Market Definition

The market refers to the industry focused on mobile and web-based applications designed to help users track their food intake, monitor nutritional values, set dietary goals, and maintain a healthy lifestyle.

These apps often include features such as calorie counting, meal planning, macronutrient analysis, hydration tracking, and integration with wearable fitness devices.

Diet and Nutrition Apps Market Overview

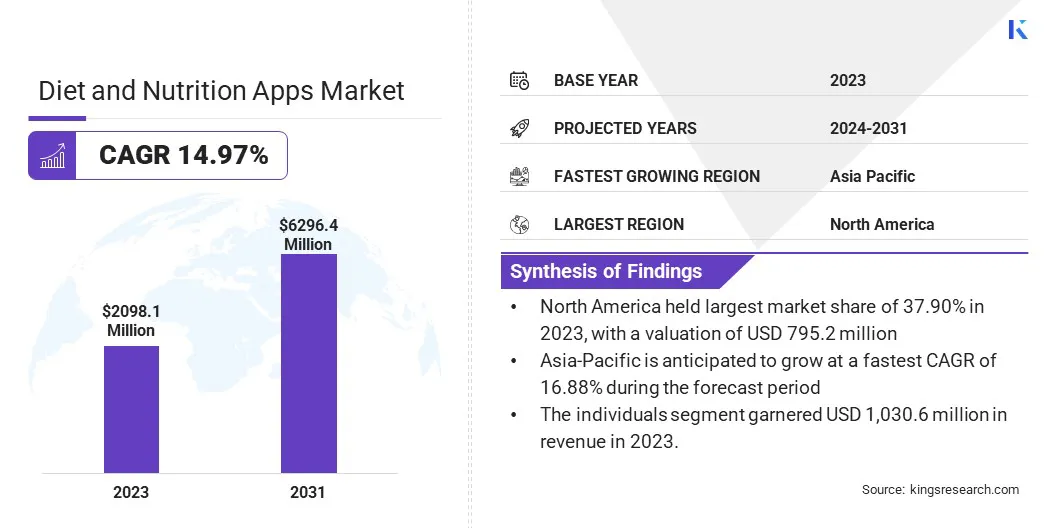

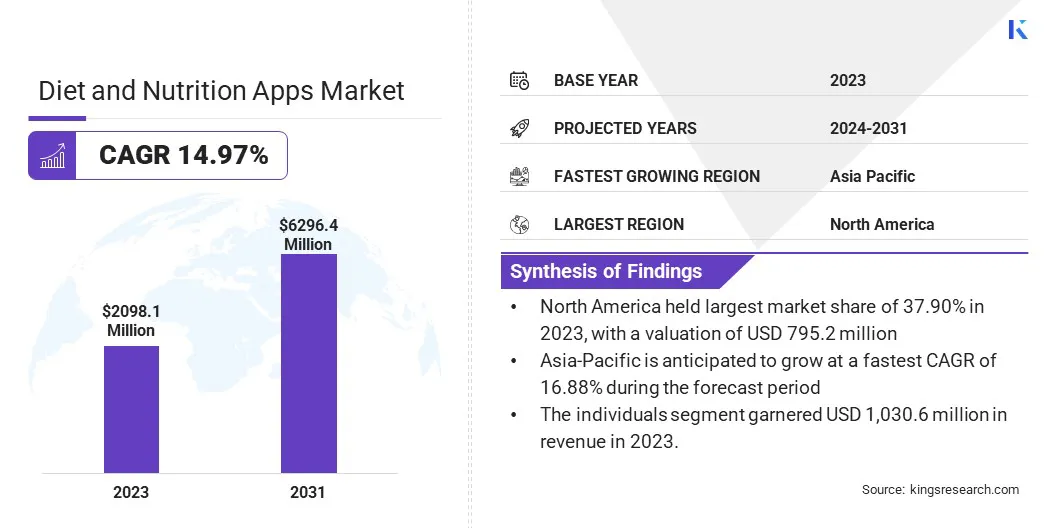

The global diet and nutrition apps market size was valued at USD 2,098.1 million in 2023 and is projected to grow from USD 2,371.4 million in 2024 to USD 6,296.4 million by 2031, exhibiting a CAGR of 14.97% during the forecast period.

The market is registering significant growth due to increasing consumer awareness of health and wellness, rising adoption of smartphones and wearable devices, and the growing prevalence of obesity and other lifestyle-related diseases.

Major companies operating in the diet and nutrition apps industry are Lifesum AB, MyFitnessPal, Inc., FitNow, Inc., MyNetDiary Inc., Noom, Inc., YAZIO, EatFit, fatsecret, Hitung Kalori, PlateJoy LLC, HealthifyMe Wellness Private Limited, Azumio Inc., Innit International SCA, Cronometer, and Fitia .

