Market Definition

Critical limb ischemia (CLI) treatment refers to the medical, surgical, and interventional approaches aimed at restoring blood flow and preserving limb function in patients suffering from severe obstruction of peripheral arteries.

It encompasses pharmacological therapies such as antiplatelet drugs and anticoagulants, surgical revascularization and bypass procedures, and minimally invasive endovascular techniques including angioplasty, atherectomy, and stenting. It focuses on reducing the risk of limb loss, promoting wound healing, and enhancing patient quality of life.

Critical Limb Ischemia Treatment Market Overview

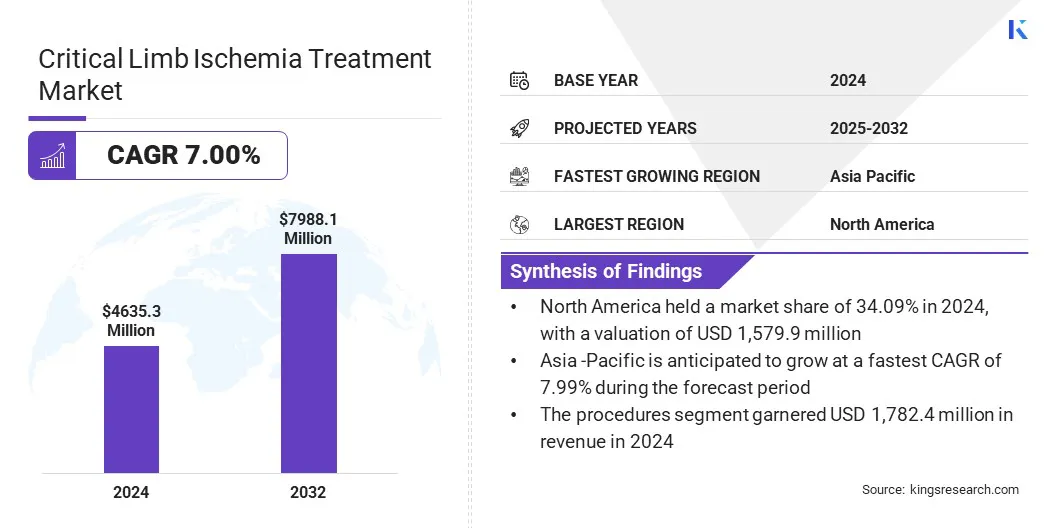

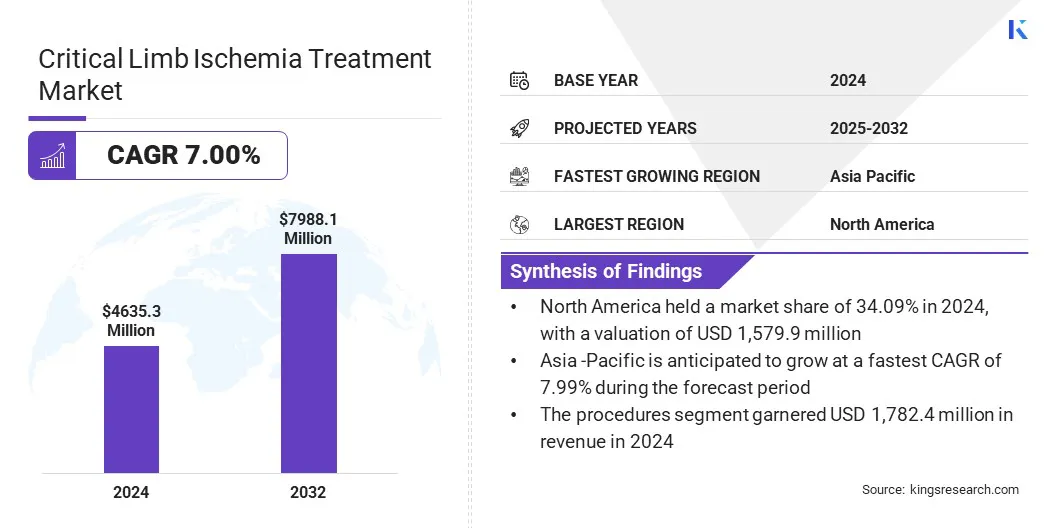

According to Kings Research, the global critical limb ischemia treatment market size was valued at USD 4,635.3 million in 2024 and is projected to grow from USD 4,951.9 million in 2025 to USD 7,988.1 million by 2032, exhibiting a CAGR of 7.00% during the forecast period.

