Market Definition

The market involves the strategic outsourcing of logistics operations such as inventory management, packaging, order processing, and last-mile handling. It covers customized logistics planning, coordination, and execution aligned with a client’s supply chain needs.

Widely used in industries like automotive, healthcare, e-commerce, and manufacturing, contract logistics supports scalable, end-to-end solutions across various sectors. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Contract Logistics Market Overview

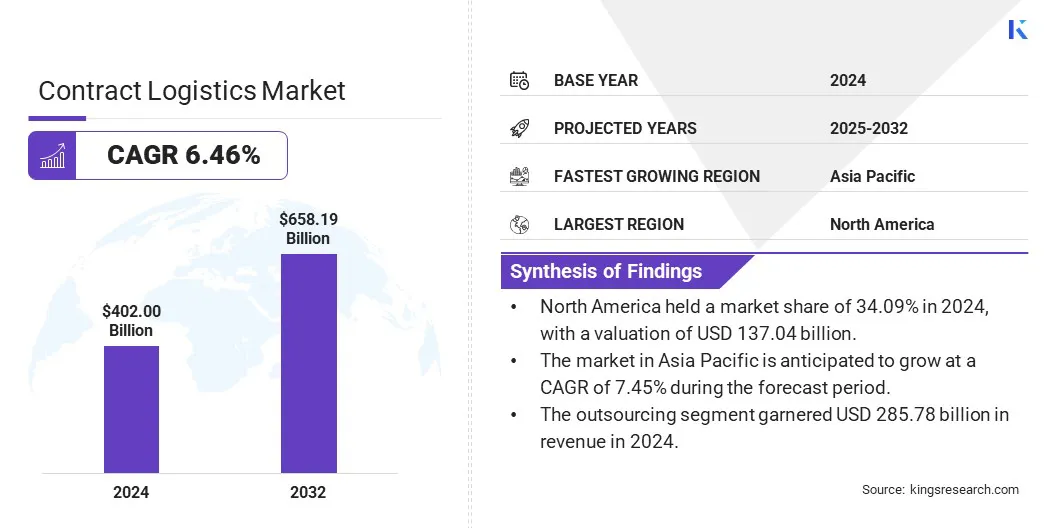

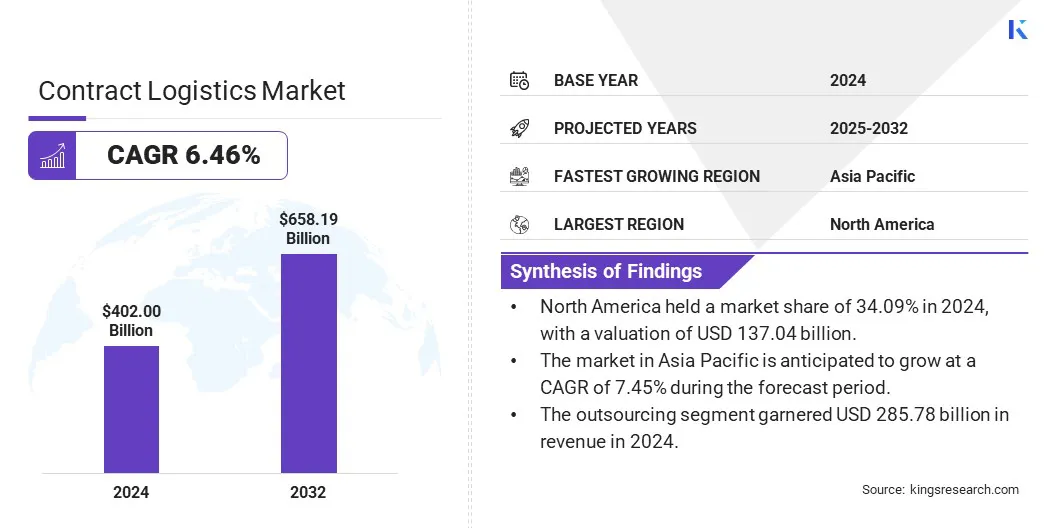

The global contract logistics market size was valued at USD 402.00 billion in 2024 and is projected to grow from USD 424.74 billion in 2025 to USD 658.19 billion by 2032, exhibiting a CAGR of 6.46% during the forecast period.

