Market Definition

The market encompasses solutions and services designed to identify, map, and manage cloud-based applications, resources, and services across public, private, and hybrid cloud environments.

It includes tools that enable organizations to gain visibility into cloud usage, enhance governance, ensure compliance, and optimize cloud operations by detecting shadow IT and unauthorized cloud deployments within enterprise ecosystems. The report provides insights into the core driving factors of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Cloud Discovery Market Overview

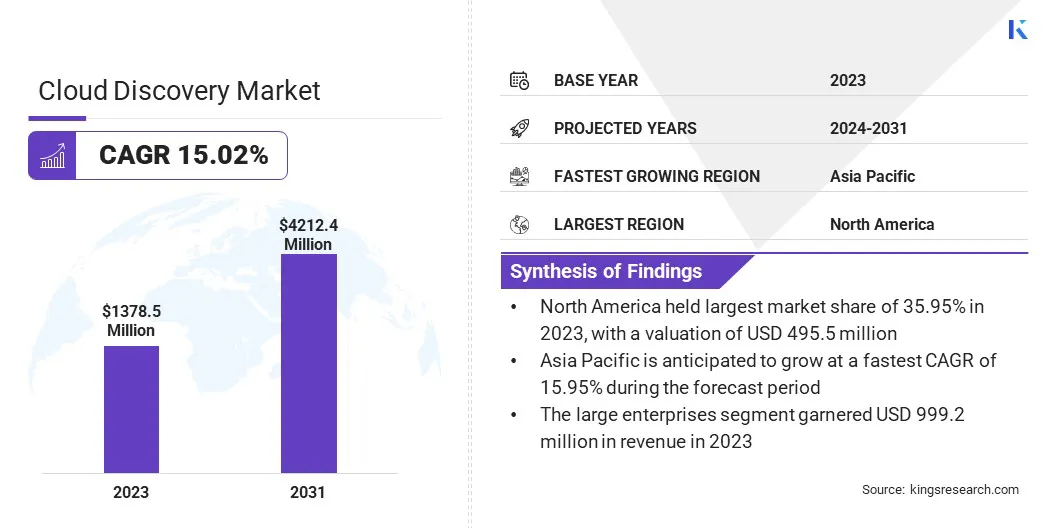

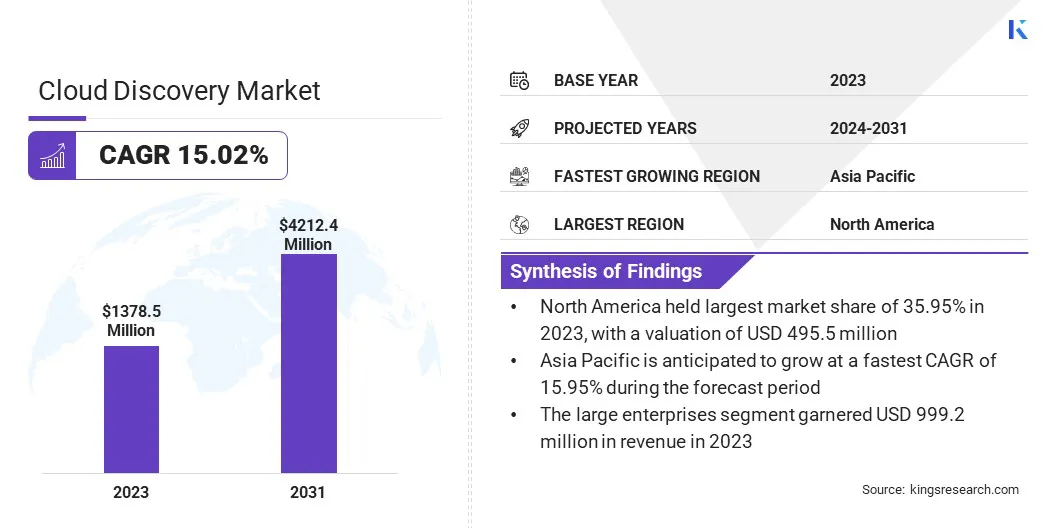

The global cloud discovery market size was valued at USD 1,378.5 million in 2023 and is projected to grow from USD 1,581.7 million in 2024 to USD 4,212.4 million by 2031, exhibiting a CAGR of 15.02% during the forecast period.

The market is growing rapidly as more businesses adopt complex, multi-cloud, and hybrid cloud setups. As digital transformation accelerates, companies need tools to detect unauthorized cloud usage and optimize cloud resource management.

Major companies operating in the cloud discovery industry are Microsoft, Alphabet Inc., IBM Corp., Oracle, McAfee, LLC, Palo Alto Networks, Cisco Systems, Inc., Flexera, ServiceNow, Trend Micro Incorporated, Sophos Ltd., BMC Software, Inc., NetApp, Red Hat, Inc., and Qualys, Inc.

