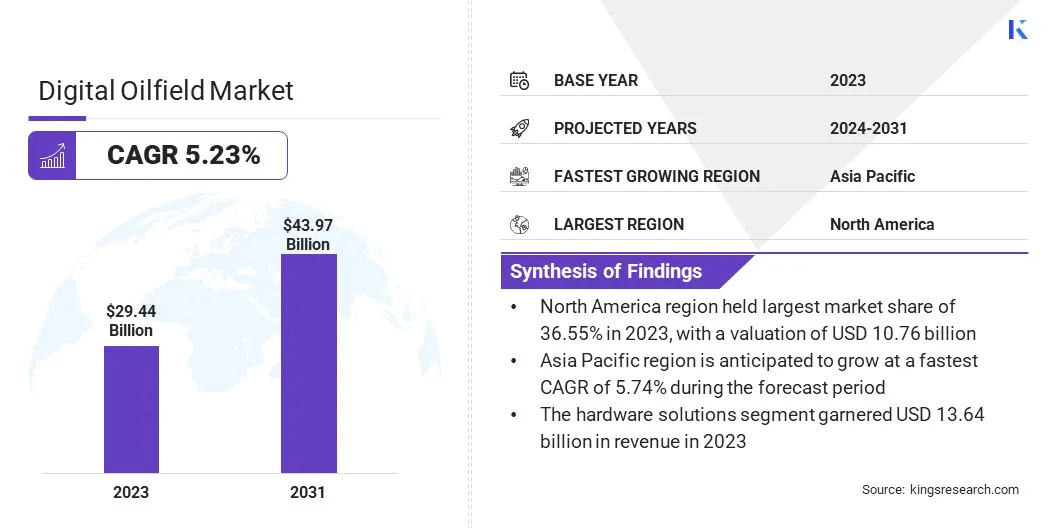

The global digital oilfield market size was valued at USD 29.44 billion in 2023 and is projected to grow from USD 30.78 billion in 2024 to USD 43.97 billion by 2031, exhibiting a CAGR of 5.23% during the forecast period.

Market growth is propelled by the increasing focus on automating workflows and integrating real-time monitoring solutions. Moreover, the surge in global energy demand, combined with the necessity to improve recovery rates from mature fields, is fueling the adoption of digital oilfield technologies.

Major companies operating in the digital oilfield industry are Digi International Inc., Siemens, Halliburton, Viridien, Emerson Electric Co., Baker Hughes Company, Nabors Industries Ltd., SLB, KONGSBERG, Rockwell Automation, NOV, ABB, Weatherford, Honeywell International Inc, and Pason Systems Corp.

The market is expanding due to the growing focus on process automation and the integration of AI-powered real-time monitoring solutions. These technologies enable oil and gas operators to leverage large volumes of operational data to enhance decision-making, automate routine procedures, and anticipate potential failures before they cause disruptions.

AI models analyze continuous data from sensors and other digital devices to track equipment health, optimize drilling activities, and better manage reservoir performance.

- In January 2023, Baker Hughes unveiled a range of new digital solutions aimed at boosting efficiency, performance, and emissions reduction across the oilfield, gas, and industrial sectors. Key offerings include Leucipa, an automated field production solution for oil and gas optimization, and Cordant, a suite of process optimization and asset performance management. The company also partnered with Corva to provide intelligent rig visualization and drilling operations, supporting the shift toward smarter, more sustainable energy practices.

Key Highlights:

- The digital oilfield industry size was recorded at USD 29.44 billion in 2023.

- The market is projected to grow at a CAGR of 5.23% from 2024 to 2031.

- North America held a share of 36.55% in 2023, valued at USD 10.76 billion.

- The production optimization segment garnered USD 11.40 billion in revenue in 2023.

- The hardware solutions segment is expected to reach USD 18.49 billion by 2031.

- The onshore segment is projected to generate a revenue of USD 24.42 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 5.74% over the forecast period.

Market Driver

"Growing Focus on Real-Time Data Analytics and Remote Monitoring"

The digital oilfield market is experiencing notable growth, fueled by the increasing need for real-time data analytics and remote monitoring. As oil and gas operations become more complex and geographically dispersed, operators are turning to digital technologies to monitor assets, track performance, and manage field operations remotely.

This allows companies to make data-driven decisions in real time, improving operational efficiency and reducing risks associated with human error. Additionally, the growing reliance on cloud-based solutions enables better collaboration and data sharing across teams, enhancing the ability to monitor production remotely and streamline workflows.