The market is strongly supported by the rising demand for supply chain customization, allowing businesses to align logistics solutions with specific operational needs. Additionally, innovation in logistics technology and automation is streamlining processes, improving visibility, and reducing costs, further accelerating the expansion of the market.

Major companies operating in the contract logistics industry are Kuehne + Nagel International AG, DHL, DSV A/S, SNCF Group, CMA CGM Group, NIPPON EXPRESS HOLDINGS, INC., Yusen Logistics Co., Ltd., XPO, Inc., United Parcel Service of America, Inc., FedEx Corp., Ryder System, Inc., LOGISTEED, Ltd, Penske Logistics, Sinotrans Limited, and Agility.

The rapid expansion of global e-commerce networks is driving the market. Online retailers increasingly rely on third-party logistics providers for warehousing, inventory handling, and delivery services.

Shopping patterns are shifting toward multi-channel platforms, thus, contract logistics is essential for handling large volumes of time-sensitive shipments. This is fueling the demand for end-to-end logistics partnerships that support scalability, service consistency, and reduced operational burdens for digital commerce businesses.

- In May 2025, InPost, a parcel locker company, partnered with British online fashion retailer ASOS to introduce the UK's first next-day out-of-home (OOH) delivery service. This initiative leverages InPost's extensive network of 12,800 parcel lockers and pick-up/drop-off points across the UK, offering customers convenient and rapid delivery options. The service expansion follows InPost's acquisition of British courier company Yodel in April 2025, enhancing its logistics capabilities and positioning it as the third-largest independent logistics operator in the UK.

Key Highlights

- The contract logistics industry size was valued at USD 402.00 billion in 2024.

- The market is projected to grow at a CAGR of 6.46% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 137.04 billion.

- The outsourcing segment garnered USD 285.78 billion in revenue in 2024.

- The transportation segment is expected to reach USD 197.75 billion by 2032.

- The automotive segment secured the largest revenue share of 30.12% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.45% during the forecast period.

Market Driver

Rising Demand for Supply Chain Customization

The demand for customized supply chain services is accelerating the growth of the contract logistics market. Companies are shifting away from standard logistics models to tailored solutions that align with sector-specific requirements.

Contract logistics providers offer specialized services such as kitting, labeling, packaging, and real-time tracking to meet these expectations. The ability to design and manage flexible supply chains is becoming a critical success factor for enterprises in sectors like healthcare, automotive, and electronics.

- In May 2025, MSL Copack + Ecomm introduced advanced kitting services that integrate AI-driven systems for precision and efficiency. The company is expanding customization options to include personalized branding and flexible assembly processes, aiming to meet the evolving needs of clients. Additionally, MSL is implementing real-time tracking systems to provide visibility across the entire supply chain process, ensuring transparency and efficiency.

Market Challenge

Rising Operational Costs

A significant challenge hindering the growth of the contract logistics market is the rising operational costs, particularly related to transportation, fuel, and labor. The demand for faster and more customized services is increasing, pressurizing companies to maintain profitability while managing these expenses.

Logistics companies are adopting advanced technologies like automation, Artificial Intelligence (AI), and data analytics to optimize routes, reduce fuel consumption, and improve overall efficiency.

Additionally, many companies are investing in Electric Vehicles (EVs) and alternative fuels to reduce dependency on traditional energy sources, helping cut costs in the long term.

Market Trend

Innovation in Logistics Technology and Automation

The implementation of automation, robotics, and warehouse management systems is contributing to the expansion of the contract logistics market. These technologies enhance efficiency, reduce errors, and improve visibility throughout the logistics cycle.

