Digital Genome Market Size

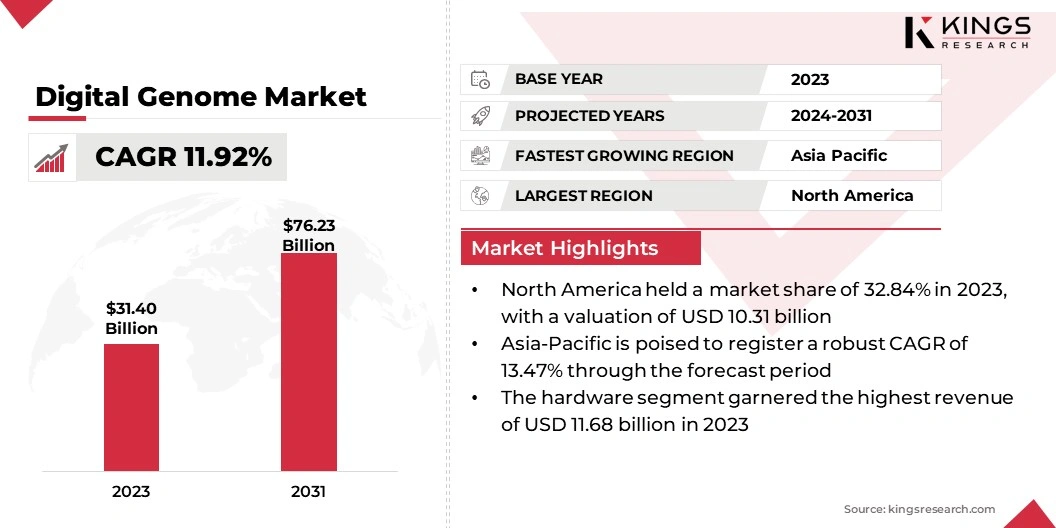

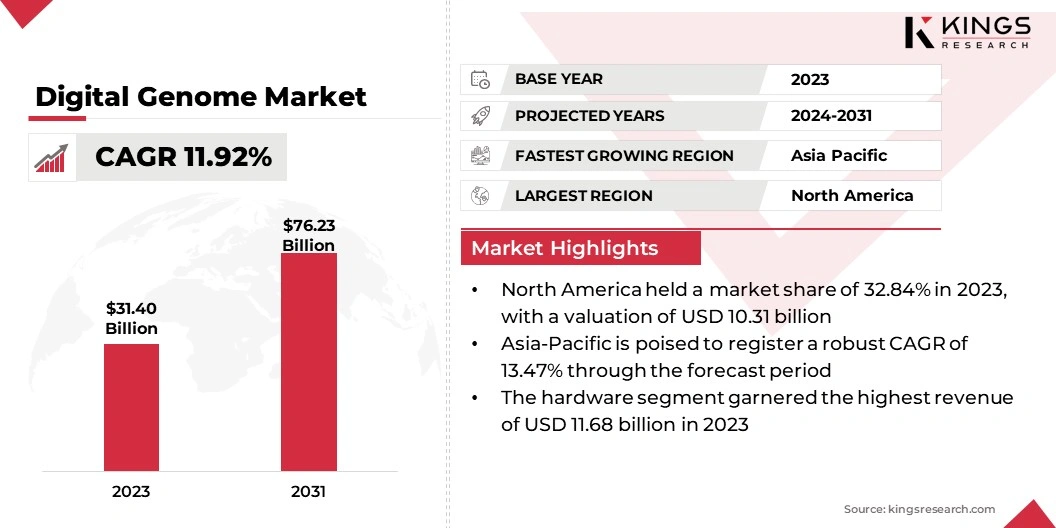

The global Digital Genome Market size was valued at USD 31.40 billion in 2023 and is projected to grow from USD 34.66 billion in 2024 to USD 76.23 billion by 2031, exhibiting a CAGR of 11.92% during the forecast period. The market is expanding rapidly with advancements in sequencing technologies and the growing demand for personalized medicine.

