Market Definition

The market encompasses skincare, haircare, and makeup products formulated without animal testing. Catering to women, men, and children, these products are distributed through hypermarkets and supermarkets, specialty stores, pharmacies & drugstores, and online retailers.

Cruelty-Free Cosmetics Market Overview

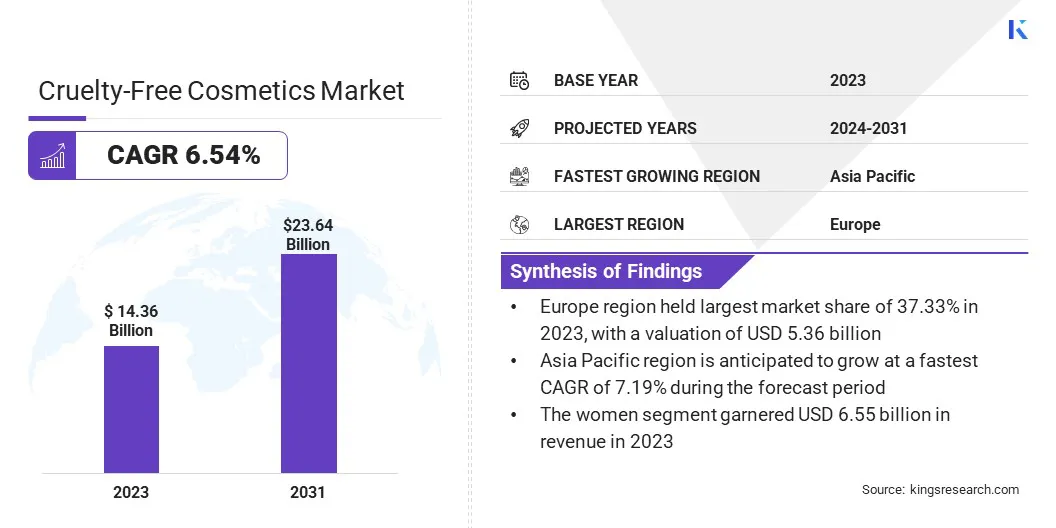

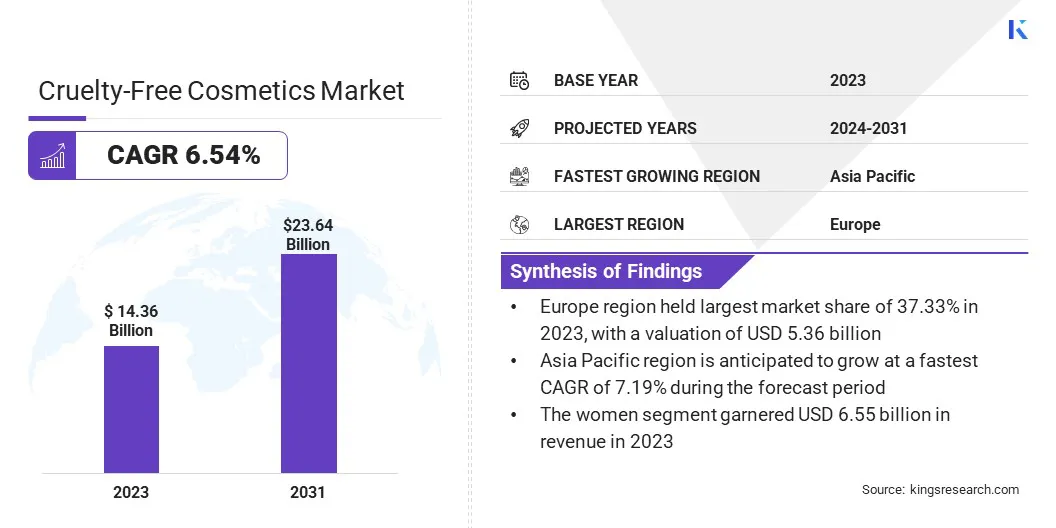

The global cruelty-free cosmetics market size was valued at USD 14.36 billion in 2023 and is projected to grow from USD 15.18 billion in 2024 to USD 23.64 billion by 2031, exhibiting a CAGR of 6.54% during the forecast period.

This growth is driven by increasing consumer demand for ethical beauty products, stricter animal testing regulations, and advancements in alternative testing methods. Brands are investing in vegan formulations, plant-based ingredients, and innovative product development to meet evolving consumer preferences.

