Market Definition

The market focuses on technologies and solutions that enable human-like interactions between users and machines. These systems often involve natural language processing (NLP), machine learning, and artificial intelligence (AI) to allow users to communicate with devices, software, or platforms through text or speech.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Conversational Systems Market Overview

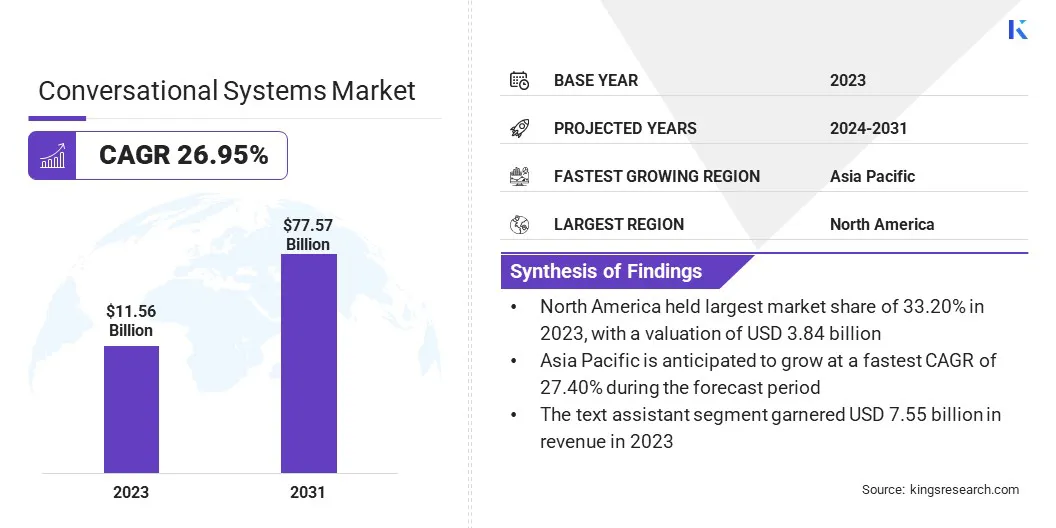

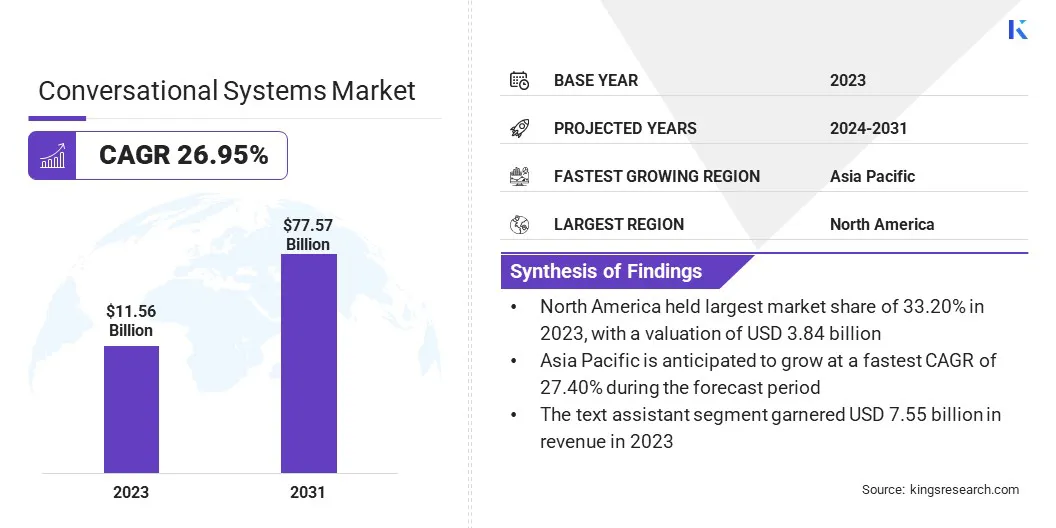

Global conversational systems market size was valued at USD 11.56 billion in 2023, which is estimated to be valued at USD 14.59 billion in 2024 and reach USD 77.57 billion by 2031, growing at a CAGR of 26.95% from 2024 to 2031.

Advancements in AI and NLP technologies are crucial for improving conversational systems' ability to understand and respond to human language accurately, making these systems more effective, efficient, and widely adopted across industries.

Major companies operating in the conversational systems industry are IBM, Alphabet Inc., Microsoft, Gamut Analytics Pvt. ltd., Oracle, Baidu, Salesken AI Inc., Accenture, Conversica, Inc., Jio Haptik Technologies Limited, Rasa Technologies Inc., Avaamo, Kore.ai, Inc., Inbenta Holdings Inc., Pypestream, and others.

