Market Definition

The market comprises solutions and services that facilitate the issuance, management, and validation of digital certificates, ensuring secure online communications and identity authentication. This market is segmented by component into certificates and services, catering to both small & medium enterprises and large enterprises.

Key certificate types include domain-validated, organization-validated, extended-validated, and self-signed certificates. The market serves industries such as banking, financial services, and insurance, IT & telecom, healthcare, government, and e-commerce.

Certificate Authority Market Overview

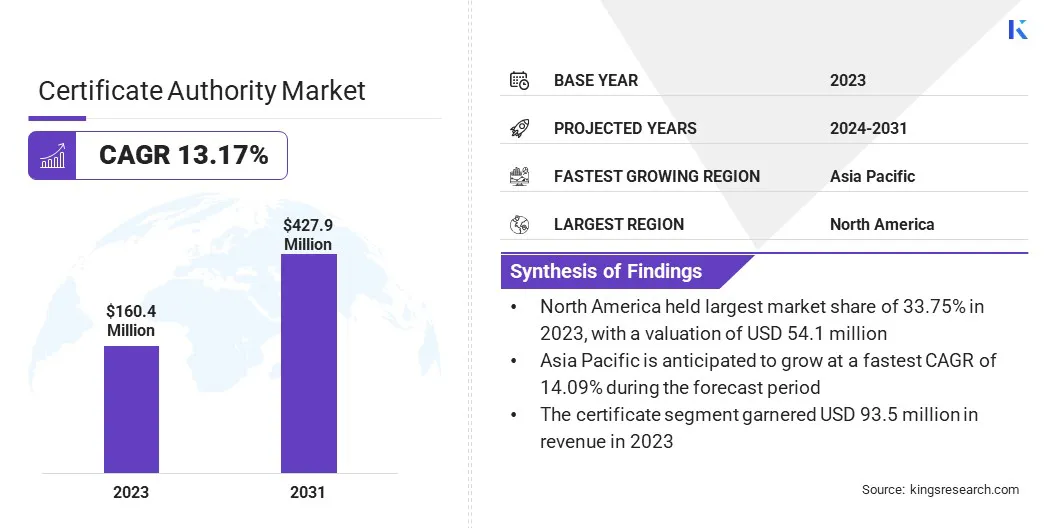

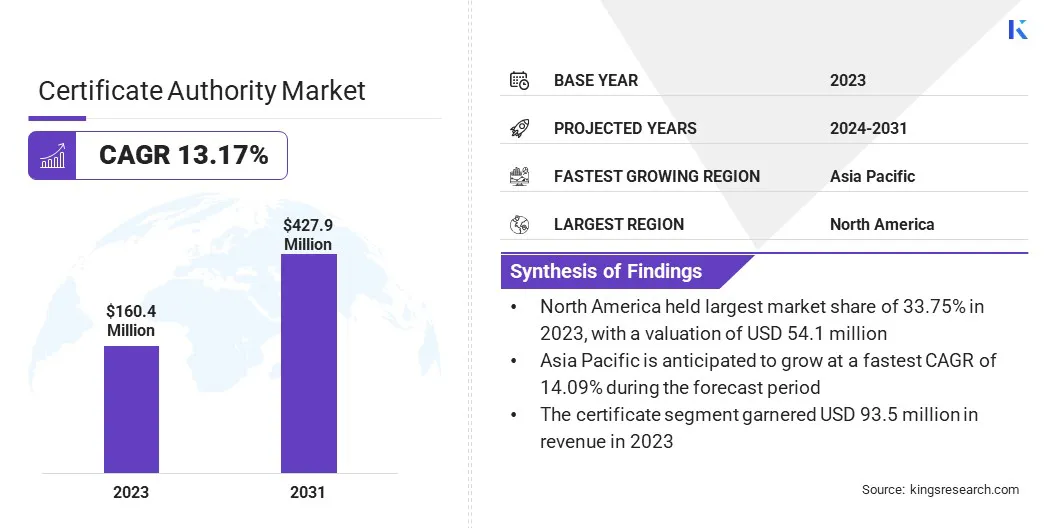

The global certificate authority market size was valued at USD 160.4 million in 2023 and is projected to grow from USD 179.9 million in 2024 to USD 427.9 million by 2031, exhibiting a CAGR of 13.17% during the forecast period. This market is registering robust growth, driven by the increasing demand for secure digital communication and identity authentication solutions.

