Health Insurance Market Size

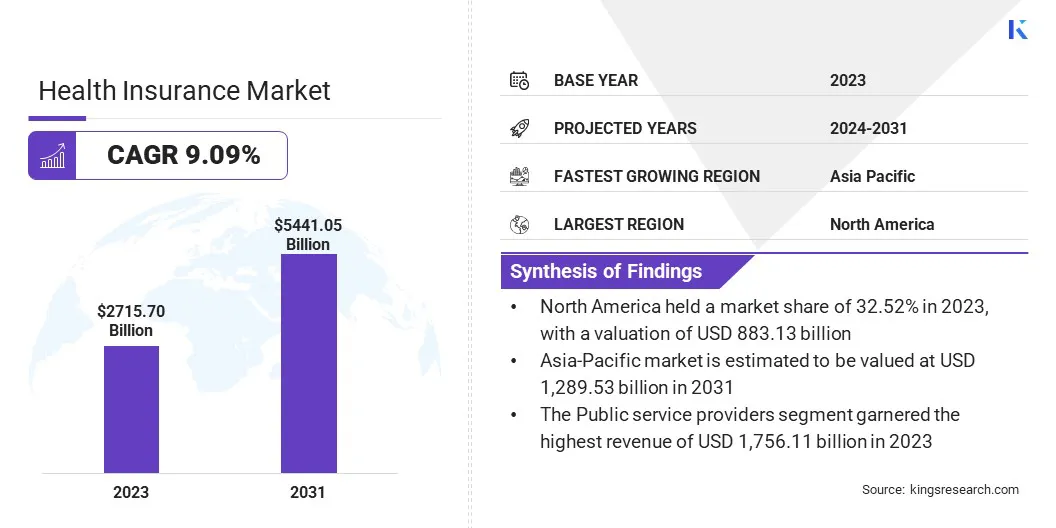

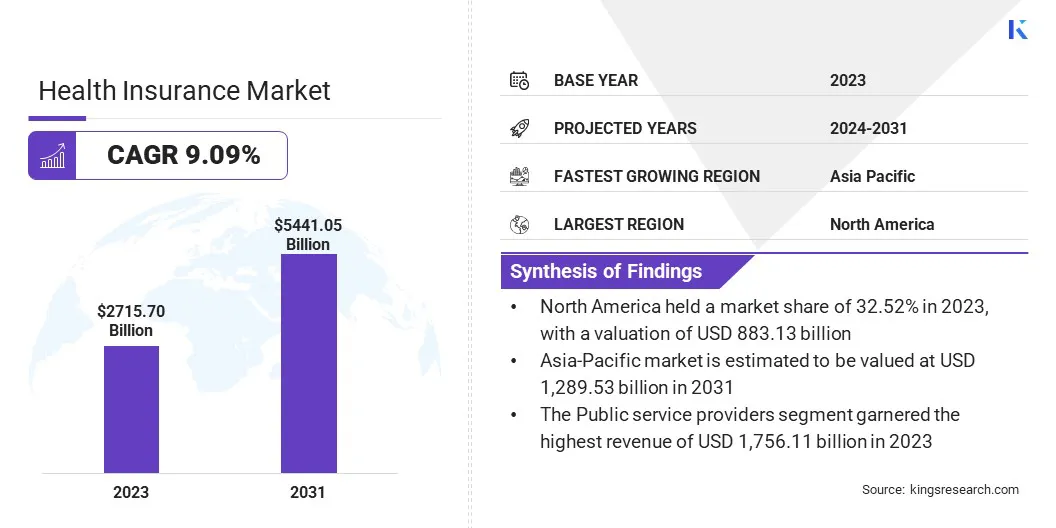

The Global Health Insurance Market size was valued at USD 2,715.70 billion in 2023 and is projected to reach USD 5,441.05 billion by 2031, growing at a CAGR of 9.09% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Aetna Inc. (CVS Health Corporation), UNITEDHEALTH GROUP, Berkshire Hathaway Specialty Insurance, Cigna Healthcare., Elevance Health, Centene Corporation, Ping An Insurance (Group) Company of China, Ltd., Allianz Care, Zurich Insurance Group AG and Others.

The increasing healthcare costs necessitate the coverage for medical expenses, resulting in increased awareness among populations regarding the benefits of health insurance. Health insurance helps mitigate the financial risk associated with illnesses, as sudden medical expenses can have detrimental consequences on the financial stability of individuals.

Additionally, several governmental policies and incentives provided by employers that encourag or mandate health insurance coverage significantly contribute to market growth. The health insurance market is a part of the overall insurance market, where products and services are bought, sold, and traded. This encompasses a wide range of insurance products, including life insurance, health insurance, property insurance, and various other types of coverage.

The insurance industry operates under stringent regulatory frameworks established by government authorities. This ensures the implementation of fair practices, stability, and consumer protection within the industry. The insurance market plays a crucial role in managing and distributing risks among individuals along with businesses,

Analyst’s Review

The health insurance market is likely to grow due to the rapid development of the healthcare industry. Rapid advancements in technology make treatment for previously unknown diseases and illnesses possible, improving patient outcomes and expanding the scope of medical care.

However, this results in high treatment costs, thereby placing the entire financial burden on patients. Health insurance companies must enhance their portfolio to enhance the coverage of their services while charging reasonable premiums, with the objective of expanding their customer base.

Health Insurance Market Growth Factors

The escalation in the cost of healthcare exerts a significant impact on the health insurance market. This is propelled by various factors, including advancements in medical technology, greater demand for adequate healthcare services, and a rapidly aging population. These dynamics are fueled by rising expenses, which prompts insurers to adapt strategies.

