Market Definition

The market refers to the industry that deals with the provision, management, and distribution of materials and products required for conducting clinical trials. Clinical trials are research studies that aim to evaluate the safety and efficacy of new drugs, devices, or treatments.

Clinical Trial Supplies Market Overview

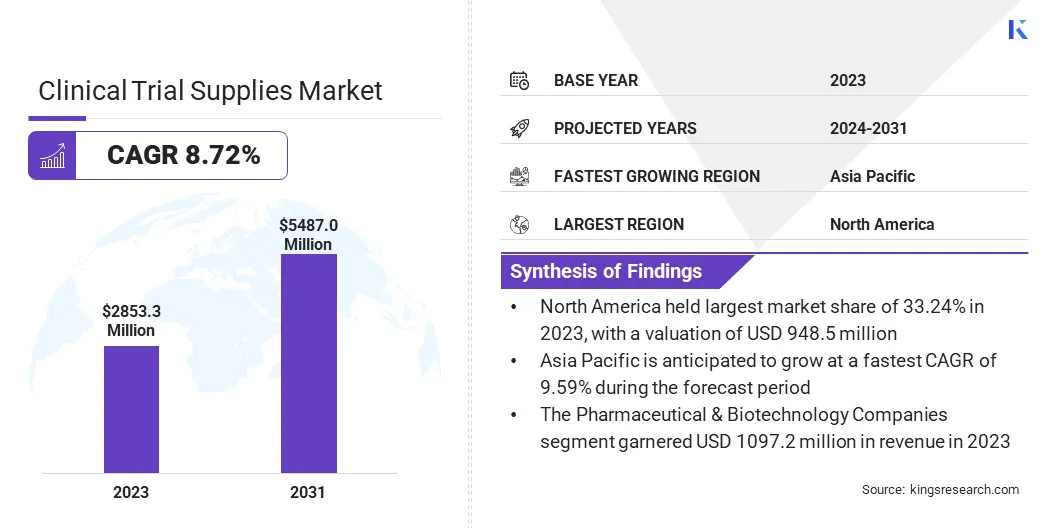

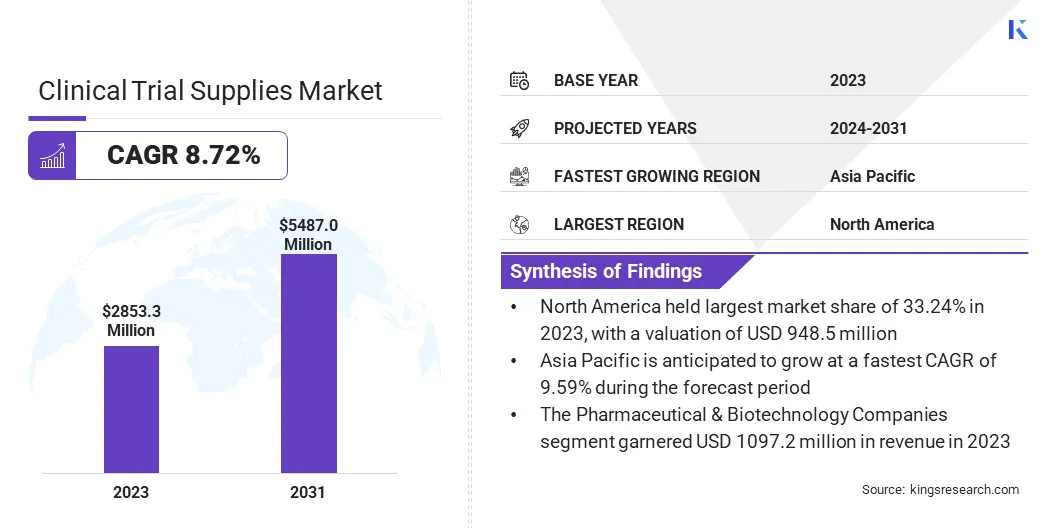

The global clinical trial supplies market size was valued at USD 2853.3 million in 2023, which is estimated to be valued at USD 3055.8 million in 2024 and reach USD 5487.0 million by 2031, growing at a CAGR of 8.72% from 2024 to 2031.

Advancements in drug development, particularly in personalized medicines and biologics, are driving the need for specialized clinical trial supplies. These therapies need tailored handling, packaging, and distribution methods to maintain efficacy, which fuels demand for advancedand specialized supply chain solutions.

