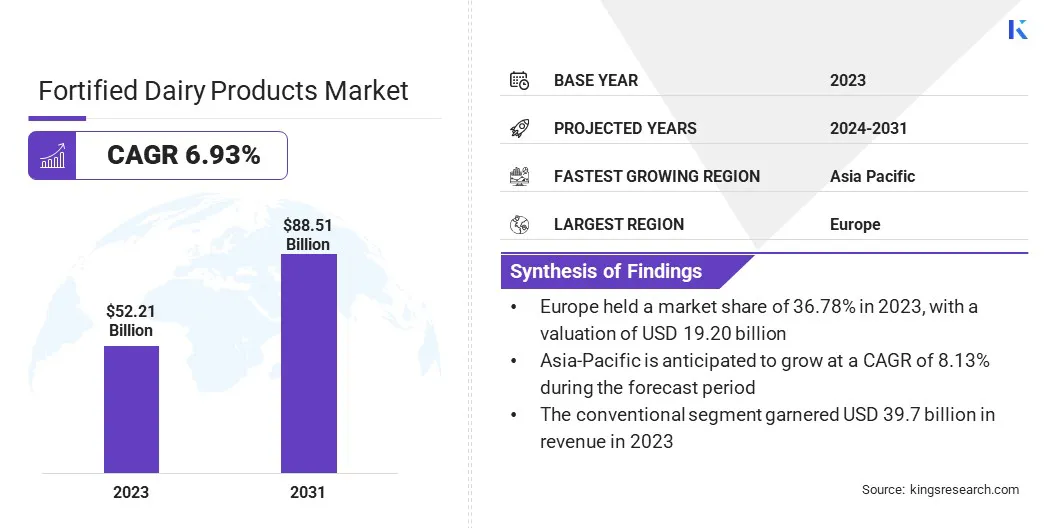

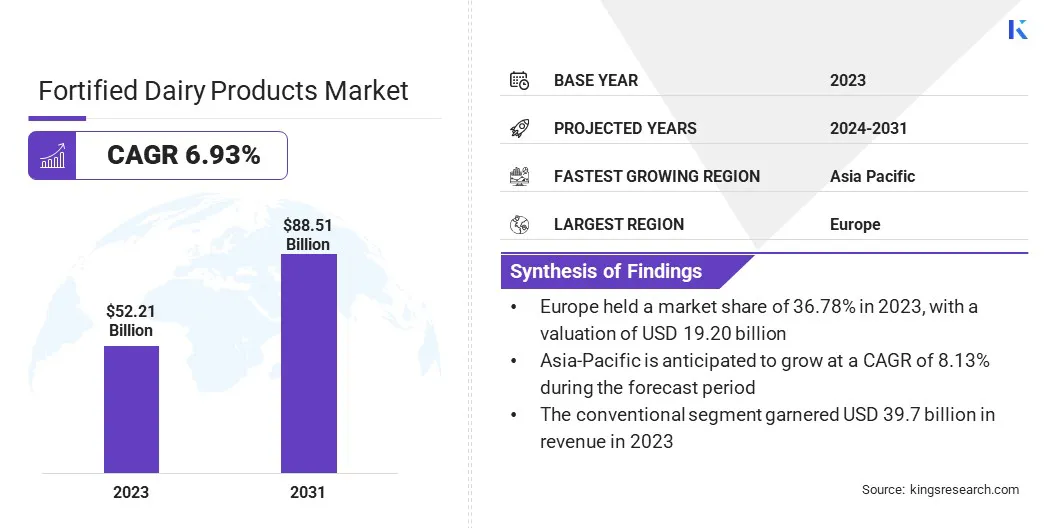

Fortified Dairy Products Market Size

The global Fortified Dairy Products Market size was valued at USD 52.21 billion in 2023 and is projected to grow from USD 55.36 billion in 2024 to USD 88.51 billion by 2031, exhibiting a CAGR of 6.93% during the forecast period. The market growth is driven by increasing consumer health awareness, rising demand for nutrient-rich foods, and the expansion of product offerings that cater to specific dietary needs.

In the scope of work, the report includes products offered by companies such as Arla Foods amba, China Modern Dairy Holdings Ltd., Dairy Australia, Dairy Farmers of America, Inc., Danone, Fonterra Co-operative Group Limited, FrieslandCampina, General Mills Inc., BASF SE, GCMMF, and others.

The fortified dairy products market expansion is driven by increasing consumer awareness about the nutritional benefits of essential vitamins and minerals. The growing health consciousness, particularly regarding bone health and immunity, has fueled the demand for dairy products enriched with nutrients such as calcium, vitamin D, and omega-3 fatty acids.

In addition, the rising prevalence of lifestyle-related diseases, such as osteoporosis and vitamin deficiencies contributes to market growth. Government initiatives promoting fortified foods to address micronutrient deficiencies, especially in developing countries, also play a crucial role in driving product demand.