Strategies employed can vary from tweaking premiums, and including co-pay options, along with options regarding coverage, which helps strike a balance toward profitability and affordability for consumers. Navigating these challenges requires insurers to be agile and employ innovative strategies to manage costs, ensuring access to vital healthcare services.

The rising costs of healthcare and evolving patterns of healthcare utilization are significant driving forces behind the health insurance market. Various factors, including rapid advances in medical technology, pharmaceutical innovations, and the prevalence of chronic diseases, influence healthcare service costs and the preferred coverage sought by individuals and employers.

As a result, insurers continually assess and adjust their pricing strategies, benefit designs, and provider networks to manage costs effectively while ensuring adequate coverage for policyholders.

Health Insurance Market Trends

Technological advancements are reshaping the health insurance market landscape, driving trends such as telemedicine, wearable health devices, and data analytics. These innovations enable insurers to offer more personalized and preventive healthcare solutions, streamline administrative processes, and improve customer experiences.

Additionally, advancements in artificial intelligence and machine learning help insurers better assess risks, detect fraud, and optimize pricing strategies. Embracing technology allows health insurers to stay competitive, enhance operational efficiency, and meet customers' evolving needs and expectations.

A shift toward value-based care models is transforming the healthcare reimbursement landscape. Insurers are increasingly incentivizing providers based on patient outcomes and quality of care rather than traditional fee-for-service arrangements. This trend promotes cost containment, enhances care coordination, and fosters collaboration among stakeholders to improve overall healthcare quality and affordability.

- For instance, the US Affordable Care Act (ACA, 2010) comprised guidelines aimed toward supporting medical care delivery methods that lowered the cost of healthcare. The 'Value-Based Insurance Design' permitted the formulation of group health plans and insurance issuance coverage to utilize value-based insurance designs.

Segmentation Analysis

The global market is segmented based on service provider, type, end users, coverage type, and geography.

By Service Provider

Based on service providers, the market is segmented into public and private service providers. Public service providers dominated the health insurance market with a value of USD 1,756.11 billion in 2023. This is due to insurance being a mandatory part of the public sector employee benefits.

Furthermore, there is substantial public sector intervention regarding providing access to affordable healthcare and other related services, including health insurance, among others, which is a key factor fueling segment growth.

By Type

Based on type, the health insurance industry is segmented into medical insurance, critical illness, and others. The critical illness segment is poised to experience the fastest growth at a CAGR of 10.06% over 2024-2031, mainly backed by the increasing awareness among individuals about the financial risks associated with major illnesses such as cancer, heart disease, and stroke. As people become more conscious of these risks, they are seeking insurance coverage that specifically addresses the costs associated with critical illnesses.

Additionally, advancements in medical technology and treatments have improved survival rates for critical illnesses, in turn increasing healthcare expenses. This has prompted individuals to seek insurance policies that provide comprehensive coverage for critical illnesses, including medical treatment costs and associated expenses such as rehabilitation, home care, and loss of income.

By End Users

Based on end users, the market is bifurcated into corporate and individuals. The corporate sector holds 53.3% of the market share in 2023. This is likely because large corporations typically negotiate favorable terms and pricing with health insurance providers due to their large employee base. This enables them to secure comprehensive coverage at competitive rates, resulting in cost savings compared to individual or small group policies.

Furthermore, the corporate sector often has a diverse workforce with varying health risks. By pooling the health risks of many employees, insurance providers can spread the financial risk more effectively, leading to more stable premiums and reduced volatility in claims costs.

Health Insurance Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Health Insurance Market share stood around 32.52% in 2023 in the global market, with a valuation of USD 883.13 billion.

North America's dominance in the market stems from its large population, high healthcare costs, prevalent employer-sponsored coverage, significant government programs such as Medicare and Medicaid, a dynamic regulatory environment shaped by reforms, particularly the Affordable Care Act, technological advancements, and a robust private healthcare system fostering innovation and choice in insurance products.

Asia-Pacific is anticipated to experience significant growth over the forecast period, and the region's market is estimated to be valued at USD 1,289.53 billion in 2031.

The Asia Pacific health insurance market is expected to grow rapidly due to expanding middle-class income, aging populations, increased healthcare spending, urbanization, lifestyle changes, government initiatives, and rising awareness. These factors are driving the demand for coverage against rising healthcare costs and chronic diseases, which is positively influencing the regional market outlook.

Competitive Landscape

The health insurance market report will provide valuable insight with an emphasis on the fragmented end-user of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Health Insurance Market

- Aetna Inc. (CVS Health Corporation)

- UNITEDHEALTH GROUP

- Berkshire Hathaway Specialty Insurance

- Cigna Healthcare.

- Elevance Health

- Centene Corporation

- Ping An Insurance (Group) Company of China, Ltd.

- Allianz Care

- Zurich Insurance Group AG

Key Industry Developments

- January 2024 (Approval): Narayana Health received regulatory approval to launch a health insurance business in India from the Insurance Regulatory and Development Authority of India (IRDAI). The company plans to roll out strategies for its insurance services in the first quarter of 2025.

- February 2024 (Launch): AXA - Global Healthcare announced the launch of its new healthcare payment card, a virtual service aimed at simplifying the insurance claims process. The card provides services that enable quicker claims settlement and treatment access. Furthermore, it allowed members to pay for services such as over-the-counter medication and certain outpatient treatments without using their funds or needing to submit a claim.

The Global Health Insurance Market is Segmented as:

By Service Provider

- Public Service Provider

- Private Service Provider

By Type

- Medical Insurance

- Critical Illness

- Others

By End Users

By Coverage Type

- Lifetime Coverage

- Term Coverage

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America