Market Definition

The market is a structured system for trading certificates representing electricity generated from solar , wind , and renewable gas. Each certificate signifies one megawatt-hour (MWh) of renewable electricity delivered to the grid.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Renewable Energy Certificate Market Overview

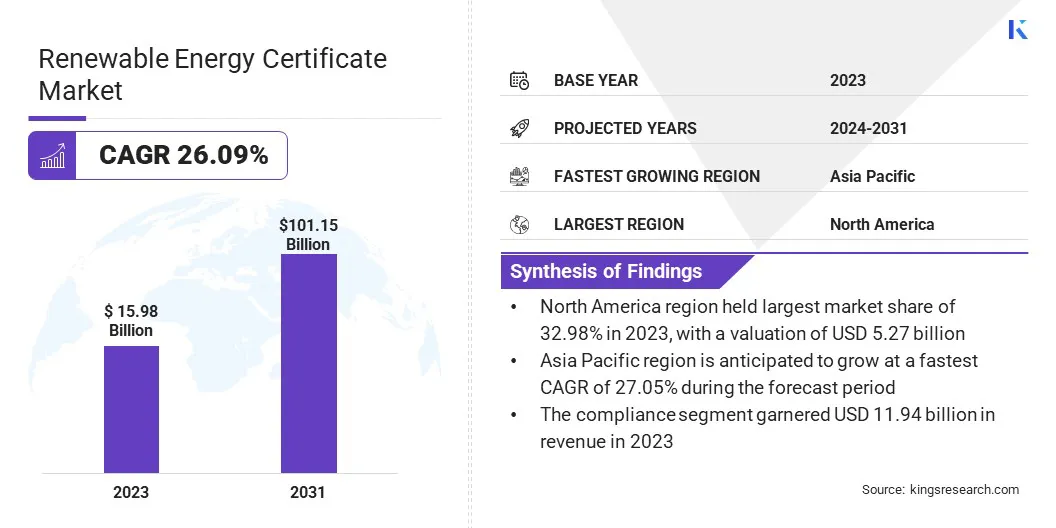

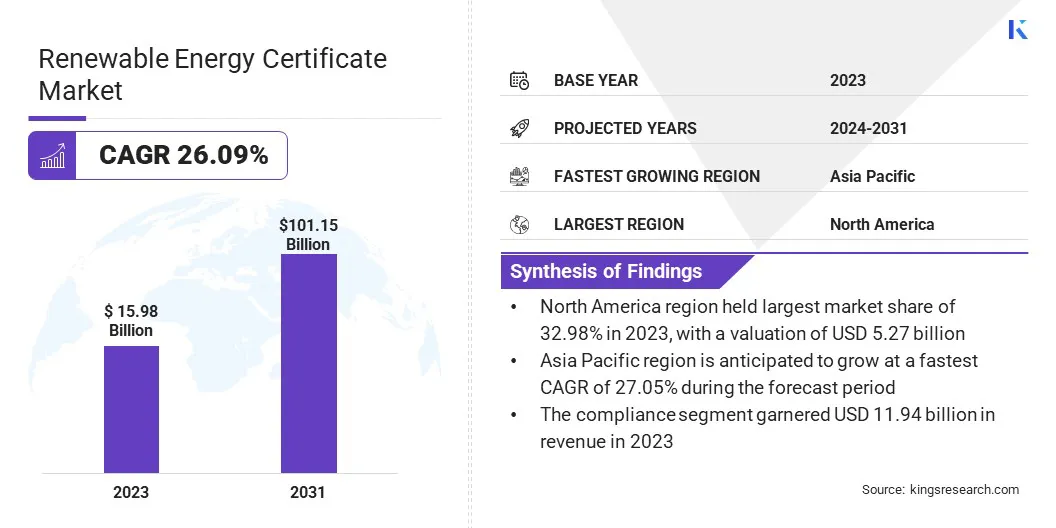

The global renewable energy certificate market size was valued at USD 15.98 billion in 2023 and is projected to grow from USD 19.97 billion in 2024 to USD 101.15 billion by 2031, exhibiting a CAGR of 26.09% during the forecast period.

Market growth is driven by increasing government mandates, clean energy targets, and rising corporate sustainability commitments, including net-zero and 100% renewable energy goals. Technological advancements in solar, wind, and hydroelectric power are further enhancing REC supply.

Major companies operating in the renewable energy certificate ndustry are Enel Spa, Sterling Planet, Mekrapid Products Ltd, South Pole, NextEra Energy Resources, LLC., CLP Power Hong Kong Limited, Monsoon Carbon, 3Degrees, Inc., Isaksen Solar, SP group, Statkraft, Tenaga Nasional Berhad, Ecohz, Western Area Power Administration, and CRS.

Moreover, the adoption of digital platforms for REC tracking and trading is significantly improving transparency, streamlining operations, and expanding global market accessibility.

