Market Definition

Cellular IoT connects devices to the internet using mobile networks, enabling remote monitoring and control through embedded sim technology. It supports seamless data transmission over wide areas and across diverse environments. This connectivity solution serves industries such as smart agriculture, logistics, utilities and healthcare where reliable, low‑power communication is essential.

Businesses deploy cellular IoT to enable real‑time asset tracking, predictive maintenance, smart metering and remote diagnostics, driving operational efficiency and enabling scalable, data‑driven decision making.

Cellular IoT Market Overview

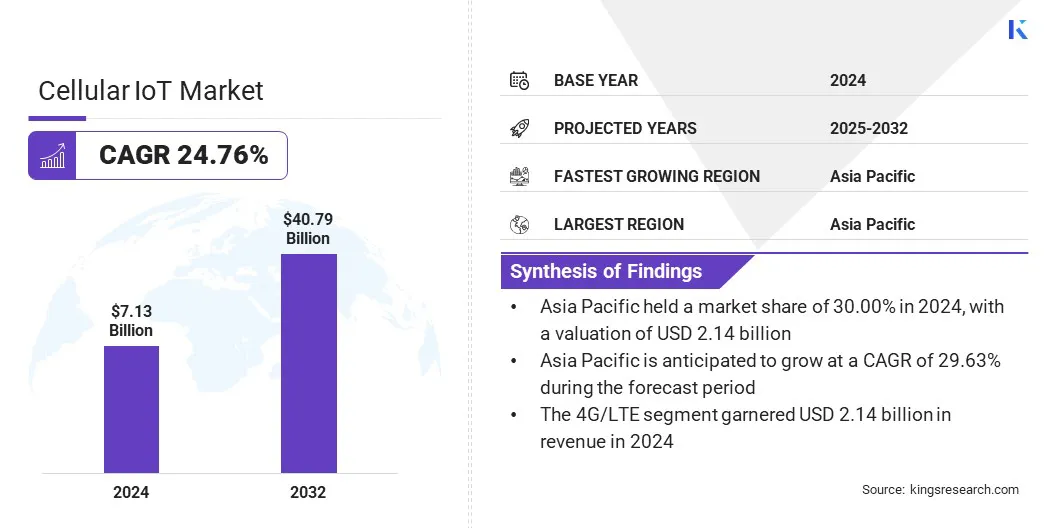

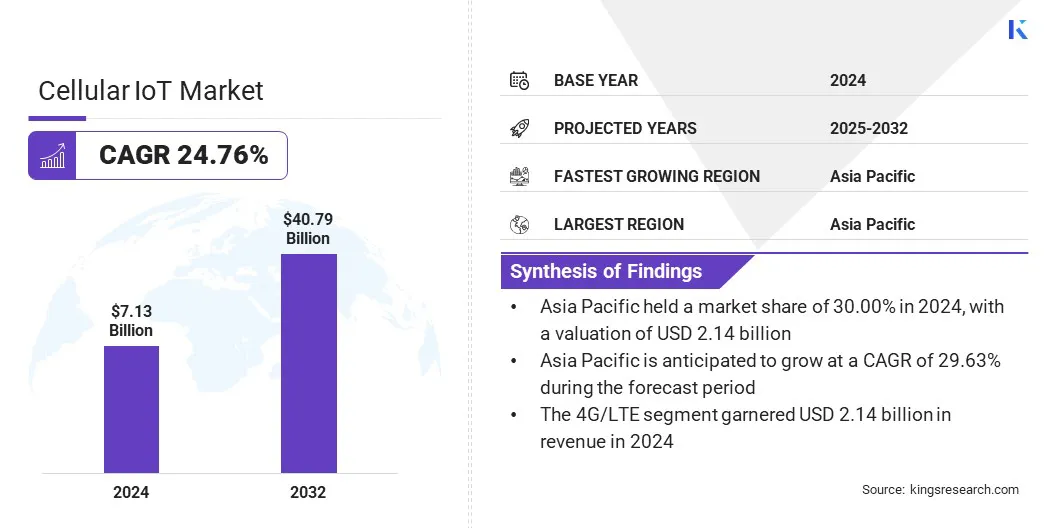

The cellular IoT market size was valued at USD 7.13 billion in 2024 and is projected to grow from USD 8.67 billion in 2025 to USD 40.79 billion by 2032, exhibiting a CAGR of 24.76% during the forecast period. The market is driven by the rising adoption of vehicle telematics and connected mobility solutions that require real-time data and wide-area connectivity.