Rising adoption of Secure Sockets Layer (SSL) and Transport Layer Security (TLS) certificates across websites and digital platforms to ensure data encryption and user trust is a key factor fueling the market. The growing emphasis on regulatory compliance, particularly in sectors such as BFSI, healthcare, and government, has accelerated the deployment of CA solutions.

Major companies operating in the certificate authority industry are Internet Security Research Group, GMO Internet Group, Inc., Sectigo Group Inc. CA Ltd., GoDaddy Operating Company, LLC., DigiCert, Inc., Entrust Corporation, SSL.com, Gen Digital Inc., Newfold Digital, VeriSign, Inc., Trustwave Holdings, Inc., Asseco Data Systems S.A., Assa Abloy AB, Aruba S.p.A., and Buypass AS.

Additionally, the rapid proliferation of e-commerce, cloud services, and digital payment platforms is driving the demand for robust security frameworks. The increasing reliance on remote work environments, IoT ecosystems, and connected devices has amplified the need for secure network infrastructures, contributing to market growth.

Advancements in cryptographic technologies and automated certificate lifecycle management are also enhancing operational efficiency and scalability, further strengthening the market outlook.

- In October 2024, Siemens and Nexus announced their partnership to integrate Nexus GO Cards with Siemens’ SiPass system. The collaboration focused on simplifying and enhancing secure physical access management through a cloud-based platform.

Key Highlights

- The certificate authority industry size was valued at USD 160.4 million in 2023.

- The market is projected to grow at a CAGR of 13.17% from 2024 to 2031.

- North America held a market share of 33.75% in 2023, with a valuation of USD 54.1 million.

- The certificate segment garnered USD 93.5 million in revenue in 2023.

- The small & medium enterprises segment is expected to reach USD 247.3 million by 2031.

- The domain validated segment is expected to reach USD 135.7 million by 2031.

- The BFSI segment is expected to reach USD 128.1 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 14.09% during the forecast period.

Market Driver

"Cybersecurity and Global Compliance"

The certificate authority market is registering significant growth, driven by rising cybersecurity threats and the growing demand for comprehensive security solutions across regions. Businesses are increasingly prioritizing data protection and trust with customers as cyberattacks become more frequent and sophisticated.

Cyber threats such as data breaches, ransomware, and phishing attacks have heightened the need for robust digital certificates, including SSL/TLS certificates, to ensure secure communication and authentication.

In today's digital landscape, securing websites, online transactions, and sensitive customer data is more critical than ever. SSL/TLS certificates are essential tools for encrypting data and verifying the identity of online entities, offering a trusted and secure way to protect sensitive information during transmission over the internet.

Additionally, as organizations expand their digital presence globally, they face the challenge of adhering to region-specific security regulations and compliance requirements. This has fueled the demand for certificate authority services that can provide scalable, cross-border security solutions.

Businesses require digital certificates, identity management, and encryption solutions that not only ensure secure communication across regions but also comply with local data privacy laws and international standards.

This demand for compliance-driven security solutions is driving the need for certificate authorities to enhance their offerings and provide regionally tailored services to ensure that businesses maintain trust, meet legal obligations, and secure their digital infrastructure globally.

- In April 2024, DigiCert and Deutsche Telekom announced a strategic partnership to enhance digital certificates and identity management offerings. The collaboration aimed to deliver comprehensive security solutions tailored to the diverse needs of European customers, focusing on public key infrastructure, identity and access management, and hardware security solutions for various devices.

Market Challenge

"Complexity of Certificate Lifecycle Management"

A major challenge in the certificate authority market is the increasing complexity of certificate lifecycle management, particularly for large organizations with expansive digital infrastructures. As businesses scale, they often require hundreds or thousands of certificates for various applications, websites, and devices.

Managing these certificates, ensuring timely renewals, and handling updates or revocations can become overwhelming, especially when dealing with large volumes across different platforms. This complexity makes it easier for errors to occur, such as missed renewals or improper revocations, creating security vulnerabilities.

Expired certificates or mismanaged digital certificates can leave critical systems exposed to cyberattacks, posing significant risks to data integrity and trust. Certificate authorities are offering automated certificate management solutions that streamline the lifecycle process.

Automated systems help organizations monitor certificate statuses, schedule renewals, and manage updates or revocations with minimal human intervention.

