Market Definition

The clinical trial imaging industry comprises services and technologies involved in imaging for clinical research, such as modalities like MRI, CT, and PET. Driven by developments in imaging technologies and growing demand for precision diagnostics, this market supports the development of new drugs and treatments with enhanced safety and efficacy assessments.

Clinical Trial Imaging Market Overview

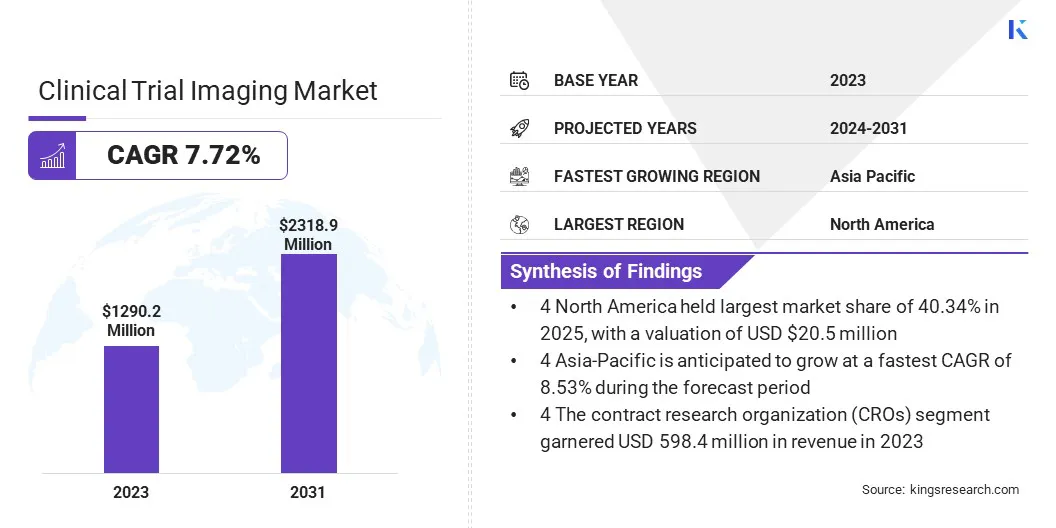

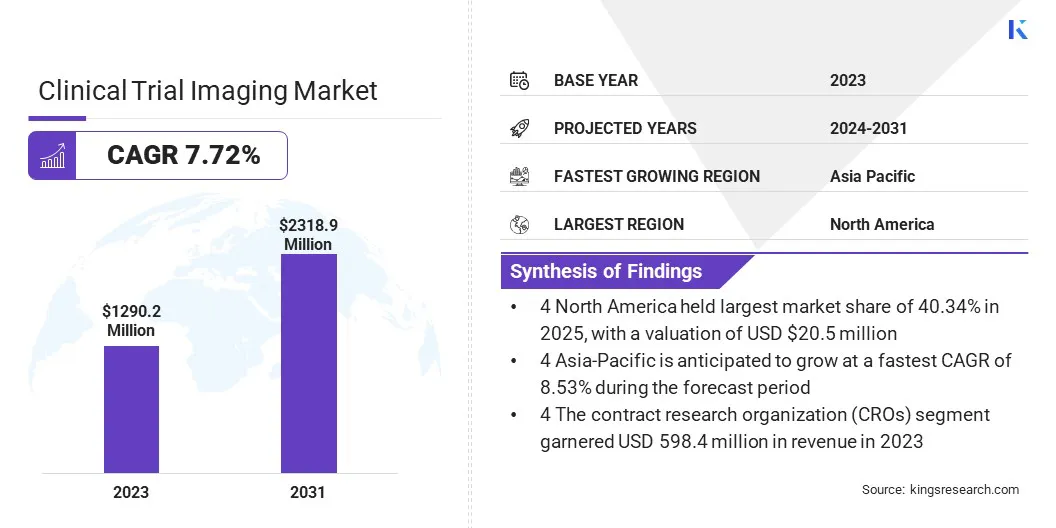

The global clinical trial imaging market size was valued at USD 1290.2 million in 2023, which is estimated to be valued at USD 1377.4 million in 2024 and reach USD 2318.9 million by 2031, growing at a CAGR of 7.72% from 2024 to 2031.

The market is poised for growth, driven by increasing investments in pharmaceutical R&D, advancements in imaging technologies, and a rising number of contract research organizations (CROs). These factors enhance trial efficiency and accuracy, fueling the demand for imaging services in drug development.

Major companies operating in the clinical trial imaging market are IXICO plc, Resonance, Inc., Koninklijke Philips N.V., Navitas Life Sciences, ProScan Imaging, LLC, Medpace, Radiant Sage Ventures, ICON plc, Siemens Healthcare Private Limited, General Electric Company, Caidya, Image Core Lab, Medidata, Perspectum, and Perceptive.

