Market Definition

The market encompasses the development and production of semiconductor-based sensors that convert light into electronic signals using complementary metal-oxide-semiconductor technology. These sensors are fabricated through photolithographic processes on silicon wafers, integrating amplifiers and signal processing circuits directly on the chip.

This enables high-speed imaging and low power consumption. CMOS sensors are widely used in consumer electronics such as smartphones, tablets, and digital cameras. They are also utilized in automotive systems, medical imaging, industrial inspection and surveillance. The report provides insights into the major drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

CMOS Image Sensor Market Overview

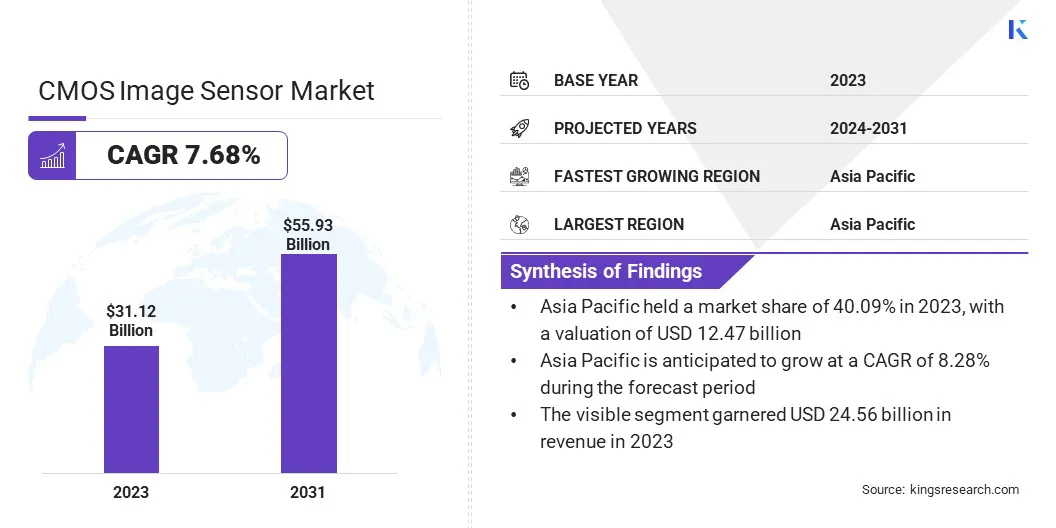

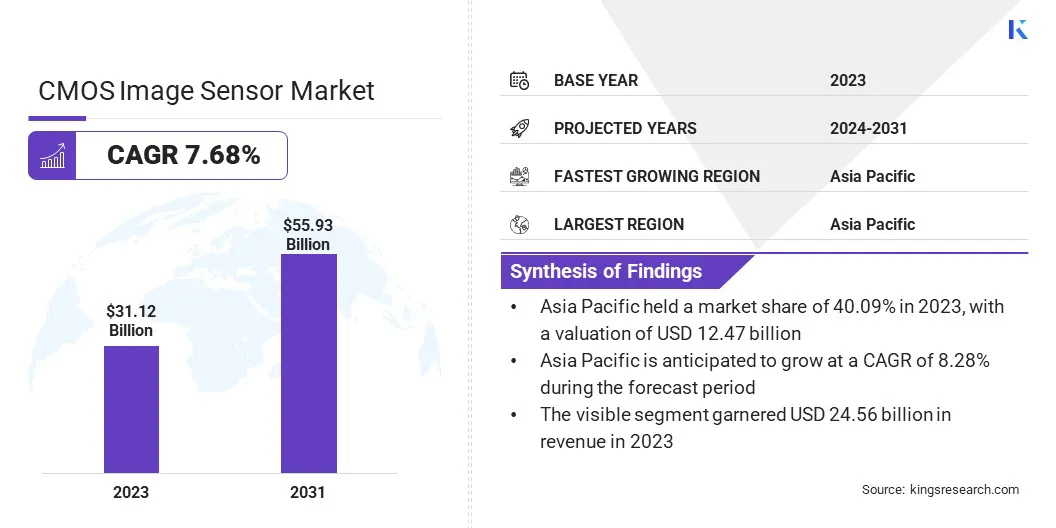

The global CMOS image sensor market size was valued at USD 31.12 billion in 2023 and is projected to grow from USD 33.31 billion in 2024 to USD 55.93 billion by 2031, exhibiting a CAGR of 7.68% during the forecast period.