Major companies operating in the cruelty-free cosmetics industry are Clorox, Too Faced Cosmetics, LLC., MILANI COSMETICS, The Body Shop International Limited, plum, Charlotte Tilbury Beauty Inc., INIKA Organic, Avalon Organics, Gabriel Cosmetics Inc., Garnier LLC, Natura, e.l.f. Cosmetics, Inc., Markwins Beauty Brands, Inc., Urban Decay, and bareMinerals.

Brands are focusing on vegan formulations, sustainable sourcing, and alternative testing methods to meet industry standards. Transparency and innovation play a crucial role in building consumer trust, influencing market competition, and expanding brand presence across key retail channels.

- In April 2024, Serena Williams partnered with the Good Glamm Group to launch Wyn Beauty, a celebrity-led cosmetics brand. Wyn offers vegan and cruelty-free products across 10 distinct face, lip, and eye categories. The brand is available exclusively at 685 Ulta Beauty stores across the U.S.

Key Highlights:

- The cruelty-free cosmetics industry size was recorded at USD 14.36 billion in 2023.

- The market is projected to grow at a CAGR of 6.54% from 2024 to 2031.

- Europe held a market share of 37.33% in 2023, with a valuation of USD 5.36 billion.

- The skincare segment garnered USD 6.00 billion in revenue in 2023.

- The women segment is expected to reach USD 10.60 billion by 2031.

- The hypermarkets and supermarkets segment is expected to reach USD 8.26 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.19% during the forecast period.

Market Driver

Growing Consumer Preference and Regulatory Support

The market is expanding as consumer demand for ethical beauty aligns with increasing regulatory support. Consumers are actively seeking sustainable, transparent, and cruelty-free products, driving brands to reformulate and adopt ethical practices.

The growing demand for vegan and plant-based cosmetics is further driving the shift toward responsible beauty solutions. Certifications such as Leaping Bunny and PETA’s cruelty-free label have reinforced consumer confidence, making ethical beauty a competitive advantage.

- In June 2024, ästhetik skincare received Leaping Bunny certification, a widely recognized standard for cruelty-free cosmetics. This certification strengthens consumer trust and reflects the industry’s broader shift toward regulatory-backed cruelty-free standards and ethical product development.

Market Challenge

High R&D Costs for Alternative Testing Methods

A key challenge in the cruelty-free cosmetics market is the high cost associated with developing and validating alternative testing methods. Traditional animal testing has been widely used for safety and efficacy assessments, and transitioning to cruelty-free alternatives, such as in-vitro testing and computer modeling, requires substantial investment.

These advanced testing methods can be time-consuming and expensive, particularly for smaller cosmetic brands with limited budgets. To address this challenge, industry stakeholders can collaborate with research institutions and leverage government incentives to promote cruelty-free cosmetics.

Investment in advanced technologies such as 3D tissue engineering can also provide reliable, cost-effective alternatives. Additionally, adopting a shared database of validated cruelty-free testing methodologies can help reduce R&D costs while ensuring product safety and regulatory compliance.

Market Trend

Expansion of Vegan and Plant-Based Cruelty-Free Cosmetics

The growing preference for vegan and plant-based formulations is one of the leading trends in the market. Consumers are seeking products that are free from animal testing and do not contain animal-derived ingredients such as beeswax, lanolin, and carmine.

This shift is driving brands to develop innovative formulations using plant-based, synthetic, and biotechnology-driven alternatives. Additionally, regulatory bodies and certification programs are contributing to the standardization of cruelty-free and vegan claims, supporting consumer confidence.

- In April 2024, Ästhetik Skincare launched its organic tinted mineral sunscreen SPF 50, aligning with the growing trend toward vegan and cruelty-free cosmetics. This skincare-infused, reef-safe formula caters to the increasing consumer demand for ethical, high-performance sun protection, free from animal-derived ingredients and testing.

Cruelty-Free Cosmetics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Skincare (Facial Care (Lotions, Face Creams, & Moisturizers, Cleansers & Face Wash, Facial Serums, Others), Body Care (Hair Removal Products, Lotions, Creams, & Moisturizers, Others)), Haircare (Shampoo, Conditioner, Oils, Serums, Others), Makeup (foundations, Lipsticks, Others), Others

|

|

By Consumer Orientation

|

Women, Men, Children

|

|

By Distribution Channel

|

Hypermarkets and Supermarkets, Specialty Stores, Pharmacies & Drugstores, Online Retailers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Skincare, Haircare, Makeup, Others): The skincare segment earned USD 6.00 billion in 2023 due to increasing consumer preference for clean-label and ethically sourced skincare products.