The market is growing more with the incorporation of artificial intelligence (AI) and machine learning, which enables personalized nutrition recommendations and real-time dietary tracking.

The compatibility of these apps with fitness platforms, the rising demand for plant-based and specialized diets, and the increasing influence of social media on health trends contribute to the market’s expansion.

- In February 2025, MyFitnessPal, Inc. unveiled its 2025 Winter Release, featuring Voice Log for meal tracking via voice commands, Weekly Habits for personalized goal setting, and Intent for advanced meal planning. These updates were done to enhance user experience and support sustainable healthy habits.

Key Highlights

- The diet and nutrition apps industry size was recorded at USD 2,098.1 million in 2023.

- The market is projected to grow at a CAGR of 14.97% from 2024 to 2031.

- North America held a market share of 37.90% in 2023, with a valuation of USD 795.2 million.

- The calorie tracking apps segment garnered USD 734.3 million in revenue in 2023.

- The iOS segment is expected to reach USD 3,017.5 million by 2031.

- The individuals segment is anticipated to witness the fastest CAGR of 16.09% during the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 16.88% during the forecast period.

Market Driver

"Increasing Prevalence of Lifestyle Diseases"

The rising prevalence of lifestyle diseases like obesity, diabetes, and heart disorders is driving the demand for diet and nutrition apps. Poor eating habits and inactivity have fueled health concerns, leading to the adoption of digital tools for meal tracking, calorie monitoring, and personalized nutrition. These apps promote healthier eating, aid in weight management, and support chronic disease prevention.

Increasing recommendations from healthcare providers and integration with wearable devices further enhance their adoption and effectiveness. Their convenience, real-time tracking, and AI-driven insights make them essential tools for individuals striving to maintain a balanced and healthy lifestyle.

- In June 2024, Cleveland Clinic launched the Cleveland Clinic Diet app, offering personalized wellness and diet coaching with advanced food and fitness tracking. The app features two programs: BodyGuard Plan for balanced nutrition and HeartSmart Plan for better cardiovascular health.

Market Challenge

"Lack of Accuracy and Reliability"

Many diet and nutrition apps rely on user input and generic databases, leading to inaccuracies in calorie counts, portion sizes, and nutritional values. Inconsistent food entries and variations in serving sizes can mislead users, affecting their diet tracking and health goals.

AI-driven estimations help but may lack precision, especially for homemade or culturally specific meals. Enhancing accuracy through verified food sources, barcode scanning, and expert integration remains a key challenge.

To overcome this, developers can integrate verified food databases, barcode scanning, and AI-powered food recognition to ensure precise nutritional information. Partnering with nutritionists and healthcare professionals can also enhance credibility by providing expert-validated recommendations.

Implementing machine learning algorithms that adapt to user preferences and regional food variations can further improve accuracy. Encouraging user feedback and community-driven food database updates can also refine data quality. Integration with smart kitchen devices and wearables can automate food tracking, reduce manual input errors, and enhance overall reliability.

Market Trend

"AI-Driven Personalization and Wearable Integration for Smarter Nutrition Tracking"

AI-powered personalization and integration with wearable devices are transforming the diet and nutrition apps market by offering highly tailored health solutions. Advanced AI and machine learning analyze user data, including dietary habits, activity levels, and metabolic patterns, to provide personalized meal plans and nutrition recommendations.

When integrated with smartwatches and fitness trackers, these apps can monitor real-time calorie intake, physical activity, and even biometric data like heart rate and glucose levels. This seamless connectivity enhances accuracy, helps users make informed dietary choices, and promotes a more holistic approach to health and wellness.

- In February 2025, Alma Nutrition Inc. launched the first AI-powered nutrition companion app to simplify healthy eating through personalized and effortless meal planning. The app leverages advanced AI to provide tailored nutrition recommendations, helping users make informed dietary choices based on their preferences and health goals.

Diet and Nutrition Apps Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Calorie Tracking Apps, Diet & Meal Planning Apps, Nutrition Analysis Apps, Wellness & Lifestyle Management Apps

|

|

By Platform

|

iOS, Android, Web-based Platforms

|

|

By End User

|

Individuals, Fitness Centers & Gyms, Corporate Wellness Programs, Healthcare Providers & Nutritionists

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Calorie Tracking Apps, Diet & Meal Planning Apps, Nutrition Analysis Apps, Wellness & Lifestyle Management Apps): The calorie tracking apps segment earned USD 734.3 million in 2023 due to rising health awareness, increased demand for weight management solutions, and seamless integration with fitness trackers.