The rising use of advanced driver-assistance systems in the automotive sector, which rely on CMOS sensors for real-time imaging and object detection, is driving the market. Additionally, the growing integration of CMOS sensors in smart surveillance and security systems, driven by their improved low-light performance and energy efficiency, is further fueling market growth.

Major companies operating in the CMOS image sensor industry are Sony Corporation, Samsung, Canon, Panasonic Corporation, STMicroelectronics, OMNIVISION, Semiconductor Components Industries, LLC, Teledyne Technologies Incorporated, Hamamatsu Photonics K.K., Toshiba Electronic Devices & Storage Corporation, Sharp Corporation, SmartSens Technology Co., Ltd., PixArt Imaging Inc., SK hynix Inc., and Silicon Optronics, Inc.

Increasing consumer demand for high-quality smartphone photography is significantly contributing to the growth of the market. Smartphone OEMs are continuously upgrading camera specifications by integrating multi-lens systems and high-resolution sensors to enhance imaging capabilities.

CMOS sensors enable compact design and advanced functions such as HDR, depth sensing, and low-light enhancement. Continuous innovation in mobile photography, including the rise of AI-based imaging and computational photography, is reinforcing the demand for CMOS-based camera modules in mobile devices, in turn driving the growth of the market.

- In June 2024, Samsung launched three advanced mobile image sensors tailored for use in both primary and secondary smartphone cameras: the ISOCELL HP9, ISOCELL GNJ, and ISOCELL JN5. The ISOCELL HP9 is equipped with 200 million 0.56-micrometer (μm) pixels within a 1/1.4-inch optical format. The ISOCELL GNJ incorporates dual-pixel technology and offers 50 million 1.0μm pixels in a 1/1.57-inch format. The ISOCELL JN5 delivers 50 million 0.64μm pixels, housed in a 1/2.76-inch optical format.

Key Highlights

- The global CMOS image sensor market size was recorded at USD 31.12 billion in 2023.

- The market is projected to grow at a CAGR of 7.68% from 2024 to 2031.

- Asia Pacific held a market share of 40.09% in 2023, with a valuation of USD 12.47 billion.

- The visible segment garnered USD 24.56 billion in revenue in 2023.

- The 2D segment is expected to reach USD 45.87 billion by 2031.

- The 5 MP to 12 MP segment secured the largest revenue share of 41.36% in 2023.

- The automotive segment is poised for a robust CAGR of 8.71% through the forecast period.

- North America is anticipated to grow at a CAGR of 7.85% during the forecast period.

Market Driver

Rising Adoption in Automotive ADAS and Safety Systems

The integration of CMOS image sensors into advanced driver assistance systems (ADAS) and in-vehicle monitoring technologies is driving the growth of the market. Increasing focus on safety, automation, and driver behavior analysis across premium and mid-range vehicles is accelerating demand.

CMOS sensors offer compact size, fast processing, and low-light performance, aligning with modern automotive requirements. In addition, continuous advancements in autonomous driving technology are further expanding the scope of sensor deployment across the global automotive industry.

- In October 2024, Sony Semiconductor Solutions Corporation announced that the company will launch the ISX038 CMOS image sensor for automotive cameras, marking the industry's first sensor capable of simultaneously processing and outputting both RAW and YUV images. The sensor maintains compatibility with Sony’s existing lineup and offers backward compatibility for manufacturers to leverage previously gathered data, for ADAS system development.

Market Challenge

Managing Heat Generation and Power Consumption in High-Resolution Sensors

Managing heat generation and power consumption, particularly in high-resolution and high-frame-rate applications pose a significant challenge in the CMOS image sensor market. As pixel density and functionality increase, sensors tend to generate excess heat, which degrade image quality and device reliability.