Market growth is driven by the rising global prevalence of diabetes and peripheral artery disease, which expands the at-risk patient population. Additionally, the growing aging population is contributing to higher incidences of vascular disorders and chronic limb-threatening conditions, increasing the demand for timely diagnosis and advanced therapies.

Key Highlights:

- The critical limb ischemia treatment Industry size was recorded at USD 4,635.3 million in 2024.

- The market is projected to grow at a CAGR of 7.00% from 2025 to 2032.

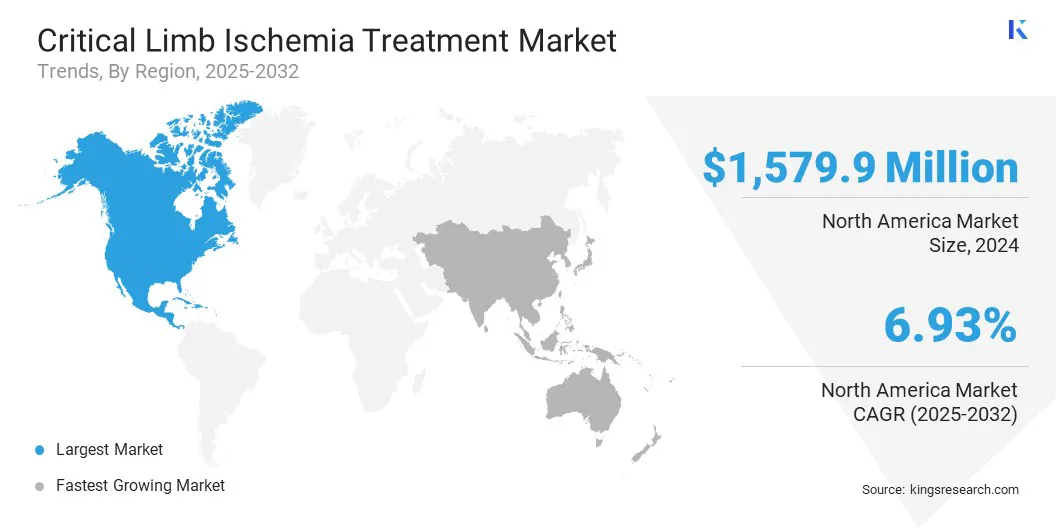

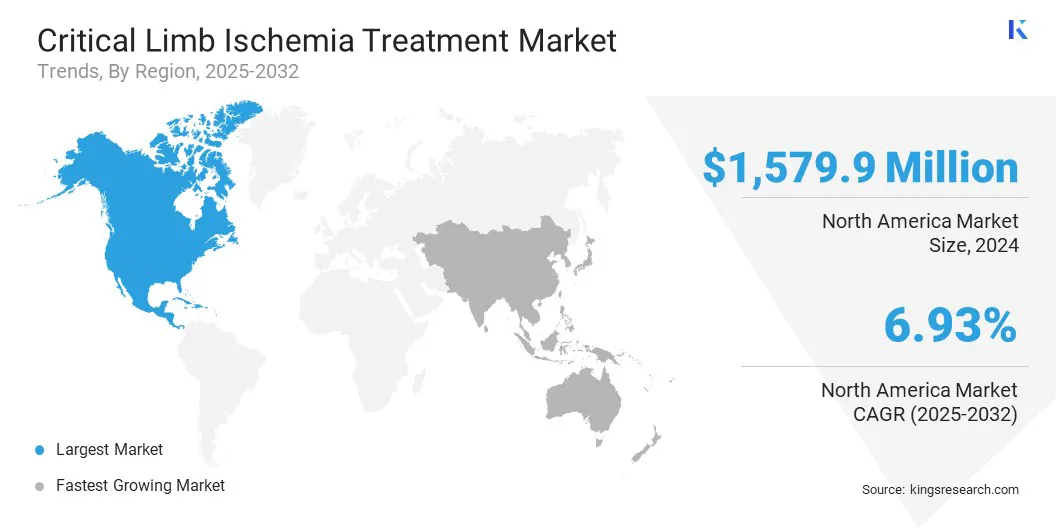

- North America held a share of 34.09% in 2024, valued at USD 1,579.9 million.