- For instance, the Government of India's food fortification initiatives address malnutrition and hunger comprehensively. As of July 2024, the Central Pool held 60.8 million metric tons of foodgrains, exceeding the norm and supporting various government programs. The National Food Security Act provides subsidized food to up to 75% of the rural and 50% of the urban populations.

The expanding middle-class population, with greater purchasing power and access to information, continues to boost the consumption of fortified dairy products.

The global market is experiencing robust growth due to the rising demand for nutritionally enhanced foods. Fortification refers to the adding essential nutrients, such as vitamins, minerals, and fatty acids, to food products in order to meet specific health needs.

This market encompasses a wide range of products, including milk, yogurt, cheese, and butter, each fortified to fulfill different nutritional requirements. Europe is currently leading the market, driven by high consumer awareness and its well-established dairy industries. However, emerging markets in Asia-Pacific are rapidly growing, with increasing urbanization and disposable incomes.

The market is a segment of the dairy industry that focuses on enhancing the nutritional content of traditional dairy items by adding essential nutrients. These products are designed to provide added health benefits beyond basic nutrition, targeting specific dietary needs, such as bone health, immune support, and overall wellbeing.

Fortification can include the addition of vitamins (A, D), minerals (calcium, iron), and other bioactive components (probiotics, omega-3 fatty acids). The market covers a variety of dairy products, including milk, yogurt, cheese, and butter, which are consumed by individuals across all age groups. The aim is to address nutritional gaps and contribute to better public health outcomes.

Analyst’s Review

Manufacturers in the fortified dairy products market are actively investing in product innovation and expanding their portfolios to meet the evolving consumer demands. New product launches are focusing on personalized nutrition, with options targeting specific health concerns, such as bone health, immunity, and gut health.

Companies are also increasingly adopting sustainable practices, such as using eco-friendly packaging and sourcing responsibly, which resonates with environmentally conscious consumers. To maintain a competitive edge, manufacturers are advised to prioritize transparency in labeling and ingredient sourcing to achieve consumer trust.

Additionally, expanding into emerging markets, such as Asia-Pacific, where demand is rapidly growing, presents a significant opportunity for market expansion. Strategic partnerships and collaborations with health professionals will further enhance market penetration and consumer confidence.

- For instance, in June 2024, Galaxy Foods and the GAIN Nordic Partnership collaborated to launch a new fortified yogurt in Tanzania. The project, supported by Arla Foods Ingredients, adapted a sustainable business model from Ethiopia to Tanzania. The yogurt, designed to address malnutrition, particularly in children under five, was initially targeted at schools. The partnership involved multiple stakeholders, including the Tanzanian Dairy Board and the Tanzania Bureau of Standards.

Fortified Dairy Products Market Growth Factors

The increasing focus on preventive healthcare is driving growth in the market. Consumers are increasingly prioritizing foods that offer specific health benefits, and fortified dairy products are seen as a convenient way to enhance daily nutrient intake.

This trend is particularly eminent among health-conscious individuals and aging populations who are looking to manage severe physiological conditions, such as osteoporosis and vitamin deficiencies. The rise in disposable income is allowing consumers to spend more on premium, health-focused products. Additionally, the widespread availability of fortified dairy products in various formats, such as milk, yogurt, and cheese, ensures that these products are easily accessible, further fueling the market demand.

A significant challenge in the fortified dairy products market is consumer skepticism regarding the efficacy and safety of fortification. Some consumers are concerned about synthetic additives and question whether fortified products offer genuine health benefits. This skepticism has the potential to slow the market growth, since consumers may opt for unfortified, natural options instead.

To overcome this challenge, companies are focusing on transparency and education. By clearly communicating the scientific research supporting fortification and emphasizing the use of natural, bioavailable ingredients, manufacturers are able to build consumer trust. Additionally, collaborating with healthcare professionals and influencers to endorse fortified products further reassures consumers, driving acceptance and increasing market penetration.

Fortified Dairy Products Market Trends

Personalization of nutrition is emerging as a key trend in the market. Consumers are increasingly seeking products tailored to their specific health needs of age, gender, and lifestyle. This trend is driving the demand for fortified dairy products that offer targeted benefits, such as bone health for senior individuals, immune support for children, or heart health for adults.

Companies are responding to this trend by developing specialized products, incorporating personalized nutrition plans, and offering customizable options. Advances in technology, such as wearable devices and health apps, are making it easier for consumers to monitor their nutrient intake, further encouraging the adoption of personalized fortified dairy products. This trend is reshaping the market, promoting innovation and differentiation.

Sustainability is becoming a significant trend influencing the fortified dairy products market. Consumers are increasingly becoming concerned about the environmental impact of the products they consume, and this is driving demand for sustainably sourced and produced dairy products. Companies are adopting eco-friendly practices, such as using renewable energy, reducing water usage, and sourcing ingredients responsibly. There is also a growing focus on plant-based alternatives, with fortified plant-based dairy products gaining popularity among environmentally conscious consumers.

