Market Definition

The market refers to the industry focused on hardware devices, like GPUs, FPGAs, and ASICs, designed to enhance the processing power and efficiency of data centers.

These accelerators optimize workloads such as AI, machine learning, and big data analytics, enabling faster processing and reduced energy consumption. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth over the forecast period.

Data Center Accelerator Market Overview

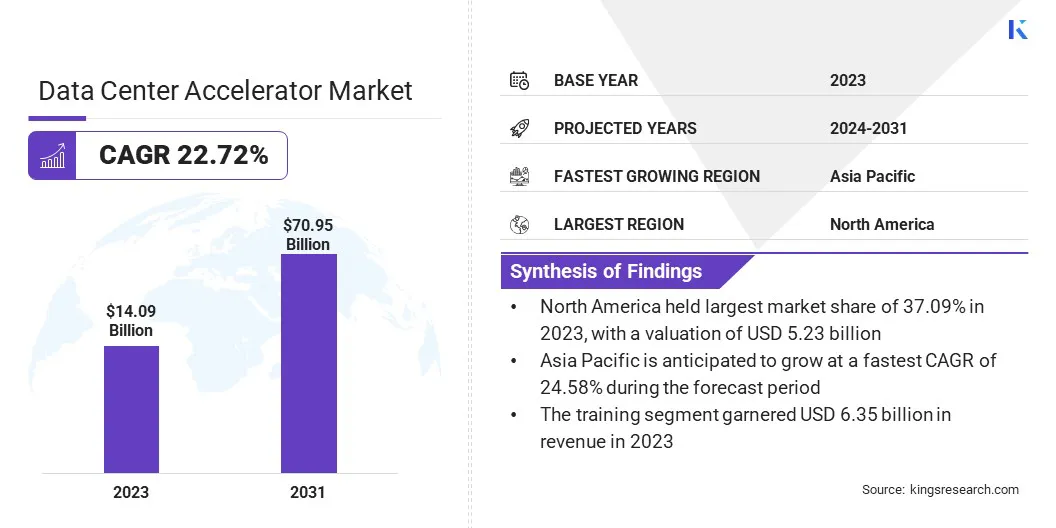

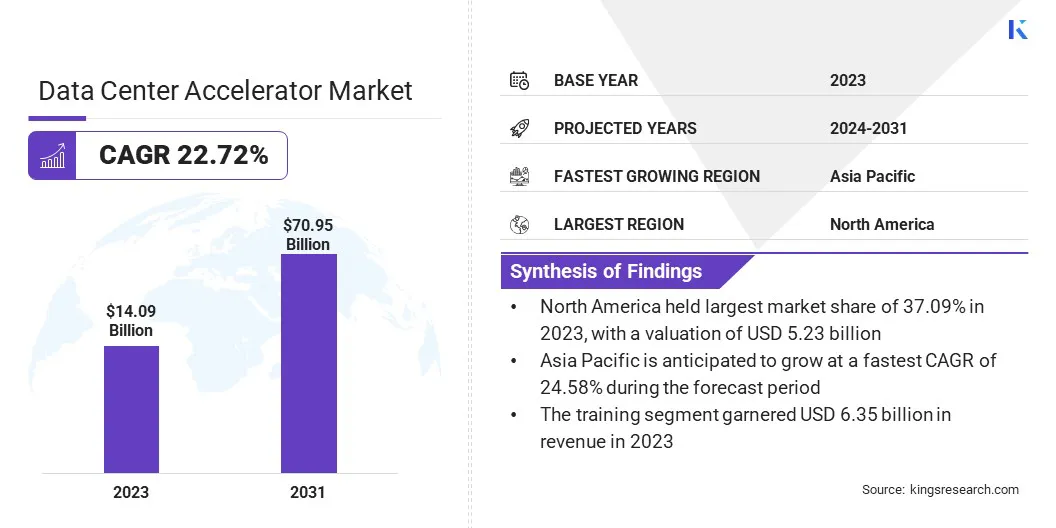

Global data center accelerator market size was valued at USD 14.09 billion in 2023, which is estimated to reach USD 16.92 billion in 2024 and USD 70.95 billion by 2031, growing at a CAGR of 22.72% from 2024 to 2031.

The demand for more storage and processing power in data centers is rising. This is fueled by the increasing complexity of workloads due to the adoption of AI, machine learning, and big data. This expansion is driving the need for more efficient and scalable data center solutions.

Major companies operating in the data center accelerator industry are NVIDIA Corporation, IBM, Dell Inc., Advanced Micro Devices, Inc., Qualcomm Technologies, Inc., Marvell, Intel Corporation, Micron Technology, Inc., Achronix Semiconductor Incorporated, Lattice Semiconductor, Lenovo, Microchip Technology Inc., NEC Corporation, Synopsys, Inc., and Voltron Data, among others.

