Market Definition

The market encompasses the development, production, and distribution of systems designed to collect, measure, and analyze data from various physical environments. These systems typically consist of hardware components such as sensors, signal conditioners, and analog-to-digital converters, combined with software tools for data processing and visualization.

The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Data Acquisition System Market Overview

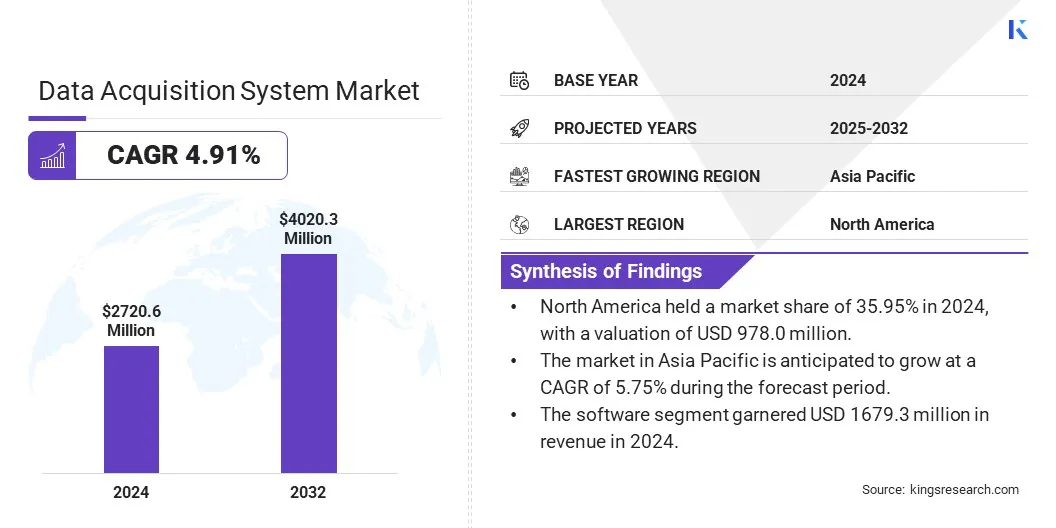

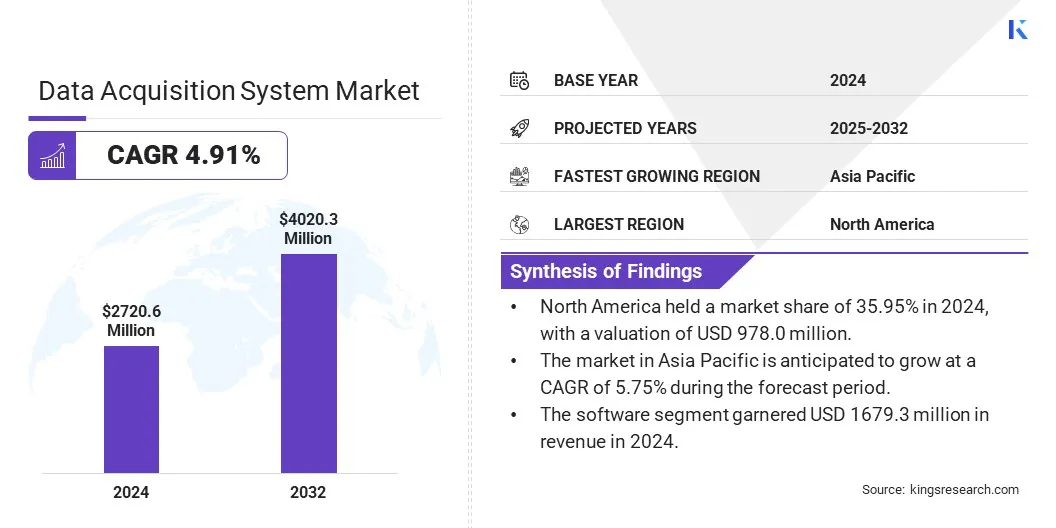

The global data acquisition system market size was valued at USD 2720.6 million in 2024 and is projected to grow from USD 2843.0 million in 2025 to USD 4020.3 million by 2032, exhibiting a CAGR of 4.91% during the forecast period.

This growth is attributed to the rising demand for real-time monitoring and automation across industries such as manufacturing, automotive, aerospace, and energy, driven by organizations' growing focus on operational efficiency and data-driven decision-making The need for accurate and high-speed data collection, particularly in testing and research applications, is further contributing to market expansion.

- In December 2024, ABB announced that its CEM-DAS (Continuous Emissions Monitoring Data Acquisition and Handling System) became the first system to pass the EN 17255 proficiency test, the first international standard for emissions monitoring systems. This six-month test phase was able to confirm that CEM-DAS delivers consistent and accurate emissions reporting, regardless of vendor-specific data processing.