- The procedures segment garnered USD 1,782.4 million in revenue in 2024.

- The hospital segment is expected to reach USD 2,630.2 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.99% over the forecast period.

Major companies operating in the critical limb ischemia treatment market are Abbott Laboratories, Cook Group, Inari Medical, Inc., Micro Medical Solutions, Terumo Medical Corporation, Medtronic Inc., BIOTRONIK SE & Co. KG, Cordis, AngioDynamics, Pluri Biotech Ltd, Boston Scientific Corporation, Koninklijke Philips N.V., Cynata Therapeutics Ltd, Eli Lilly and Company, and Inari Medical, Inc.

Rising national health expenditures in the U.S. are fueling market growth by increasing investments in advanced vascular care and expanding access to revascularization and wound management. These investments support the adoption of innovative therapies, strengthen healthcare infrastructure, and improve patient outcomes.

- In June 2025, the Centers for Medicare & Medicaid Services (CMS) projected national health expenditures to grow at an annual rate of 5.8% from 2024 to 2033, accounting for 20.3% of GDP by 2033.

Market Driver

Rising Prevalence of Diabetes

A major factor propelling the expansion of the critical limb ischemia treatment market is the rising prevalence of diabetes, a major risk factor for peripheral artery disease and its progression to CLI. The growing diabetic population has led to increased cases of chronic wounds, infections, and vascular blockages that require advanced medical intervention.

In response, healthcare providers are expanding revascularization procedures, wound care solutions, and pharmacological therapies. This growing demand is boosting global investment in innovative CLI treatments, medical devices, and supportive care infrastructure.

- In April 2025, the International Diabetes Federation (IDF) reported that 589 million adults aged 20–79 were living with diabetes in 2024, a figure projected to rise to 853 million by 2050. This rapid growth in the diabetic population is significantly increasing the prevalence of peripheral artery disease and critical limb ischemia, thereby fostering global demand for advanced treatment solutions.

Market Challenge

High Cost of Advanced Treatments

A key challenge impeding the expansion of the critical limb ischemia treatment market is the high cost of advanced therapies. Procedures such as angioplasty, stenting, atherectomy, and hybrid revascularization involve expensive devices, require specialized expertise, and extended hospital resources.

Regenerative options such as stem cell and gene-based treatments remain prohibitively expensive, which limits patient access. These high costs create barriers to adoption, particularly in emerging markets, and place financial pressure on healthcare systems, restraining market growth.

To address this challenge, market players are developing cost-efficient stents, catheters, and drug-coated devices while streamlining manufacturing to reduce unit costs. They are localizing production in cost-sensitive regions, offering tiered pricing models, and expanding minimally invasive procedures that cut hospitalization expenses.

Additionally, companies are investing in clinical studies to prove long-term value, adopting digital platforms for remote monitoring, and offering physician training programs to optimize resource utilization.

Market Trend

Growing Adoption of Minimally Invasive and Hybrid Procedures

A notable trend influencing the critical limb ischemia treatment market is the growing adoption of minimally invasive and hybrid procedures. Endovascular interventions, including angioplasty, stenting, and atherectomy, are increasingly combined with selective surgical techniques to create hybrid approaches that improve procedural success rates.

These methods reduce hospital stays, minimize patient discomfort, and accelerate recovery compared to traditional open surgeries. Healthcare providers are expanding the use of these techniques to enhance patient outcomes, lower complication risks, and optimize resource utilization in CLI management.

- In December 2024, Terumo Interventional Systems launched the R2P NaviCross peripheral support catheter in the U.S. The 200 cm catheter is designed for radial-to-peripheral procedures, enabling physicians to access and cross lesions above and below the knee. It supports the treatment of peripheral artery disease and critical limb ischemia.

Critical Limb Ischemia Treatment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Procedures (Antiplatelet drugs, Anticoagulants, Cholesterol-lowering drugs, Pain relievers, Others), Medications (Endovascular procedures, Surgical procedures) Others

|

|

By End User

|

Hospital, Specialty vascular clinics, Ambulatory Surgery Centers, Homecare settings

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Procedures, Medications, and Others): The procedures segment earned USD 1,782.4 million in 2024, fueled by increasing adoption of minimally invasive and hybrid revascularization techniques for critical limb ischemia.