The emergence of precision medicine emphasizes the need for novel imaging biomarkers for patient stratification and treatment monitoring. Finally, expanding healthcare expenditures and improving infrastructure in emerging markets present new opportunities for clinical trial imaging services, contributing to the overall market expansion.

- For instance, in October, 2024, the National Institutes of Health (NIH) launched a proof-of-concept clinical trial of precision medicine. This proof-of-concept clinical trial sponsored by the National Cancer Institute, within the NIH, is envisioned to accelerate the development of additional targeted therapies against aggressive hematologic malignancies.

Key Highlights:

- The clinical trial imaging industry size was valued at USD 1290.2 million in 2023.

- The market is projected to grow at a CAGR of 7.72% from 2024 to 2031.

- North America held a market share of 40.34% in 2023, with a valuation of USD 520.5 million.

- The operational imaging services segment garnered USD 321.5 million in revenue in 2023.

- The medical devices manufacturers segment is expected to reach USD 251.1 million by 2031.

- The computed tomography (CT) segment garnered USD 388.6 million in revenue in 2023.

- The oncology segment is expected to reach USD 1120.8 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.53% during the forecast period.

Market Driver

"Increased R&D Investments and Technological Advancements"

The clinical trial imaging market is mainly driven by increased investments in research and development (R&D) from pharmaceutical and imaging companies. This increase in funding allows the adoption of more advanced imaging technologies, which help improve the accuracy and efficiency of trials.

Moreover, the growth in Contract Research Organizations (CROs) boosts operational capabilities and makes clinical trials more streamlined. The growing demand for accurate diagnostic equipment is a significant driver of market growth as diverse stakeholders seek new imaging technologies to enable comprehensive data collection and review.

Additionally, the integration of artificial intelligence (AI) into imaging analysis is changing the process of data interpretation, leading to faster trial times and better results.

- For instance, in November 2024, the National Institutes of Health announced an algorithm using AI to expedite the process of matching possible volunteers with pertinent clinical research studies.

Market Challenge

"High Costs and Regulatory Hurdles"

The clinical trial imaging market faces significant challenges, primarily due to the high costs associated with advanced imaging technologies. The financial burden of acquiring and maintaining sophisticated imaging equipment can deter smaller research institutions and CROs from utilizing these essential tools.

Additionally, regulatory hurdles and the lack of standardized protocols complicate compliance and data integration, hindering operational efficiency. Moreover, the shortage of skilled personnel in imaging analysis poses a challenge to effectively harnessing these technologies, limiting the potential for innovation and growth in the market.

Market Trend

"Emerging Markets and Increased Focus On Precision Medicine"

The clinical trial imaging market is registering several significant trends that are shaping its evolution. Increased focus on precision medicine is driving the development of novel imaging biomarkers that enable more accurate patient stratification and monitoring of treatment responses.

Emerging markets, particularly in countries like India and China, are becoming pivotal growth areas, due to rising healthcare investments and demand for clinical trial imaging services. Furthermore, technological advancements in imaging modalities, such as enhanced Computed Tomography (CT) and Magnetic Resonance Imaging (MRI), are improving diagnostic capabilities and trial outcomes.

The growing number of CROs is streamlining clinical trial processes by providing specialized imaging services and expertise, thereby improving operational efficiencies in trial management. Lastly, the rise of cloud-based imaging solutions, which enhance data accessibility & management and facilitate collaboration among stakeholders in clinical trials is also aiding the market growth.

- For instance, in December 2024, the Image Analysis Group (IAG) launched DYNAMIKA V.7, a cutting-edge cloud platform tailored for clinical trials imaging. DYNAMIKA V.7 empowers researchers with advanced tools for seamless data handling, ensuring compliance and facilitating quicker decision-making in trial processes.

Clinical Trial Imaging Market Report Snapshot

| Segmentation |

Details |

| By Service |

Clinical Trial Design and Consultation Services, Reading and Analytical Services, Operational Imaging Services, System and Technology Support Services, Project and Data Management |

| By End Use |

Biotechnology and Pharmaceutical Companies, Medical Devices Manufacturers, Academic and Government Research Institutes, Contract Research Organization (CROs), Others |

| By Modality |

X-ray, Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Ultrasound, Others |

| By Therapeutic Area |

Oncology, Cardiology, Neurology, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Service (Clinical Trial Design and Consultation Services, Reading and Analytical Services, Operational Imaging Services, System and Technology Support Services, and Project and Data Management): The operational imaging services segment earned USD 321.5 million in 2023, due to the increasing demand for efficient imaging processes that enhance the quality and speed of clinical trials. These services are critical for providing timely and accurate imaging data, which is essential for evaluating the safety and efficacy of new therapies.

