Market Definition

The market encompasses the global landscape for diagnostic systems and reagents used in clinical laboratories to assess the chemical composition of body fluids. This market includes a broad range of analyzers, reagents, and supporting solutions used to perform various routine and specialized tests.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Clinical Chemistry Analyzers Market Overview

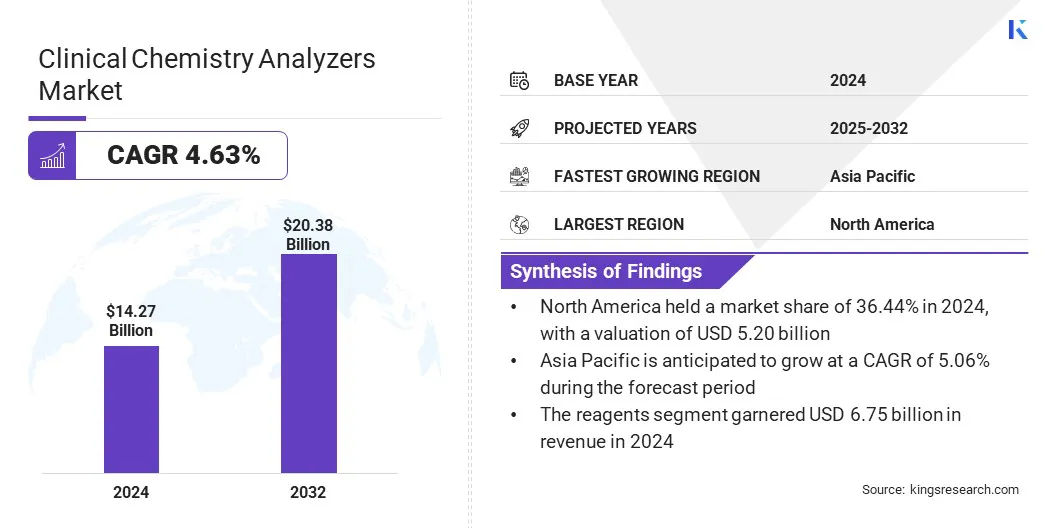

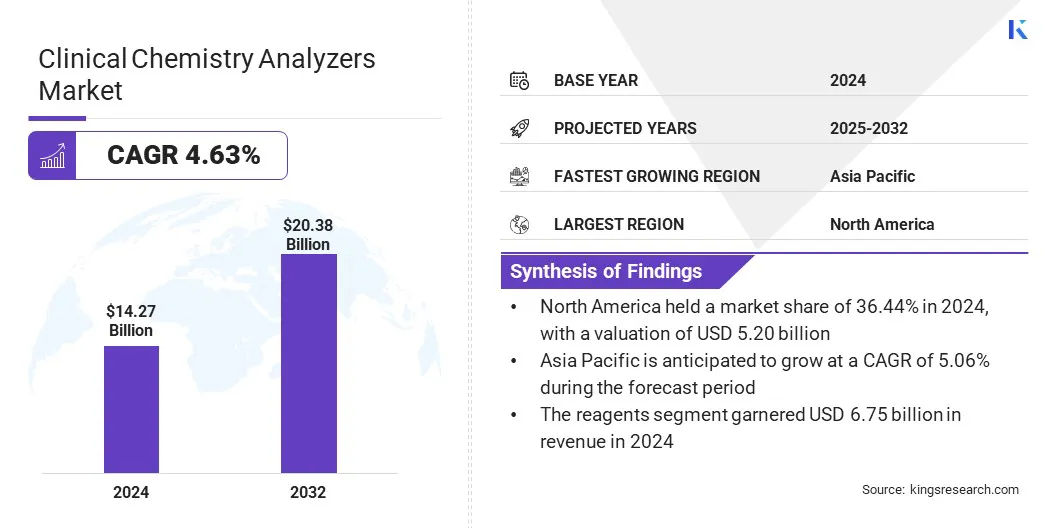

The global clinical chemistry analyzers market size was valued at USD 14.27 billion in 2024 and is projected to grow from USD 14.85 billion in 2025 to USD 20.38 billion by 2032, exhibiting a CAGR of 4.63% during the forecast period.