- By End User (Hospital, Specialty vascular clinics, Ambulatory Surgery Centers, and Homecare settings): The hospital segment held a share of 33.24% in 2024, largely attributed to advanced infrastructure, specialized expertise, and higher patient volumes for CLI treatments.

Critical Limb Ischemia Treatment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America critical limb ischemia treatment market share stood at 34.09% in 2024, valued at USD 1,579.9 million. This dominance is reinforced by the rising prevalence of diabetes and peripheral artery disease, increasing the population at risk of developing critical limb ischemia and boosting demand for timely diagnosis, intervention, and advanced treatment options.

Increasing healthcare investments and reimbursement support from governments, private insurers, and healthcare providers are enhancing patient access to advanced critical limb ischemia therapies. Additionally, the growing prevalence of vascular conditions among adults is fueling demand for effective treatments and specialized interventions.

- In April 2025, the U.S. Centers for Disease Control and Prevention (CDC) reported that approximately 6.5 million Americans aged 40 and above are affected by peripheral artery disease (PAD), fueling demand for critical limb ischemia treatment and advanced vascular interventions.

The Asia-Pacific critical limb ischemia treatment industry is set to grow at a CAGR of 7.99% over the forecast period. This growth is attributed to rapid urbanization and changing lifestyles in countries such as China and India, leading to higher incidences of diabetes and peripheral artery disease.

Strengthening healthcare infrastructure through government initiatives is improving access to advanced therapies, including minimally invasive endovascular procedures, drug-eluting stents, and atherectomy devices. Additionally, increasing research and clinical studies are fostering the development of new therapies and treatment protocols, supporting regional market growth.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates CLI treatment by overseeing the approval, quality, and safety of medical devices, endovascular products, drugs, and biologics used in revascularization and wound care. Its role includes clinical trials, labeling, manufacturing standards, and post-market surveillance, ensuring safe adoption of innovative therapies.

- In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) manages approval, quality, and post-market surveillance of medical devices, interventional catheters, stents, and pharmaceuticals. It enforces U.K. Medical Device Regulations, oversees clinical trials, and ensures safety reporting to protect patient outcomes.

- In China, the National Medical Products Administration (NMPA) regulates CLI treatment by approving medical devices, drugs, and combination products used in peripheral interventions and vascular care. It supervises clinical evaluation, product registration, manufacturing compliance, and post-market monitoring.

- In India, the Central Drugs Standard Control Organization (CDSCO), under India’s Ministry of Health and Family Welfare, approves drugs, medical devices, and stents for vascular interventions. It oversees clinical trials, device classification, import approvals, and quality standards, ensuring patient safety and access to advanced CLI therapies.

Competitive Landscape

Major players operating in the critical limb ischemia treatment industry are advancing next-generation resorbable scaffolds that dissolve after restoring vessel patency by supporting natural vessel healing and reducing the need for repeat interventions. Market players are accelerating research partnerships and clinical collaborations to validate novel therapies and deliver safer, more durable treatment options.

Additionally, they are initiating large-scale clinical trials, including randomized studies on atherectomy systems with balloon angioplasty, to generate robust evidence for improved outcomes in below-the-knee critical limb ischemia treatment.

- In July 2025, AngioDynamics enrolled the first patient in the AMBITION BTK trial, a multicenter, randomized study evaluating the Auryon Atherectomy System with balloon angioplasty versus balloon angioplasty alone for treating below-the-knee lesions in critical limb ischemia patients.

Key Companies in Critical Limb Ischemia Treatment Market:

- Abbott Laboratories

- Cook Group

- Inari Medical, Inc

- Micro Medical Solutions

- Terumo Medical Corporation

- Medtronic Inc

- BiotroniBIOTRONIK SE & Co. KG

- Cordis

- AngioDynamics

- Pluri Biotech Ltd

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Cynata Therapeutics Ltd

- Eli Lilly and Company

- INARI MEDICAL, INC.

Recent Developments (Product Launch)

- In April 2024, Abbott received U.S. FDA approval for the Esprit BTK Everolimus Eluting Resorbable Scaffold System, a first dissolvable stent for below-the-knee arteries. It supports vessels, delivers drug therapy, and gradually dissolves, offering improved outcomes for patients with chronic limb-threatening ischemia compared to standard balloon angioplasty.