Market Definition

The market encompasses the extraction, processing, and utilization of chromite ore, a key source of chromium used in metallurgy, chemicals, and refractories. The market involves mining, beneficiation through gravity separation & flotation, and refining to produce ferrochrome and chromium compounds.

Chromium is essential in stainless steel production, contributing to corrosion resistance and durability. Additionally, chromite is used in foundry sands, refractory bricks, and pigments. Its applications extend to aerospace, automotive, and construction sectors, due to its strength-enhancing properties.

Chemical-grade chromite is vital in leather tanning and catalysts, making the market integral to multiple industrial processes. The report highlights the primary market drivers, alongside significant trends, regulatory frameworks, and the competitive landscape, shaping the market expansion in the coming years.

Chromite Market Overview

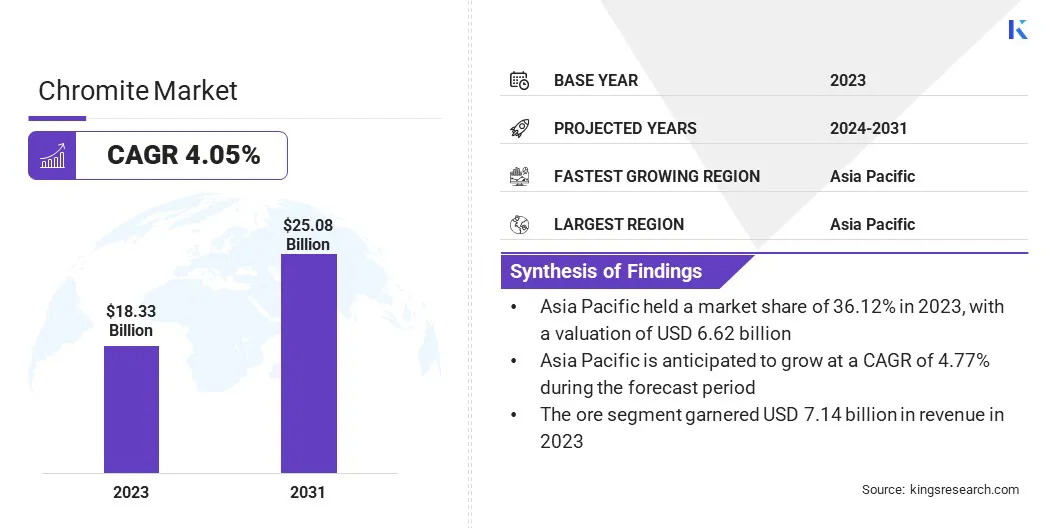

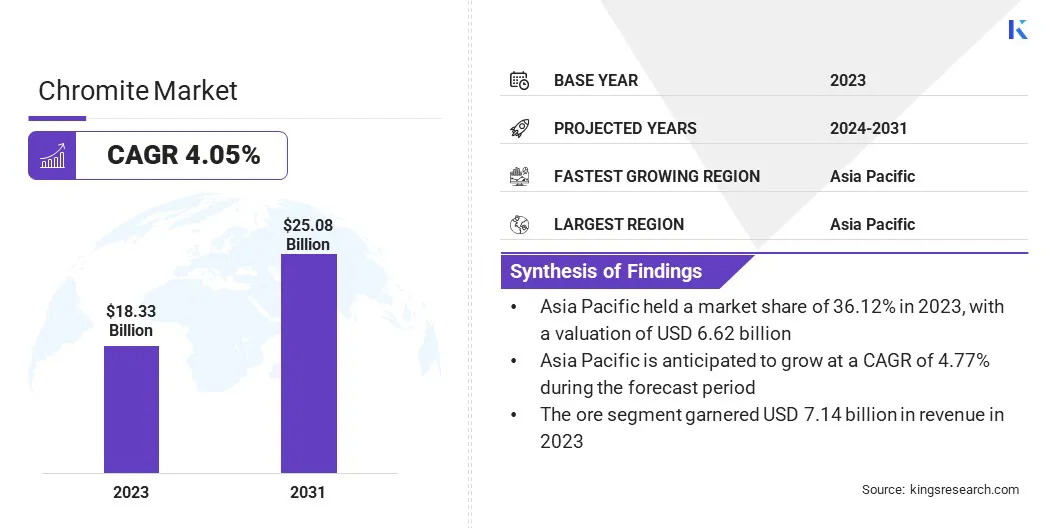

The global chromite market size was valued at USD 18.33 billion in 2023 and is projected to grow from USD 18.99 billion in 2024 to USD 25.08 billion by 2031, exhibiting a CAGR of 4.05% during the forecast period.

Strategic mining initiatives and government policies are strengthening the market by promoting resource exploration and ensuring regulatory support for sustainable extraction. Additionally, technological advancements in chromite processing are improving efficiency, reducing waste, and enhancing product quality, driving demand across key industries such as stainless steel and specialty alloys.