The market is rapidly expanding, driven by advancements in artificial intelligence, natural language processing, and machine learning technologies. These systems enable businesses to enhance user engagement, streamline operations, and improve decision-making through real-time, automated interactions.

As industries seek to optimize customer experience and operational efficiency, demand for AI-driven solutions that can interpret, process, and respond to human language continues to grow. The market is set to witness further innovation, enabling businesses enhance user engagement and data management.

- In May 2024, Vianai Systems launched Boomi FinTalk, a conversational AI solution designed for finance. Powered by Vianai, it allows finance teams to ask real-time, natural language questions across multiple data sources, providing actionable insights for informed decision-making.

Key Highlights:

- The conversational systems market size was recorded at USD 11.56 billion in 2023.

- The market is projected to grow at a CAGR of 26.95% from 2024 to 2031.

- North America held a market share of 33.20% in 2023, with a valuation of USD 3.84 billion.

- The compute platforms segment garnered USD 5.66 billion in revenue in 2023.

- The text assistant segment is expected to reach USD 51.03 billion by 2031.

- The customer support & personal assistant segment held a share of 33.28% in 2023.

- The media & entertainment segment is anticipated to grow at a CAGR of 29.59% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 27.40% through the projection period.

Market Driver

Advancements in Artificial Intelligence and Natural Language Processing

Continuous advancements in artificial intelligence and natural language processing (NLP) are fueling the growth of the market. AI innovations, particularly in machine learning and deep learning, allow systems to process and understand complex human language more accurately.

As NLP technologies evolve, conversational systems can offer increasingly sophisticated interactions, delivering more accurate responses and improving user experiences. These advancements enable conversational systems to cater to diverse industries, leading to wider adoption across customer service, healthcare, finance, and enterprise applications.

- In May 2023, Moveworks launched Creator Studio, a no-code, generative AI platform enabling enterprises to rapidly develop custom conversational AI use cases. This platform leverages advanced large language models to automate tasks, connect systems, and delivers instant access to information across applications without requiring coding expertise.

Market Challenge

AI Bias and Hallucinations

AI bias and hallucinations pose significant challenges to the progress of the conversational systems market, as models may generate biased or inaccurate responses, undermining credibility. To address this challenge, companies are implementing advanced training techniques, leveragging diverse datasets, and incorporating anti-bias algorithms.

Additionally, integrating human oversight and continual model refinement further enhance accuracy. These solutions ensure that conversational systems provide reliable, unbiased, and trustworthy interactions, enhancing user confidence and system effectiveness.

Market Trend

Integration with Industry-Specific Applications

Integration with industry-specific applications is a prominent trend in the market, as AI-powered solutions are increasingly customized for sectors such as automotive and healthcare. By tailoring systems to meet the unique needs of each industry, conversational platforms deliver more relevant, precise, and actionable insights.

For instance, in automotive, conversational AI assists with real-time navigation and personalized in-car experiences, while in healthcare, it supports patient management and provides medical information, improving overall efficiency and user satisfaction within these industries.

- In January 2025, Mercedes-Benz and Google Cloud expanded their strategic partnership to introduce new AI-powered conversational capabilities to the MBUX Virtual Assistant. By leveraging Google Cloud’s Automotive AI Agent, the assistant will offer more personalized, detailed responses on navigation, points of interest, and real-time updates, enhancing the driving experience.

Conversational Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Compute Platforms, Solutions, Services

|

|

By Type

|

Text Assistant, Voice Assisted, Others

|

|

By Application

|

Branding & Advertisement, Customer Support & Personal Assistant, Data Privacy & Compliance, Others

|

|

By Vertical

|

BFSI, Healthcare & Life Sciences, Media & Entertainment, Retail & E-commerce, Telecommunication, Travel & Hospitality, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Compute Platforms, Solutions, and Services): The compute platforms segment earned USD 5.66 billion in 2023 due to the increasing demand for advanced hardware and cloud infrastructure supporting conversational AI.

- By Type (Text Assistant, Voice Assisted, and Others): The text assistant segment held a share of 65.32% in 2023, fueled by the growing preference for text-based interactions in customer service and virtual assistant applications across industries.

- By Application (Branding & Advertisement, Customer Support & Personal Assistant, Data Privacy & Compliance, and Others): The customer support & personal assistant segment is projected to reach USD 26.02 billion by 2031, propelled by the rising adoption of AI-driven tools for automating customer service and enhancing user experience.