Additionally, the integration of edge computing with cellular networks is enhancing responsiveness and reducing latency, making cellular IoT more viable for critical, time-sensitive applications.

Major companies operating in the cellular IoT industry are China Mobile International Limited, China Telecom, AT&T Intellectual Property, Verizon, Telekom Deutschland GmbH, Quectel, Fibocom Wireless Inc., Thales, Semtech Corporation, Qualcomm Technologies, Inc., MediaTek, Ericsson, Intel Corporation, Huawei Technologies Co., Ltd., and SEQUANS.

Expansion of 5G networks is driving rapid growth in the market by enabling ultra-reliable, low-latency, and high-capacity connectivity for advanced applications. For instance, Ericsson reported that total cellular IoT connections reached approximately 4 billion by the end of 2024, and is forecasted to grow at a CAGR of around 11% through 2030, exceeding 7 billion connections.

Industrial automation, automotive systems, and healthcare monitoring solutions are increasingly relying on cellular IoT to ensure seamless real-time communication and high device density. Enhanced network reliability is allowing mission-critical applications to operate with greater safety, speed, and precision. Manufacturers and service providers are integrating cellular IoT to support scalable and intelligent edge operations.

Key Highlights

- The global cellular IoT Industry size was valued at USD 7.13 billion in 2024.

- The market is projected to grow at a CAGR of 24.76% from 2025 to 2032.

- Asia Pacific held a market share of 30.00% in 2024, with a valuation of USD 2.14 billion.

- The 4G/ LTE segment garnered USD 2.14 billion in revenue in 2024.

- The software segment is expected to reach USD 17.44 billion by 2032.

- The industrial segment secured the largest revenue share of 30.60% in 2024.

- The healthcare providers segment is poised for a robust CAGR of 28.13% through the forecast period.

- North America is anticipated to grow at a CAGR of 21.61% during the forecast period.

Market Driver

Vehicle Telematics and Connected Mobility

The proliferation of cellular-connected vehicles is driving the demand for cellular IoT solutions across the automotive sector. Vehicle telematics systems are using cellular connectivity to enable real-time tracking, diagnostics, and remote monitoring across personal and commercial vehicles.

- In April 2024, Marelli launched ProConnect, a fully integrated cockpit and telematics platform, at the Auto China exhibition in Beijing. It combines instrument cluster, infotainment, and 5G telematics into a single System‑on‑Chip (MT8675 by MediaTek), supporting up to six displays and twelve cameras. An integrated TCU reduces component redundancy by up to 40 % compared to traditional architectures.

Applications such as vehicle-to-everything (V2X) communication, fleet management, and over-the-air (OTA) software updates depend on reliable, high-speed, low-latency cellular networks to ensure consistent performance and real-time data exchange.

Cellular IoT supports enhanced safety, predictive maintenance, and improved route optimization in connected mobility ecosystems. Growth in autonomous and semi-autonomous driving technologies is further increasing the need for robust and scalable connectivity.

Market Challenge

Security and Data Privacy Vulnerabilities Increasing Operational Risk

A key challenge in the cellular IoT market is the growing exposure to cybersecurity threats as more devices become connected across critical applications. Vulnerabilities such as unauthorized access, device hijacking, and exploitation of 5G network APIs are increasing operational risks and compromising data integrity. These vulnerabilities are critical in sectors like healthcare, industrial automation, and smart cities where secure data transmission is essential.

To address this challenge, market players are integrating advanced encryption protocols, developing secure device authentication frameworks, and working closely with telecom providers to harden network APIs. Companies are also deploying real-time threat monitoring and firmware update systems to proactively manage evolving security risks.

- In February 2025, Aeris launched IoT Watchtower, a fully integrated cellular IoT security solution. It delivers real-time visibility into device behavior and network traffic using embedded AI-driven threat detection. The platform also includes enforcement capabilities that allow enterprises and telecom operators to implement zero‑trust controls inline, all without requiring additional hardware or SIM modifications.

Market Trend

Integration of Edge Computing–Enabled Cellular Networks

The integration of edge computing with cellular networks is emerging as a key trend in the cellular IoT market, enhancing system performance and responsiveness. Localized data processing at the edge is minimizing reliance on cloud infrastructure, reducing latency, and improving bandwidth efficiency.

