Market Definition

The dairy testing market refers to the industry focused on the analysis and evaluation of dairy products to ensure quality, safety, and compliance with regulatory standards.

It encompasses a range of testing services, including chemical, microbiological, and physical assessments, to detect contaminants, verify nutritional content, and maintain product integrity. This market includes laboratories, testing equipment manufacturers, catering to dairy producers, processors, and regulatory bodies.

Dairy Testing Market Overview

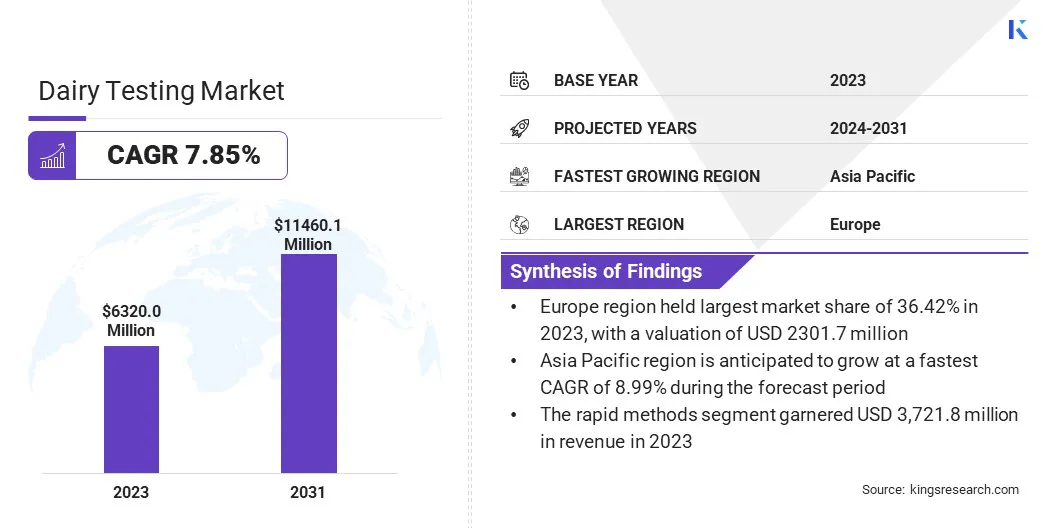

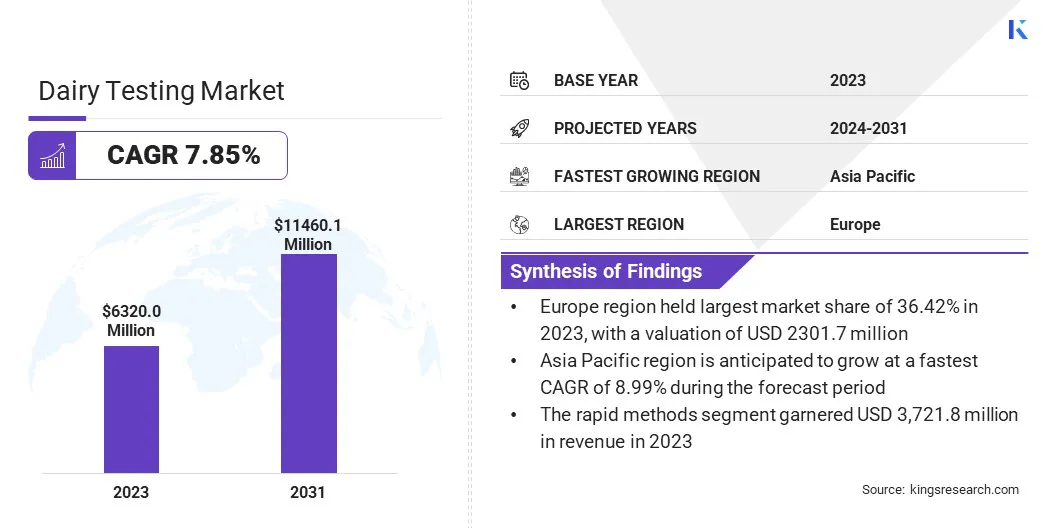

The global dairy testing market size was valued at USD 6,320.0 million in 2023 and is projected to grow from USD 7,262.8 million in 2024 to USD 11,460.1 million by 2031, exhibiting a CAGR of 7.85% during the forecast period.