With an increasing number of countries introducing supportive regulatory frameworks and carbon reduction initiatives, the REC market is set to witness continued growth across both compliance-driven and voluntary sectors.

- In January 2023, Bureau Veritas launched a dedicated certification scheme for renewable hydrogen to support safe, sustainable production practices using renewable energy sources. Developed in response to growing industry demand, the scheme aims to provide a comprehensive standard for hydrogen producers and off-takers, enhancing transparency and promoting investment in the hydrogen sector.

Key Highlights:

- The renewable energy certificate industry size was recorded at USD 15.98 billion in 2023.

- The market is projected to grow at a CAGR of 26.09% from 2024 to 2031.

- North America held a share of 32.98% in 2023, valued at USD 5.27 billion.

- The solar energy segment garnered USD 8.16 billion in revenue in 2023.

- The greater than 5000 KWH segment is expected to reach USD 51.23 billion by 2031.

- The compliance segment is projected to reach USD 76.20 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 27.05% over the forecast period.

Market Driver

"Major Emphasis on Corporate Sustainability Goals and Net-Zero Commitments"

The growth of the renewable energy certificate (REC) market is fueled by the growing adoption of corporate sustainability goals and net-zero commitments across various industries. As organizations seek to reduce carbon footprints and align with global climate initiatives, RECs offer a credible means to source renewable electricity.

These certificates offer companies the ability to match their energy consumption with renewable generation, helping them achieve targets such as 100% renewable energy use or carbon neutrality. This has resulted in a surge in voluntary REC purchases, enabling firms to achieve climate targets while enhancing their market reputation and competitiveness.

- In December 2023, LevelTen Energy, in collaboration with AES, Constellation, Google, and Microsoft, launched the Granular Certificate Trading Alliance to develop a first-of-its-kind trading and management platform for granular Renewable Energy Certificates (RECs). Supported by the Intercontinental Exchange (ICE), the platform enables time- and location-specific tracking of carbon-free energy generation, allowing buyers to match consumption with clean energy on an hourly basis.

Market Challenge

"Lack of Uniform Regulatory Frameworks

A major challenge hampering the development of the renewable energy certificate (REC) market is the lack of uniform regulatory frameworks across regions, which creates fragmentation and limits seamless trading of certificates globally.

Different countries and even states within the same country often follow varying definitions, eligibility criteria, and verification standards for RECs. This regulatory inconsistency complicates cross-border transactions and affects investor confidence and market liquidity.

This challenge can be addressed through the harmonization of certification systems and the adoption of internationally recognized standards, such as those under the European Energy Certificate System (EECS) or the development of bilateral agreements between countries.

Additionally, increasing collaboration between governments, regulatory bodies, and private stakeholders can lead to the creation of more interoperable REC markets.

Market Trend

"Digitization and Block Chain Integration"

The renewable energy certificate (REC) market is experiencing a notable shift with the increasing adoption of digitization and block chain technology, enhancing operational efficiency and transparency across the value chain. Traditional REC management systems often face challenges related to administrative complexity, limited interoperability, and delayed verification processes.

In response, market players are turning to block chain enabled platforms to enable decentralized, real-time tracking, enhancing traceability and trust. This approach mitigates the risk of double counting and fraud, shortens settlement timelines, and reduces transaction costs.

By faciliatating cross-border trading and ensuring verifiable certificate provenance, blockchain is emerging as a major solution for scaling both compliance and voluntary REC markets. As demand for credible and auditable green energy sourcing rises, this technology-driven trend is becoming a key differentiator for market participants.

- In March 2023, GoNetZero collaborated with Instituto Totum to launch a blockchain-powered digital platform for trading Brazil International Renewable Energy Certificates (I-REC). The partnership aims to provide end-to-end management of Brazil’s I-REC system by integrating the digital platforms of both entities.

Renewable Energy Certificate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Energy Type

|

Solar Energy, Wind Power, Gas Power, Hydro-electric Power

|

|

By Capacity

|

Greater than 5000 KWH, 1000-5000 KWH, 0-1000 KWh

|

|

By End Use

|

Compliance, Voluntary

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Energy Type (Solar Energy, Wind Power, Gas Power, and Hydro-electric Power): The solar energy segment earned USD 8.16 billion in 2023 due to widespread adoption of large-scale solar installations and declining technology costs.

- By Capacity (Greater than 5000 KWH, 1000-5000 KWH, and 0-1000 KWh): The greater than 5000 KWH segment held a share of 51.24% in 2023, fueled by the prevalence of utility-scale renewable energy projects.

- By End Use (Compliance and Voluntary): The compliance segment is projected to reach USD 76.20 billion by 2031, propelled by regulatory requirements and renewable purchase mandates for utilities.