The integration of artificial intelligence and expansion of genomic databases are key trends enhancing data analysis and research. This is expected to drive the market toward significant growth, offering advanced solutions for tailored healthcare and drug development.

In the scope of work, the report includes solutions offered by companies such as Agilent Technologies, Inc., Inscripta, Inc., bioMérieux, GE Healthcare, Laboratory Corporation of America Holdings., Illumina, Inc., Bruker Spatial Biology, Inc., PacBio, PerkinElmer Inc., Quest Diagnostics Incorporated, and others.

The digital genome market is experiencing robust growth due to advancements in sequencing technologies and increasing demand for personalized medicine. Next-Generation Sequencing (NGS) and single-cell sequencing are enhancing the accuracy and accessibility of genomic data, while the integration of AI and ML technologies is improving data analysis and interpretation capabilities. The expansion of comprehensive genomic databases, supported by government initiatives is further fueling market development.

- In August 2022, Mount Sinai Health System and the Icahn School of Medicine, in collaboration with the Regeneron Genetics Center (RGC), launched the Mount Sinai Million Health Discoveries Program. This research initiative aims to create a unique dataset that will enable researchers to evaluate the effectiveness of genetics-based precision medicine in guiding daily patient care.

As personalized medicine becomes more prevalent, the need for detailed genomic information continues to rise, propelling the demand for digital genome solutions over the forecast period.

Digital genome refers to the comprehensive digital representation of an organism's complete genetic information, captured through advanced sequencing technologies and computational tools. This digital framework allows the storage, analysis, and interpretation of genomic data, enabling detailed insights into genetic variations, gene functions, and hereditary conditions.

By integrating large-scale genomic datasets with sophisticated bioinformatics and artificial intelligence, digital genome helps in personalized medicine, drug development, and genomic research. It plays a crucial role in understanding complex genetic diseases, improving diagnostic accuracy, and tailoring treatments to individual genetic profiles, thereby advancing precision healthcare.

Analyst’s Review

Genomic sequencing is increasingly becoming a core component of clinical practices, supported by substantial government investments and initiatives.

- The Genome India Project, funded by the Department of Biotechnology, successfully sequenced 10,000 Indian genomes by March 2024, creating a reference Indian human genome. This project exemplifies how government support accelerates the integration of genomic data into healthcare systems.

Such initiatives will likely enhance the availability of high-quality genomic data, fostering advancements in personalized medicine and driving market growth. Substantial funding from both government and manufacturers in genomics propels the expansion of the digital genome market, supporting new research and clinical applications.

Digital Genome Market Growth Factors

Continuous advancements in sequencing technologies, such as Next-Generation Sequencing (NGS) and single-cell sequencing, are significantly propelling the digital genome market.

- In January 2023, Agilent Technologies, Inc. revealed the acquisition of Avida Biomed, a company specializing in target enrichment workflows for clinical researchers who use Next-Generation Sequencing (NGS) methods to study cancer.

NGS offers high-throughput capabilities, allowing rapid and cost-effective sequencing of entire genomes. Single-cell sequencing provides detailed insights into genetic variation at individual cell levels, revealing complex biological processes. These innovations make genomic data more accessible and accurate, reducing costs and increasing the efficiency of genomic analyses.

As a result, there is a growing demand for digital genome tools and services that leverage these technologies and drive market expansion. However, the market is expected to be hindered by high costs associated with advanced genomic technologies and regulatory complexities related to data privacy and ethics. These issues can restrict access to genomic services and slow down-market adoption.

Key players are addressing these challenges by investing in cost-reduction strategies and developing more affordable genomic solutions. They are also working closely with regulatory bodies to streamline compliance processes and ensure data privacy standards. By focusing on innovation and regulatory alignment, companies are enhancing the accessibility and adoption of genomic technologies, mitigating barriers to further propel market growth.