Major companies in the clinical trial supplies industry are Thermo Fisher Scientific Inc., Marken, Catalent, Inc, Eurofins Central Laboratory, Parexel International (MA) Corporation, Biocair, Almac Group, Piramal Pharma Limited, Sharp Services, LLC, PCI Pharma Services, NUVISAN GmbH, OCT Group LLC., COREX LOGISTICS LIMITED, Acnos Pharma GmbH, CSI, and others.

The market focuses on the provision and management of materials that are necessary for conducting clinical trials. It ensures the efficient and compliant delivery of drugs, medical devices, and other trial-related products to clinical sites.

This market supports the pharmaceutical and biotech sectors by addressing logistical complexities and regulatory requirements necessary for the successful execution of clinical trials, enabling the progression of drug development from initial phases to completion.

- In October 2024, PCI Pharma Services introduced the pci | bridge platform, winning a Supply Chain Excellence Award. This solution enhances supply chain visibility, streamlines clinical trial management, and reduces manual processes, improving efficiency in drug development and distribution.

Key Highlights:

- The clinical trial supplies industry size was recorded at USD 2853.3 million in 2023.

- The market is projected to grow at a CAGR of 8.72% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 948.5 million.

- The phase III segment garnered USD 909.4 million in revenue in 2023.

- The supply chain management segment is expected to reach USD 2268.9 million by 2031.

- The medical device companies segment is anticipated to witness fastest CAGR of 8.80% during the forecast period.

- The makret in Asia Pacific is anticipated to grow at a CAGR of 9.59% during the forecast period.

Market Driver

"Advancements in Drug Development"

The growth of personalized medicines and biologics is significantly driving the clinical trial supplies market. These therapies require specialized handling, packaging, and distribution methods, which includes precise temperature control and secure storage.

As the demand for targeted treatments increases, so does the need for innovative solutions in supply chain management. This trend has prompted the development of sophisticated logistics, packaging technologies, and tracking systems to ensure the integrity and timely delivery of clinical trial materials.

- In February 2025, Selkirk Pharma introduced ClinFAST, a service designed to expedite fill/finish for clinical trials. By reducing production timelines, ClinFAST addresses difficulties in drug development, particularly for biologics and personalized medicines, supporting the rise in need for specialized clinical trial supplies.

Market Challenge

"Supply Chain Complexities"

A major challenge in the clinical trial supplies market is to manage the distribution of trial materials on a global scale. Guaranteeing timely delivery while maintaining compliance with regulations can lead to delays, inefficiencies, and increase in costs.

For addressing this, companies are leveraging advanced technologies such as real-time tracking systems, automated inventory management, and digital platforms that provide end-to-end visibility. These solutions streamline logistics, enhance coordination across different stakeholders, and make sure that supplies reach trial sites effectively and with adherence to regulations.

- In August 2023, SAP launched the Intelligent Clinical Supply Management solution, addressing global distribution challenges by enhancing supply chain visibility. The platform helps in forecasting, manufacturing, packaging, and shipping, which enables the effective management of clinical trials and ensuring a timely, compliant delivery of materials.

Market Trend

"Cold Chain Logistics"

Cold chain logistics has become a significant trend in the clinical trial supplies market due to the rise in demand for biologics and tailored medicines. These treatments need a fixed temperature throughout their distribution to maintain efficacy and safety.

As a result, advanced cold chain solutions, which include temperature-monitored packaging, real-time tracking, and specialized transport, are being implemented for ensuring the integrity of sensitive materials.

This trend is fueling innovations in logistics, making it crucial for clinical trials that involve temperature-sensitive products to function efficiently and abide by regulatory standards.

- In January 2025, Ancillare launched enhanced Cold Chain Management service, which ensures the safe transport and handling of temperature-sensitive supplies in clinical trials.This service includes sourcing, storage, and compliance with global regulations, ensuring the integrity and timely delivery of clinical trial materials .

Clinical Trial Supplies Market Report Snapshot

|

Segmentation

|

Details

|

|

By Phase

|

Phase I, Phase II, Phase III, Phase IV

|

|

By Service

|

Manufacturing, Storage & Distribution, Supply Chain Management

|

|

By End-User

|

Pharmaceutical & Biotechnology Companies, Contract Research Organisations, Medical Device Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Phase (Phase I, Phase II, Phase III, Phase IV): The phase III segment earned USD 909.4 million in 2023, due to the growing number of late-stage clinical trials that require large-scale distribution of supplies.

