Market Definition

Coating resins are polymer-based materials used as binders in coatings, paints, and varnishes to provide adhesion, durability, and protective properties. They form a continuous film when applied to a surface, enhancing resistance to chemicals, moisture, UV radiation, and mechanical wear.

Coating resins also contribute to gloss, flexibility, and hardness while improving weatherability and overall performance. They are used across various industries, including automotive, construction, packaging, and industrial coatings, to enhance surface protection and longevity.

Coating Resins Market Overview

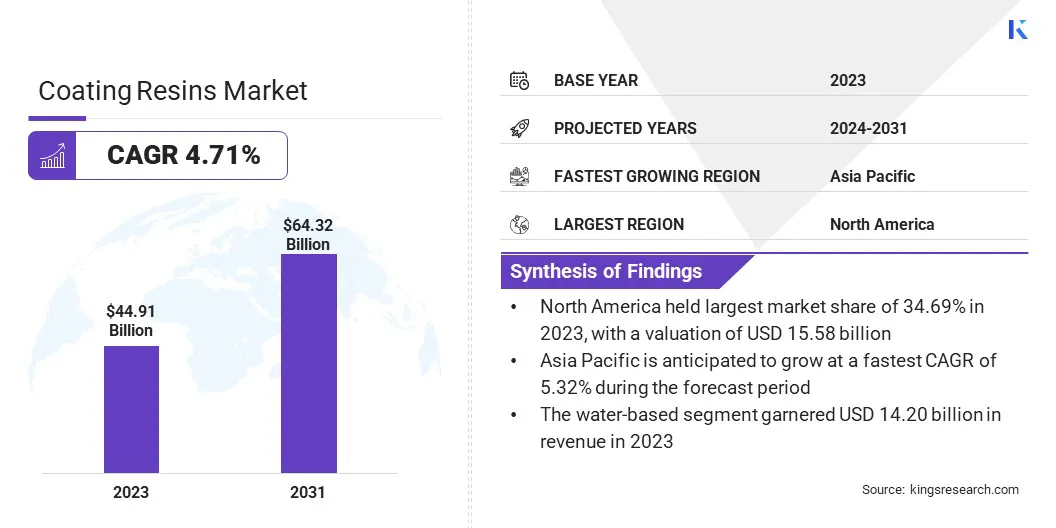

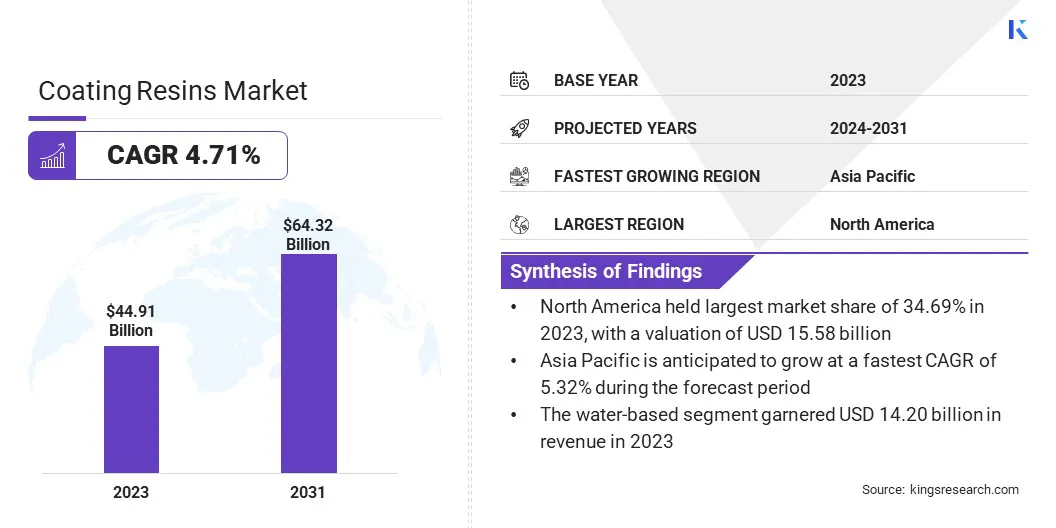

The global coating resins market size was valued at USD 44.91 billion in 2023 and is projected to grow from USD 46.59 billion in 2024 to USD 64.32 billion by 2031, exhibiting a CAGR of 4.71% during the forecast period.

The global market is witnessing steady growth due to the rising demand from industries such as construction, automotive, and packaging. The increasing focus on sustainable and eco-friendly coatings, fueled by stringent environmental regulations, has led to a shift toward waterborne, UV-curable, and bio-based resins.

The expansion of residential, commercial, and industrial construction projects worldwide is further contributing to this growth. Rapid urbanization, increased government investments in infrastructure, and the rising demand for protective and decorative coatings in buildings are highlighting the need for high-performance resins that offer durability, weather resistance, and aesthetic appeal.

Major companies operating in the coating resins industry are The Sherwin-Williams Company, BASF, Dow, Allnex GMBH, Covestro AG, Arkema, Hexion Inc., PPG Industries, Inc., Akzo Nobel N.V., NAN YA PLASTICS CORPORATION, KUKDO CHEMICAL CO., LTD., DIC CORPORATION, Eternal Materials Co.,Ltd., Wacker Chemie AG, and Synthomer plc.

