Market Definition

The market encompasses the industry focused on providing remote data storage, protection, and recovery solutions through cloud-based infrastructure. It includes a range of services that enable businesses and individuals to securely store, manage, and restore critical data in case of loss, corruption, or cyber threats.

This market covers various deployment models such as public, private, and hybrid cloud solutions, catering to different levels of security, scalability, and compliance requirements.

Cloud Backup Market Overview

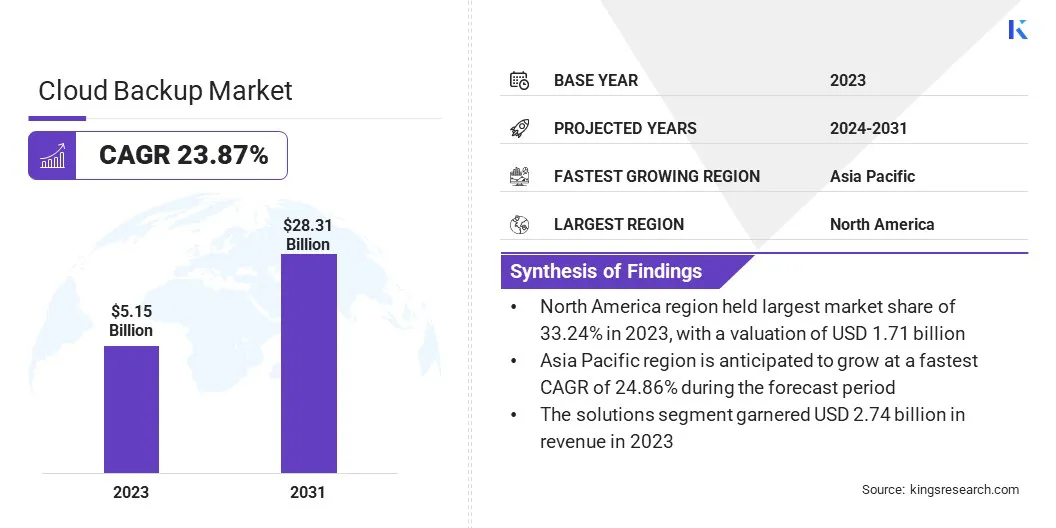

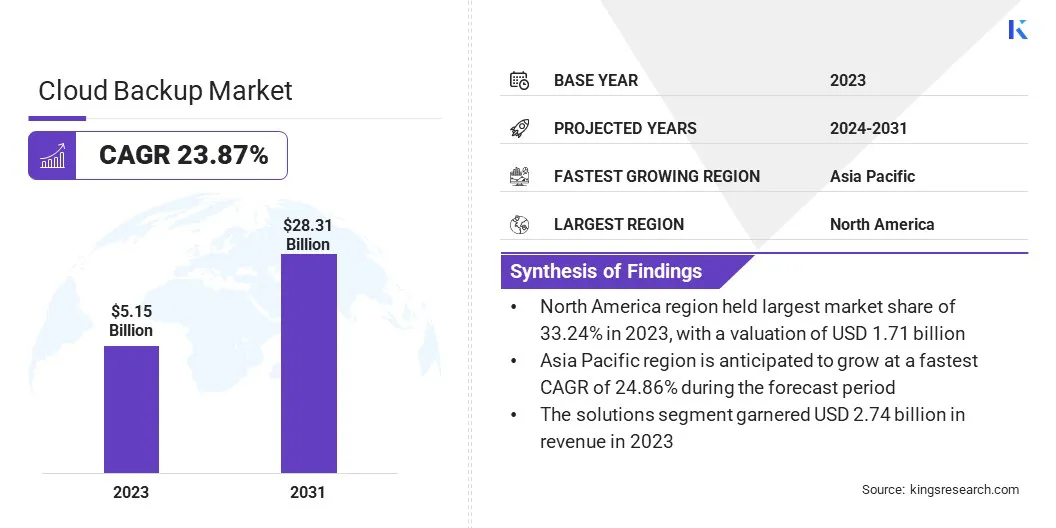

The global cloud backup market size was valued at USD 5.15 billion in 2023 and is projected to grow from USD 6.33 billion in 2024 to USD 28.31 billion by 2031, exhibiting a CAGR of 23.87% during the forecast period.

The growth of the market is driven by the increasing volume of digital data, the rising adoption of cloud-based solutions, and the growing emphasis on data security and compliance. Industries are transitioning to cloud backup solutions to ensure seamless data recovery, minimize downtime, and enhance operational efficiency.