- By End Use (Biotechnology and Pharmaceutical Companies, Medical Devices Manufacturers, Academic and Government Research Institutes, and Contract Research Organization (CROs)): The contract research organization (CROs) segment held 46.38% share of the marke in 2023, due to their role in managing clinical trials for pharmaceutical and biotechnology companies.

- By Modality (X-ray, Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Ultrasound, Others): The computed tomography (CT) segment held 30.12% share of the market in 2023, due to its ability to deliver high-resolution images that are crucial for assessing disease progression and treatment response.

- By Therapeutic Area (Oncology, Cardiology, Neurology, Others): The oncology segment is projected to reach USD 1120.8 million by 2031, owing to the rising global burden of cancer and the increasing need for advanced imaging techniques to facilitate early diagnosis and treatment monitoring.

Clinical Trial Imaging Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

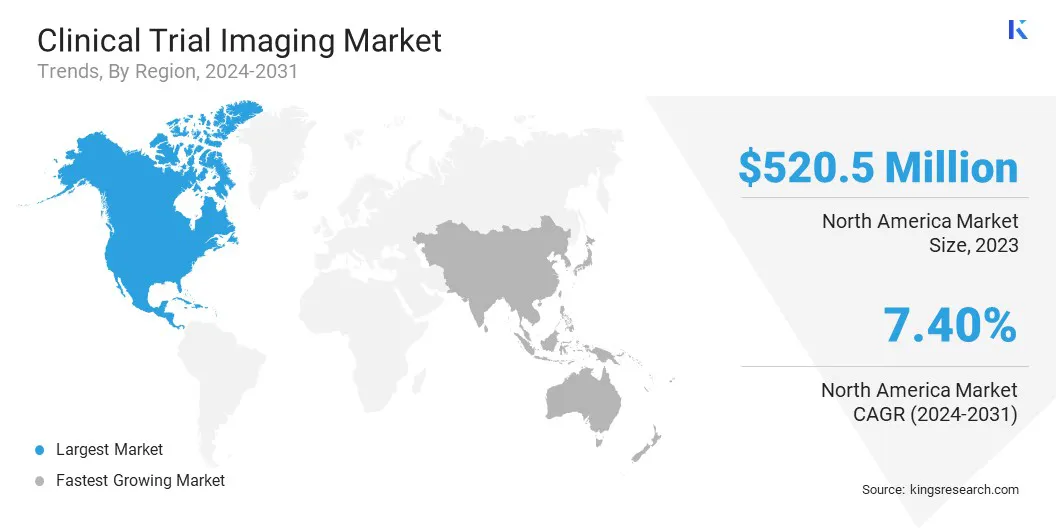

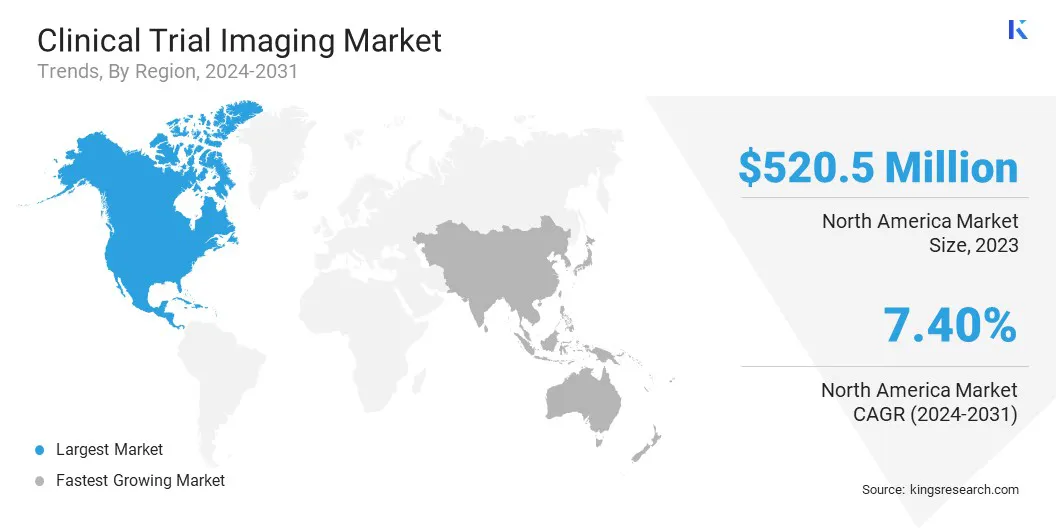

North America accounted for a significant clinical trial imaging market share of around 40.34% in 2023, valued at USD 520.5 million, driven by the presence of advanced healthcare infrastructure and significant investments in R&D.