Market Trend

"Rise of Subscription-based Certificates and Shift Toward Cloud-based Certificate Management"

The certificate authority market is registering key trends that are reshaping the way organizations manage digital certificates and security solutions. One of the key trends is the rise of subscription-based certificate solutions and API integrations.

This shift allows SSL/PKI resellers, domain registrars, web hosts, and Managed Service Providers (MSPs) to automate certificate lifecycle management and domain validation through a single API.

Businesses can eliminate traditional per-certificate costs by moving to a subscription-based model, enabling them to scale their operations more efficiently while streamlining certificate management. This trend is making the process more cost-effective and providing additional benefits like enhanced automation and simplified workflows.

- In February 2025, Sectigo launched Certificates as a Service (CaaS), designed for SSL/PKI resellers, domain registrars, web hosts, and MSPs. The new offering enables partners to automate certificate lifecycle management and domain validation procedures through a single API, while offering a subscription-based pricing model that eliminates traditional per-certificate costs and enhances scalability.

Another trend is the increasing shift toward cloud-based certificate solutions. As organizations continue to embrace cloud technologies, there is a growing demand for scalable, flexible, and cost-effective ways to manage digital certificates.

Cloud-based certificate authorities allow businesses to automate processes, centralize management, and ensure a seamless experience across multiple platforms. This trend not only makes it easier to deploy, monitor, and maintain certificates but also plays a crucial role in driving the growth of cloud-based security solutions in the market.

Certificate Authority Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Certificate, Services

|

|

By Organization

|

Small & Medium Enterprises, Large Enterprises

|

|

By Type

|

Domain validated, Organization validated, Extended validated, Self-Signed

|

|

By Vertical

|

BFSI, Retail, Government, Healthcare, Travel & Hospitality, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Certificate, Services): The certificate segment earned USD 93.5 million in 2023, due to the growing implementation of SSL/TLS certificates to enhance website security, encrypt digital transactions, and protect online communications.

- By Organization (Small & Medium Enterprises, Large Enterprises): The small & medium enterprises segment held 57.87% share of the market in 2023, due to increasing digitalization efforts and the growing need to secure customer data.

- By Type (Domain validated, Organization validated, Extended validated, Self-Signed): The domain validated segment is projected to reach USD 135.7 million by 2031, owing to its cost-effectiveness and ease of issuance, making it suitable for SMEs and individual website owners.

- By Vertical (BFSI, Retail, Government, Healthcare, Travel & Hospitality, Others): The BFSI segment is projected to reach USD 128.1 million by 2031, owing to regulatory requirements and the increasing need to secure financial transactions and sensitive customer information.

Certificate Authority Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a significant certificate authority market share of 33.75% in 2023, with a valuation of USD 54.1 million, driven by the advanced digital infrastructure, strong cybersecurity frameworks, and extensive adoption of online platforms in the region. The presence of major industry players, combined with heightened awareness of data protection, has further strengthened the region’s market position.

Regulatory mandates have played a pivotal role in accelerating the adoption of SSL/TLS certificates by enforcing stringent data protection measures, compelling organizations to implement encryption protocols to secure sensitive customer information.

Additionally, the region's thriving e-commerce industry, extensive use of cloud platforms, and increasing digital banking services have amplified the demand for robust security measures, further boosting the market.

The BFSI sector, in particular, has registered increased investments in security solutions to mitigate cyber threats and ensure secure financial transactions. Moreover, the rising adoption of IoT devices and connected infrastructure has further driven the demand for certificate authority solutions to enhance network security.

The certificate authority industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 14.09% over the forecast period. This expansion is driven by the region's rapid digital transformation, increasing internet penetration, and the widespread adoption of cloud computing and e-commerce platforms.

Countries such as China, India, Japan, and South Korea are registering substantial growth in digital ecosystems, compelling organizations to prioritize robust security frameworks to safeguard sensitive information.

Rising investments in fintech solutions, digital banking platforms, and online retail services are further driving the demand for secure authentication and encryption technologies. Additionally, government initiatives aimed at strengthening data privacy regulations are encouraging enterprises to adopt advanced security protocols, enhancing trust and protecting customer data.

The region’s expanding small and medium-sized enterprise sector is also contributing to growth, as businesses increasingly embrace digital platforms and require effective solutions to ensure secure communication channels.

- In November 2024, Speed Sign Technologies and Nexus announced their partnership to expand digital signature solutions in India. The collaboration aims to establish Speed Sign as the first private Certificate Authority in Rajasthan, issuing Digital Signature Certificates (DSCs) and e-signatures, leveraging Nexus' EAL 4+ certified Smart ID PKI platform for enhanced digital trust and security in the country's e-governance infrastructure.