Major companies operating in the cloud backup industry are Dell Inc., Backblaze, Open Text Corporation, Asigra Inc., Huawei Cloud Computing Technologies Co., Ltd., IDrive Inc., Oracle, IBM, HPE, Acronis International GmbH, Alibaba Cloud, Datto, Inc., Microsoft, Dropbox, and Amazon Web Services, Inc.

The integration of cloud backup with disaster recovery-as-a-service is increasingly being adopted, enabling organizations to enhance resilience against data loss incidents. The market is further supported by regulatory mandates requiring organizations to implement secure and reliable data storage solutions, reinforcing the role of cloud backup in modern IT infrastructures.

- In November 2024, The Attivo Group introduced a Disaster Recovery Solution tailored for small and mid-sized businesses (SMBs) utilizing on-premise software. This service offers secure, deployable data backups to safeguard against unexpected events such as natural disasters, power outages, or cyberattacks, ensuring business continuity without necessitating a full transition to cloud systems.

Key Highlights:

- The cloud backup industry size was recorded at USD 5.15 billion in 2023.

- The market is projected to grow at a CAGR of 23.87% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 1.71 billion.

- The solutions segment garnered USD 2.74 billion in revenue in 2023.

- The public segment is expected to reach USD 11.71 billion by 2031.

- The large enterprises segment is expected to reach USD 16.23 billion by 2031.

- The BFSI segment is expected to reach USD 8.10 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 24.86% during the forecast period.

Market Driver

Growing Data Volumes and Cybersecurity Concerns

The market is driven by the growing need for secure data storage and the rising concerns over cybersecurity threats and regulatory compliance. The demand for scalable and reliable cloud backup solutions is increasing rapidly as organizations generate vast amounts of digital data due to cloud adoption, IoT expansion, and remote work environments.

To prevent data loss and ensure uninterrupted operations, businesses are increasingly prioritizing automated data protection and disaster recovery strategies. The increasing frequency of ransomware attacks and data breaches has increased the need for secure backup solutions.

Additionally, with data protection regulations in place across various regions, enterprises are adopting encrypted, compliant cloud backup services to safeguard sensitive information and meet industry mandates. These factors are expanding the adoption of cloud backup solutions, in turn driving the growth of the market.

- In March 2025, Eon launched its cloud-native backup solution specifically designed to safeguard against ransomware attacks. This innovative solution is engineered to provide instant recovery and rapid restoration of clean data, offering faster performance compared to traditional backup solutions.

Market Challenge

Data Security and Compliance Complexities

The major challenges in the cloud backup market are ensuring data security and meeting regulatory compliance across various regions and industries. As businesses increasingly store sensitive information in the cloud, concerns over data breaches, unauthorized access, and compliance with stringent regulations such as GDPR, HIPAA, and PIPL have intensified.

To address these challenges, companies are adopting end-to-end encryption, zero-trust security models, and compliance-focused cloud backup services. They are implementing advanced encryption protocols for data in transit and at rest, deploying AI-driven security tools, and utilizing region-specific data centers to meet regulatory requirements while ensuring secure data protection and reliable recovery.

Market Trend

AI Integration in Cloud Backup

A key trend in the market is the integration of AI and automation in cloud backup solutions, which enables predictive analytics, real-time threat detection, and automated backup scheduling.

Companies are leveraging AI-powered tools to enable, predictive analytics, real-time threat detection, and automated scheduling. These solutions help optimize storage utilization, proactively identify vulnerabilities and streamline recovery processes. This further reduces manual involvement while minimizing the risk of operational delays.

- In February 2025, Veeam Software expanded its partnership with Microsoft. As part of this collaboration, Microsoft made an equity investment in Veeam to jointly develop AI-powered solutions aimed at enhancing customers' data protection and recovery capabilities. The partnership focuses on integrating Microsoft's AI services into Veeam's data resilience platform, with the goal of providing faster insights, improved threat detection, and more automated recovery processes.

Cloud Backup Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solutions, Services

|

|

By Deployment

|

Public, Private, Hybrid

|

|

By Organization

|

Small & Medium Enterprises, Large Enterprises

|

|

By Vertical

|

BFSI, Healthcare, Retail, IT & Telecommunications, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solutions, Services): The Solutions segment earned USD 2.74 billion in 2023 due to the rising demand for automated and scalable backup solutions that ensure data protection and compliance.

- By Deployment (Public, Private, Hybrid): The public segment held 41.79% of the market in 2023, due to its cost-effectiveness, ease of deployment, and widespread adoption among SMEs.