Major companies operating in the data acquisition system industry are NATIONAL INSTRUMENTS CORP, Keysight Technologies, Rockwell Automation, ADLINK Technology Inc., Yokogawa Electric Corporation, AMETEK Programmable Power Inc., ABB, Dataforth Corporation, Advantech Co., Ltd., Siemens, Curtiss-Wright, Teledyne Technologies Incorporated, TEKTRONIX, INC., HIOKI E.E. CORPORATION, and Emerson Electric Co.

Technological advancements in sensor integration, wireless communication, and cloud-based analytics are enhancing the performance of data acquisition systems. The modernization of industrial infrastructure and the growing adoption of smart manufacturing solutions are further driving the market growth over the forecast period.

Key Highlights:

- The data acquisition system market size was valued at USD 2720.6 million in 2024.

- The market is projected to grow at a CAGR of 4.91% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 978.0 million.

- The software segment garnered USD 1679.3 million in revenue in 2024.

- The high segment is expected to reach USD 1501.1 million by 2032.

- The food & beverages segment is anticipated to witness fastest CAGR of 5.05% during the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.75% during the forecast period.

Market Driver

Rising Demand for Real-Time Operational Data Monitoring

The data acquisition system market is driven by the rising demand for real-time monitoring across industrial, commercial, and research applications. Industries are prioritizing real-time monitoring to enable timely decision-making, improve quality control, and ensure operational safety.

This is driven by increasing process complexity and the need to maintain efficiency, reduce downtime, and comply with regulatory requirements. Data acquisition systems play a critical role in capturing and analyzing live data from sensors and machines.

They enable early detection of performance anomalies, equipment malfunctions, or safety hazards in dynamic environments such as manufacturing plants, energy facilities, and transportation systems. Moreover, the proliferation of smart factories driven by digital transformation initiatives, is expected to further accelerate the adoption of real-time data acquisition solutions in the coming years.

Market Challenge

Rapid Technological Advancements and Risk of Product Obsolescence

Ongoing advancements in sensor, communication, and data processing technologies present a key challenge for the data acquisition (DAQ) system market. Many end users face difficulties in keeping systems current without incurring high upgrade costs or experiencing operational disruptions.

Components such as signal conditioners, analog-to-digital converters, and data logging software can become outdated quickly as new, more efficient solutions enter the market. This rapid pace of innovation results in shorter product lifecycles, compelling organizations to choose between operating with less efficient legacy systems or investing in frequent upgrades to maintain compatibility, performance, and compliance.

To mitigate this challenge, manufacturers are designing modular, scalable DAQ platforms that enable selective component upgrades rather than full system replacements. Efforts are also being directed toward backward-compatible architectures and extended product support timelines to ease transitions and protect user investments.

Market Trend

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) is significantly transforming data acquisition systems by enhancing data analysis, predictive capabilities, and operational efficiency. Modern systems incorporate AI and ML algorithms capable of processing large volumes of data, enabling real-time anomaly detection, predictive maintenance, and process optimization.

These features allow for immediate identification of faults and inefficiencies, reducing downtime and improving decision-making in complex industrial environments. Integration with broader digital transformation initiatives further supports smarter automation and enhances overall system performance.

Additionally, AI-driven analytics facilitate continuous improvement and adaptive learning, helping organizations optimize resource use and lower maintenance costs. As industries increasingly adopt smart manufacturing and connected infrastructure, the adoption of AI- and ML-enabled data acquisition systems is playing a critical role in driving innovation, operational excellence, and competitive advantage.

Data Acquisition System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software

|

|

By Speed

|

Low, High, Ultra-High

|

|

By Vertical

|

Automotive, Healthcare, Food & Beverages, Aerospace & Defense, Energy & Power, Manufacturing, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software): The software segment earned USD 1679.3 million in 2024 due to the rising demand for advanced data analysis, visualization, and real-time monitoring capabilities across various industries.

- By Speed (Low, High, Ultra-High): The high segment held 37.74% of the market in 2024, due to its widespread use in industrial automation, automotive testing, and aerospace applications that require fast and accurate data capture.

- By Vertical (Automotive, Healthcare, Food & Beverages, Aerospace & Defense, Energy & Power, Manufacturing, Others): The automotive segment is projected to reach USD 976.6 million by 2032, owing to rising demand for vehicle testing and the growing adoption of electric and autonomous vehicles.

Data Acquisition System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America data acquisition system market share stood at around 35.95% in 2024, with a valuation of USD 978.0 million. This dominance is attributed to the region’s strong industrial automation base, high adoption of advanced testing technologies, and the presence of leading data acquisition system providers.

Furthermore, increasing investments in smart manufacturing, automotive innovation, and aerospace research are driving market growth across the region. The region's emphasis on compliance with stringent data accuracy and monitoring standards supports continued growth across critical sectors such as aerospace and defense, energy, healthcare, and transportation.

