Enquire Now

Digital Insurance Platform Market Size, Share, Growth & Industry Analysis, By Component (Platforms, Services), By Deployment (Cloud-based, On-premises), By Insurance Type (Property and Casualty Insurance, Life Insurance, Health Insurance, Automotive Insurance, Travel Insurance, Others), By End User, and Regional Analysis, 2025-2032

Pages: 190 | Base Year: 2024 | Release: October 2025 | Author: Versha V.

Key strategic points

A digital insurance platform is an integrated technology system that enables insurers and intermediaries to manage core functions such as policy administration, claims processing, billing, and customer engagement through a unified digital environment.

The market encompasses software platforms and related services deployed through cloud or on-premises models. It covers adoption across life, health, property and casualty, automotive, travel, and specialized insurance segments, serving insurers, third-party administrators, and brokers worldwide.

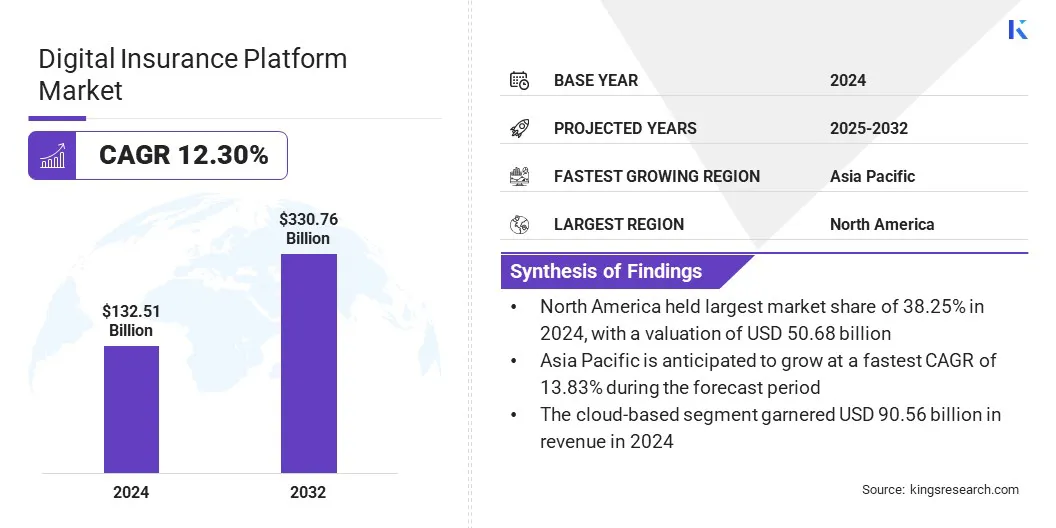

The global digital insurance platform market size was valued at USD 132.51 billion in 2024 and is projected to grow from USD 146.83 billion in 2025 to USD 330.76 billion by 2032, exhibiting a CAGR of 12.30% over the forecast period.

The market is expanding as insurers adopt advanced technologies to improve policy administration, claims processing, billing, and customer engagement. Growth is driven by the rising demand for cloud-based deployment, adoption of analytics for risk assessment, and utilization of platforms that enable shorter time to market while ensuring compliance.

Major companies operating in the digital insurance platform market are Oracle, Software Group, Sure, Inc., Cogitate, Boost Insurance Agency, Inc., Salesforce, Inc., Microsoft, SAP SE, Accenture, DXC Technology Company, Appian, BriteCore, Insuresoft, CoverGo Limited, and Quantemplate.

Key players are pursuing collaborations with consulting firms and technology providers to integrate AI-driven solutions with cloud-native SaaS platforms. This enables insurers to modernize core systems, automate routine tasks, reduce manual errors, and optimize workflows. The partnerships support scalable, end-to-end solutions for risk management, customer onboarding, underwriting, and product configuration while improving digital customer experiences and operational performance.

Growing Workforce Fuel Demand for Digital Insurance Platforms

The digital insurance platform market experiences strong growth due to mandatory workers’ compensation insurance, which requires employers to cover one or more employees in most regions. Expanding global workforce drives higher demand for policies and increases administrative complexity.

According to the International Labour Organization, the employment-to-population ratio increased from 55.8% in 2020 to 57.8% in 2025, further increasing policy volumes. Rising policy volumes create demand for scalable, automated systems to manage administration, claims, compliance, and reporting. Digital platforms allow employers and insurers to comply with regulations efficiently and reduce operational risk.

Data Security and Compliance Challenges

A major challenge in the digital insurance platform market is safeguarding sensitive customer and financial data while meeting regulatory requirements. Insurers face escalating risks of cyberattacks, data breaches, and unauthorized foreign access when adopting global cloud infrastructure for critical operations. Regulatory frameworks add significant complexity, since violations can result in heavy financial penalties and lasting reputational damage.