- By Service (Manufacturing, Storage & Distribution, Supply Chain Management): The supply chain management segment held 41.79% of the market in 2023, due to the increasing need for efficient, real-time tracking of clinical trial supplies.

- By End-User (Pharmaceutical & Biotechnology Companies, Contract Research Organisations, Medical Device Companies): The pharmaceutical & biotechnology companies segment is projected to reach USD 2112.5 million by 2031, owing to the rise in demand for innovative drugs and personalized therapies.

Clinical Trial Supplies Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

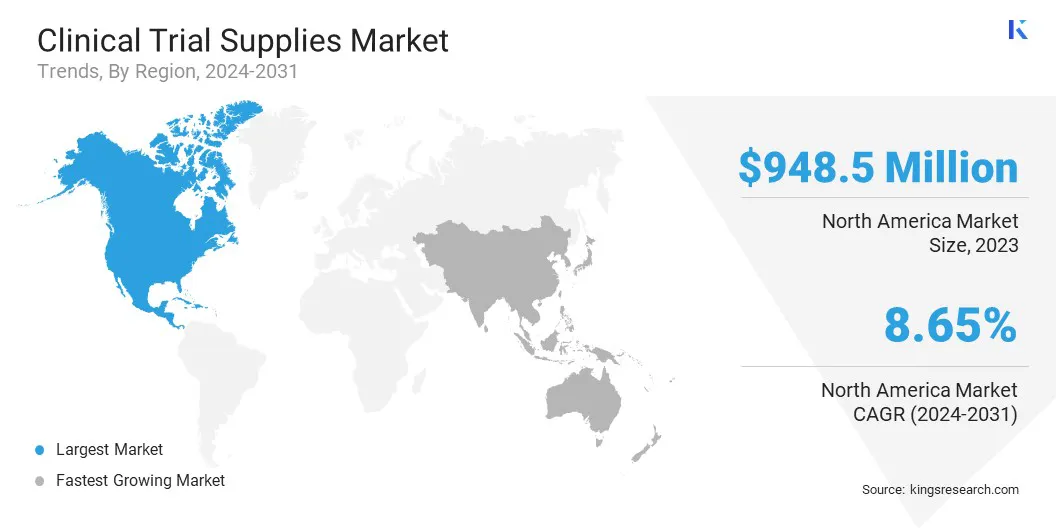

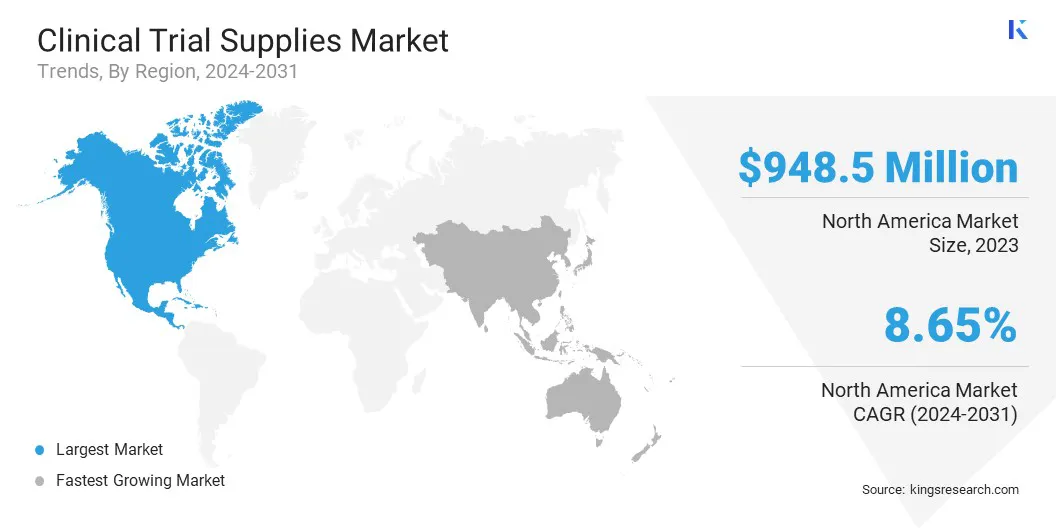

The North America clinical trial supplies market share stood at around 33.24% in 2023 in the global market, with a valuation of USD 948.5 million. North America is a dominating region in the market, fueled by advanced infrastructure, technological innovations, and strong investment in clinical and commercial supply chains.