Contract logistics providers are investing in smart warehouses, predictive analytics, and AI-enabled routing systems to improve service reliability. Such innovations help meet client expectations for performance and transparency, positioning contract logistics providers as key partners in digital supply chains.

- In March 2024, Covariant launched RFM-1 (Robotics Foundation Model 1), a robotics foundation model that gives robots a human-like ability to reason and understand their environment. The model is trained on text, images, videos, robot actions, and a range of numerical sensor readings captured by warehouse robots running the Covariant Brain. This technology enables robots to learn how to manipulate objects using deep learning and reinforcement learning, enhancing their capabilities in tasks such as goods-to-person picking, kitting, depalletization, item induction, and order sortation.

Contract Logistics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Outsourcing, Insourcing

|

|

By Service

|

Transportation, Warehousing, Distribution, Aftermarket Logistics

|

|

By End-use Industry

|

Automotive, Retail & E-commerce, Healthcare & Pharmaceuticals, High-Tech & Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Outsourcing and Insourcing): The outsourcing segment earned USD 285.78 billion in 2024, due to its ability to provide specialized, cost-efficient supply chain solutions that allow companies to focus on core activities while leveraging expert third-party services for improved operational efficiency.

- By Service (Transportation, Warehousing, Distribution, and Aftermarket Logistics): The transportation segment held 40.50% share of the market in 2024, due to its critical role in ensuring efficient, timely, and cost-effective movement of goods across supply chains.

- By End-use Industry (Automotive, Retail & E-commerce, Healthcare & Pharmaceuticals, and High-Tech & Industrial): The high-tech & industrial segment is projected to reach USD 207.24 billion by 2032, owing to its complex supply chains, stringent handling requirements, and growing demand for specialized, time-sensitive delivery solutions that enhance operational efficiency.

Contract Logistics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America contract logistics market share stood at around 34.09% in 2024, with a valuation of USD 137.04 billion. North America's robust infrastructure, coupled with the rapid adoption of new logistics technologies, is boosting the market in the region.

Many logistics providers in the region are incorporating automation, AI, robotics, and IoT systems in warehouses and transportation management. The ability to optimize supply chain processes is a significant advantage that boosts the demand for contract logistics services in North America.

Moreover, the healthcare and pharmaceutical sectors are expanding rapidly in North America, particularly with the growth of biologics, vaccines, and personalized medicine.

Logistics providers in North America are increasingly offering cold chain solutions, real-time monitoring, and regulatory compliance services tailored to the pharmaceutical and healthcare industries, further driving the market demand.

- In February 2024, Sensitech introduced TempTale GEO X, an advanced IoT temperature monitoring solution designed specifically for the life sciences industry and logistics organizations. The TempTale GEO X offers a validated, GxP-compliant system to track the temperature of sensitive medicines and vaccines during global transportation across various modes, including air, ocean, road, and rail.

The contract logistics industry in Asia Pacific is poised for significant growth at a robust CAGR of 7.45% over the forecast period. The growth of e-commerce in Asia Pacific is driving the market.

With more consumers shopping online, businesses require advanced logistics services to manage the complexities of multi-channel order fulfillment. This growth is particularly significant in sectors like fashion, electronics, and consumer goods, where efficient logistics are crucial to maintaining customer satisfaction.

- In July 2024, Goldman Sachs Asset Management acquired seven last-mile logistics properties in Australia, totaling 65,300 square meters across key cities. This investment capitalizes on the increasing demand for rapid delivery services driven by e-commerce growth.

The continuous development of regional trade partnerships and transportation corridors is expanding the market opportunities for logistics providers who specialize in regional and cross-border solutions, contributing to the growth of the market in the region.