- By Consumer Orientation (Women, Men, Children): The women segment held 45.62% of the market in 2023, due to their strong inclination toward premium, high-quality cruelty-free cosmetics.

- By Distribution Channel (Hypermarkets and Supermarkets, Specialty Stores, Pharmacies & Drugstores, and Online Retailers): The hypermarkets and supermarkets segment is projected to reach USD 8.26 billion by 2031, owing to the increasing availability of cruelty-free cosmetics in mainstream retail chains.

Cruelty-Free Cosmetics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe cruelty-free cosmetics market share stood around 37.33% in 2023 in the global market, with a valuation of USD 5.36 billion. The region’s strong regulatory framework, including bans on animal testing under the EU Cosmetics Regulation, has significantly contributed to market expansion.

In July 2023, the European Commission reaffirmed its commitment to phasing out animal testing by responding to the European Citizens' Initiative (ECI) ‘Save Cruelty-Free Cosmetics’. The Commission introduced a roadmap aimed at strengthening the existing ban on animal testing for cosmetics while promoting alternative testing methods.

This regulatory push further reinforces Europe’s leadership in the cruelty-free cosmetics industry. Growing consumer preference for ethical and sustainable beauty products, along with the presence of leading cruelty-free brands, has further fueled demand for cruelty-free cosmetics in this region.

The increasing adoption of plant-based and vegan formulations, coupled with rising investments in alternative testing methods, continues to drive growth in this region.

Asia Pacific is poised to grow at a significant growth at a CAGR of 7.19% over the forecast period, driven by shifting regulatory policies, rising disposable incomes, and increasing awareness of ethical beauty products. Countries like Japan, South Korea, and China are experiencing growing demand for clean and cruelty-free formulations.

Regulatory changes in China, allowing non-animal testing alternatives for imported cosmetics are expected to accelerate market growth. Additionally, the influence of Korean and Japanese beauty trends, which emphasize sustainability and innovation, is further boosting the market in this region.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates cosmetic safety, labeling, and ingredients under the Federal Food, Drug, and Cosmetic Act. The FDA ensures that cosmetics are not adulterated or misbranded, holding companies accountable for product safety and accurate labeling.

- In Europe, the European Commission regulates the market, ensuring compliance with strict animal testing bans. The European Chemicals Agency (ECHA) oversees safety assessments.

Competitive Landscape

The cruelty-free cosmetics industry is highly competitive, driven by increasing consumer demand for ethical beauty products and regulatory shifts favoring non-animal testing alternatives. Leading brands are focusing on product innovation, sustainable sourcing, and advanced alternative testing methods to strengthen their market presence.

Strategic collaborations, certifications from organizations like Leaping Bunny and PETA, and strong brand positioning are key differentiators. Emerging and established companies are investing in vegan formulations, biotechnology-driven ingredients, and eco-friendly packaging to attract conscious consumers.

Additionally, expanding retail availability and targeted marketing strategies are intensifying competition, pushing brands to enhance transparency, ethical sourcing, and product efficacy to maintain a competitive edge.

- In October 2023, Organic Harvest expanded into the color cosmetics segment with a 100% vegan and cruelty-free makeup line, reinforcing its commitment to toxin-free beauty. The brand introduced six new product categories, catering to the rising demand for eco-conscious and skin-friendly cosmetics.

List of Key Companies in Cruelty-Free Cosmetics Market:

- Clorox

- Too Faced Cosmetics, LLC.

- MILANI COSMETICS

- The Body Shop International Limited

- plum

- Charlotte Tilbury Beauty Inc.

- INIKA Organic

- Avalon Organics

- Gabriel Cosmetics Inc.

- Garnier LLC

- Natura

- e.l.f. Cosmetics, Inc.

- Markwins Beauty Brands, Inc.

- Urban Decay

- bareMinerals

Recent Developments (Certifications /New Product Launch)

- In February 2025, Coty secured Leaping Bunny certification for Paixão brand, strengthening its commitment to cruelty-free cosmetics. This achievement underscores the company’s dedication to ethical beauty, aligning with growing consumer demand and regulatory advancements while reinforcing its position as a leader in sustainable and transparent product development.

- In August 2024, Smashbox launched in the U.S. Amazon Premium Beauty Store, expanding its online retail presence. This move provides consumers with greater accessibility to Smashbox products and strengthens its position in the growing e-commerce beauty segment.