- By Vertical (BFSI, Healthcare & Life Sciences, Media & Entertainment, Retail & E-commerce, Telecommunication, Travel & Hospitality, and Others): The media & entertainment segment is anticipated to grow at a CAGR of 29.59% over the forecast period, fostered by the increasing use of conversational systems for content recommendations and interactive user engagement.

Conversational Systems Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America conversational systems market share stood at around 33.20% in 2023, valued at USD 3.84 billion. This dominance is reinforced by its robust technological infrastructure, high adoption of AI and automation solutions, and the presence of key market players. Businesses in the region are are rapidly adopting innovative technologies to streamline operations and improve customer experiences.

Furthermore, the growing demand for customer support automation across various industries, combined with substantial investments in AI research and development, has reinforced North America's leading position in the global conversational AI market.

- In October 2024, Community Health Systems (CHS) and Denim Health partnered to scale conversational AI across CHS’ Patient Access Center, improving call center efficiency, reducing call times, and enhancing the patient experience with AI-powered solutions for authentication, self-scheduling, and care gap closures.

Asia Pacific conversational systems industry is set to grow at a robust CAGR of 27.40% over the forecast period. This growth is bolstered by rapid digital transformation, high smartphone penetration, and increasing demand for AI-driven customer service solutions.

Countries such as China, India, and Japan are adopting conversational AI technologies across various sectors, including retail, banking, and healthcare, to enhance user experiences. The region's large population, rising internet access, and advancements in AI and machine learning are accelerating the adoption of conversational systems, positioning the region as a key market.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) prevents fraudulent practices, offering guidance to consumers on avoiding scams, while focusing on transparency, privacy, and data security in AI deployments.

- The EU General Data Protection Regulation (GDPR) governs the processing and transfer of personal data within the EU and provides guidelines on consent and data usage for AI models.

- In India, the Digital Personal Data Protection Bill, 2023 ensures lawful data processing, individuals' rights, data fiduciary obligations, and penalties for breaches. It emphasizes transparency, consent, security, and safeguards for children's data.

Competitive Landscape

In the conversational systems market, companies are increasingly integrating advanced AI technologies to enhance customer experiences and operational efficiency. They are leveraging natural language processing (NLP) and machine learning algorithms to create more intuitive, context-aware systems that can handle complex interactions.

By combining AI with human expertise, businesses are optimizing workflows, improving response accuracy, and reducing operational costs. Additionally, companies are focusing on multi-channel integration, supporting various languages and industries to offer personalized and seamless customer interactions across platforms.

- In April 2025, Alorica launched evoAI, a conversational AI platform designed to enhance customer experiences across digital and voice channels. The platform uses advanced neural networks and rule-based systems to provide adaptive, emotionally intelligent interactions, improving efficiency and reducing operational costs. EvoAI supports over 120 languages, delivering personalized service and offering seamless integration across various industries, demonstrating significant improvements in customer satisfaction, resolution times, and agent productivity.

List of Key Companies in Conversational Systems Market:

- IBM

- Alphabet Inc.

- Microsoft

- Gamut Analytics Pvt. ltd.

- Oracle

- Baidu

- Salesken AI Inc

- Accenture

- Conversica, Inc.

- Jio Haptik Technologies Limited

- Rasa Technologies Inc

- Avaamo

- Kore.ai, Inc.

- Inbenta Holdings Inc

- Pypestream

Recent Developments (Partnerships/Product Launch)

- In April 2025, Tata Consultancy Services (TCS) partnered with Vianai Systems to integrate conversational AI into decision intelligence. This collaboration enables businesses to engage with their data using natural language, providing real-time insights. By combining AI with advanced analytics, it empowers executives to make informed, data-driven decisions, streamlining business processes.

- In October 2023, KPMG in India and Vianai Systems announced a strategic alliance to introduce AI-based Conversational Finance. By leveraging Vianai’s hila Enterprise, this collaboration allows finance professionals to query enterprise data in natural language, delivering real-time insights with high accuracy, reducing reliance on IT or analysts for decision-making.

- In October 2023, Lumeto unveiled an AI-driven upgrade to its InvolveXR platform, marking a significant milestone in healthcare simulation. The new conversational system, powered by Large Language Models, allows virtual patients to engage in natural, free-flowing dialogues with learners. This breakthrough enables customizable scenarios for training, enhancing patient care skills, clinical judgment, and cultural sensitivity in medical education.