- By Platform (iOS, Android, Web-based Platforms): The iOS segment held 45.32% of the market in 2023, due to a strong user base, higher in-app spending, and the platform's emphasis on premium health and wellness apps.

- By End User (Individuals, Fitness Centers & Gyms, Corporate Wellness Programs, Healthcare Providers & Nutritionists): The Individuals segment is projected to reach USD 3,339.4 million by 2031, owing to increasing health consciousness, the growing adoption of self-monitoring tools, and the rising demand for personalized nutrition solutions.

Diet and Nutrition Apps Market Regional Analysis

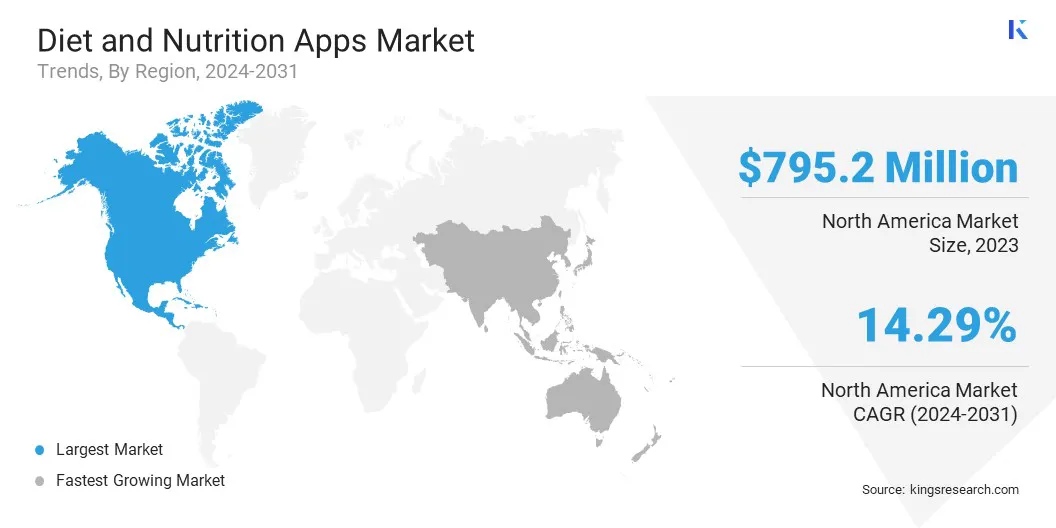

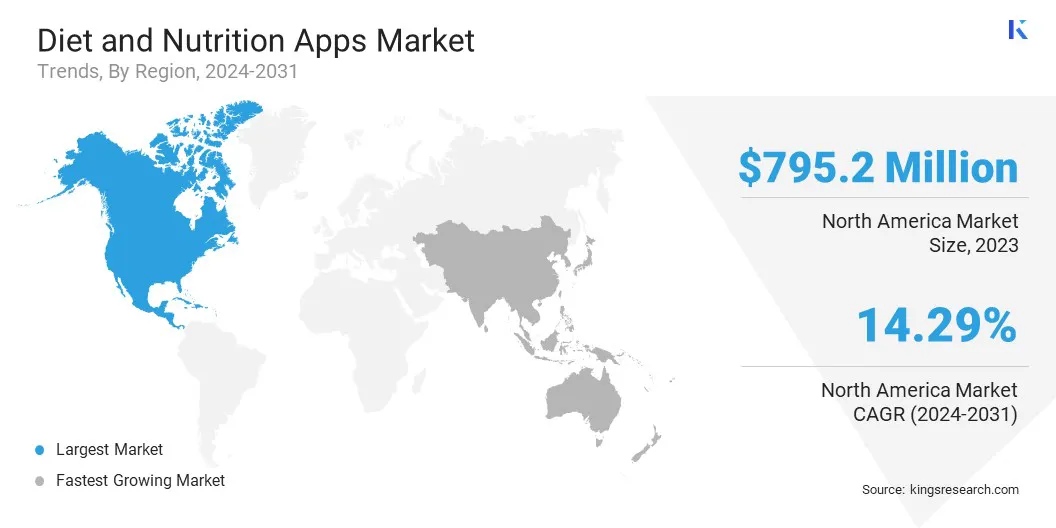

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America diet and nutrition apps market share stood around 37.90% in 2023, with a valuation of USD 795.2 million. North America’s high growth in the market is a result of high smartphone penetration, increasing health awareness, and the growing prevalence of obesity and lifestyle-related diseases.

The region benefits from strong technological advancements, widespread adoption of wearable fitness devices, and the presence of major market players offering innovative solutions.

