Market Definition

The market encompasses the development, adoption, and application of Artificial Intelligence (AI) technologies in diagnostic and imaging solutions across the healthcare sector.

It includes AI-driven software, platforms, and algorithms integrated with imaging modalities such as X-ray, MRI, CT scans, and ultrasound scans to enhance image analysis, interpretation, and clinical decision-making.

The market covers various stakeholders, including healthcare providers, medical imaging equipment manufacturers, AI technology developers, and research institutions, contributing to improved diagnostic accuracy, workflow efficiency, and patient outcomes.

AI in Medical Imaging Market Overview

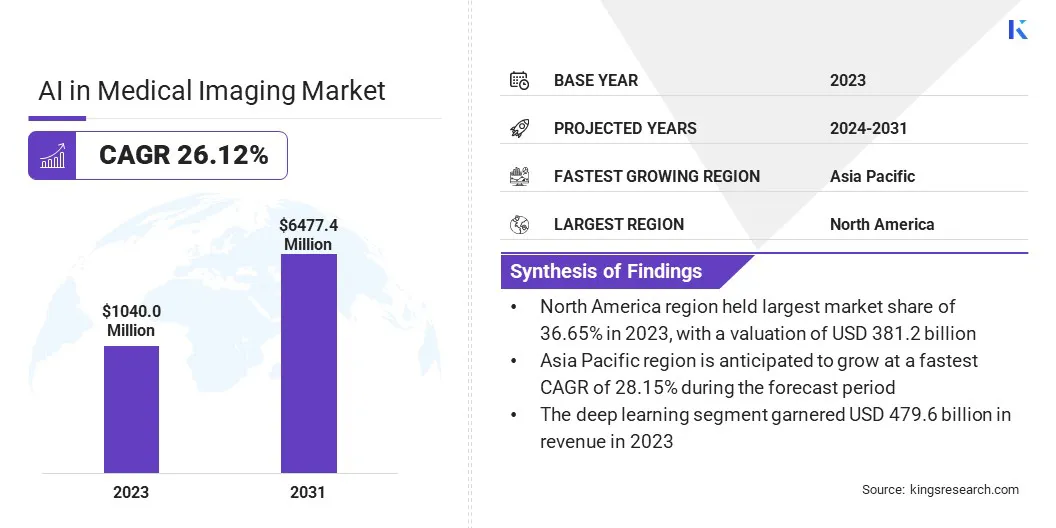

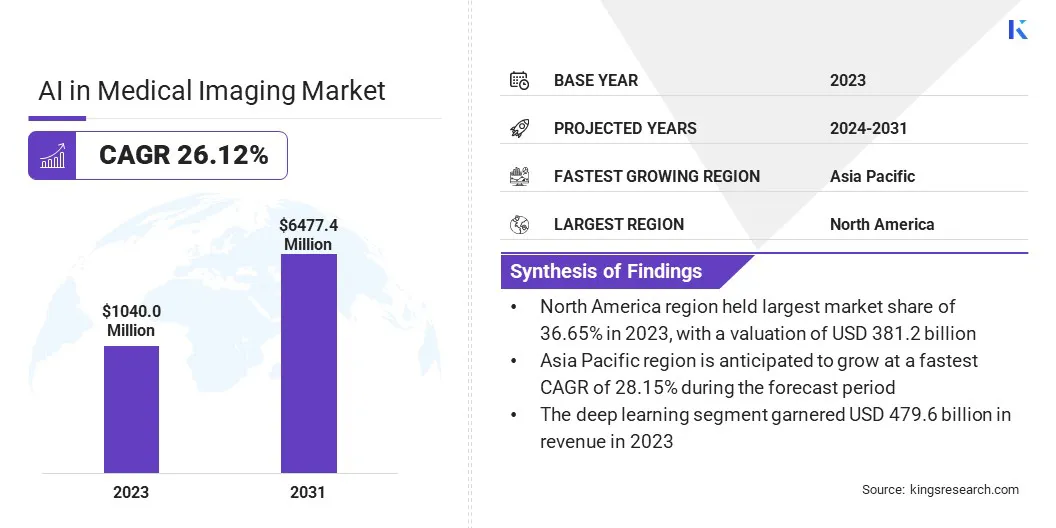

The global AI in medical imaging market size was valued at USD 1,040.0 million in 2023 and is projected to grow from USD 1,276.0 million in 2024 to USD 6,477.4 million by 2031, exhibiting a CAGR of 26.12% during the forecast period.