Regulatory Frameworks

- In the U.S., no centralized government agency is solely dedicated to regulating CAs. However, the Federal Information Processing Standards (FIPS) outline cryptographic requirements that CAs must follow when handling federal data.

- In the EU, the eIDAS Regulation provides a legal framework for electronic identification and trust services, including requirements for CAs issuing qualified digital certificates. eIDAS mandates strict security controls, identity verification standards, and liability measures for CAs operating within EU member states.

- In China, the Electronic Signature Law of the People's Republic of China regulates CAs, ensuring secure electronic authentication services. This law requires CAs to obtain a license from the Ministry of Industry and Information Technology (MIIT) and follow defined standards for certificate issuance, data protection, and audit procedures.

- In Japan, the Act on Electronic Signatures and Certification Business governs the operation of CAs. The law outlines requirements for CA licensing, ensuring secure digital signatures, and mandates compliance with strict data integrity and confidentiality standards.

- In India, the Information Technology Act, 2000 provides the regulatory framework for CAs under the supervision of the Controller of Certifying Authorities (CCA). The CCA ensures that CAs comply with licensing requirements, security protocols, and key management standards to maintain the integrity and trustworthiness of digital certificates.

Competitive Landscape

The certificate authority industry is characterized by numerous established players and emerging firms offering a wide range of solutions to meet the growing demand for secure digital communications.

Market participants are actively investing in advanced encryption technologies, automation solutions for certificate lifecycle management, and cloud-based security services to enhance their offerings.

The increasing integration of AI and ML in security frameworks is further driving innovation, enabling providers to deliver more efficient threat detection, automated renewal processes, and improved identity authentication solutions.

Vendors are also expanding their service portfolios by offering comprehensive solutions that cater to enterprises of all sizes, from small businesses to large corporations. Strategic partnerships, collaborations with cloud service providers, and integration with digital identity platforms are becoming key approaches to enhance market presence.

Additionally, providers are focusing on improving user experience by streamlining certificate issuance processes and offering centralized management platforms for enhanced control and visibility.

Amid evolving regulatory compliance requirements, vendors are actively aligning their solutions to meet industry-specific security standards, ensuring data protection across sectors such as BFSI, healthcare, retail, and government.

- In December 2024, DigiCert announced the release of its open-source Domain Control Validation (DCV) library. The library is designed to strengthen the domain validation process, reduce errors in certificate issuance, and provide a standards-compliant solution to enhance transparency, compliance, and security for certificate authorities and developers globally.

List of Key Companies in Certificate Authority Market:

- Internet Security Research Group

- GMO Internet Group, Inc.

- Sectigo Group Inc. CA Ltd.

- GoDaddy Operating Company, LLC.

- DigiCert, Inc.

- Entrust Corporation

- SSL.com

- Gen Digital Inc.

- Newfold Digital

- VeriSign, Inc.

- Trustwave Holdings, Inc.

- Asseco Data Systems S.A.

- Assa Abloy AB

- Aruba S.p.A.

- Buypass AS

Recent Developments (M&A/Partnerships/Agreements/Product Launch)

- In January 2025, Sectigo announced the acquisition of Entrust’s public certificate business, significantly expanding its enterprise operations. The acquisition, which doubles Sectigo’s footprint in the market, enhances its Certificate Lifecycle Management (CLM) capabilities and prepares the company for emerging challenges such as shorter certificate lifespans and postquantum cryptography.

- In October 2024, Sectigo and SCC France announced their partnership to deliver premier digital trust solutions to the French market. The collaboration focuses on helping French organizations modernize digital certificate management processes, utilizing Sectigo’s automated Certificate Lifecycle Management platforms, including Sectigo Certificate Manager (SCM) and SCM Pro, to streamline the validation, issuance, and renewal of certificates across various business applications and infrastructures.

- In October 2024, Nexus announced that its GO Workforce solution achieved ANSSI qualification for eIDAS compliance, ensuring that its cloud-based identity management service meets France's regulatory standards. The certification strengthens digital trust and security for highly regulated sectors in France.

- In October 2024, GoDaddy announced the launch of its 90-day reissuance, fully installed and managed SSL certificates. The service provides five encryption refreshes annually and offers an automated process for SSL lifecycle management, reducing manual steps and ensuring continuous protection for websites.