Market Definition

The market focuses on the integration of edge computing with 5G networks to process data closer to the source, minimizing latency and optimizing real-time applications. This market encompasses hardware, software, and services that facilitate decentralized data processing, reducing reliance on centralized cloud infrastructure.

It involves deploying edge nodes, micro data centers, and AI-driven analytics to support use cases such as autonomous vehicles, smart cities, industrial automation, and immersive technologies.

The report highlights the primary market drivers, alongside significant trends, regulatory frameworks, and the competitive landscape, shaping the industry's expansion in the coming years.

5G Edge Computing Market Overview

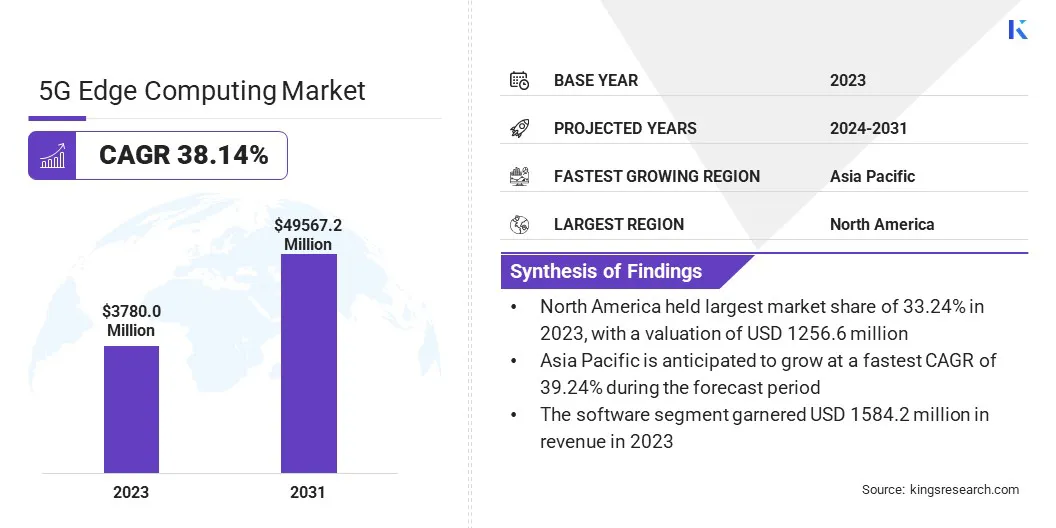

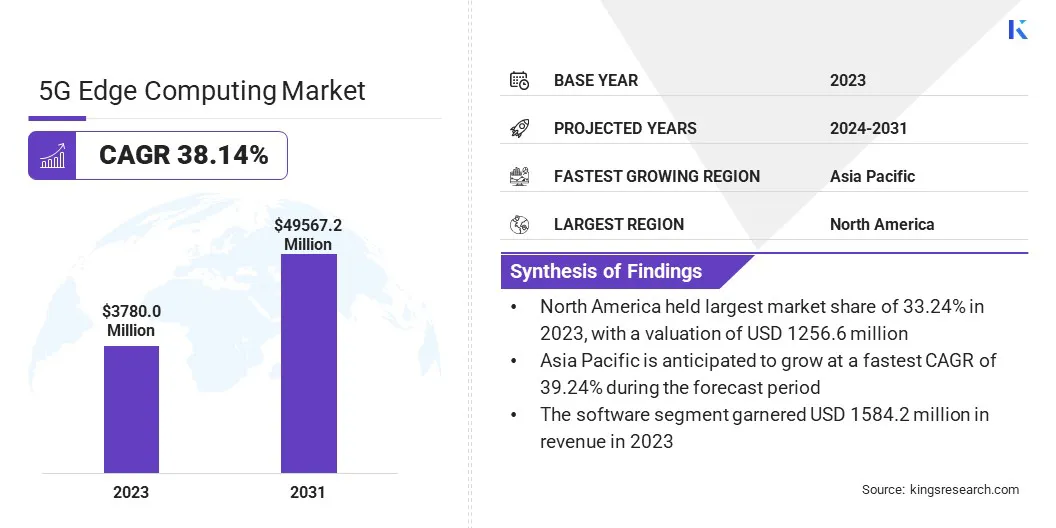

The global 5G edge computing market size was valued at USD 3780.0 million in 2023 and is projected to grow from USD 5163.9 million in 2024 to USD 49567.2 million by 2031, exhibiting a staggering CAGR of 38.14% over the forecast period.