Major companies operating in the global chromite industry are Glencore, Assmang Proprietary Limited, Samancor Chrome, YILDIRIM Group, Eurasian Resources Group, Outokumpu Oyj, Merafe Resources Limited, International Ferro Metals Limited, Tata Steel, Afarak Group SE, Hernic Ferrochrome (Pty) Ltd, Ferro Alloys Corporation Ltd., CVK Madencilik, KWG Resources Inc., and Oman Chromite Company.

Expanding construction activities globally have increased the demand for chromite-based materials. Infrastructure projects, including bridges, highways, commercial buildings, and energy facilities, require corrosion-resistant steel, which relies on ferrochrome.

Government initiatives promoting smart cities, transportation networks, and industrial zones are fueling the demand for stainless steel, directly impacting the market. In developing regions, rising investments in public infrastructure have further strengthened the supply chain for chromite mining and ferrochrome production, contributing to market expansion.

Key Highlights:

- The chromite industry size was valued at USD 18.33 billion in 2023.

- The market is projected to grow at a CAGR of 4.05% from 2024 to 2031.

- Asia Pacific held a market share of 36.12% in 2023, with a valuation of USD 6.62 billion.

- The ore segment garnered USD 7.14 billion in revenue in 2023.

- The stainless steel production segment is expected to reach USD 12.31 billion by 2031.

- Europe is anticipated to grow at a CAGR of 4.77% during the forecast period.

Market Driver

Strategic Mining Initiatives and Government Policies

Governments in major chromite-producing regions have introduced policies to enhance mineral development, creating growth opportunities in the market. Strategic investments, infrastructure improvements, and streamlined regulatory frameworks in South Africa, Kazakhstan, and India strengthen the mining sector in these countries.

Increased foreign direct investment in mining projects has expanded exploration activities, improving the availability of high-grade chromite ore. Policies supporting sustainable mining and responsible extraction have further enhanced production efficiency, driving the market.

- In October 2024, Oman’s Ministry of Energy and Minerals finalized two mining concession agreements for the development of Concession Areas 11-A and 51-F, aligning with the nation’s strategy to expand its mining sector. The agreements were awarded to Oman Chromite Company and Minerals Development Oman (MDO). Under these agreements, both companies are required to undertake an extensive exploration program, incorporating topographic mapping, geophysical surveys, and remote sensing techniques. Additionally, they will conduct geological mapping along with geochemical and physical analyses to assess the resource potential of the designated areas.

Market Challenge

Environmental Regulations and Sustainability Concerns

Environmental regulations and sustainability concerns pose significant challenges to the growth of the chromite market. Mining operations must comply with strict emission controls, waste management policies, and land restoration mandates, increasing operational costs and limiting expansion.

Companies are investing in eco-friendly extraction technologies, adopting advanced waste recycling methods, and implementing sustainable mining practices. Strategic collaborations with environmental agencies and research institutions are driving the development of low-impact processing techniques.

Additionally, businesses are integrating renewable energy sources into mining operations, reducing carbon footprints while ensuring long-term compliance with evolving regulatory frameworks.

Market Trend

Technological Advancements in Chromite Processing

Improved metallurgical techniques have optimized chromite refining, lowering production costs and increasing yield efficiency. Innovations in beneficiation processes, including gravity separation and flotation, have enhanced ore purity, strengthening the market.

Smelting technologies with higher energy efficiency have enabled cost-effective ferrochrome production, improving supply chain stability. Companies are investing in automation and AI-driven monitoring systems to optimize extraction processes, reducing waste and enhancing operational efficiency. These advancements are significantly increasing production capacity and driving the market.

- In October 2024, researchers at the Islamic Azad University in Tehran, Iran, conducted a study focusing on the recovery of chromite fines using the Slon High Gradient Magnetic Separator. This advanced magnetic separation technology effectively isolates fine chromite particles from ore processing streams, enhancing resource utilization in chromite processing. The study demonstrated that employing the Slon separator significantly improves chromite recovery rates while minimizing environmental impact, marking a substantial advancement in chromite processing technology.

Chromite Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Ore, Chromium-rich Slags, Chromite Sands, Others

|

|

By Application

|

Stainless Steel Production, Chemical Industry, Refractories Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Ore, Chromium-rich Slags, Chromite Sands, and Others): The ore segment earned USD 7.14 billion in 2023, due to its direct use in ferrochrome production, which is essential for stainless steel manufacturing, along with rising demand from metallurgical, refractory, and chemical industries.

- By Application (Stainless Steel Production, Chemical Industry, Refractories Manufacturing, and Others): The stainless steel production segment held 46.43% share of the market in 2023, due to the high demand for ferrochrome, a key alloying element that enhances corrosion resistance, strength, and durability in stainless steel.

Chromite Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a market share of around 36.12% in 2023, with a valuation of USD 6.62 billion. The expansion of stainless steel manufacturing in China and India is significantly strengthening the chromite market in Asia-Pacific.