The market is driven by the increasing adoption of AI to enhance diagnostic precision, streamline workflows, and improve patient care. Advancements in deep learning, Machine Learning (ML), and computer vision have enabled AI-powered imaging solutions to assist radiologists in detecting diseases at an early stage with greater accuracy.

The rising prevalence of chronic conditions such as cancer, cardiovascular diseases, and neurological disorders has amplified the demand for AI-driven imaging technologies.

Major companies operating in the AI in medical imaging industry are GE HealthCare, Aidoc, Viz.ai, Inc., Infervision, Exo Imaging, Inc, Subtle Medical, Inc., Tempus, RadNet Inc., Siemens Healthineers AG, Qure.ai, NVIDIA Corporation, Lunit Inc., VUNO Inc., Paige AI, Inc., and Koninklijke Philips N.V.

Additionally, the integration of AI with medical imaging equipment is enhancing automation, reducing analysis time, and supporting real-time decision-making. Growing investments in healthcare digitization, the expansion of telemedicine, and the rising need for personalized treatment further contribute to market expansion.

- In January 2024, Hyperfine, Inc. launched the AI-powered 8th generation of Swoop system software, enhancing brain imaging capabilities with improved image quality and workflow efficiencies.

Key Highlights:

- The AI in medical imaging industry size was valued at USD 1,040.0 million in 2023.

- The market is projected to grow at a CAGR of 26.12% from 2024 to 2031.

- North America held a market share of 36.65% in 2023, with a valuation of USD 381.2 million.

- The deep learning segment garnered USD 479.6 million in revenue in 2023.

- The computed tomography (CT) segment is expected to reach USD 2,190.0 million by 2031.

- The oncology segment is expected to reach USD 1,926.8 million by 2031.

- The hospitals segment is expected to reach USD 2,526.6 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 28.15% during the forecast period.

Market Driver

"AI for Early Disease Detection and Diagnosis"

The AI in medical imaging market is registering significant growth, driven by the increasing adoption of AI for early disease detection and diagnosis, as well as the rising integration of AI with healthcare IT systems.

AI-powered imaging solutions are revolutionizing radiology by enhancing the accuracy and efficiency of disease identification, particularly for conditions such as cancer, cardiovascular diseases, and neurological disorders.

AI assists radiologists in early detection by enabling faster and more precise analysis of medical images, leading to improved patient outcomes and reduced diagnostic errors.

Additionally, the seamless integration of AI with Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS) is streamlining imaging workflows, minimizing radiologist workload, and optimizing clinical decision-making.

The market is registering rapid expansion as healthcare providers increasingly embrace AI-driven automation and decision-support tools, further accelerating advancements in medical imaging technologies.

- In October 2024, Family Medical Practice (FMP Healthcare Group) Care1 - Health Executive Center and Siemens Healthineers Vietnam announced the official launch of the 3D mammography system (MAMMOMAT Inspiration) combined with Transpara AI to enhance the accuracy of breast cancer detection. MAMMOMAT Inspiration is an advanced digital breast tomosynthesis system designed to provide high-resolution 3D imaging, improving lesion visibility and reducing false positives. When integrated with Transpara AI, an AI-powered detection system, the solution assists radiologists in identifying early signs of breast cancer with greater accuracy and efficiency, streamlining workflow and enhancing patient outcomes.

Market Challenge

"Regulatory Uncertainty"

Amajor challenge in the AI in medical imaging market is the lack of standardized regulations and interoperability across healthcare systems. AI-powered imaging solutions must comply with varying regulatory frameworks across different regions, making it difficult for companies to achieve widespread adoption.

Additionally, the integration of AI with existing PACS and RIS is often hindered by compatibility issues, limiting seamless data exchange. The potential solution to this challenge is the development of global regulatory harmonization and standardized validation protocols.