Regulatory Frameworks

- In the U.S., the Hazardous Materials Transportation Act (HMTA) ensures the safe transport of hazardous materials, including packaging and labeling standards. The Federal Motor Carrier Safety Administration (FMCSA) sets rules on trucker qualifications, hours of service, and vehicle maintenance. Additionally, the Warehouse Indirect Source Rule (ISR) in California mandates emission controls, holding warehouse owners accountable for pollution from truck traffic servicing their facilities.

- The European Union Customs Code (Regulation (EU) No 952/2013) provides a framework for cross-border trade, setting out procedures for the import and export of goods within the EU. EU Road Transport Regulations manage vehicle safety, driver working hours, and operational standards, ensuring uniformity and safety across member states. These regulations aim to streamline trade and logistics activities while maintaining safety and efficiency across Europe.

- China’s Compulsory Certification (CCC) mark is mandatory for products, including logistics equipment, to meet stringent safety and quality standards before being sold in the market. The Customs Law of the People’s Republic of China governs all imports and exports, detailing customs clearance procedures and tariffs, directly influencing logistics operations, especially in cross-border trade.

- In Japan, the Road Transport Vehicle Act establishes safety standards for vehicles involved in logistics, covering vehicle specifications and load securing measures. The Waste Management and Public Cleansing Law regulates the proper disposal and recycling of waste from logistics operations, ensuring environmental sustainability in the logistics sector. These regulations ensure a safe and environmentally responsible logistics environment.

Competitive Landscape

Market players are actively adopting strategies like expanding their logistics and warehouse infrastructure to strengthen their service capabilities. This approach is especially important as the demand from e-commerce and reverse logistics continues to grow.

Companies are improving delivery efficiency, increasing storage capacity, and offering faster turnaround times by adding large, strategically located facilities. These developments are improving customer satisfaction and supporting broader market expansion.

- In May 2025, DHL Supply Chain acquired IDS Fulfillment, enhancing its e-commerce capabilities for small and midsize businesses. The acquisition brings more than 1.3 million square feet of strategically located multi-client warehouse and distribution space across the U.S. This follows the January 2025 acquisition of Inmar's reverse logistics business, making DHL the largest returns processing provider in North America.

List of Key Companies in Contract Logistics Market:

- Kuehne + Nagel International AG

- DHL

- DSV A/S

- SNCF Group

- CMA CGM Group

- NIPPON EXPRESS HOLDINGS, INC.

- Yusen Logistics Co., Ltd.

- XPO, Inc.

- United Parcel Service of America, Inc.

- FedEx Corp.

- Ryder System, Inc.

- LOGISTEED, Ltd

- Penske Logistics

- Sinotrans Limited

- Agility

Recent Developments (Agreements/Expansion/Product Launches)

- In April 2025, Marinetrans secured the project logistics contract for two Floating Liquefied Natural Gas (FLNG) vessel construction projects. The contracts, running from 2025 to 2027, were awarded by Black & Veatch, a Kansas-based engineering and construction firm specializing in energy infrastructure. As part of the agreement, Marinetrans will deliver end-to-end project logistics services, covering the transport of critical components, heavy-lift shipments, global supply chain coordination, and on-site logistics support.

- In March 2025, CMA CGM announced a USD 20 billion investment in the U.S. maritime transportation, logistics, and supply chain capabilities over the next four years. The investment includes expanding port terminals and creating a logistics R&D hub in Boston.

- In May 2024, Scan Global Logistics and Hapag-Lloyd launched a multimillion-dollar initiative to integrate ocean biofuel into their shipping operations. The use of biofuel sourced from renewable materials is intended to help their customers significantly cut carbon emissions and align with broader global efforts to address climate change.

- In April 2024, CEVA Logistics signed a three-year agreement to deliver logistics services for Biesse, a global manufacturer of integrated systems and machinery used in processing wood, glass, stone, plastic, and composite materials. Under the contract, CEVA Logistics will manage Biesse’s warehousing and material handling operations, with a strong emphasis on goods movement, unloading, picking processes, and inventory management.