This architecture supports real-time decision-making and enables greater autonomy in critical applications such as industrial automation, smart cities, and connected infrastructure. Edge-enabled cellular networks are also facilitating scalable, low-latency operations across high-data-volume environments without overburdening central systems.

- In December 2024, Cavli Wireless launched its CQM220 5G RedCap cellular IoT module, which integrates advanced edge computing capabilities within the module. The new module supports on-board processing of data and analytics, enabling real-time decision-making without continuous cloud dependency. This enhances network flexibility by reducing latency, optimizing bandwidth usage, and empowering local autonomy for use cases like industrial automation and smart infrastructure.

Cellular IoT Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

2G, 3G, 4G/ LTE, 5G, NB-IoT (Narrowband IoT), LTE-M (LTE Cat-M1), EC-GSM-IoT

|

|

By Component

|

Hardware, Software, Services

|

|

By Application

|

Smart Utilities, Smart City, Healthcare, Automotive & Transportation, Industrial, Retail, Consumer Electronics, Agriculture

|

|

By End User

|

Enterprises, Government, Consumers, Utilities, Healthcare Providers, Agribusinesses, OEMs/ Device Manufacturers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (2G, 3G, 4G/ LTE, 5G, NB-IoT (Narrowband IoT), LTE-M (LTE Cat-M1), and EC-GSM-IoT): The 4G/ LTE segment earned USD 2.14 billion in 2024 due to its widespread network availability, proven reliability, and ability to support a broad range of IoT applications with moderate-to-high data and mobility requirements.

- By Component (Hardware, Software, and Services): The software segment held 17.44 of the market in 2024, due to the increasing need for device management platforms, connectivity management, and data analytics solutions that enable seamless integration, control, and optimization of large-scale IoT deployments.

- By Application (Smart Utilities, Smart City, Healthcare, Automotive & Transportation, Industrial, Retail, Consumer Electronics, and Agriculture): The Industrial segment is projected to reach USD 10.78 billion by 2032, owing to the high demand for real-time monitoring, automation, and predictive maintenance in manufacturing, energy, and logistics, which require reliable, wide-area connectivity and scalable IoT solutions.

- By End User (Enterprises, Government, Consumers, Utilities, Healthcare Providers, Agribusinesses, and OEMs/ Device Manufacturers): The healthcare providers segment is poised for significant growth at a CAGR of 28.13% through the forecast period, attributed to the growing demand for connected medical devices and remote patient monitoring systems that rely on reliable, real-time data transmission for efficient and continuous care delivery.

Cellular IoT Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific cellular IoT market share stood at around 30.00% in 2024, with a valuation of USD 2.14 billion. This dominance is driven by large-scale public initiatives across several Asia Pacific countries aimed at modernizing digital infrastructure.

These government-led programs are increasingly allocating substantial funding toward smart city development, industrial automation, and transportation upgrades that rely heavily on connected devices with real-time data capabilities.

For instance, the South Korean Ministry of Land, Infrastructure and Transport announced its 4th Smart City Comprehensive Plan for 2024–2028. The plan includes approximately USD 115 million investment in Gwangmyeong City to develop it as a climate-neutral pilot smart city.

Moreover, high adoption rates of connected consumer devices such as smart meters, wearables, and connected appliances in the region are expanding the volume of real-time data traffic across networks. This growing ecosystem of smart products is increasing the need for reliable and scalable cellular IoT networks to manage and transmit data efficiently.

The cellular IoT industry in North America is poised for a CAGR of 21.61% over the forecast period. This growth is largely driven by the ongoing modernization efforts within North American industries, particularly in manufacturing, energy, and logistics. Businesses in this region are increasingly adopting Industrial IoT (IIoT) technologies and investing in cellular-connected systems to support remote monitoring, predictive maintenance, and real-time supply chain tracking.

This strategic focus on enhancing operational efficiency and harnessing data-driven insights is driving robust demand for cellular IoT solutions, particularly those leveraging LTE-M and 5G networks.