Collaborative efforts between regulatory bodies, healthcare institutions, and AI developers can help establish clear guidelines for AI model training, clinical validation, and performance benchmarking.

Regulatory clarity can accelerate market adoption and build trust among healthcare professionals by ensuring that AI-driven imaging solutions meet consistent safety and efficacy standards.

Market Trend

"Cloud Adoption & Generative AI"

The AI in medical imaging market is evolving with key trends such as the expansion of cloud-based AI imaging solutions and the growing use of generative AI in radiology.

Cloud-based AI platforms are transforming medical imaging by enabling remote access to diagnostic tools, real-time collaboration among healthcare professionals, and enhanced data management. These solutions improve scalability and interoperability, allowing hospitals and imaging centers to integrate AI-driven diagnostics seamlessly into existing healthcare infrastructures.

Additionally, the emergence of generative AI is reshaping radiology by automating report generation, enhancing image quality, and creating synthetic datasets for AI model training.

This technology improves workflow efficiency and supports precision diagnostics by generating detailed insights from medical images. AI-powered imaging is becoming more advanced, accessible, and efficient as these trends gain momentum, driving further innovation in the market.

- In December 2024, ConcertAI launched a Software-as-a-Service (SaaS) cloud version of TeraRecon’s AI-enabled portfolio, integrating CARAai and Eureka Clinical AI into a single cloud platform. This advancement enhances accessibility for healthcare providers by enabling AI-powered visualization and clinical workflows through a subscription-based service.

AI in Medical Imaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Deep Learning, Machine Learning, Natural Language Processing

|

|

By Modality

|

Computed Tomography (CT), Magnetic Resonance Imaging (MRI), X-ray, Ultrasound, Nuclear Imaging

|

|

By Application

|

Neurology, Cardiology, Oncology, Orthopedics, Others

|

|

By End User

|

Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Research and Academic Institutions

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Deep Learning, Machine Learning, Natural Language Processing): The deep learning segment earned USD 479.6 million in 2023, due to its advanced pattern recognition capabilities, enabling improved image analysis and disease detection.

- By Modality (Computed Tomography (CT), Magnetic Resonance Imaging (MRI), X-ray, and Ultrasound): The computed tomography (CT) segment held 36.12% share of the market in 2023, due to its widespread use in diagnosing complex conditions with high-resolution imaging.

- By Application (Neurology, Cardiology, Oncology, and Orthopedics): The oncology segment is projected to reach USD 1,926.8 million by 2031, owing to the increasing adoption of AI-driven imaging for early cancer detection and precise tumor assessment.

- By End User (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, and Research and Academic Institutions): The hospitals segment is projected to reach USD 2,526.6 million by 2031, owing to the growing integration of AI-powered imaging solutions for enhanced diagnostics and patient management.

AI in Medical Imaging Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America AI in medical imaging market accounted for a market share of around 36.65% in 2023, with a valuation of USD 381.2 million. The dominance is driven by advanced healthcare infrastructure, high adoption of AI-powered imaging solutions, and strong investments in medical technology.

The presence of leading AI and medical imaging companies, coupled with significant funding from government and private organizations for AI-driven healthcare innovations, has further propelled the market.

Moreover, the increasing prevalence of chronic diseases, such as cancer, cardiovascular diseases, and neurological disorders, is driving the demand for AI-enhanced imaging solutions that improve early diagnosis and treatment planning.

AI-driven radiology tools assist in detecting abnormalities more efficiently, reducing workload for radiologists and improving patient outcomes. Additionally, increasing integration of AI in radiology workflows, rising prevalence of chronic diseases, and supportive regulatory frameworks have contributed to the dominant market share of the region.

The AI in medical imaging industry in Asia Pacific is poised to grow at a significant CAGR of 28.15% over the forecast period, fueled by rapid advancements in healthcare infrastructure, increasing adoption of AI-based diagnostic solutions, and rising burden of chronic diseases.

Countries such as China, Japan, and India are registering strong demand for AI-driven medical imaging, due to expanding healthcare investments, government initiatives promoting AI in healthcare, and growing awareness of early disease detection.