To address this, companies are investing in advanced sensor architectures and adopting back-side illumination (BSI) technology, which improves light sensitivity while minimizing energy use. Additionally, innovations in pixel-level circuitry and low-power processing techniques are being implemented to enhance thermal efficiency, enabling stable performance across consumer electronics, automotive, and industrial imaging applications.

Market Trend

Integration in Smart Surveillance and Security Systems

The growing implementation of smart surveillance solutions in public infrastructure and private facilities is promoting the growth of the market.

These sensors are widely used in IP cameras and AI-enabled surveillance systems that require high frame rates, motion tracking, and night vision. Rising demand for real-time monitoring in urban security, traffic control, and industrial safety is driving the adoption of next-gen security devices with edge processing and cloud integration.

- In January 2025, Canon Inc. developed a CMOS sensor with that offer 410 megapixels with a 35 mm full-frame sensor. This new sensor is designed for applications requiring ultra-high resolution, such as surveillance and security and offers high image clarity while maintaining a compact form factor. It also incorporates a four-pixel binning function to enhance sensitivity and capture brighter images in low-light conditions.

CMOS Image Sensor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Spectrum

|

Visible, Non-visible

|

|

By Image Processing Technology

|

2D, 3D

|

|

By Resolution Outlook

|

Up to 5 MP, 5 MP to 12 MP, 12 MP to 16 MP, Above 16 MP

|

|

By End-use Outlook

|

Aerospace & Defense, Automotive, Consumer Electronics, Healthcare & Lifesciences, Industrial, Security & Surveillance, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Spectrum (Visible, Non-visible): The visible segment earned USD 24.56 billion in 2023 due to its widespread adoption across consumer electronics, automotive, and industrial applications where high-resolution color imaging under standard lighting conditions is essential.

- By Image Processing Technology (2D, 3D): The 2D segment held 82.97% of the market in 2023, due to its widespread deployment across consumer electronics and surveillance systems, where high-resolution imaging is prioritized for cost-effective and efficient performance.

- By Resolution Outlook (Up to 5 MP, 5 MP to 12 MP, 12 MP to 16 MP, and Above 16 MP): The 5 MP to 12 MP segment is projected to reach USD 23.35 billion by 2031, owing to its optimal balance of image quality, cost-efficiency, and widespread integration across smartphones, automotive systems, and security devices.

- By End-use Outlook (Aerospace & Defense, Automotive, Consumer Electronics, Healthcare & Lifesciences, Industrial, Security & Surveillance, Others): The automotive segment is poised for significant growth at a CAGR of 8.71% through the forecast period, attributed to increasing deployment of advanced driver-assistance systems (ADAS) and autonomous driving technologies that require high-performance imaging for real-time environment perception and safety monitoring.

CMOS Image Sensor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific CMOS image sensor market share stood around 40.09% in 2023 in the global market, with a valuation of USD 12.47 billion. Industries across this region are integrating vision-based automation systems for manufacturing and warehouse operations.

CMOS image sensors enable real-time quality inspection, robotic navigation, and visual recognition tasks essential for optimizing industrial processes. This shift toward smart manufacturing and edge computing is creating a sustained demand for reliable, high-speed sensors, in turn, driving the market.

- In November 2024, Sony Semiconductor Solutions Corporation (SSS) launched the IMX925 stacked CMOS image sensor, featuring a back-illuminated pixel structure and global shutter architecture. This new sensor is engineered for industrial imaging applications and it is able to deliver high-speed processing at 394 frames per second.

Large-scale electronics manufacturers in the Asia Pacific are increasingly integrating camera modules in-house into devices such as smartphones, tablets, and smart appliances, enabling greater control over sensor selection, cost management, and product design. This approach reinforces the adoption of CMOS image sensors and accelerates market growth in the region.

The CMOS image sensor industry in North America is poised for significant growth at a robust CAGR of 7.85% over the forecast period. The region has witnessed significant growth in the integration of multi-camera ADAS technologies across both consumer and commercial vehicle fleets.