Packaging is another area of focus, with companies shifting toward recyclable or biodegradable packaging materials. This trend in concert with sustainability practices is appealing to eco-conscious consumers and is becoming a competitive advantage for brands in the market.

Segmentation Analysis

The global market has been segmented based on nature, type, sales channel, and geography.

By Nature

Based on nature, the market is categorized into organic and conventional segments. The conventional segment led the fortified dairy products market in 2023, reaching a valuation of USD 39.7 billion. The conventional segment is expanding significantly due to its widespread adoption and affordability among consumers.

Conventional fortified dairy products are more accessible and are often available at lower prices compared to organic options. This affordability appeals to a broader consumer base, including middle-income families who prioritize cost-effectiveness. Additionally, conventional products are more widely distributed and are available in a variety of formats, making them a convenient choice for everyday consumption. The strong presence of established brands in this segment, coupled with extensive marketing efforts, is reinforcing consumer trust and driving sales.

By Type

Based on type, the fortified dairy products market has been classified into milk, cheese, yogurt, milk powder, and others. The yogurt segment is expected to register a significant growth at a CAGR of 9.25% over the forecast period from 2024 to 2031. This segment is experiencing significant growth due to the perceived health benefits and versatility of yogurt.

Yogurt is widely recognized for its probiotic content, which supports digestive health, making it increasingly popular among health-conscious consumers. The fact that it can be consumed as a snack, dessert, or meal accompaniment, is also contributing to its expansion.

Additionally, the introduction of a variety of flavors, fortified options, and plant-based alternatives is attracting a diverse consumer base to this segment. The rising demand for convenient, nutritious foods is further boosting yogurt's appeal, as consumers continue to seek functional and enjoyable dairy products.

By Sales Channel

Based on sales channel, the market has been segmented into supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and others. The supermarket/hypermarket segment secured the largest market share of 36.78% in 2023. The supermarket/hypermarket segment is expanding as the preferred sales channel as it offers a wide range of product offerings and accessibility.

These large retail outlets offer a comprehensive selection of fortified dairy products, allowing consumers to compare brands, prices, and nutritional content, all under one roof. The convenience of one-stop shopping, coupled with frequent promotional offers and discounts, is attracting a steady stream of customers. Moreover, the ability to physically inspect products before purchase enhances consumer confidence, particularly in the food and beverage sector. The presence of dedicated dairy sections and in-store nutritional guidance further supports consumer decision-making.

Fortified Dairy Products Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe dominated the global fortified dairy products market accounting for a share of 36.78% in 2023, with a valuation of USD 19.20 billion. The region is dominating the market due to a combination of high consumer awareness, advanced dairy industry infrastructure, and strong regulatory support for food fortification.

European consumers are increasingly prioritizing health and nutrition, driving demand for fortified products. The region's well-established dairy sector, coupled with a long tradition of dairy consumption, provides a solid foundation for market growth.

Government initiatives and policies promoting the fortification of food products to combat nutritional deficiencies are further bolstering the market growth. The presence of leading global dairy brands and increasing focus on innovation and product development are also key factors contributing to Europe’s significant market share.

Asia-Pacific is also expected to experience the fastest growth over the forecast period at a CAGR of 8.13%. The region is experiencing rapid growth in the fortified dairy products market due to rising health awareness, increasing disposable incomes, and growing urbanization.

Consumers are becoming more health-conscious, which is generating a higher demand for nutritious and functional foods, including fortified dairy products. In addition, the region’s expanding middle class along with their increasing purchasing power is also contributing to market growth.

The growing prevalence of lifestyle-related health issues, such as osteoporosis and vitamin deficiencies, is further driving the demand for fortified dairy products. The expansion of retail networks and increasing availability of fortified options across both traditional and modern retail channels are further supporting this growth.

Competitive Landscape

The global fortified dairy products market report will provide valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Fortified Dairy Products Market

- Arla Foods amba

- China Modern Dairy Holdings Ltd.

- Dairy Australia

- Dairy Farmers of America, Inc.

- Danone

- Fonterra Co-operative Group Limited

- FrieslandCampina

- General Mills Inc.

- BASF SE

- GCMMF

Key Industry Developments

- January 2024 (Product Launch): Yoplait launched Yoplait Protein, a dairy snack comprising 15g of protein and 3g of sugar per serving. The product combines ultra-filtered milk with traditional yogurt fermentation, ensuring a smooth texture without the sour taste often associated with high-protein yogurts.

- November 2023 (Product Launch): Nestlé announced the development of N3 milk, made from cow's milk with added prebiotic fibers and lower lactose content, resulting in over 15% fewer calories. Using proprietary technology, Nestlé has enhanced the milk’s nutritional profile to support gut health. The N3 range, launched in China, included full cream and skimmed powdered milk, as well as fortified options for healthy aging, aimed at promoting bone health, muscle strength, and immunity.

The global fortified dairy products market has been segmented:

By Nature

By Type

- Milk

- Cheese

- Yogurt

- Milk Powder

- Others

By Sales Channel

- Supermarket/Hypermarket

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America