Additionally, the presence of emerging AI startups and collaborations between healthcare providers & technology firms are accelerating the adoption of AI-powered imaging solutions across the region.

- In August 2024, MVision AI announced the successful approval of its application for MVision AI Segmentation (Contour+) by the Central Drugs Standard Control Organization (CDSCO). This regulatory milestone paves the way for the deployment of MVision AI’s advanced image analysis algorithms in radiation therapy treatment planning workflows across India.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates AI-powered medical imaging solutions under its Software as a Medical Device (SaMD) framework, ensuring their safety, effectiveness, and performance in clinical settings. AI-based imaging software is classified based on risk levels, typically as Class II or Class III medical devices, requiring regulatory approval before market entry.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates AI-driven imaging software, requiring approval for clinical use, particularly for autonomous decision-making in diagnostics. The Indian Council of Medical Research (ICMR) has also issued guidelines on AI in healthcare, ensuring ethical use, data privacy, and clinical validation of AI-driven imaging technologies.

Competitive Landscape:

The AI in medical imaging industry is characterized by intense competition, with key players focusing on strategic initiatives and technological advancements to strengthen their market position.

Companies are actively investing in Research and Development (R&D) to improve AI-driven imaging algorithms, ensuring higher accuracy in disease detection and diagnosis. Many firms are integrating deep learning and ML models into imaging systems to optimize workflow automation and clinical decision support.

Strategic partnerships and collaborations with healthcare providers, research institutions, and medical device manufacturers are a common approach to accelerating innovation and expanding AI adoption in radiology.

Firms are also pursuing regulatory approvals in key markets to ensure compliance with evolving healthcare standards and facilitate widespread commercialization of their AI-powered imaging solutions.

Another crucial strategy involves expanding product portfolios by launching AI-driven imaging solutions tailored for specific medical conditions such as oncology, cardiology, and neurology.

Companies are increasingly incorporating cloud-based AI platforms to enable remote access, improve data management, and enhance interoperability with existing healthcare IT systems. Mergers and acquisitions are being utilized to strengthen AI capabilities, acquire proprietary algorithms, and gain access to a broader customer base.

Additionally, businesses are investing in geographic expansion, particularly in emerging markets, by establishing partnerships with local healthcare providers and securing regulatory clearances.

- In November 2024, Viz.ai announced a collaboration with Microsoft to integrate its AI-powered disease detection solution with Precision Imaging Network, under Microsoft Cloud for Healthcare. The partnership aims to deliver over 48 AI models seamlessly integrated into clinical workflows, providing actionable clinical insights to enhance patient outcomes.

List of Key Companies in AI in Medical Imaging Market:

- GE HealthCare

- Aidoc

- Viz.ai, Inc.

- Infervision

- Exo Imaging, Inc

- Subtle Medical, Inc.

- Tempus

- RadNet Inc.

- Siemens Healthineers AG

- Qure.ai

- NVIDIA Corporation

- Lunit Inc.

- VUNO Inc.

- Paige AI, Inc.

- Koninklijke Philips N.V.

Recent Developments (Partnerships/ Product Launch)

- In March 2025, GE HealthCare and NVIDIA announced their collaboration at GTC 2025, expanding their 16-year partnership to advance AI-driven autonomous imaging solutions. The collaboration focuses on autonomous applications and autonomous X-ray technologies within ultrasound, aiming to reduce the burden on healthcare professionals by enhancing imaging efficiency and accuracy.

- In February 2025, DeepHealth, Inc. introduced its AI-powered radiology informatics and cancer screening solutions at ECR 2025 in Vienna, powered by DeepHealth OS. The company launched Diagnostic Suite, an AI-enhanced PACS replacement, and SmartMammo, an AI-driven mammography SaaS solution, to streamline radiology workflows.

- In January 2025, Royal Philips unveiled the AI-powered CT-5300 at AOCR 2025, Chennai, marking a breakthrough in Computed Tomography (CT) imaging. The 128-slice system integrates AI-driven reconstruction, cardiac motion correction, and smart workflows, enhancing speed, accuracy, and efficiency across clinical applications.