Market Definition

The market involves the production, distribution, and application of chlorinated paraffins, which are chemical compounds derived from chlorinating paraffin. These compounds are primarily used as plasticizers, flame retardants, and lubricants across industries such as automotive, construction, textiles, and plastics.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Chlorinated Paraffin Market Overview

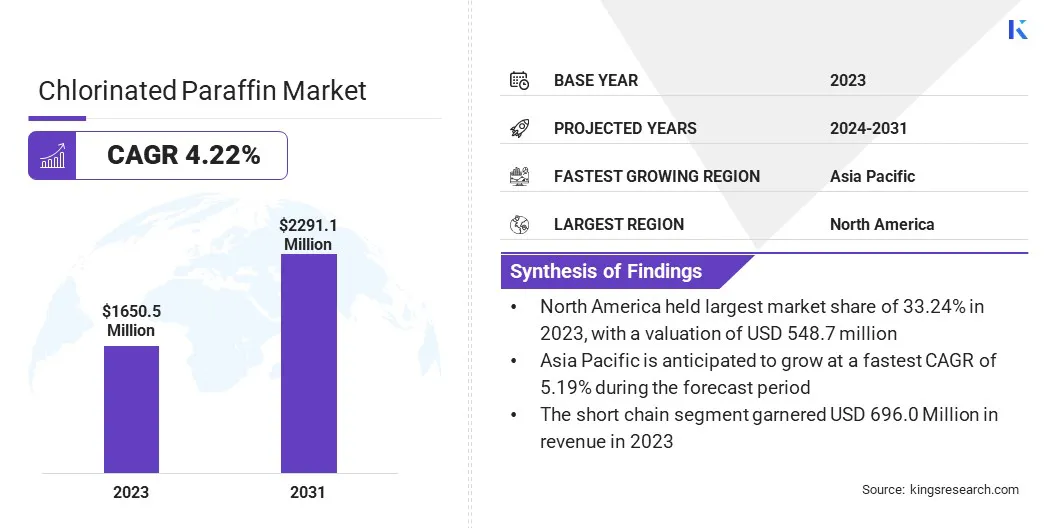

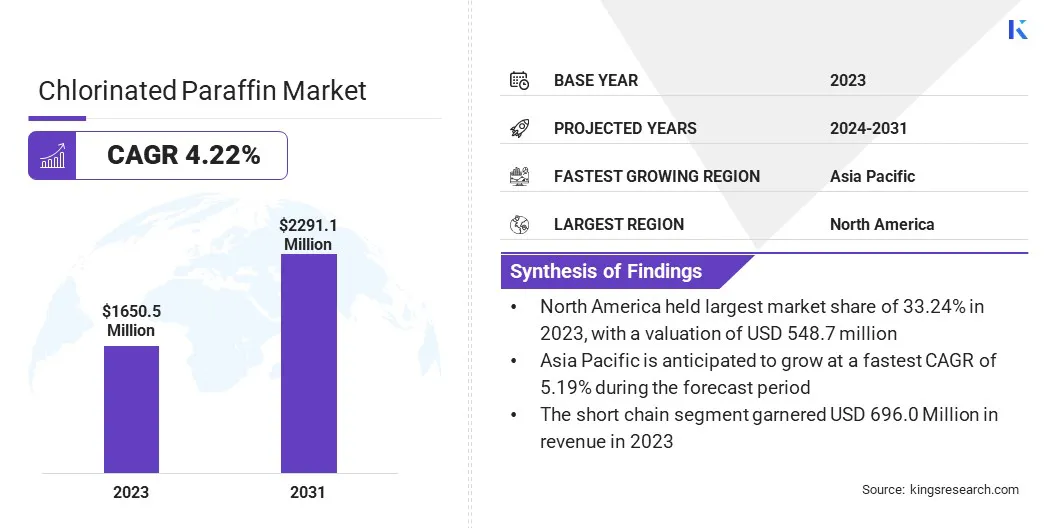

The global chlorinated paraffin market size was valued at USD 1650.5 million in 2023 and is projected to grow from USD 1715.5 million in 2024 to USD 2291.1 million by 2031, exhibiting a CAGR of 4.22% during the forecast period.

Growing demand from end-use industries such as automotive, construction, agriculture, and electronics is leading to increased consumption of various chemical products.

Additionally, the market is experiencing a strong shift toward sustainable and bio-based chemicals, supported by increasing environmental awareness and stricter regulatory frameworks. Technological advancements in production processes, including automation and AI integration, are improving operational efficiency and product quality.