This growth is driven by rising concerns over food safety, increasing incidences of dairy adulteration, and stringent quality control measures. Advancements in rapid testing technologies, such as PCR-based detection, chromatography, and spectroscopy, are enhancing efficiency and accuracy.

Major companies operating in the global dairy testing industry are Bio-Rad Laboratories, Inc., Neogen Corporation, Bruker, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Dairyland Laboratories, PerkinElmer Inc., IDEXX, METTLER TOLEDO, Mérieux NutriSciences Corporation, FOSS INDIA PVT LTD, Meizheng, Page & Pedersen International Ltd., Apex Instrument, and Charm Sciences.

The expanding dairy industry, coupled with growing consumer demand for premium, organic, and functional dairy products, is fueling investments in automated dairy testing solutions to ensure consistent quality and compliance. The increasing adoption of AI-driven diagnostic tools, spectroscopic analysis, and microbiological testing is further enhancing accuracy and efficiency.

Key Highlights:

- The global dairy testing market size was valued at USD 6,320.0 million in 2023.

- The market is projected to grow at a CAGR of 7.85% from 2024 to 2031.

- Europe held a market share of 36.42% in 2023, with a valuation of USD 2,301.7 million.

- The milk & milk powder segment garnered USD 1,867.6 million in revenue in 2023.

- The rapid methods segment is expected to reach USD 7,362.6 million by 2031.

- The dairy processing plants segment is expected to reach USD 4,588.8 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.99% during the forecast period.

Market Driver

"Stringent Food Safety Regulations"

The dairy testing market is registering significant growth, due to stringent food safety regulations imposed by global regulatory bodies. Governments and food safety authorities, such as the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and the Food Safety and Standards Authority of India (FSSAI), mandate rigorous quality checks to ensure the safety and purity of dairy products.

Rising concerns regarding contamination, adulteration, and the presence of harmful pathogens like Listeria, Salmonella, and E. coli have further intensified the need for advanced testing solutions.

This regulatory-driven demand for advanced testing solutions is fueling the expansion of the market, ensuring that dairy products meet safety standards before reaching consumers.

- In October 2024, the Food Safety and Standards Authority of India (FSSAI) introduced SOPs for dairy operators to enhance milk quality testing, ensuring compliance with stringent safety norms. This initiative aims to curb adulteration, improve traceability, and strengthen regulatory oversight in the market.

Market Challenge

"High Cost of Advanced Testing Technologies"

The primary challenge facing the dairy testing market is the high cost associated with advanced testing technologies. Sophisticated equipment such as high-performance liquid chromatography (HPLC), mass spectrometry, and real-time PCR systems require substantial capital investment, making it difficult for small and medium-sized dairy processors to afford these technologies.

Companies in the market can explore cost-effective solutions such as portable and rapid testing kits that provide accurate results with minimal infrastructure requirements. Additionally, partnerships with third-party testing laboratories can help dairy producers access high-quality testing services without incurring heavy upfront investments.

Government incentives and subsidies for food safety compliance could also support small-scale dairy businesses in implementing essential testing protocols. These measures help stakeholders enhance product safety while managing costs effectively.

Market Trend

"Rising Adoption of Automation and AI"

The dairy testing market is registering a shift toward Artificial Intelligence (AI)-driven solutions to enhance quality control, accuracy, and efficiency. AI-powered diagnostic tools and automated testing systems streamline sample analysis, reducing human error and accelerating detection of contaminants, ensuring faster and more reliable product evaluations.

Machine Learning (ML) algorithms play a crucial role in predictive analytics, identifying contamination risks before they escalate. AI-powered microbial detection and robotic sample handling optimize operational workflows, minimizing manual intervention and improving consistency.

AI adoption in the market is set to drive innovation, efficiency, and scalability as dairy manufacturers prioritize advanced quality assurance, transforming traditional testing methodologies and reinforcing food safety standards.

- In October 2024, researchers from Penn State, Cornell University, and IBM Research adopted an innovative milk safety testing approach. By integrating genetic sequencing of milk microbes with AI, they developed a method capable of detecting anomalies such as contamination or unauthorized additives. This advancement holds significant potential for enhancing dairy safety protocols.