Platform providers are addressing these issues through advanced encryption technologies that secure data both at rest and in transit across systems. They are also deploying external key management solutions, which grant insurers full control over encryption keys, thereby ensuring compliance and reducing exposure to security threats.

Leveraging Generative AI for Enhanced Efficiency and Decision-Making

The digital insurance platform market grows due to the adoption of generative AI, which automates processes such as claims handling, underwriting, and policy administration. Insurers use these AI-driven platforms to accelerate data-driven decision-making and reduce operational errors while improving productivity across business functions.

Generative AI enables advanced scenario modeling and analytics, which helps organizations optimize risk management and streamline workflows while ensuring compliance. This trend encourages the development of intelligent, scalable, and efficient digital platforms that enhance operational performance and support strategic decision-making.

|

Segmentation |

Details |

|

By Component |

Platforms (Policy Administration Platforms, Claims Management Platforms, Billing and Payment Platforms, Customer Engagement Platforms), Services (Implementation and Integration, Consulting and Advisory, Support and Maintenance) |

|

By Deployment |

Cloud-based, On-premises |

|

By Insurance Type |

Property and Casualty Insurance, Life Insurance, Health Insurance, Automotive Insurance, Travel Insurance, Others |

|

By End User |

Insurance Companies, Brokers and Agents, Third-Party Administrators, InsurTech Firms |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

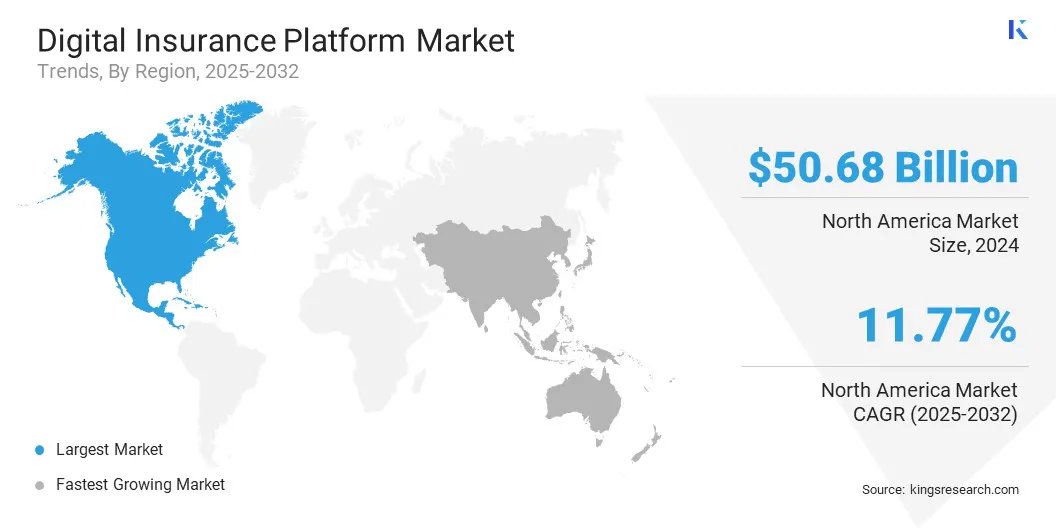

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America digital insurance platform market share stood at around 38.25% in 2024 in the global market, with a valuation of USD 50.68 billion. This expansion is supported by regulatory mandates that require employers to provide workers’ compensation insurance and vehicle owners to maintain minimum auto liability coverage. These obligations drive consistent demand for automated policy administration, claims management, and compliance solutions.

Insurers in the region are also adopting AI, automation, and advanced analytics to optimize workflows, reduce operational errors, and improve customer engagement. Strong technological infrastructure and high digital adoption further strengthen North America’s lead in the market.

The digital insurance platform market in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 13.83% over the forecast period. This growth is fueled by investments by insurers and technology providers to expand digital insurance infrastructure across the region.

Companies allocate resources to enhance cloud-based platforms and integrate AI-driven decision making while localizing solutions for regulatory compliance and operational efficiency. Investments also target talent acquisition, product development, and ecosystem expansion to enable rapid deployment of insurance services.

These financial commitments allow insurers to modernize legacy systems, optimize resource allocation, and deliver scalable, innovative, and market-responsive insurance solutions.

Key players in the digital insurance platform industry are strengthening their position by integrating agentic AI to drive product innovation. These technologies automate core processes, strengthen governance, and improve agility across operations.

Companies are also adopting no-code and low-code development tools to simplify customization, accelerate deployment, and minimize reliance on IT teams. This approach allows business users to design solutions that align with compliance, operational efficiency, and faster product delivery. Through these strategies, providers deliver scalable, efficient, and adaptive platforms that establish them in a dynamic market.

Frequently Asked Questions