The market is experiencing significant growth due to the increasing demand for more power-efficient solutions. Advances in processor technology are driving substantial improvements in energy efficiency, offering businesses the opportunity to reduce operating costs through server consolidation and performance optimization.

These innovations enable data centers to handle more demanding workloads while minimizing energy consumption, leading to reduced total cost of ownership (TCO). With more organizations modernizing their infrastructure, the market is poised for continued expansion to meet efficiency-driven needs.

- In February 2025, Intel launched its Xeon 6 processors, offering groundbreaking AI, networking, and data center performance. These processors deliver up to 68% savings in Total Cost of Ownership (TCO) through improved energy efficiency and server consolidation. Enterprises are adopting Xeon 6 to enhance operational efficiency and manage next-gen workloads.

Key Highlights:

- The data center accelerator india size was recorded at USD 14.09 billion in 2023.

- The market is projected to grow at a CAGR of 22.72% from 2024 to 2031.

- North America held a market share of 37.09% in 2023, with a valuation of USD 5.23 billion.

- The Cloud-based segment garnered USD 7.62 billion in revenue in 2023.

- The GPU segment is expected to reach USD 24.07 billion by 2031.

- The Training segment had a market share of 45.09% in 2023.

- The Retail & E-commerce segment is anticipated to grow at a CAGR of 26.95% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 24.58% during the forecast period.

Market Driver

The Expansion of Data Centers

The market is growing rapidly due to the rising need for enhanced processing capabilities in modern data centers. Accelerators like GPUs, FPGAs, and AI chips help optimize machine learning, real-time data analysis, and high-performance computing (HPC).

These technologies significantly improve processing speeds and efficiency, making them essential for businesses that rely on large-scale data processing. As enterprises continue to scale up their operations and handle more complex workloads, the demand for these accelerators will keep expanding across healthcare, finance, retail, telecommunications, and manufacturing industries.

- In October 2024, Micron Technology's 9550 PCIe Gen5 SSDs were added to the NVIDIA recommended vendor list for the GB200 NVL72 system. These high-performance, energy-efficient storage solutions optimize AI workloads, delivering up to 34% higher throughput and significant energy savings, benefiting AI model training and high-performance computing.

Market Challenge

Heat Generated by High-performance Accelerators

In the data center accelerator market, cooling requirements pose a significant challenge due to the intense heat generated by high-performance accelerators like GPUs and FPGAs. Implementing advanced cooling solutions, such as liquid or immersion cooling, is complex and costly, which increases operational expenses.

A viable solution is adopting energy-efficient cooling technologies, optimizing airflow, and leveraging AI-driven systems to dynamically adjust cooling based on real-time data, thus enhancing efficiency and reducing energy consumption in data centers while meeting performance needs.

Market Trend

Increased Customization

In the market, there is a growing trend of customization. More vendors are offering application-specific accelerators optimized for targeted markets like AI and networking. These specialized accelerators are designed to meet the unique computational needs of specific workloads, improving efficiency and reducing processing times.

By customizing hardware for particular applications, such as AI model training or network traffic management, vendors are enhancing performance, enabling faster deployment, and addressing the evolving demands of industry-specific use cases.

- In March 2025, AMD launched its 5th Gen EPYC Embedded processors powered by the "Zen 5" architecture. These processors offer high performance, efficiency, and extended product lifecycles, tailored for networking, storage and industrial edge markets, with partners like Cisco and IBM. As data center accelerators rely on high-performance systems to handle specialized workloads, these embedded processors can contribute to distributed computing environments, complementing the needs of data centers by enabling faster data processing at the edge.

Data Center Accelerator Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment Mode

|

On-premise, Cloud-based, Hybrid

|

|

By Processor Type

|

GPU, FPGA, ASIC, CPU

|

|

By Application

|

Training, Inference, High-Performance Computing (HPC), Cloud and Enterprise Data Centers

|

|

By End-use Industry

|

IT & Telecom, BFSI, Healthcare, Government & Defense, Retail & E-commerce, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Deployment Mode (On-premise, Cloud-based, Hybrid): The Cloud-based segment earned USD 7.62 billion in 2023, due to the increasing demand for scalable and efficient cloud computing solutions across industries.

- By Processor Type (GPU, FPGA, ASIC, CPU): The GPU segment held 43.09% of the market in 2023, due to GPUs' superior parallel processing capabilities, ideal for AI, deep learning, and high-performance computing workloads.

- By Application [Training, Inference, High-Performance Computing (HPC), Cloud and Enterprise Data Centers]: The training segment is projected to reach USD 27.10 billion by 2031, owing to the increasing demand for AI/ML training models and the need for high-performance computing infrastructure.