Dairy Testing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Milk & Milk Powder, Cheese & Cheese Powder, Butter & Butter Powder, Ice Cream & Frozen Desserts, Infant Foods, Others

|

|

By Technology

|

Traditional Methods, Rapid Methods

|

|

By End User

|

Dairy Farms & Production Facilities, Dairy Processing Plants, Research Institutes, Regulatory Bodies & Quality Control Agencies, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Milk & Milk Powder, Cheese & Cheese Powder, Butter & Butter Powder, Ice Cream & Frozen Desserts, Infant Foods, and Others): The milk & milk powder segment earned USD 1,867.6 million in 2023, due to its high consumption volume and susceptibility to contamination, necessitating rigorous testing protocols.

- By Technology (Traditional Methods, Rapid Methods): The rapid methods segment held 58.89% share of the market in 2023, due to the increasing adoption of faster, more efficient, and highly accurate testing technologies.

- By End User (Dairy Farms & Production Facilities, Dairy Processing Plants, Research Institutes, and Regulatory Bodies & Quality Control Agencies): The dairy processing plants segment is projected to reach USD 4,588.8 million by 2031, owing to the increasing complexity of dairy production, rising automation, and the need for stringent quality control.

Dairy Testing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe accounted for around 36.42% share of the global dairy testing market in 2023, with a valuation of USD 2,301.7 million. The region’s strong market position is driven by its well-established dairy industry, stringent food safety standards, and high consumer demand for premium dairy products.

Countries such as Germany, France, the Netherlands, and the UK are among the largest dairy producers, necessitating rigorous quality control measures. The growing preference for organic, lactose-free, and fortified dairy products has further increased the need for advanced testing solutions.

Furthermore, European dairy producers are heavily investing in automated and digitalized testing solutions on account of rising consumer awareness regarding foodborne illnesses, antibiotic residues, and adulteration. This trend, combined with the region’s strong export market for dairy products, is expected to drive growth in the market in Europe in the coming years.

The dairy testing industry in Asia Pacific is poised to grow at a significant CAGR of 8.99% over the forecast period, driven by the region’s rapidly expanding dairy industry, increasing consumer demand for high-quality dairy products, and rising concerns over food safety.

Countries such as China, India, Japan, Australia, and New Zealand are among the largest dairy producers and consumers, necessitating stringent quality control measures to ensure product safety and compliance with international standards.

The growing urban population and rising disposable incomes in India & China have fueled the demand for premium dairy products, including organic, lactose-free, and fortified dairy options, prompting manufacturers to adopt advanced dairy testing technologies.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the dairy testing market under the Federal Food, Drug, and Cosmetic Act (FD&C Act) and Pasteurized Milk Ordinance (PMO). The FDA mandates rigorous microbiological, chemical, and contaminant testing to ensure dairy product safety, quality, and compliance with national food safety standards.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates the market by establishing stringent quality and safety standards for milk and dairy products. It mandates regular testing for contaminants, adulterants, and microbiological safety, ensuring compliance with the food safety standards.

Competitive Landscape

The global dairy testing market is characterized by several participants, including both established corporations and emerging organizations . Key industry participants focus on technological advancements, strategic partnerships, and expanding their product portfolios to gain a competitive edge.

Leading companies invest in rapid testing technologies. Mergers, acquisitions, and collaborations between testing service providers, dairy manufacturers, and research institutions are driving innovation in automated and high-throughput dairy testing solutions.

The market also sees competition from regional players catering to local regulatory requirements and customized testing solutions. With growing consumer demand for premium dairy products and stricter food safety norms, the market is expected to register continued investments and technological advancements, intensifying competition.

- In March 2024, Everest Instruments launched three advanced dairy testing solutions—the YAMA FTIR-based Milk Analyser, Everest GC4500 Gas Chromatography machine, and Somatic Cell Analyser. These innovations enhance milk composition analysis, fatty acid profiling, and somatic cell detection, strengthening quality control and safety standards in the market.

List of Key Companies in Dairy Testing Market:

- Bio-Rad Laboratories, Inc.

- Neogen Corporation

- Bruker

- Agilent Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Dairyland Laboratories

- PerkinElmer Inc.

- IDEXX

- METTLER TOLEDO

- Mérieux NutriSciences Corporation

- FOSS INDIA PVT LTD

- Meizheng

- Page & Pedersen International Ltd.

- Apex Instrument

- Charm Sciences

Recent Development (New Product Launch)

- In April 2023, Eurofins USA introduced a validated method for detecting recombinant Bovine Somatotropin (rBST) in liquid milk, enhancing quality control and safety standards in the dairy testing market. This advancement ensures greater accuracy in identifying hormone-treated milk, addressing consumer concerns and industry compliance requirements.