- By Organization (Small & Medium Enterprises, Large Enterprises): The large enterprises segment is projected to reach USD 16.23 billion by 2031, owing to the increasing need for advanced data management, security, and disaster recovery strategies.

- By Vertical (BFSI, Healthcare, Retail, and IT & Telecommunications, Others): The BFSI segment is projected to reach USD 8.10 billion by 2031, owing to data retention policies and the rising adoption of cloud-based security solutions.

Cloud Backup Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America cloud backup market share stood around 33.24% in 2023 in the global market, with a valuation of USD 1.71 billion. The region's dominance is attributed to the strong presence of major cloud service providers, high adoption of advanced IT infrastructure, and data security regulations.

The rapid shift towards cloud-based solutions among enterprises, coupled with the increasing frequency of cyber threats, has further driven the demand for cloud backup services in this region. Additionally, the growing investment in AI-driven backup solutions and disaster recovery technologies strengthens the market position of North America.

Asia Pacific is poised to grow at a significant growth at a CAGR of 24.86% over the forecast period, driven by the rapid digital transformation across industries and increasing cloud adoption among businesses. The expansion of SMEs, rising internet penetration, and government initiatives supporting cloud-based infrastructure have significantly contributed to market growth.

Countries like China, India, and Japan are witnessing a surge in cloud investments, further boosting demand for backup solutions. Additionally, the growing awareness of data security and compliance requirements has accelerated the adoption of cloud backup services, positioning Asia Pacific as a key growth region in the global market.

Regulatory Frameworks

- In Europe, the General Data Protection Regulation (GDPR) governs cloud backup services by mandating strict data protection, consent management, and cross-border data transfer rules. Cloud backup providers must ensure compliance with GDPR's data processing and security standards requirements to operate within the European market.

- In India, the Digital Personal Data Protection Act (DPDPA) 2023 governs cloud backup providers, enforcing data localization requirements, user consent protocols, and rigorous security measures to protect personal data.

Competitive Landscape

The cloud backup industry is characterized by intense competition, with key players focusing on strategic initiatives such as product innovation, partnerships, and acquisitions to strengthen their market position.

Companies are continuously enhancing their cloud backup solutions by integrating advanced technologies like artificial intelligence, machine learning, and automation to improve data security, optimize storage efficiency, and enable faster recovery times.

Strategic alliances with cloud service providers, cybersecurity firms, and enterprise software vendors are commonly employed to expand service offerings and enhance interoperability.

Market participants are also investing in multi-cloud and hybrid cloud backup solutions to cater to diverse enterprise needs, ensuring flexibility and scalability in data protection strategies. To gain a competitive edge, companies are expanding their presence across high-growth regions through localized data centers and compliance-driven cloud backup solutions.

Additionally, many providers are adopting a subscription-based pricing model and offering value-added services such as disaster recovery-as-a-service (DRaaS) and ransomware protection to cater to a broader customer base.

- In October 2023, Samsung Electronics announced the global rollout of Temporary Cloud Backup, a service designed to securely store and transfer important data for Samsung Galaxy users. This feature allows users to upload data, including photos, videos, and private files, to Samsung Cloud via their Samsung Account, with individual file sizes capped at 100GB.

List of Key Companies in Cloud Backup Market:

- Dell Inc.

- Backblaze

- Open Text Corporation

- Asigra Inc.

- Huawei Cloud Computing Technologies Co., Ltd.

- IDrive Inc.

- Oracle

- IBM

- HPE

- Acronis International GmbH

- Alibaba Cloud

- Datto, Inc.

- Microsoft

- Dropbox

- Amazon Web Services, Inc.

Recent Developments (Product Launch)

- In October 2024, Eon ecured USD127 million in funding across seed, Series A, and Series B rounds. The company introduced a platform designed to streamline cloud backups by scanning, mapping, and classifying cloud resources, offering recommendations based on business and compliance needs.

- In November 2024, ISSQUARED Inc. launched the Fabulix Backup & DR product line, a hybrid solution designed to enhance enterprise data protection with comprehensive backup, near real-time replication, and seamless disaster recovery capabilities. The solution streamlines data management across physical, virtual, and cloud environments through centralized monitoring and automated recovery processes.

- In February 2024, Veeam Software launched Veeam Data Cloud, a platform built on Microsoft Azure that delivers data protection and recovery services as a cloud service. The initial offerings include Backup-as-a-Service (BaaS) solutions for Microsoft 365 and Microsoft Azure, aiming to simplify backup operations for organizations.