CMOS image sensors are a core component in enabling features such as lane detection, pedestrian recognition, and 360-degree surround view systems. With a growing focus on driver safety regulations and insurance-based telematics, the demand for high-resolution, low-latency CMOS sensors in automotive applications continues to strengthen across North America.

Furthermore, retail operators and technology vendors in North America are incorporating vision systems into smart shelving, loss prevention, and automated checkout solutions. This technological shift toward camera-enabled automation is helping fuel consistent demand across retail and commercial property applications.

Regulatory Frameworks

- In the U.S., CMOS image sensor manufacturers must comply with the Export Administration Regulations (EAR) under the Bureau of Industry and Security. These include controls on advanced semiconductor technologies, especially where national security and foreign policy concerns arise. Recent 2024 updates placed stricter export limits on semiconductor-related products involving AI and imaging components.

- The EU regulates CMOS image sensors under the Restriction of Hazardous Substances (RoHS) Directive, limiting hazardous substances like lead and mercury in electronic equipment. The directive supports environmental sustainability and mandates compliance across all member states. Manufacturers must also meet CE marking and Waste Electrical and Electronic Equipment (WEEE) recycling obligations.

- China’s Ministry of Industry and Information Technology enforces regulatory guidelines that mirror RoHS-like restrictions on hazardous substances in electronic components. These measures are part of the broader “Green Product Certification” and “China RoHS 2.0” initiatives, aimed at ensuring environmental compliance and aligning domestic manufacturing with international eco-design and safety standards.

- Japan regulates CMOS image sensors under the Foreign Exchange and Foreign Trade Act (FEFTA), requiring licenses for exporting designated sensitive technologies. The country introduced tighter controls in 2023 for semiconductor manufacturing equipment. Compliance with industrial safety standards and traceability of high-performance imaging technologies are also essential in Japan's electronics manufacturing ecosystem.

Competitive Landscape

Market players are actively pursuing strategies centered on technological advancement and product development to strengthen their competitive position and address evolving demands. These initiatives are focused on improving pixel architecture, optimizing color accuracy, and expanding functionality under diverse lighting conditions.

By refining image quality and sensor performance through proprietary design enhancements, companies are enhancing their value proposition across sectors such as automotive, industrial automation, and security.

- In March 2023, Panasonic Holdings Corporation unveiled a new Organic Photoconductive Film (OPF) CMOS image sensor that delivers high color accuracy under various lighting conditions. The new sensor uses OPF’s light absorption technology to create a thinner photoelectric layer. It also includes pixel separation to reduce color crosstalk. This layered design improves color accuracy by minimizing interference between green, red, and blue channels.

List of Key Companies in CMOS Image Sensor Market:

- Sony Corporation

- Samsung

- Canon

- Panasonic Corporation

- STMicroelectronics

- OMNIVISION

- Semiconductor Components Industries, LLC

- Teledyne Technologies Incorporated

- Hamamatsu Photonics K.K.

- Toshiba Electronic Devices & Storage Corporation

- Sharp Corporation

- SmartSens Technology Co., Ltd.

- PixArt Imaging Inc.

- SK hynix Inc.

- Silicon Optronics, Inc.

Recent Developments (Product Launch)

- In October 2024, OMNIVISION introduced the OX03H10, a 3-megapixel CMOS image sensor with TheiaCel technology, which enables ultra-high dynamic range and LED flicker mitigation. Designed for surround-view and rear-view camera systems, the sensor delivers exceptional image clarity across varying lighting environments, enhancing overall driving safety.

- In September 2024, Sony Semiconductor Solutions Corporation (SSS) launched the LYT-818, a 50-megapixel CMOS image sensor engineered to minimize noise in low-light environments while offering a high dynamic range. This sensor is tailored for main and sub smartphone cameras and it is marketed under the LYTIA brand for mobile imaging.

- In November 2023, Teledyne Technologies introduced the Emerald Gen2 series, a next-generation family of CMOS image sensors developed using Teledyne e2v’s cutting-edge imaging technology. Engineered for superior performance, these sensors are optimized for diverse machine vision applications, offering enhanced capabilities to meet evolving industrial imaging requirements.