The growth is due to the increasing prevalence of chronic diseases such as diabetes, kidney disorders, and cardiovascular diseases, as these conditions require regular biochemical testing. Additionally, technological advancements in automation, accuracy, and speed of diagnostic systems are further boosting the demand for clinical chemistry analyzers.

Major companies operating in the clinical chemistry analyzers industry are Mindray, Sysmex Corporation, F. Hoffmann-La Roche Ltd, Cardinal Health, HORIBA, High-Tech Corporation, Abbott, Analytik Jena GmbH+Co. KG, Beckman Coulter, Inc., Becton, Dickinson and Company, Siemens Healthcare LLC, Eppendorf SE, PerkinElmer Inc., Thermo Fisher Scientific Inc., and Agilent Technologies, Inc.

The growing adoption of point-of-care (POC) testing for rapid and accessible results, is contributing significantly to the expansion of the market. The integration of clinical chemistry and immunoassay analyzers into single, unified systems is further driving market growth. These integrated systems combine multiple testing capabilities in one device, enhancing efficiency and reducing operational costs.

- In April 2024, Mindray launched new solutions for mid-volume laboratories, including two stand-alone analyzers (CL-2600i and BS-1000M) and two integrated systems (M680 and M980). These solutions aim to enhance operational efficiency and reduce turnaround time in chemiluminescence immunoassay and clinical chemistry testing.

Key Highlights:

- The clinical chemistry analyzers market size was recorded at USD 14.27 billion in 2024.

- The market is projected to grow at a CAGR of 4.63% from 2025 to 2032.

- North America held a market share of 36.44% in 2024, with a valuation of USD 5.20 billion.

- The reagents segment garnered USD 6.75 billion in revenue in 2024.

- The basic metabolic panels segment is expected to reach USD 6.03 billion by 2032.

- The hospitals and clinics segment is expected to reach USD 9.38 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 5.06% during the forecast period.

Market Driver

Rising Prevalence of Chronic Diseases

The global market is driven by the rising prevalence of chronic diseases. This includes diabetes, kidney disorders, and cardiovascular diseases that require ongoing biochemical testing for effective diagnosis and management. Clinical chemistry analyzers are vital in monitoring disease progression and adjusting treatment plans.

This increasing need for regular testing is driving the adoption of advanced diagnostic tools including clinical chemistry analyzers globally, thereby driving market growth.

- In 2024, the U.S. National Institutes of Health reported that approximately 422 million people globally are living with diabetes, with the prevalence continuing to rise steadily.

Market Challenge

High Cost of Advanced Systems

A major challenge in the clinical chemistry analyzers market is the high cost of advanced systems. These systems are often expensive due to their advanced technology and automation features. A solution is the development of more affordable, modular systems.

By offering flexible, scalable solutions with lower upfront costs, manufacturers can make these devices more accessible to a wider range of healthcare providers, improving market penetration in cost-sensitive areas.

Market Trend

Integration of Clinical Chemistry and Immunoassay Analyzers

A market trend in the market is the integration of clinical chemistry and immunoassay analyzers into single, unified systems. This integration allows healthcare providers to perform a wide range of tests, including both chemical and immunoassay diagnostics, using a single device.

It enhances workflow efficiency by reducing the need for multiple instruments, streamlining testing processes, and cutting down on operational costs.

Moreover, integrated systems offer improved test accuracy, faster turnaround times, and reduce the likelihood of errors associated with sample handling and transfer between different devices. This is beneficial in high-demand clinical environments where time-sensitive results are crucial.

- In July 2024, Beckman Coulter Diagnostics introduced the DxC 500i Clinical Analyzer, an integrated clinical chemistry and immunoassay analyzer designed for satellite and independent laboratories. The system combines DxC 500 AU chemistry analyzer technology with Six Sigma performance, offering scalability, flexibility, and commutable patient results.

Clinical Chemistry Analyzers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Analyzers, Reagents, Others

|

|

By Test Type

|

Basic Metabolic Panels, Liver Panel, Renal Panels, Lipid Profiles, Thyroid Function Panels, Others

|

|

By End User

|

Hospitals and Clinics, Diagnostic Laboratories, Research Laboratories & Institutes, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Analyzers, Reagents, Others): The reagents segment earned USD 6.75 billion in 2024 due to the high demand for repeat testing and consistent use in routine diagnostics.