Cloud discovery is essential for improving security, meeting regulatory requirements, and optimizing costs. As organizations focus on improved cloud governance, the demand for accurate and automated discovery solutions is rising. The integration of artificial intelligence and machine learning accelerates real-time insights, supportig better control over expanding cloud environments.

- In December 2024, Rubrik, Inc. integrated Data Security Posture Management (DSPM) into its Rubrik Security Cloud platform to enhance data visibility and reduce sensitive data exposure risks across cloud, SaaS, and on-premises environments. The solution leverages Microsoft MIP labeling to identify data risks and supports secure AI adoption, offering simplified deployment without disruptive new data scans.

Key Highlights

- The cloud discovery industry size was valued at USD 1,378.5 million in 2023.

- The market is projected to grow at a CAGR of 15.02% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 495.5 million.

- The solution segment garnered USD 864.2 million in revenue in 2023.

- The large enterprises segment is expected to reach USD 2,995.5 million by 2031.

- The BFSI segment is likely to generate a revenue of USD 939.8 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 15.95% over the forecast period.

Market Driver

"Growing Use of Multi Cloud and Hybrid Cloud Setups"

The market is experiencing substantial growth, primarily driven by the increasing adoption of multi-cloud and hybrid cloud architectures. These environments, which integrate public and private cloud platforms, offer enhanced operational flexibility but introduce significant complexity in asset visibility and management.

Cloud discovery tools address this challenge by enabling organizations to identify, monitor, and control their cloud-based assets across diverse platforms. These solutions play a critical role in strengthening security posture, ensuring regulatory compliance, and optimizing resource utilization and cost efficiency.

As enterprise cloud environments expand, the demand for robust and scalable cloud discovery solutions continues to accelerate.

- In April 2025, Infoblox and Google Cloud partnered to deliver cloud-native networking and security solutions. The collaboration focused on simplifying operations and enhancing enterprise security through the integration of Infoblox Universal DDI with Google’s Cloud WAN, and the launch of Google Cloud DNS Armor powered by Infoblox for preemptive detection of malicious activity in cloud workloads.

Market Challenge

"Data Visibility and Control in Multi-Cloud Environments"

A major challenge hampering the expansion of the cloud discovery market is the lack of visibility and control over data spread across multiple cloud platforms. With businesses increasingly adopting multi-cloud and hybrid cloud strategies, their data is dispersed across various cloud services and regions.

This makes it challenging to track the location, access, and protection of sensitive data, leading to compliance issues, security risks, and potential breaches. This challenge can be addressed through the development of cloud discovery tools that provide centralized visibility and governance across all cloud environments. They use automated scanning to catalog data, monitor access, and identify vulnerabilities, ensuring secure and effective data management.

Market Trend

"Advancements in AI-Powered Security"

The cloud discovery market is experiencing significant growth, mainly due to the increasing use of AI-powered security solutions. As businesses increasingly adopt multi-cloud and hybrid cloud environments, the demand for enhanced data security and risk management intensifies.

AI technologies, particularly those detecting anomalous user behavior, enable faster identification of potential threats across cloud platforms. By analyzing vast data sets and identifying patterns, AI supports the protection of sensitive information.

As cloud management grows more complex, AI-driven security features in cloud discovery tools are ibecoming more effective in securing data across diverse environments..

- In March 2025, Concentric AI introduced its User Behavior Data Analytics (UBDA) feature within its Semantic Intelligence data security governance platform. The new capabilities enable organizations to identify abnormal user activity related to sensitive data across cloud and on-premises environments, enhancing data security and risk monitoring. The platform also supports integrations with Google Cloud Storage, Azure Data Lake, and ServiceNow, broadening its data security capabilities.

Cloud Discovery Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, Services

|

|

By Organization Size

|

Large Enterprises, Small & Medium Enterprises

|

|

By Vertical

|

BFSI, Healthcare, IT & Telecommunications, Retail, Government, Manufacturing, Transportation & Logistics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solution and Services): The solution segment earned USD 864.2 million in 2023 due to the growing need for centralized visibility and automated detection of cloud assets across complex enterprise environments.

- By Organization Size (Large Enterprises and Small & Medium Enterprises): The large enterprises segment held a share of 72.48% in 2023, attributed to extensive cloud infrastructure, higher cybersecurity priorities, and stringent regulatory compliance requirements.

- By Vertical (BFSI, Healthcare, IT & Telecommunications, Retail, Government, Manufacturing, Transportation & Logistics, and Others): The BFSI segment is projected to reach USD 939.8 million by 2031, propelled by increased adoption of cloud services and regulatory demands for data security and risk management.