These digital advancements empower operators to improve decision-making, optimize resource allocation, and minimize downtime, all while ensuring better safety and compliance with environmental regulations.

- In January 2025, Baker Hughes introduced SureCONNECT FE, the field-proven downhole fiber-optic wet-mate system. This innovative technology enables real-time, efficient reservoir performance in high-pressure environments, while reducing rig time, maintenance costs, and safety risks. SureCONNECT FE facilitates seamless fiber-optic monitoring and intelligent completion systems throughout the wellbore, enhancing production efficiency and enabling more informed operational decisions without interventions.

Market Challenge

"Rising Cybersecurity Risks Associated With Digitalization"

A significant challenge impeding the progress of the digital oilfield market is the cybersecurity risks associated with increasing digitalization. As oil and gas companies adopt more advanced digital technologies, including IoT devices, cloud platforms, and real-time data analytics, they are becoming increasingly vulnerable to cyberattacks.

These digital systems handle sensitive operational data, making them prime targets for hackers that can disrupt operations, compromise proprietary information, or result in significant financial losses. As critical infrastructure becomes increasingly connected to the internet, the risks of data breaches, ransomware attacks, and system failures continue to rise.

This challenge can be addressed through the implementation of robust cybersecurity frameworks that include advanced encryption methods, multi-factor authentication, and continuous network monitoring.

Additionally, integrating AI-driven security systems can help detect and prevent potential threats in real time, ensuring that digital oilfield systems remain secure and resilient against evolving cyber threats. Regular security audits, employee training, and compliance with international cybersecurity standards can further strengthen the protection of digital assets.

Market Trend

"Rising Integration of Artificial Intelligence"

A significant trend influencing the digital oilfield market is the growing integration of AI to enhance operational efficiency and decision-making. AI technologies, particularly machine learning and deep learning, are being increasingly deployed to analyze vast amounts of data generated by digital oilfield systems.

AI algorithms can process real-time data from sensors and monitoring devices, providing actionable insights that help optimize drilling, production, and reservoir management.

These AI-driven solutions are capable of predicting equipment failures before they occur, enabling predictive maintenance and reducing costly downtime. Furthermore, AI can analyze complex geological data to improve drilling accuracy and reservoir modeling, enhancing overall recovery rates.

- In September 2024, SLB introduced the Lumi data and AI platform to integrate advanced artificial intelligence, including generative AI, into workflows across the energy value chain. This open and modular platform provides secure access to high-quality data spanning subsurface, surface, planning, and operational domains, promoting cross-functional collaboration and enterprise-level decision-making. Lumi combines large language models with SLB’s industry-specific foundation models to accelerate AI adoption and enhance operational performance.

Digital Oilfield Market Report Snapshot

|

Segmentation

|

Details

|

|

By Process Type

|

Production Optimization, Drilling Optimization, Reservoir Optimization, Others

|

|

By Solution Type

|

Hardware Solutions, Software & Service Solutions, Data Storage Solutions

|

|

By Application

|

Onshore, Offshore

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Process Type (Production Optimization, Drilling Optimization, Reservoir Optimization, and Others): The production optimization segment earned USD 11.40 billion in 2023 due to the growing need for real-time data analytics and automated workflows to enhance output and reduce downtime.

- By Solution Type (Hardware Solutions, Software & Service Solutions, and Data Storage Solutions): The hardware solutions segment held a share of 46.32% in 2023, attributed to increased deployment of advanced field instruments and IoT-enabled devices to improve operational visibility.

- By Application (Onshore and Offshore): The onshore segment is projected to reach USD 24.42 billion by 2031, propelled by the rising adoption of digital technologies across mature oilfields and cost-effective implementation in accessible terrains.

Digital Oilfield Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America digital oilfield market share stood at around 36.55% in 2023, valued at USD 10.76 billion. This dominance is attributed to the region’s early adoption of advanced digital technologies, strong presence of leading oilfield service providers, and substantial investments in automation and data-driven solutions across shale plays.

The U.S., in particular, has witnessed widespread deployment of digital tools for production and drilling optimization, supported by a robust digital infrastructure and a focus on enhancing operational efficiency in unconventional oil and gas extraction.