- By Test Type (Basic Metabolic Panels, Liver Panel, Renal Panels, and Lipid Profiles): The basic metabolic panels held 32.10% of the market in 2024, due to their widespread use in monitoring chronic conditions such as diabetes and kidney disorders.

- By End User (Hospitals and Clinics, Diagnostic Laboratories, Research Laboratories & Institutes, and Others): The hospitals and clinics segment is projected to reach USD 9.38 billion by 2032, owing to the increasing patient volume and rising adoption of automated diagnostic systems.

Clinical Chemistry Analyzers Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America clinical chemistry analyzers market share stood at around 36.44% in 2024, with a valuation of USD 5.20 billion. This dominance is due to the region's well-established healthcare infrastructure, high diagnostic testing volumes, and strong reimbursement frameworks.

The region benefits from advanced laboratory automation, widespread adoption of high-throughput analyzers, and the presence of major market players. Continuous investment in R&D and early adoption of new technologies by hospitals and diagnostic centers is further driving the growth of the market.

Asia Pacific is poised to grow at a significant CAGR of 5.06% over the forecast period. This growth is due to the rising healthcare investments, expanding medical infrastructure, and increasing demand for diagnostic services in this region. Countries such as China, India, and South Korea are witnessing a rise in chronic diseases and greater government focus on healthcare access.

The establishment of new diagnostic labs and a broader focus on preventive screening have supported the adoption of clinical chemistry analyzers across the region.

- In May 2025, Apollo Diagnostics unveiled its Digi-Smart Central Reference Laboratory in Chennai, India. It is a fully automated 45,000-square-foot facility integrating five major laboratory disciplines including clinical chemistry and immunoassay. The lab is designed to reduce turnaround time by 60% and ensure 100% accuracy using advanced robotics, high-definition cameras, machine learning, and bespoke algorithms.

Regulatory Frameworks

- In the U.S., clinical chemistry analyzers are regulated by the Food and Drug Administration (FDA). The FDA classifies these analyzers as medical devices and oversees their safety and effectiveness. These devices are fall under Clinical Chemistry and Clinical Toxicology Devices" (21 CFR Part 862) in the Code of Federal Regulations.

- In Europe, clinical chemistry analyzers fall under the In Vitro Diagnostic Medical Devices Regulation (IVDR) (EU) 2017/746, which replaced the earlier IVD Directive. The regulation requires conformity assessments by Notified Bodies, implementation of CE marking, and adherence to strict post-market surveillance and performance evaluation standards.

Competitive Landscape

The key players in the clinical chemistry analyzers market are focusing on advancing automation capabilities, integrating artificial intelligence, and enhancing throughput efficiency to differentiate their offerings. Many companies are investing in R&D to introduce compact, user-friendly analyzers with faster turnaround times and improved connectivity.

Strategic collaborations with diagnostic laboratories and healthcare institutions are common to strengthen distribution networks and increase product visibility. Several manufacturers are expanding their presence in high-growth regions through joint ventures, local manufacturing, and tailored solutions.

- In December 2023, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. completed its acquisition of a 75% controlling stake in Germany-based DiaSys Diagnostic Systems GmbH. With this acquisition, DiaSys became a majority-owned subsidiary of Mindray. This aims to strengthen Mindray’s in-vitro diagnostics portfolio, accelerate the development of its overseas supply chain, and enable synergistic growth through global integration and collaboration.

List of Key Companies in Clinical Chemistry Analyzers Market:

- Mindray

- Sysmex Corporation

- F. Hoffmann-La Roche Ltd

- Cardinal Health

- HORIBA

- High-Tech Corporation

- Abbott

- Analytik Jena GmbH+Co. KG

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Siemens Healthcare LLC

- Eppendorf SE

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

Recent Developments (Agreements/ Product Launch)

- In June 2024, Roche launched the Cobas C 703 and cobas ISE neo analytical units for its cobas pro integrated solutions in countries accepting the CE mark. The new units offer higher testing capacity and advanced automation, with the Cobas C 703 delivering up to 2,000 clinical chemistry tests per hour and 70 reagent positions.

- In April 2024, Siemens Healthineers and Sysmex Corporation began independently distributing their combined hemostasis testing portfolio in the United States and Europe under their respective brands. The integration includes systems such as the CN-3000/6000, CS-2500, CS-5100, and CA-600 series, supporting high, mid, and low-volume testing.

growth at a