Cloud Discovery Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America cloud discovery market accounted for a substantial share of 35.95% in 2023, valued at USD 495.5 million. This dominance is primarily reinforced by the early and widespread adoption of cloud infrastructure among large enterprises across the U.S. and Canada, coupled with increased investments in advanced IT operations and security tools.

The presence of numerous leading cloud service providers and technology firms in the region has accelerated the development and deployment of sophisticated cloud discovery solutions.

Additionally, a strong focus on digital transformation across sectors such as BFSI, IT, and retail has fueled demand for tools that enable better visibility and control over cloud assets.

Asia Pacific cloud discovery industry is expected to register the fastest CAGR of 15.95% over the forecast period. This growth is mainly fostered by the rapid expansion of digital ecosystems, where cloud adoption is surging among small and medium enterprises (SMEs) and large enterprises.

Increasing reliance on Software as a Service (SaaS) platforms, coupled with rising concerns over shadow IT in fast-growing tech and manufacturing sectors, is boosting the demand for cloud discovery solutions.

Moreover, the region’s strong shift toward cloud-native business models and infrastructure modernization is prompting organizations to adopt automated discovery tools to maintain operational control and visibility across distributed environments.

- In February 2025, OpenText expanded its investment in the Asia-Pacific region and announced upcoming Summits in Tokyo and Sydney. It focuses on advancements in AI, cloud, and security to support digital transformation and enterprise technology growth.

Regulatory Frameworks

- In the U.S., cloud computing is regulated by the Federal Risk and Authorization Management Program (FedRAMP), which provides a standardized approach to security assessment, authorization, and continuous monitoring for cloud services used by federal agencies. The Health Insurance Portability and Accountability Act (HIPAA) impose strict guidelines on cloud service providers handling health data to ensure privacy and security.

- In Europe, the European Commission shapes the regulatory landscape for cloud computing. The Digital Markets Act (DMA) addresses anti-competitive practices by major platform providers, promoting fair competition. The General Data Protection Regulation (GDPR) sets strict requirements for cloud service providers regarding data protection and privacy, ensuring the security of personal data.

Competitive Landscape

The cloud discovery industry is characterized by key players leveraging distinct strategies to maintain and expand their market presence. Leading companies are focusing on product innovation by integrating AI and ML into their cloud discovery solutions to provide enhanced automation and real-time insights. This is aimed at improving operational efficiency and offering more accurate cloud asset management.

Strategic partnerships and collaborations are another common approach, with companies teaming up with cloud service providers, managed service providers, and security firms to create comprehensive solutions that cater to evolving enterprise needs.

Furthermore, mergers and acquisitions are being used to strengthen product portfolios, enter new geographical markets, and acquire advanced technologies.

- In October 2024, Zoovu partnered with Microsoft to offer its AI search and product discovery platform on the Microsoft Azure Marketplace. The collaboration enables Azure customers to create personalized eCommerce experiences with enhanced scalability, speed, and AI-powered product recommendations.

List of Key Companies in Cloud Discovery Market:

- Microsoft

- Alphabet Inc.

- IBM Corp.

- Oracle

- McAfee, LLC

- Palo Alto Networks

- Cisco Systems, Inc.

- Flexera

- ServiceNow

- Trend Micro Incorporated

- Sophos Ltd.

- BMC Software, Inc.

- NetApp

- Red Hat, Inc.

- Qualys, Inc.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, Rubrik expanded its cyber resilience capabilities across cloud, hypervisor, and SaaS platforms through new innovations unveiled at its annual Cyber Resilience Summit. The launch included Cloud Posture Risk Management (CPR), a feature designed to automatically discover and inventory cloud data assets, enhancing visibility and enabling more informed backup strategies.

- In October 2024, Commvault launched Cloud Rewind, a cyber-resilience solution on its cloud platform designed to help cloud-first organizations rapidly recover from cyberattacks. The solution integrates resource discovery, dependency mapping, drift analysis, and automated cloud reconstruction, enabling quick restoration of cloud applications and infrastructure. It supports all major cloud platforms and reduces downtime by automating the identification and recovery of critical cloud components.

- In September 2024, Infoblox unveiled its Universal DDI Product Suite to enhance cloud networking and security services. The suite, designed for hybrid and multi-cloud environments, introduced three core components: Universal DDI Management, Universal Asset Insights, and NIOS-X as a Service, aimed at streamlining operations, improving asset visibility, and enabling proactive security across NetOps, CloudOps, and SecOps teams.

- In May 2024, Check Point Software Technologies Ltd. introduced a new API discovery feature on its CloudGuard Web Application Firewall (WAF). The feature, part of Check Point’s Cloud Native Application Protection Platform (CNAPP), strengthens cloud security by providing organizations with enhanced API protection and insight into their API inventory across cloud environments, reducing the risk of unauthorized access and data breaches.