The U.S. leads this region, due to its robust ecosystem of pharmaceutical companies, a high concentration of clinical trial sites, and a favorable regulatory environment that supports efficient trial processes.

The market in Asia Pacific is anticipated to register the fastest growth, at a projected CAGR of 8.53% over the forecast period, due to lower operational costs, an expanding pool of clinical trial participants, and improving regulatory frameworks that facilitate faster approvals.

- For instance, in December 2024, according to the World Health Organization (WHO), Southeast Asia is experiencing a rapid increase in clinical trial activities, remaining the only region that has not seen a decline since the peak of the COVID-19 pandemic.

Meanwhile, the market in Asia Pacific is registering rapid growth, due to increasing healthcare expenditure, a rising patient population, and a growing emphasis on improving healthcare access and quality. Countries like China and India are investing heavily in their healthcare systems, which includes expanding their clinical trial capabilities.

- In July 2024, according to The White House, the U.S government is fostering actionable strategies for enhancing health outcomes through diverse clinical trials, emphasizing community engagement, recruitment acceleration, participant-centered design, and innovative readiness approaches to ensure inclusive and effective clinical research in the U.S.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S, the regulation of clinical trials imaging is overseen by the Food and Drug Administration (FDA). The FDA has established comprehensive guidelines to ensure the quality, safety, and efficacy of imaging trials, which are essential for drug development and evaluation.

- In Europe, the regulation of clinical trials imaging is primarily overseen by the European Medicines Agency (EMA) and national competent authorities within EU Member States.

- In China, the diagnostic devices are primarily regulated by the National Medical Products Administration (NMPA), which is responsible for the approval and monitoring of clinical trials involving medical devices.

- In Japan, the regulation of clinical trials involving imaging devices is primarily overseen by the Pharmaceuticals and Medical Devices Agency (PMDA), which operates under the Ministry of Health, Labour and Welfare (MHLW). This regulatory body evaluates the efficacy and safety of imaging devices before they can be utilized in clinical settings, thereby safeguarding public health.

Competitive Landscape:

The clinical trial imaging market is characterized by a number of participants, including both established corporations and rising organizations. To gain a competitive edge in this rapidly evolving sector, organizations are actively implementing a variety of strategic initiatives.

Key strategies include the development and launch of innovative imaging technologies, forming strategic partnerships and collaborations with research institutions, expanding global market reach, and pursuing mergers and acquisitions to enhance their capabilities.

Additionally, companies are investing in advanced imaging solutions, leveraging AI and machine learning (ML), and enhancing data analytics to improve the efficiency and accuracy of clinical trials, ultimately accelerating the drug development process.

- For instance, in January 2025, ActiGraph's acquisition of Biofourmis Connect enhances its clinical trial capabilities by integrating an AI-driven digital trial platform, creating a unified ecosystem that modernizes clinical research and improves the efficiency of data collection and analysis throughout the drug development lifecycle.

List of Key Companies in Clinical Trial Imaging Market:

- IXICO plc

- Resonance, Inc.

- Koninklijke Philips N.V.

- Navitas Life Sciences

- ProScan Imaging, LLC

- Medpace

- Radiant Sage Ventures

- ICON plc

- Siemens Healthcare Private Limited

- General Electric Company

- Caidya

- Image Core Lab

- Medidata

- Perspectum

- Perceptive, and

- Others

Recent Developments:

- In July 2024, GE HealthCare announced the acquisition of Intelligent Ultrasound's clinical AI business, increasing its capabilities with technology improving workflows and enhance ease-of-use for the benefit of clinicians and patients.

- In May 2024, palleos healthcare GmbH announced a merger with OCT Global SA, representing a major breakthrough in the field of clinical research. This strategic merger combines their expertise, enabling efficient patient recruitment and a wider range of solutions, ultimately advancing the clinical research landscape significantly.

- In April 2024, Clario, announced the acquisition of ArtiQ. This acquisition enhances Clario's capabilities in clinical trials by integrating advanced AI technologies, significantly improving data collection and analysis processes, and driving efficiency and accuracy in trial outcomes.

- In January 2024, Deep6.ai announced its partnership with Graticule to enhance clinical trial recruitment. By developing advanced algorithms and real-world data services, they aim to efficiently identify and prioritize eligible patients across various disease indications.

- In September 2023, MedQIA, and DARC merged to establish Voiant, LLC, a transformative force in AI-driven clinical trial imaging. This strategic consolidation aims to integrate a leading AI-based imaging platform with exceptional scientific and clinical expertise, enabling biopharmaceutical companies to receive rapid and high-quality clinical endpoint data.

- In November 2023, AstraZenec launched Evinova, a health technology firm dedicated to enhancing clinical trials through AI-driven solutions. This initiative aims to streamline trial design and execution, reducing costs and time in drug development.