Additionally, rising demand for personalized nutrition, corporate wellness programs, and the integration of AI-driven health tracking features contribute to market growth. Government initiatives promoting digital health solutions further support the expansion of diet and nutrition apps in the region.

- In September 2024, InsideTracker launched Nutrition DeepDive, an AI-powered food and supplement tracker that analyzes dietary intake in relation to blood biomarkers, DNA, and fitness data. The app provides personalized nutrition insights, requiring only a seven-day logging period before generating tailored health recommendations.

The diet and nutrition apps industry in Asia-Pacific is poised for significant growth at a robust CAGR of 16.88% over the forecast period. This growth is driven by increasing health consciousness, rising smartphone penetration, and growing awareness of lifestyle-related diseases.

The region’s expanding middle-class population and a surge in digital health adoption, fuels demand for personalized nutrition solutions. Countries like China, India, and Japan are leading the growth, supported by rapid urbanization and increasing investments in health-tech innovations.

Additionally, the popularity of specialized diets, government initiatives promoting health and wellness, and the integration of AI-driven tracking features contribute to market expansion.

Regulatory Frameworks

- The European Commission - Nutrition and Health Claims Regulation (NHCR) ensures that any nutrition or health claims made on food products, are scientifically substantiated. This regulation prevents misleading information by requiring all claims to be accurate, evidence-based, and approved before being used in labeling or advertising.

- The Office of the National Coordinator for Health Information Technology (ONC) - Fast Healthcare Interoperability Resources (FHIR) Standard establishes guidelines for seamless data exchange of electronic health records (EHRs). This regulation enhances interoperability, ensuring secure and standardized health data sharing across digital health platforms.

- The Centers for Disease Control and Prevention (CDC) - Health Insurance Portability and Accountability Act (HIPAA) safeguards the privacy and security of health information, ensuring that personal health data is protected from unauthorized access.

Competitive Landscape

The diet and nutrition apps industry is highly competitive, driven by AI innovations, personalized health solutions, and strategic partnerships with fitness platforms and wearable devices. Market players focus on innovation, AI, machine learning, and data analytics to enhance user experience and provide accurate dietary recommendations.

Strategic collaborations with healthcare professionals, fitness platforms, and wearable device manufacturers have become essential for expanding service offerings and improving app functionality.

Freemium models, subscription-based services, and premium features such as real-time coaching and AI-driven meal planning are widely used to attract and retain users. Regulatory compliance and data privacy measures have also become key priorities as users demand greater transparency and security in handling their health data.

- In April 2024, MyFitnessPal, Inc. introduced new tools and content to support members using GLP-1 medications for weight management. These enhancements include medication logging features and a comprehensive GLP-1 Nutrition Plan designed to mitigate side effects and optimize nutrient intake. In addition to medication tracking, MyFitnessPal introduced a free recipe collection and an in-app Nutrition Plan, developed by registered dietitians with guidance from its Scientific Advisory Council.

List of Key Companies in Diet and Nutrition Apps Market:

- Lifesum AB

- MyFitnessPal, Inc.

- FitNow, Inc.

- MyNetDiary Inc.

- Noom, Inc.

- YAZIO

- EatFit

- fatsecret

- Hitung Kalori

- PlateJoy LLC

- HealthifyMe Wellness Private Limited

- Azumio Inc.

- Innit International SCA

- Cronometer

- Fitia

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, WW International Inc. launched its next-gen program with AI-powered features, including a food scanner for instant Points tracking, a recipe analyzer, and access to registered dietitians. The program also expanded its ZeroPoint food list by 150+ items, enhancing meal planning and nutrition support.

- In June 2024, Noom, Inc. launched two advanced AI-powered features - AI food logging and Welli, Noom’s new AI personal health assistant. With these innovations, Noom now utilizes AI to enhance food tracking through photo, text, and voice logging, providing a more accurate and convenient way to track meals and nutrition within the Noom app.

- In February 2024, January AI introduced the ‘January app’ that predicts blood sugar responses by analyzing photos of meals, eliminating the need for continuous glucose monitors. Leveraging generative AI, the app provides personalized insights into how different foods affect blood glucose levels, aiding users in making informed dietary choices.

- In February 2024, Otsuka Pharmaceutical Co., Ltd. launched "Mogumogu Town," an augmented reality (AR) nutrition education game app for smartphones and tablets. The app allows users to photograph their meals, triggering the appearance of "Mogumin" characters representing the meal's ingredients in AR.

- In February 2023, Albertsons Companies, Inc. introduced Sincerely Health, a digital health and wellness platform accessible through 16 of its grocery brands' websites and mobile apps. This platform offers activity tracking, goal setting, and integration with wearable devices to support users in managing their health and wellness.