Major companies operating in the chlorinated paraffin industry are INOVYN, Grasim Industries Limited, Dover Chemical Corporation, LEUNA-Tenside GmbH, JSC Kaustik, Ajinomoto Fine-Techno Co., Inc, Aditya Birla Chemicals Limited, KLJ Group, Química del Cinca, Flow Tech Group of Industries, OMAL, Altair Chemical, NCP Chlorchem, Caffaro Industrie, Makwell Group, and others.

Ongoing investment in research and development (R&D) within the chemical manufacturing industry is fostering innovation, improving product offerings and production efficiency.

This progress helps manufacturers meet evolving industry standards and sustainability goals, while advancing the development of high-performance materials. As global demand for specialized chemical solutions rises, R&D remains crucial in strengthening market competitiveness and ensuring long-term growth.

- As of mid-2024, According to the International Trade Administration, the U.S. chemical manufacturing industry comprised 14,000 establishments producing over 70,000 products, employing more than 902,300 people. In 2023, total foreign direct investment (FDI) in the sector reached USD 766.7 billion. Foreign-owned firms contributed USD 60.2 billion to U.S. exports in 2022 and invested USD 28.2 billion in research and development (R&D).

Key Highlights:

Key Highlights:

- The chlorinated paraffin industry size was recorded at USD 1650.5 million in 2023.

- The market is projected to grow at a CAGR of 4.22% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 548.7 million.

- The short chain technology segment garnered USD 696.0 million in revenue in 2023.

- The lubricating additives segment is expected to reach USD 626.3 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 5.19% over the forecast period.

Market Driver

"Rising Investment in Domestic Production Capabilities"

The growth of the chlorinated paraffin market is fueled by increasing investment in domestic production capabilities. Governments and private companies are focusing on expanding manufacturing capacities and diversifying chemical outputs. This investment is enhancing supply chain resilience, ensuring a steady supply of essential chemicals, and supporting growth.

- In June 2023, during the 10th Arab-China Business Forum in Saudi Arabia, a USD 10 billion investment agreement was announced. Among the key deals Saudi Arabia’s Ministry of Investment (MISA), the Ministry of Industry and Mineral Resources, and Chinese manufacturer signed a USD 150 million agreement to establish production facilities in Saudi Arabia for caustic soda, chlorine derivatives, chlorinated paraffin, calcium chloride, polyvinyl chloride (PVC), and related products.

Market Challenge

"Volatility in Raw Material Prices"

A major challenge limiting the expansion of the chlorinated paraffins market is the volatility of raw material prices, particularly due to fluctuations in crude oil prices, which directly affect the cost of chlorinated paraffin production. These price fluctuations can lead to inconsistent profit margins for manufacturers and disrupt supply chains.

To address this challenge, companies are investing in supply chain diversification and exploring alternative feedstocks to reduce dependency on crude oil. Furthermore, adopting more efficient production processes and improving operational efficiency can help mitigate the impact of raw material cost volatility.

Market Trend

"Notable Shift Toward Medium and Long-Chain Chlorinated Paraffins (MCCPs and LCCPs)"

The chlorinated paraffin market is witnessing a notable shift toward medium and long-chain chlorinated paraffins. Short-chain chlorinated paraffins have been flagged for their persistence in the environment and their potential toxicity.

However, medium and long-chain variants are perceived as environmentally friendly and less harmful, making them more appealing for manufacturers, particularly as regulations tighten around hazardous chemicals. This trend is being influenced by the growing demand for sustainable and safer chemicals across key end-use industries such as plastics to lubricants.

Chlorinated Paraffin Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Short Chain, Medium Chain, Long Chain

|

|

By Application

|

Lubricating Additives, Plastics, Rubber, Paints, Adhesives & Sealants, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Short Chain, Medium Chain, and Long Chain): The short chain segment earned USD 696.0 million in 2023 due to its widespread use in industrial applications such as plasticizers, lubricants, and as a component in fuel additives, where high performance under demanding conditions is essential.

- By Application (Lubricating Additives, Plastics, Rubber, and Paints, and Adhesives & Sealants): The lubricating additives held a share of 27.30% in 2023, propelled by the growing automotive and machinery industries, which require high-performance lubricants to reduce friction and extend equipment life.

Chlorinated Paraffin Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America chlorinated paraffin market accounted for a share of around 33.24% in 2023, valued at USD 548.7 million. This growth is fostered by the region's strong industrial base and established PVC industry, which relies heavily on chlorinated paraffins.

North America chlorinated paraffin market accounted for a share of around 33.24% in 2023, valued at USD 548.7 million. This growth is fostered by the region's strong industrial base and established PVC industry, which relies heavily on chlorinated paraffins.