- In February 2024, Digi International Inc., a U.S.–based IIoT company, launched the Digi IX40, a 5G edge computing industrial cellular router. The device supports LTE-M, 5G connectivity, and local edge intelligence for use cases such as predictive maintenance, asset monitoring, and advanced robotics. It integrates multiple machines with cloud-delivered operational technology (OT) and IT infrastructure to streamline operations in manufacturing, energy, and logistics environments.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) governs cellular IoT devices through regulations on radiofrequency emissions, device certification, and spectrum usage. In 2024, the FCC introduced a voluntary cybersecurity labeling program to enhance consumer awareness about the security features of IoT products. Cellular IoT deployments must also comply with the National Institute of Standards and Technology (NIST) guidelines for device encryption, secure updates, and network resilience.

- The European Union mandates that all cellular IoT devices comply with GDPR for personal data protection and the Radio Equipment Directive (RED) for technical conformity. ETSI standards define minimum cybersecurity and communication requirements. Manufacturers must also adhere to the Cyber Resilience Act, which introduces binding obligations for connected product security across the device lifecycle, including embedded software, patches, and remote connectivity.

- China regulates cellular IoT under the Cybersecurity Law and the Data Security Law, which enforce strict controls over cross-border data flows and require data localization for certain sectors. The Ministry of Industry and Information Technology (MIIT) manages spectrum licensing, equipment type approval, and security certification. Devices must also meet requirements set by the China Compulsory Certification (CCC) scheme and adhere to national encryption standards.

- Japan enforces cellular IoT regulations through the Ministry of Internal Affairs and Communications (MIC), which governs radiofrequency use and technical standards. Devices must obtain certification under the Radio Law and meet performance benchmarks recognized by international bodies such as the Global Certification Forum (GCF) and PCS Type Certification Review Board (PTCRB). Data protection is regulated by the Act on the Protection of Personal Information (APPI), covering IoT services with user data.

Competitive Landscape

Major players in the cellular IoT industry are adopting strategies such as setting up local manufacturing units, forming technology partnerships, and licensing established module technologies. These steps are helping companies reduce dependence on imports and ensure better control over supply chains.

Firms are also focusing on producing secure, certified cellular IoT modules to meet regional compliance needs. Investments in domestic production and collaborative development are contributing to the growth of the market.

- In December 2024, Eagle Electronics announced the establishment of a manufacturing facility in Solon, Ohio. The company raised USD 14 million to license Quectel’s cellular module technology and begin domestic production by March 2025. The facility aims to produce secure, US‑made cellular IoT modules through partnerships such as with Cherish Health.

List of Key Companies in Cellular IoT Market:

- China Mobile International Limited

- China Telecom

- AT&T Intellectual Property

- Verizon

- Telekom Deutschland GmbH

- Quectel

- Fibocom Wireless Inc.

- Thales

- Semtech Corporation

- Qualcomm Technologies, Inc.

- MediaTek

- Ericsson

- Intel Corporation

- Huawei Technologies Co., Ltd.

- SEQUANS

Recent Developments (Collaboration/Agreements/Product Launch)

- In February 2025, Onomondo and Syniverse collaborated to integrate Onomondo’s SoftSIM and connectivity management platform with Syniverse’s Tier‑1 IPX network and commerce solutions. The agreement enables enhanced global IoT device visibility, real-time monitoring, and streamlined billing processes.

- In January 2025, Semtech achieved FCC and PTCRB certification for its EM8695 5G RedCap module with AT&T. The EM8695 module, powered by Qualcomm’s Snapdragon X35 Modem‑RF System, passed tests on AT&T’s RedCap network and is now cleared for North American carrier deployment. The certification positions the module for mid-range IoT use cases such as wearables, industrial sensors, video surveillance, and asset tracking.

- In October 2024, Digi International launched the Digi 360 subscription solution. The offering includes cellular routers, software, services, and an extended warranty in a single managed package. The platform simplifies deployment and centralized management of enterprise-grade IoT connectivity.

- In February 2024, TCL introduced the LINKKEY IK511, a 3GPP Release 17–compliant 5G RedCap USB dongle, at MWC Barcelona. Powered by Qualcomm’s Snapdragon X35 Modem-RF System, the device offers low-power, cost-efficient 5G connectivity tailored for both machine-to-machine (M2M) and consumer IoT applications. The dongle supports the industrial deployment of 5G RedCap across sectors such as manufacturing, logistics, and smart infrastructure by enabling simplified and scalable device connectivity.

significant