Additionally, industries such as aerospace, marine, and automotive are increasingly requiring coatings with advanced properties, such as scratch resistance, anti-corrosion, heat resistance, and self-healing capabilities.

Innovations in resin formulations, including nanotechnology and smart coatings, are further propelling market growth by enhancing product performance and extending the lifespan of coated surfaces.

- In January 2025, SiO New Material launched SIO-517, a high-performance silicone resin offering 8H hardness, 20-30 years durability, and heat resistance up to 650°C. The room temperature curing resin is designed for high-temperature, corrosion-resistant, and eco-friendly coatings across industries like automotive, industrial, and marine.

Key Highlights:

- The coating resins industry size was valued at USD 44.91 billion in 2023.

- The market is projected to grow at a CAGR of 4.71% from 2024 to 2031.

- North America held a share of 34.69% in 2023, valued at USD 15.58 billion.

- The acrylic segment garnered USD 12.40 billion in revenue in 2023.

- The water-based segment is expected to reach USD 19.62 billion by 2031.

- The architectural segment is likely to generate a revenue of USD 17.24 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 5.32% over the forecast period.

Market Driver

"Rising Demand for Eco-Friendly Coating Resins"

The expansion of the coating resins market is propelled by the growing demand for sustainable and eco-friendly coatings and the rising adoption of high-performance coatings in industrial applications. Traditional solvent-based coatings release volatile organic compounds (VOCs), which contribute to air pollution and pose health risks.

In response, stricter global emission norms are prompting manufacturers to develop low-VOC, water-based, and bio-based coating resins. Sustainable alternatives, such as acrylic, alkyd, and epoxy resins derived from renewable sources, ensure regulatory compliance while offering benefits such as low odor, reduced toxicity, and improved indoor air quality.

This shift is particularly evident in architectural and automotive coatings, where sustainability is a key purchasing factor.

Additionally, industries such as automotive, aerospace, and construction require high-performance coatings that offer enhanced durability, corrosion resistance, and thermal stability. The demand for advanced epoxy, polyurethane, and acrylic resins is increasing as companies seek to improve product longevity and efficiency in harsh environments.

- In June 2024, Arkema announced a breakthrough in manufacturing processes by incorporating up to 40% post-consumer recycled content from end-of-life packaging into its powder coating resins. The new recycled-based powder coating resins utilize post-consumer PET (Polyethylene terephthalate) as an alternative feedstock, enhancing sustainability and performance.

Market Challenge

"High Raw Material Costs and Environmental Concerns"

High raw material costs presents a significant challenge to the progress of the coating resins market. Essential components such as resins, solvents, and pigments are subject to price fluctuations due to several factors, including raw material scarcity, rising energy costs, and supply chain disruptions.

These increased production costs affect manufacturers' profit margins and the final product pricing. To combat this, companies can explore alternative, cost-effective raw materials, such as plant-based resins or recycled materials, which can help lower the dependency on volatile raw materials.

Moreover, the market growth is hindered by rising environmental concerns regarding traditional resins. Conventional resins often contain VOCs and other harmful substances that contribute to air pollution and environmental degradation.

The development ofeco-friendly alternatives such as water-based, bio-based , and low-VOC resins, addresses these concerns. These solutions adhere to strict regulations and align with rising consumer demand for sustainable products.

Market Trend

"Advancements in Technology"

A major trend in the coating resins market is the rising demand for automotive coatings, supported by the increasing production of vehicles, particularly in emerging economies, and the shift toward electric vehicles.

As automotive manufacturers seek to improve the durability, aesthetics, and protection of vehicles, there is a growing need for advanced coating solutions that offer resistance to corrosion, UV radiation, and environmental damage.

Another notable trend is the incorporation of nanotechnology into coating resins. This advancement enhances the performance of coatings, providing superior scratch resistance, self-cleaning properties, and improved UV protection.

Industries such as automotive, aerospace, and marine are increasingly adopting these high-performance coatings to enhance the durability and functionality of their products.

- For instance, in November 2024, SiO New Material introduced SIOResin SIO-513, a high-performance self-crosslinking nano silicone resin topcoat for multi-industry coatings. The advanced resin offers superior durability and protection for surfaces such as stone, plastic, metal, and glass, making it ideal for automotive, aerospace, and consumer electronics applications.

Coating Resins Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Acrylic, Alkyd, Polyurethane, Epoxy, Polyester

|

|

By Technology

|

Water-based, Solvent-based, Powder-based, Others

|

|

By End Use

|

Architectural, Industrial, Automotive, Packaging, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Acrylic, Alkyd, Polyurethane, Epoxy, and Polyester): The acrylic segment earned USD 12.40 billion in 2023, mainly due to its superior weather resistance, durability, and widespread use in architectural and industrial coatings.

- By Technology (Water-based, Solvent-based, Powder-based, and Others): The water-based held a share of 31.62% in 2023, attributed to growing environmental regulations, low VOC emissions, and increasing adoption of sustainable coatings.