- By End-use Industry (IT & Telecom, BFSI, Healthcare, Government & Defense, Retail & E-commerce, Others): The retail & E-commerce segment is anticipated to have a CAGR of 26.95% during the forecast period, driven by the growing need for efficient data processing and personalized customer experiences in digital platforms.

Data Center Accelerator Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America data center accelerator market share stood at around 37.09% in 2023 in the global market, with a valuation of USD 5.23 billion. North America dominates the market due to its advanced technological infrastructure, strong presence of key players, and rapid adoption of AI, machine learning, and cloud computing technologies.

The region benefits from significant investments in data centers, coupled with the increasing demand for high-performance computing across industries such as finance, healthcare, and technology. Additionally, North America's well-developed research and development ecosystem, along with favorable government policies, contribute to its leadership in the market.

- In February 2025, Accenture invested in Voltron Data to help organizations leverage GPU technology for large-scale data processing. This collaboration will enhance generative AI and machine learning capabilities by enabling faster data analysis for banking and communications industries.

Asia Pacific is poised for significant growth at a robust CAGR of 24.58% over the forecast period. Asia Pacific is poised to be the fastest-growing region in the data center accelerator industry, driven by rapid digital transformation, increasing adoption of cloud services, and strong investments in AI and machine learning technologies.

Countries like China, India, and Japan are witnessing infrastructure expansion, with businesses embracing advanced computing solutions to support data-intensive applications. The region's large consumer base, growing e-commerce industry, and technological advancements in sectors like fintech and healthcare further propel the demand for high-performance accelerators.

Regulatory Frameworks

- In India, the Digital Personal Data Protection Act, 2023 ensures the processing of personal data balances individual privacy rights with the need for lawful data processing and related activities.

- In the U.S., the Federal Energy Management Program (FEMP) promotes data center energy efficiency, aligning with the Smart Cloud Strategy and the M-16-19 Memorandum. FEMP supports agencies by offering resources and encouraging participation in the Better Buildings Challenge and Data Center Accelerator.

- In the EU, the General Data Protection Regulation (GDPR) sets strict guidelines for storage, processing, and transfer of personal data, significantly impacting data centers by ensuring data protection and privacy compliance across the region.

Competitive Landscape

In the data center accelerator market, companies are focusing on developing specialized hardware designed to enhance computational efficiency and speed. These accelerators are increasingly integrated with AI, machine learning, and high-performance computing workloads, providing faster processing power and optimized energy consumption.

The market is evolving with innovations in custom-designed chips, GPUs, and other co-processors to meet the growing demand for scalable, high-performance infrastructure in data centers.

- In November 2024, NEC received an order for a next-generation supercomputer system from Japan's National Institutes for Quantum Science and Technology and National Institute for Fusion Science. The system, featuring advanced CPUs and GPUs, will enhance fusion research, achieving 2.7 times higher performance compared to its predecessors.

List of Key Companies in Data Center Accelerator Market:

- NVIDIA Corporation

- IBM

- Dell Inc.

- Advanced Micro Devices, Inc.

- Qualcomm Technologies, Inc.

- Marvell

- Intel Corporation

- Micron Technology, Inc.

- Achronix Semiconductor Incorporated

- Lattice Semiconductor

- Lenovo

- Microchip Technology Inc.

- NEC Corporation

- Synopsys, Inc.

- Voltron Data

Recent Developments (Product Launch)

- In October 2024, AMD introduced the AlveoUL3422 accelerator, for ultra-low latency electronic trading. Featuring an AMD Virtex UltraScale+ FPGA, it enables sub-3ns FPGA transceiver latency, offering a cost-effective solution for high-frequency traders. The slim FHHL form factor optimizes rack space, while ecosystem solutions expedite deployment, providing firms of all sizes with a competitive edge in high-speed trading.

- In September 2024, Intel launched the Xeon 6 with Performance-cores (P-cores) and the Gaudi 3 AI accelerators, advancing enterprise AI infrastructure. The Xeon 6 offers double the performance of its predecessors, and is optimized for AI and high-performance computing (HPC) workloads. The Gaudi 3 accelerator, designed for large-scale generative AI, provides up to 20% more throughput and 2x better price/performance than the H100 for LLaMa 2 70B inference. These innovations, alongside Intel's open ecosystem and co-engineering efforts with partners, support cost-effective and scalable AI deployments.

- In June 2024, AMD launched the Radeon PRO W7900 Dual Slot workstation graphics card, designed for high-performance AI workstations. It offers significant improvements in AI development, with up to 38% better performance-per-dollar compared to competitors. Additionally, AMD will also release ROCm 6.1, enhancing GPU compatibility for scalable AI deployment.