Digital Genome Market Trends

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) in genomic data analysis is driving significant growth in the digital genome market. These technologies streamline the interpretation of vast and complex genomic datasets, enhancing the accuracy and efficiency of analyses. AI and ML algorithms can quickly identify genetic patterns and predict health outcomes, which is crucial for personalized medicine and precision healthcare.

The increasing sophistication and accessibility of AI-driven tools is uncovering deeper insights into genetic data, driving demand for advanced digital genome solutions. This is further expected to fuel the market growth and accelerate innovation in genomics.

The increasing focus on personalized medicine is also driving the market. Healthcare systems are continuously adopting personalized approaches to offer specialized treatments as per the individual genetic profiles. This would require detailed and accessible genomic information, which is expected to fuel the digital genome market over the forecast period.

- In March 2024, the U.S.-based company, Nucleus Genomics, introduced its DNA analysis product to make the benefits of personalized medicine accessible to all.

This shift is fueling the adoption of advanced digital genome solutions, which are providing critical insights into genetic variations and their impact on health and disease. By meeting the needs of personalized medicine, digital genome technologies are expanding their market presence, enhancing their role in precision healthcare, and contributing to the overall growth of the industry.

Segmentation Analysis

The global market has been segmented on the basis of component, application, end user, and geography.

By Component

Based on component, the market has been categorized into hardware, software, and services. The hardware segment led the digital genome market in 2023, reaching a valuation of USD 11.68 billion.

The hardware segment has been sub-segmented into DNA sequencers, DNA microarrays, PCR (Polymerase Chain Reaction) equipment, and next-generation sequencing systems. This segment is witnessing significant growth with the advancing sequencing technologies, which is increasing the efficiency and accuracy of genetic data collection.

The introduction of high-throughput sequencers and advanced imaging systems is expanding the capabilities of genomic research and clinical diagnostics. Additionally, the rise in research and development activities and the growing adoption of personalized medicine are boosting the demand for sophisticated hardware solutions.

With the increasing complexity and precision of genomic data generation, the hardware segment is expected to evolve, contributing to the overall growth of the market over the forecast period.

By Application

Based on application, the market has been categorized into diagnostics, drug discovery and development, agriculture & animal research, forensics, bioinformatics and computational biology, and academic and research institutes.

The diagnostics segment captured the largest digital genome market share of 43.10% in 2023. This segment has been further categorized into personalized medicine, genetic testing, and disease risk assessment, witnessing robust growth due to advancements in genomic technologies and increasing demand for precision medicine.

- In February 2024, Veracyte, Inc., a prominent leader in cancer diagnostics, announced successful completion of its partnership with C2i Genomics, Inc. This collaboration is expected to enhance Veracyte's diagnostic platform by incorporating whole-genome minimal residual disease (MRD) capabilities, thereby expanding the company's capacity to support patients throughout the cancer care continuum.

The rise in genetic testing for hereditary diseases, cancer, and personalized treatment plans is driving the adoption of advanced diagnostic tools. Innovation in genomic assays and the use of AI for data interpretation are enhancing diagnostic accuracy and efficiency. Moreover, growing healthcare investments and rising awareness of genetic disorders are fueling the demand for diagnostic solutions.

By End User

Based on end user, the market has been categorized into hospitals and clinics, pharmaceutical and biotechnology companies, research and academic institutions, agricultural and livestock breeding companies, and forensic laboratories.

The hospitals and clinics segment is expected to account for the highest revenue of USD 25.99 billion by 2031. This segment is experiencing significant growth due to the increasing adoption of precision medicine and genomic testing in clinical settings. Hospitals and clinics are increasingly incorporating genomic tools to improve diagnosis accuracy, tailor treatment plans, and enhance patient outcomes.