- By End Use (Architectural, Industrial, Automotive, Packaging, and Others): The architectural segment is projected to reach USD 17.24 billion by 2031, boosted by rapid urbanization, infrastructure development, and surging demand for eco-friendly coatings.

Coating Resins Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America coating resins market accounted for a substantial share of 34.69% in 2023, valued at USD 15.58 billion. The region's dominance is attributed to the strong presence of key manufacturers, high demand from end-use industries such as construction, automotive, and industrial coatings, and strict environmental regulations promoting the adoption of low-VOC and sustainable coatings.

The U.S. leads the market due to its advanced infrastructure, high consumption of high-performance coatings, and continuous innovation in resin technologies. Additionally, increasing investments in renovation and remodeling activities, particularly in the residential and commercial sectors, is creating a strong demand for coating resins.

Asia Pacific coating resins industry is expected to register the fastest growth in the market, expanding at a CAGR of 5.32% over the forecast period. This rapid expansion is fostered by increasing industrialization, rapid urbanization, and infrastructure development in key economies such as China, India, and Southeast Asian countries.

The booming automotive and construction sectors, coupled with rising consumer demand for high-quality and durable coatings, are fueling regional market expansion. Additionally, government initiatives supporting sustainable and low-VOC coatings, along with a shift toward eco-friendly formulations, are fostering the adoption of advanced resin technologies.

With growing manufacturing activities and increasing foreign investments, Asia-Pacific is poised to become a key hub for coating resin production and consumption in the coming years.

- In February 2024, DIC Corporation established the DIC South Asia Private Limited Application Lab in India to evaluate coating resins for automotive and infrastructure applications. Amidst the growing demand for coating resins in India, DIC is expanding its presence by launching this open laboratory and commencing production at a second site at IDEAL CHEMI PLAST.

Regulatory Framework:

- In the U.S., the Environmental Protection Agency (EPA) regulates the production and use of coating resins through policies such as the Clean Air Act (CAA) and the Toxic Substances Control Act (TSCA). The EPA sets standards for volatile organic compound (VOC) emissions in coatings and ensures that manufacturers comply with environmental guidelines.

- In Europe, coating resins are regulated by the European Chemicals Agency (ECHA) under the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation. ECHA ensures that all chemical substances used in coatings are safe for human health and the environment, requiring manufacturers to submit safety data for evaluation.

- In India, the Central Pollution Control Board (CPCB) is responsible for regulating coating resins. It implements policies to limit VOC emissions and other pollutants in coating products and ensure manufacturers meet environmental protection standards.

Competitive Landscape

The coating resins industry is characterized by a large number of participants, including both established corporations and emerging players. Market participants focus on product development, strategic partnerships, and expansion into emerging economies to strengthen their position.

Research and development efforts are directed toward sustainable and high-performance resins, supported by the increasing demand for eco-friendly coatings with low VOC emissions and enhanced durability.

- In April 2024, AkzoNobel announced the construction of two new research labs at its Sassenheim site in the Netherlands, investing USD 8 million to advance resin and coating technologies. The new polymer lab will focus on developing sustainable resin innovations, while the Powder Coatings lab will develop low-bake cure and carbon reduction solutions.

Technological advancements play a crucial role in gaining a competitive edge, with companies investing in novel formulations such as waterborne, UV-curable, and bio-based resins to meet regulatory standards and evolving consumer preferences.

The market experiences frequent mergers, acquisitions, and collaborations as firms aim to expand their production capacity, diversify product portfolios, and enter new markets.

List of Key Companies in Coating Resins Market:

- The Sherwin-Williams Company

- BASF

- Dow

- Allnex GMBH

- Covestro AG

- Arkema

- Hexion Inc.

- PPG Industries, Inc.

- Akzo Nobel N.V.

- NAN YA PLASTICS CORPORATION

- KUKDO CHEMICAL CO., LTD.

- DIC CORPORATION

- Eternal Materials Co.,Ltd.

- Wacker Chemie AG

- Synthomer plc

Recent Developments (Acquisitions/Partnerships/New Product Launch)

- In February 2025, SiO New Material launched SIOResin WRS-1002, a water-based intumescent fireproof resin with 100x expansion, transparency, and eco-friendly properties. The VOC-free formulation ensures easy application and room-temperature curing while maintaining wood’s natural appearance.

- In October 2024, Nippon Paint Holdings (NPHD) acquired AOC, a leader in unsaturated polyester, vinyl ester, and CASE (Coatings, Adhesives, Sealants, and Elastomers) solutions. The deal aligns with NPHD’s growth strategy, leveraging AOC’s strong market position, advanced technology, and profitability.

- In July 2024, AGC Vinythai and Michigan State University’s Professor partnered with allnex to advance biobased epoxy resins by replacing bisphenol A (BPA) with lignin. The collaboration aims to develop sustainable, BPA-free epoxy coatings using lignin, biobased epichlorohydrin, and biobased hardeners.

- In March 2024, Safic-Alcan expanded its partnership with BB Resins Srl to expand epoxy solutions in Poland. Building on their collaboration in Canada, this expansion targets the industrial coatings, building, and flooring sectors.