The expansion of data-intensive applications, including AI-driven analytics and IoT deployments, is driving the demand for 5G edge computing, enabling real-time data processing with minimal latency.

Additionally, enterprises' adoption of private 5G networks is accelerating, as businesses seek greater control over network performance and security. These factors contribute to the rapid integration of edge computing solutions across industries, enhancing operational efficiency and network reliability.

Major companies operating in the 5G edge computing industry are Ericsson, Nokia, Samsung Electronics, Huawei Technologies, Cisco, Qualcomm, Intel Corporation, ZTE Corporation, Microsoft, Amazon Web Services, IBM, Google, AT&T, Fujitsu Limited, and Hewlett Packard Enterprise Company.

The increasing adoption of autonomous vehicles and connected transportation systems is fueling the growth of the market. Self-driving cars rely on ultra-low latency communication to process sensor data, detect obstacles, and make split-second decisions.

Edge computing enables real-time data processing within vehicles, reducing dependency on centralized cloud servers. Smart traffic management along with vehicle-to-everything (V2X) communication, further enhances road safety and efficiency. These advantages are prompting investments in 5G-powered edge computing infrastructure across the transportation sector.

- In February 2025, Hyundai Motor Company announced the successful completion of a pilot project for Private 5G (P-5G) RedCap (Reduced Capability) technology in collaboration with Samsung Electronics Co., Ltd. P-5G operates as an on-site dedicated network using a specific frequency band, eliminating external interference and enabling seamless data transmission—crucial for smart manufacturing and centralized control of industrial robots and devices.

Key Highlights:

- The 5G edge computing industry size was recorded at USD 3780.0 million in 2023.

- The market is projected to grow at a CAGR of 38.14% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 1256.6 million.

- The software segment garnered USD 1584.2 million in revenue in 2023.

- The IT & telecommunications segment is expected to reach USD 11103.0 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 39.24% during the forecast period.

Market Driver

"Expansion of IoT Ecosystems Across Industries"

The widespread adoption of IoT devices across industries is accelerating the growth of the 5G edge computing market. According to the Institute of Electrical and Electronics Engineers (IEEE), the number of Internet of Things (IoT) connections is projected to exceed 23 billion by 2025, up from 15.1 billion in 2021.

Industrial automation, smart cities, and connected healthcare systems generate massive amounts of data that require real-time analysis. Edge computing enables IoT devices to function more efficiently by reducing data transfer loads to centralized cloud servers.

The increasing need for reliable, high-speed connectivity to support IoT-driven applications is pushing enterprises to integrate 5G-powered edge computing solutions into their operations.

Market Challenge

"High Infrastructure Deployment Costs"

The expansion of 5G edge computing is hindered by the cost of deploying advanced infrastructure, including edge data centers, network upgrades, and specialized hardware. These financial barriers limit adoption, particularly for small and medium-sized enterprises.

To address this challenge, companies are adopting cost-sharing models through strategic partnerships, using cloud-based edge solutions to reduce capital expenditures and AI-driven network optimization to enhance efficiency.

Additionally, telecom providers are offering Network-as-a-Service (NaaS) models, allowing businesses to access 5G edge capabilities without significant upfront investment, ensuring broader market adoption and scalability.

Market Trend

"Deployment of Private 5G Networks in Enterprises"

Enterprises are investing in private 5G networks to optimize operations. Manufacturing plants, logistics hubs, and healthcare facilities are leveraging private 5G to enable secure, high-performance connectivity for mission-critical applications.