The surging demand for chlorinated paraffin is further supported by regulatory shifts toward safer, more sustainable products in manufacturing processes. Additionally, technological innovations in chemical production are fueling this growth, creating opportunities for manufacturers to expand and diversify their product offerings.

The Asia-Pacific chlorinated paraffin industry is estimated to grow at a CAGR of 5.19% over the forecast period. Prominent players are increasing their production capacities and expanding operations to meet the rising demand for chlorinated paraffins across industries such as automotive, construction, and manufacturing.

New manufacturing plants are being established in key countries such as China and India to cater to growing industrial needs.

- In February 2023, Payal Group commissioned a 35 KTA expansion of its chlorinated paraffins production at India’s sole integrated primary and secondary plasticizers manufacturing facility in Dahej, Bharuch, Gujarat. This expansion increased the company’s total capacity to 70 KTA.

Regulatory Frameworks

- In the U.S., short-chain chlorinated paraffins (SCCPs) are regulated under the Toxic Substances Control Act (TSCA). The Environmental Protection Agency (EPA) has issued a Significant New Use Rule (SNUR) for SCCPs, requiring manufacturers and importers to notify the EPA at least 90 days before starting or resuming new uses. This allows the EPA to evaluate and potentially restrict such activities.

- In Europe, chlorinated paraffins are classified as hazardous under the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation. Manufacturers and importers must register these susbtances, submit safety data, and comply with stringent environmental and safety standards. Certain chlorinated paraffins are banned or restricted due to their environmental persistence.

- Globally, the Stockholm Convention on Persistent Organic Pollutants (POPs) has listed short-chain chlorinated paraffins as new POPs, prompting a global phase-out of their production and use to protect human health and the environment.

Competitive Landscape

Key players in the chlorinated paraffin industry are expanding their production capabilities and improving product formulations. They are further developing high-quality chlorinated paraffin products for various applications such as plasticizers, lubricants, and flame retardants.

Additionally, these players are strengthening their position through strategic joint ventures and partnerships to enhance their product offerings and market presence. These collaborations allow companies to combine their expertise in manufacturing and distribution.

- In May 2024, Aarti Industries Limited and UPL Limited formed a joint venture, with both companies holding an equal 50%-50% stake. It focuses on the production and marketing of specialty chemicalsfor various downstream industries. This strategic collaboration aims to leverage the strengths of both companies to expanding their product offerings and market reach in the specialty chemicals sector.

List of Key Companies in Chlorinated Paraffin Market:

- INOVYN

- Grasim Industries Limited

- Dover Chemical Corporation

- LEUNA-Tenside GmbH

- JSC Kaustik

- Ajinomoto Fine-Techno Co., Inc

- Aditya Birla Chemicals Limited

- KLJ Group

- Química del Cinca

- Flow Tech Group of Industries

- OMAL

- Altair Chemical

- NCP Chlorchem

- Caffaro Industrie

- Makwell Group

Recent Developments (Investment/Expansion)

- In April 2025, Shivtek Spechemi Industries Ltd, a part of the Shiva Group of Industries, announced a USD 75 million investment to establish new chemical manufacturing units in Gujarat and Rajasthan. The expansion aims to increase production capacity for caustic soda, chlorine, and derivatives such as chlorinated paraffin. The Gujarat facility will leverage its proximity to Hazira port for cost-effective logistics, while the Rajasthan plant will benefit from strong industrial infrastructure. Both facilities will prioritize green manufacturing and eco-friendly products.

- In June 2023, KLJ Group inaugurated a new Plasticizers & Phthalic Anhydride production facility in Gujarat, with an investment of USD 145 million. This facility is BIS-certified and marks a milestone in KLJ's backward integration strategy.

- In April 2023, Konnark expanded its manufacturing capabilities by establishing a new plant at Bharuch, Gujarat, dedicated to the production of chlorinated paraffin wax. The facility has an installed capacity of 42,000 TPA for chlorinated paraffin wax, along with 75,000 TPA for hydrochloric acid and sodium hypochlorite.

Key Highlights:

Key Highlights: North America chlorinated paraffin market accounted for a share of around 33.24% in 2023, valued at USD 548.7 million. This growth is fostered by the region's strong industrial base and established PVC industry, which relies heavily on chlorinated paraffins.

North America chlorinated paraffin market accounted for a share of around 33.24% in 2023, valued at USD 548.7 million. This growth is fostered by the region's strong industrial base and established PVC industry, which relies heavily on chlorinated paraffins.