Advances in Next-Generation Sequencing (NGS) and bioinformatics are enabling these institutions to utilize genomic data effectively. Additionally, rising investments in healthcare infrastructure and a growing emphasis on personalized medicine are fueling the demand for genomic solutions in hospitals and clinics.

Digital Genome Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America digital genome market share stood at 32.84% in 2023, with a valuation of USD 10.31 billion. The region benefits from a well-established healthcare system, advanced technological capabilities, and high adoption of genomic technologies. The presence of major biotechnology and pharmaceutical companies and strong governmental support for genomics research, further fuels market expansion. Initiatives and collaborations between leading research institutions and industry players are successfully advancing genomic data applications.

- In January 2023, SOPHiA GENETICS partnered with Memorial Sloan Kettering Cancer Center (MSK), a leading U.S. cancer center, to provide researchers and clinicians with advanced solutions that enhance analytical and testing capabilities.

Additionally, increasing prevalence of genetic disorders and rising demand for personalized medicine are contributing to the market growth in the region.

Asia-Pacific is anticipated to witness the fastest growth at a CAGR of 13.47% over the forecast period. Increasing government investments in healthcare modernization and genomic research are driving market expansion. The rapid development of biotechnology infrastructure and research capabilities in countries like China, Japan, and India are driving innovation. Additionally, increasing private sector involvement and collaboration between local firms and international biotech companies are facilitating the introduction of advanced genomic technologies.

- In February 2024, the government of Telangana unveiled a USD 240 million (INR 2000 crore) investment to expand the Genome Valley Project in Hyderabad. The government is advancing the second phase of the project, which spans 300 acres. This expansion was highlighted during the inauguration of the BioAsia 2024 conference in Hyderabad.

The rise of health awareness and proactive healthcare measures is also contributing to the growing demand for genomic solutions, which is fueling market growth in the region.

Competitive Landscape

The global digital genome market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market share across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Digital Genome Market

- Agilent Technologies, Inc.

- Inscripta, Inc.

- bioMérieux

- GE Healthcare

- Laboratory Corporation of America Holdings.

- Illumina, Inc.

- Bruker Spatial Biology, Inc.

- PacBio

- PerkinElmer Inc.

- Quest Diagnostics Incorporated

Key Industry Developments

- February 2024 (Product launch): Bio-Rad Laboratories, Inc., introduced the Vericheck ddPCR Replication Competent AAV Kit and the Vericheck ddPCR Replication Competent Lentivirus Kit. These products offer a cost-effective solution for detecting replication-competent adeno-associated virus (RCAAV) and replication-competent lentivirus (RCL), supporting safer production of gene and cell therapies.

- November 2023 (Partnership): Fabric Genomics partnered with DNAnexus and Oxford Nanopore Technologies to establish CLIA/CAP labs in pediatric and neonatal ICUs. These labs will utilize Oxford Nanopore’s platforms to investigate genetic disorders in infants.

- February 2023 (Partnership): Illumina, Inc. joined forces with the African Centre of Excellence for Genomics of Infectious Diseases to launch a training institute aimed at enhancing genomic capabilities across Africa.

The global digital genome market has been segmented:

By Component

- Hardware

- DNA Sequencers

- DNA Microarrays

- PCR (Polymerase Chain Reaction) Equipment

- Next-Generation Sequencing Systems

- Software

- Data Analysis Software

- Genome Annotation Software

- Bioinformatics Tools

- Database Management Systems

- Services

- Sequencing Services

- Data Storage and Analysis Services

- Consulting Services

- Maintenance and Support Services

By Application

- Diagnostics

- Personalized Medicine

- Genetic Testing

- Disease Risk Assessment

- Drug Discovery and Development

- Agriculture & Animal Research

- Genetically Modified Organisms (GMOs)

- Crop Improvement

- Animal Breeding

- Forensics

- Bioinformatics and Computational Biology

- Academic and Research Institutes

By End User

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Research and Academic Institutions

- Agricultural and Livestock Breeding Companies

- Forensic Laboratories

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America