China, the world’s largest stainless steel producer, continues to invest in high-capacity ferrochrome plants to meet domestic and export demands. Increased government initiatives to boost steel production and reduce import dependence have further amplified the demand for chromite in the region.

- In November 2024, China’s net stainless steel exports reached 309,100 metric tons, marking a 19.3% increase from the previous month and a 37.62% rise compared to the same period last year, as reported by China’s customs authorities. Cumulatively, from January to November 2024, the country's net stainless steel exports totaled 2.8431 million metric tons, reflecting a 42.22% year-on-year growth.

Additionally, the availability of low-cost labor and raw materials has attracted foreign investors to establish ferrochrome plants in the region. Enhanced production capabilities, coupled with favorable trade policies, are reinforcing the growth of the market across Asia-Pacific.

The chromite industry in Europe is poised for significant growth at a robust CAGR of 3.87% over the forecast period. European industries are actively integrating chromium recycling into their supply chains to reduce dependency on raw chromite imports.

This shift has led to technological advancements in ferrochrome recovery and refining processes, supporting the region’s market while aligning with stringent environmental regulations. Moreover, Turkey and Kazakhstan play a pivotal role in Europe’s chromite supply, with both countries investing in mining and ferrochrome processing capacities.

Turkey has expanded its chromite extraction operations to support regional steel manufacturers, while Kazakhstan’s Eurasian Resources Group (ERG) continues to be a key supplier of high-grade ferrochrome to European markets. These developments have secured a consistent chromite supply, reducing reliance on imports from non-European sources.

Regulatory Frameworks

- In the U.S., chromite mining is regulated by federal laws such as the Clean Air Act (CAA) and the Clean Water Act (CWA), ensuring strict emissions control and water pollution management. The Resource Conservation and Recovery Act (RCRA) mandates proper waste disposal, while the National Environmental Policy Act (NEPA) requires environmental assessments for large-scale mining projects.

- The European Union (EU) enforces strict environmental and industrial regulations through the Industrial Emissions Directive (2010/75/EU) and the REACH framework, which governs the use and disposal of chromium compounds to mitigate environmental and health risks. The Waste Framework Directive further regulates hazardous waste from chromite mining, ensuring safe disposal and recycling. Germany implements these directives through the Federal Mining Act and the Federal Immission Control Act, imposing rigorous environmental controls on mining operations.

- The chromite mining sector in China is regulated under the Environmental Protection Law, which imposes stringent environmental impact assessments and penalties for non-compliance. The Mineral Resources Law governs mining licenses and mandates the rehabilitation of mined-out areas to reduce ecological damage.

- Japan enforces rigorous environmental policies for chromite processing under the Basic Environment Law and the Mine Safety Act. These regulations ensure that mining operations adhere to strict environmental standards, including emissions control and hazardous waste management. The government mandates pollution mitigation strategies for industries handling chromium-based products, ensuring minimal environmental impact.

Competitive Landscape:

The chromite market is characterized by market players that are strengthening their presence by adopting strategies such as strategic agreements, enabling resource optimization and expanding exploration activities. These collaborations facilitate access to high-potential reserves, enhance operational efficiencies, and drive technological advancements in chromite extraction and processing.

Companies are improving supply chain stability and ensuring sustainable raw material availability by securing long-term exploration rights and forming joint ventures. Such initiatives contribute to the growth of the market by fostering investment in large-scale mining projects and supporting regional production capabilities.

- In June 2023, Oman Chromite Company entered into an agreement with Minerals Development Oman (MDO) to jointly explore and prospect chromite ore across two designated sites in the Al Batinah North and Al Buraimi governorates.

List of Key Companies in Chromite Market:

- Glencore

- Assmang Proprietary Limited

- Samancor Chrome

- YILDIRIM Group

- Eurasian Resources Group

- Outokumpu Oyj

- Merafe Resources Limited

- International Ferro Metals Limited

- Tata Steel

- Afarak Group SE

- Hernic Ferrochrome (Pty) Ltd

- Ferro Alloys Corporation Ltd.

- CVK Madencilik

- KWG Resources Inc.

- Oman Chromite Company

Recent Developments (Agreements/Expansion)

- In February 2025, Glencore's Merafe Venture entered into a chrome management agreement with Sibanye-Stillwater, aiming to enhance chromite recovery at Sibanye's South African PGM operations. This collaboration is expected to optimize chrome output, leveraging synergies to improve operational efficiencies and bolster the chromite demand amidst fluctuating platinum prices.

- In November 2024, Eurasian Resources Group (ERG) inaugurated the Bolashak chromium mine in Khromtau. The new site will ensure a stable long-term supply of high-quality raw materials for Kazakhstan’s ferroalloy plants. Advanced automated and remotely controlled equipment will enhance operational safety and boost workforce productivity.

South Africa, Kazakhstan, and India are strengthening their mining sectors through