The region's extensive network of facilities, combined with a growing focus on precision drug delivery, positions it as a leader in supporting the development and commercialization of complex therapies.

Furthermore, the region's ability to incorporate cold chain solutions and advanced packaging technologies strengthens its leadership in meeting global clinical trial demands efficiently.

- In September 2024, PCI Pharma Services announced a USD 365 million investment to expand its facilities in North America and Europe, upgrading the capabilities for advanced drug delivery systems, drug-device combination products, and cold chain logistics. This move would support clinical-to-commercial transitions globally.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 9.59% over the forecast period. Asia Pacific is the fastest-growing region in the market because of the increase in investments in healthcare infrastructure, rising clinical research activities, and the growing demand for advanced therapies.

The region reaps the benefits of a large population of patients, adoption of new technologies, and support from the government for research and development. Additionally, cost advantages and the rising prevalence of chronic diseases drive market growth, which positions Asia Pacific as a center for clinical trials and related services.

- In November 2024, BioIVT and KRISHGEN BioSystems announced an exclusive commercial agreement for enhancing clinical research in South Asia, providing researchers in India, Bangladesh, and Nepal access to a wider range of innovative biological materials for drug development and personalized medicine.

Regulatory Frameworks

- In the U.S., the FDA ensures the safety, efficacy, and security of drugs, biological products, medical devices, and clinical trial supplies, supervising regulatory compliance for public health protection in clinical research.

- In the EU, the Clinical Trials Regulation (EU No 536/2014) harmonizes clinical trial rules across member states, by focusing on transparency, safety reporting, informed consent, and streamlined multinational trials through the EU Clinical Trials Portal.

Competitive Landscape:

Companies in the clinical trial supplies industry are focusing on enhancing the efficiency and reliability of clinical trials by offering advanced technologies and services.

They provide solutions like supply chain management, data integration, interactive response systems, and decentralized trial support. These innovations aim to streamline processes, ensuring regulatory compliance and improving patient recruitment and retention throughout clinical development.

- In April 2023, Almac Clinical Technologies launched the IXRS 3 Partnership Network, which aimed at enhancing eClinical solutions for biopharmaceutical sponsors. This network fostered data sharing and collaborations for improving interoperability, streamlining clinical trials, and providing better technology and services for sponsors, sites, and patients.

List of Key Companies in Clinical Trial Supplies Market:

- Thermo Fisher Scientific Inc.

- Marken

- Catalent, Inc

- Eurofins Central Laboratory

- Parexel International (MA) Corporation

- Biocair

- Almac Group

- Piramal Pharma Limited

- Sharp Services, LLC

- PCI Pharma Services

- NUVISAN GmbH

- OCT Group LLC.

- COREX LOGISTICS LIMITED

- Acnos Pharma GmbH

- CSI

Recent Developments (Expansion/Partnerships/Agreements)

- In March 2023, LEO Pharma partnered with ICON to enhance clinical trial execution in medical dermatology. The partnership aimed at improving patient-centric, budget-friendly trials, optimizing flexible outsourcing models and ICON’s extensive services for accelerating the development and delivery of new treatments.

- In October 2024, MediLink Therapeutics announced a global clinical trial collaboration and supply agreement with Amgen for evaluating the combination of MediLink's YL201 antibody-drug conjugate and Amgen's IMDELLTRA for the treatment of extensive-stage small cell lung cancer (ES-SCLC).

- In January 2025, MAIA Biotechnology collaborated with BeiGene for Phase 2 trials evaluating THIO, a telomere-targeting agent, with tislelizumab for hepatocellular carcinoma, small cell lung cancer, and colorectal cancer.

- In January 2025, Asher Bio partnered with Amgen to evaluate etakafusp alfa (AB248) with Amgen’s bispecific T-cell engager IMDELLTRA for treating extensive-stage small cell lung cancer (ES-SCLC) in a global Phase 1b study.

- In July 2024, Catalent completed a USD 25 million expansion at its clinical supply facility in Schorndorf, Germany. The expansion added 32,000 square feet of space for temperature-controlled storage and improved Catalent’s FastChain demand-led supply service capabilities.