Renewable Energy Certificate Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America renewable energy certificate market share stood at around 32.98% in 2023, valued at USD 5.27 billion. This domainance is primarily attributed to well-established compliance frameworks, such as Renewable Portfolio Standards (RPS), across numerous U.S. states, requiring utilities to source a specific share of electricity from renewables.

The region has witnessed significant investments in wind and solar infrastructure, supported by favorable federal and state-level incentives. Additionally, there is a strong demand in the voluntary market segment, propelled by corporate and consumer sustainability commitments.

The maturity of renewable energy technologies, robust grid infrastructure, and reliable REC tracking systems such as the North American Renewables Registry (NAR) and Western Renewable Energy Generation Information System (WREGIS) further supports regional market expansion.

Asia Pacific renewable energy certificate industry is poised to grow at a CAGR of 27.05% over the forecast period. This growth is primarily fueled by rapid renewable energy deployment across major economies, including China, India, Japan, South Korea, and Australia.

Government initiatives aimed at decarbonization, national renewable energy targets, and financial incentives for green power generation have promoted large-scale investments in solar and wind projects.

In particular, China and India have set ambitious goals for renewable capacity additions, supported by large-scale infrastructure development and private sector participation. Furthermore, growing awareness of sustainability and increasing participation in voluntary REC programs are contributing to doemstic market expansion.

The ongoing development of transparent and standardized REC mechanisms in several Asia Pacific countries is expected to further enhance regional industry growth.

- In February 2025, according to the India Brand Equity Foundation, India announced a significant scale-up in its renewable energy investments, with an 83% increase to approximately USD 16.5 billion in 2024. Additionally, India plans to invest over USD 360 billion in renewable energy and infrastructure by 2030, including USD 190–215 billion to achieve 500 GW of renewable capacity and additional USD 150–170 billion for electricity transmission and storage development.

Regulatory Frameworks

- In the U.S, the Renewable Energy Certificate (REC) system is governed by state-level Renewable Portfolio Standards (RPS), which require electricity providers to source a specific percentage of their energy from renewable sources.

- In Europe, the EU Renewable Energy Directive forms the regulatory framework governing Renewable Energy Certificates. This directive mandates all member states to meet binding renewable energy targets, contributing to the EU’s overarching climate and energy goals.

Competitive Landscape

Key players operating in the renewable energy certificate (REC) industry are focusing on the development of long-term partnerships and agreements with renewable energy producers to ensure a consistent and scalable supply of RECs. These collaborations enable market participants to cater to both compliance and voluntary segments more effectively.

Moreover, they are prioritizing the integration of digital technologies for improved tracking, verification, and trading of RECs. By leveraging block chain and smart contract systems, companies are enhancing transparency, minimizing transaction costs, and building trust among stakeholders.

Additionally, investment in platform development and digital marketplaces has increased, offering streamlined REC transactions for a wider range of buyers and sellers, including small-scale producers and corporate sustainability buyers.

Several players are expanding their operations across emerging markets through acquisitions, joint ventures, and the localization of REC offerings tailored to regional regulatory frameworks. This regional diversification helps mitigate risks associated with policy changes and allows for better alignment with country-specific energy transition goals.

Furthermore, market participants are actively focusing on certification and compliance standardization by aligning with internationally recognized registries and frameworks. This enhances the credibility of issued RECs and supports cross-border trading opportunities as global demand for renewable energy sourcing is growing.

- In September 2023, Platts, a division of S&P Global Commodity Insights, collaborated with REsurety to introduce the first price assessments for Emissions-Adjusted (EA) Renewable Energy Certificates (RECs). The partnership aims to enhance transparency by incorporating carbon intensity into pricing. Leveraging REsurety's Locational Marginal Emissions (LMEs) data, Platts will assess the hourly carbon emissions impact of REC generation, beginning with the ERCOT market in the United States, and publish benchmark EA REC prices based on emissions impact.

List of Key Companies in Renewable Energy Certificate Market:

- Enel Spa

- Sterling Planet

- Mekrapid Products Ltd

- South Pole

- NextEra Energy Resources, LLC.

- CLP Power Hong Kong Limited

- Monsoon Carbon

- 3Degrees, Inc.

- Isaksen Solar

- SP group

- Statkraft

- Tenaga Nasional Berhad

- Ecohz

- Western Area Power Administration

- CRS

Recent Developments (Product Launch)

- In February 2025, Astana International Exchange (AIX) launched the trading of International Renewable Energy Certificates (I-REC), marking a significant step in the development of sustainable finance . The first transaction involved the purchase of 1,000 I-REC certificates by London-based trading firm Valor Carbon from Kazakhstan’s renewable energy producer Samruk-Green Energy. Verified by the ECOJER Association, these certificates were introduced to AIX’s sustainable finance portfolio in September 2024 as its first environmental instruments.