Additionally, the push for digital transformation and real-time performance analysis in industries such as energy, defense, and transportation further strengthens the market in North America.

- In September 2024, Emerson launched the NI mioDAQ USB data acquisition device, enhancing measurement capabilities and software integration for engineers. The device is designed to accelerate the development of complex electronic products by providing improved data acquisition and analysis features.

The data acquisition system industry in Asia-Pacific is poised for significant growth at a robust CAGR of 5.75% over the forecast period. This growth is propelled by rapid industrial expansion and automation across emerging economies such as China, India, and Southeast Asian countries.

Additionally, the region’s booming automotive, electronics, and energy sectors are driving the demand for advanced data acquisition systems. Government initiatives promoting smart manufacturing, digitalization, and infrastructure development are further fueling market growth.

Additionally, the increasing need for real-time data monitoring and compliance with international quality standards is accelerating the adoption of high-performance data acquisition solutions across Asia-Pacific.

- In March 2023, the Press Information Bureau of India reported the launch of three indigenously developed Internet of Things sensors at C-MET, Thrissur. These include a smart digital thermometer, an IoT-enabled environmental monitoring system, and a multichannel data acquisition system, which has been transferred to Murata Business Engineering India Pvt. Ltd. for commercialization.

Regulatory Frameworks

- In the European Union, data acquisition systems are regulated under the General Data Protection Regulation (GDPR), which provides strict guidelines on the collection, processing, and storage of personal data. This regulation mandates that data acquisition systems handling personal or sensitive information implement robust measures to ensure data privacy, security, and user consent.

- In the U.S., data acquisition systems used by federal agencies are regulated under the Federal Information Security Modernization Act of 2014 (FISMA 2014), which mandates the development and implementation of comprehensive information security programs.

- Globally, data acquisition systems are regulated under the International Organization for Standardization (ISO)/International Electrotechnical Commission (IEC) 27001 standard, which sets requirements for information security management to protect data confidentiality, integrity, and availability.

Competitive Landscape

The data acquisition system market is characterized by a moderately competitive landscape, featuring a combination of established global technology providers and niche players specializing in application-specific solutions.

Key market participants are focusing on strategies such as product innovation, integration of artificial intelligence and machine learning, and the development of modular, scalable systems to meet the growing demand for real-time data monitoring and analysis.

Companies are also investing in R&D to enhance system performance, ensure compatibility with evolving industrial protocols, and address emerging needs in automation and smart manufacturing.

Furthermore, strategic collaborations, partnerships with system integrators, and targeted acquisitions are being pursued to expand geographic presence, strengthen vertical-specific offerings, and maintain a competitive edge across mature and emerging markets.

- In September 2023, Onyx Technology LLC launched OnyxCAP, a FHIR (Fast Healthcare Interoperability Resources) -based clinical data acquisition platform that simplifies access to patient data from electronic medical records (EMR). It supports health plans with tools for provider grouping, fast EMR integration, and clinical data analytics to improve care gap detection and quality reporting.

List of Key Companies in Data Acquisition System Market:

- NATIONAL INSTRUMENTS CORP

- Keysight Technologies

- Rockwell Automation

- ADLINK Technology Inc.

- Yokogawa Electric Corporation

- AMETEK Programmable Power Inc.

- ABB

- Dataforth Corporation

- Advantech Co., Ltd.

- Siemens

- Curtiss-Wright

- Teledyne Technologies Incorporated

- TEKTRONIX, INC.

- HIOKI E.E. CORPORATION

- Emerson Electric Co.

Recent Developments (M&A/Partnerships/ Product Launch)

- In November 2023, Moog Inc. acquired Data Collection Limited (DCL), the developer of the Road Measurement Data Acquisition System (ROMDAS). DCL’s technologies will now operate under Moog’s Mission Systems Division within its Military Aircraft Group, enhancing Moog’s Digital Airfield Solutions offering. This strategic acquisition expands Moog’s capabilities in pavement condition monitoring and supports the development of comprehensive solutions for airfield safety and maintenance.

- In October 2023, CN Rood announced a strategic partnership with Gantner Instruments to enhance their data acquisition solutions. This collaboration expands CN Rood’s offerings with advanced measurement tools for industries like automotive, energy, and aerospace, providing integrated and tailored solutions.

- In June 2023, imc Test & Measurement GmbH launched the imc ARGUSfit, a modular and ultra-compact data acquisition system, at the Automotive Testing Expo Europe in Stuttgart, Germany. The system offers high flexibility with snap-together modules and supports up to 1,000 channels. Moreover, it is able to deliver data rates of 5 million samples per second.

, making it imc’s most powerful data acquisition system to date