Moreover, increased investments in digital twins, AI-driven analytics, and predictive maintenance systems have accelerated the shift toward fully integrated digital oilfields. The region's regulatory support for environmentally conscious operations has prompted companies to adopt smart technologies that enhance resource utilization and minimize waste.

Asia Pacific digital oilfield industry is poised to grow at a CAGR of 5.74% over the forecast period. This growth is fostered by increasing exploration and production activities in emerging economies such as China and India, coupled with rising energy demand and government initiatives to modernize oilfield operations.

The region is witnessing a growing interest in automation, IoT-based monitoring, and software-driven reservoir management as operators strive to improve recovery rates and reduce capital expenditures.

Additionally, the presence of untapped reserves and the rising participation of international oil companies in joint ventures across the region are fostering the deployment of digital technologies.

Improvements in regional digital infrastructure and rising awareness about the long-term cost benefits of digital integration are further contributing to regional market expansion.

- In December 2024, ONGC pre-launched the Well Information System (WIS), a Generative AI-powered platform aimed at fostering digital transformation in drilling and well services. Officially introduced at the Institute of Drilling Technology in Dehradun, India, the system enhances data capture, daily drilling reporting, and analytics across all offshore rigs. This initiative marks a key step toward smarter, more efficient, and sustainable oilfield operations.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates various aspects of digital oilfield operations through environmental compliance requirements related to air emissions, wastewater management, and chemical usage.

- In Europe, digital oilfield operations are regulated under the European Union’s Industrial Emissions Directive (IED) and the EU Emissions Trading System (ETS), which mandate the continuous monitoring and reporting of industrial emissions using reliable and standardized digital systems.

Competitive Landscape

Key players operating in the digital oilfield industry are enhancing technological capabilities and expanding digital solution portfolios to gain a competitive edge.

Companies are increasingly investing in R&D to introduce integrated platforms that combine data analytics, cloud computing, and artificial intelligence to streamline operations across drilling, production, and reservoir management.

Strategic collaborations with technology providers and software firms are common, enabling the co-development of customized solutions for oilfield environments. Companies are further focusing on mergers and acquisitions to strengthen their presence in high-growth regions and broaden their access to advanced digital tools.

The emphasis remains on developing real-time, end-to-end automation systems that offer predictive insights and operational transparency. Additionally, players are enhancing remote monitoring and control capabilities to reduce on-site manpower and improve safety.

To remain competitive, they are prioritizing scalable, interoperable solutions that integrate with existing infrastructure, minimizing client transition costs. Subscription-based models and modular platforms are also being introduced to facilitate digital adoption among small and mid-sized operators. Strenghthening cybersecurity features to protect operational data and digital assets has become a strategic priority.

- In November 2024, SLB launched Stream, a high-speed intelligent telemetry solution designed to enhance drilling confidence and performance in complex wells. Stream overcomes the limitations of traditional mud pulse telemetry by integrating proprietary AI algorithms with SLB’s TruLink dynamic survey-while-drilling service. It delivers uninterrupted, high-speed, and high-fidelity real-time subsurface data across all depths and conditions, enabling more informed decision-making and improved well outcomes.

List of Key Companies in Digital Oilfield Market:

- Digi International Inc.

- Siemens

- Halliburton

- Viridien

- Emerson Electric Co.

- Baker Hughes Company

- Nabors Industries Ltd.

- SLB

- KONGSBERG

- Rockwell Automation

- NOV

- ABB

- Weatherford

- Honeywell International Inc

- Pason Systems Corp.

Recent Developments (Partnerships/ Product Launch)

- In April 2024, CNX Resources and Deep Well Services collaborated to launch AutoSep Technologies, an oilfield service company focused on transforming conventional flowback operations. Operated by Deep Well Services, AutoSep combines CNX’s proprietary technology with DWS’s field expertise to deliver automated flowback solutions that reduce costs, improve safety, and minimize environmental impact, including methane emissions. Its first product, a compact automated flowback system for high-rate unconventional shale wells, targets improved deployment efficiency and reduced labor requirements in both domestic and international markets.

- In August 2023, Halliburton and PTT Exploration and Production Public Company Limited signed a Memorandum of Understanding to co-develop and market digital transformation solutions across Thailand, Malaysia, and Vietnam. The initiative leverages PTTEP’s Well Delivery Process (WDP), WellSafvy, and Advanced Production Excellence (APEX), built on Halliburton’s DecisionSpace 365 suite, to enhance operational efficiency for regional oil and gas operators.