Edge computing plays a vital role in these networks by processing data locally, ensuring low latency and security. The ability to run AI-powered analytics and automation within private 5G environments is increasing the demand for edge computing solutions.

- In March 2024, Cisco partnered with Mitsui Information and KDDI Engineering to implement a private 5G network at the Shinwa Komaki SFiC Lab in Komaki City, Japan. The initiative aims to advance smart factory applications using 5G technology. The consortium highlighted various use cases for private 5G, including automated guided vehicles (AGVs), autonomous mobile robots (AMRs), robot control systems, quality assurance processes, and data input/output via tablets.

5G Edge Computing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By End-Use

|

IT & Telecommunications, Smart Cities, Datacenters, Energy & Utilities, Automotive, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, Services): The software segment earned USD 1584.2 million in 2023 due to its critical role in enabling real-time data processing, network virtualization, and AI-driven automation, allowing enterprises to optimize performance, enhance scalability, and integrate edge applications seamlessly.

- By End-Use (IT & Telecommunications, Smart Cities, Datacenters, Energy & Utilities, Automotive, Healthcare, Others): The IT & telecommunications segment held 22.44% of the market in 2023, due to the rapid deployment of 5G infrastructure, increasing demand for low-latency data processing, and the integration of edge computing to enhance network performance, scalability, and real-time service delivery.

5G Edge Computing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

The North America 5G edge computing market share stood at around 33.24% in 2023 in the global market, with a valuation of USD 1256.6 million. The dominance of North American cloud and hyperscale data center providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, is fueling the adoption of 5G edge computing.

The integration of 5G with edge cloud infrastructure is enabling enterprises to process data closer to end users, enhancing performance for applications such as IoT, AI, and AR/VR.

- The International Energy Agency's 2024 report highlights a sharp rise in U.S.'s data center investments, driven by AI adoption and digitalization. Over the past two years, annual spending on data center construction has doubled. In 2023, capital investment by Google, Microsoft, and Amazon surpassed the entire U.S. oil and gas sector, accounting for about 0.5% of the nation’s GDP.

Additionally, North American enterprises are rapidly adopting private 5G networks to enhance operational efficiency and security, accelerating the growth of the market. Industries such as manufacturing, healthcare, and logistics are deploying dedicated 5G networks to support mission-critical applications. The region’s regulatory framework and spectrum allocation for private 5G networks further support its expansion.

Asia Pacific is expected to witness significant growth at a robust CAGR of 39.24% over the forecast period. Governments across the Asia Pacific are heavily investing in smart city projects, accelerating the adoption of 5G edge computing.

Countries like China, Japan, and South Korea are deploying edge-powered infrastructure for intelligent traffic management, surveillance, and energy-efficient urban planning.

Singapore’s Smart Nation initiative and India’s Smart Cities Mission are integrating 5G edge computing to enhance real-time data processing for public services, autonomous transport, and IoT-enabled waste management, driving demand for low-latency networks across metropolitan areas.

Furthermore, the surge in cloud gaming and extended reality (XR) applications in the Asia Pacific is driving investments in 5G edge computing. Countries like China, Japan, and South Korea are witnessing strong demand for ultra-low-latency cloud gaming platforms, AR/VR-based entertainment, and immersive virtual experiences.

Telecom operators are deploying 5G edge nodes closer to users, ensuring real-time rendering and lag-free streaming for gaming companies like Tencent, Sony Interactive Entertainment, and Nexon, reinforcing market expansion.

Regulatory Frameworks

- The U.S. adopts a market-driven approach to 5G deployment, emphasizing private sector leadership and investment. The Federal Communications Commission (FCC) oversees spectrum allocation, conducting auctions to allocate frequencies for 5G services. The "5G FAST Plan" aims to streamline infrastructure deployment and promote investment, while the "Secure 5G and Beyond Act" establishes a strategy to ensure the security of 5G networks.

- The EU focuses on harmonizing spectrum allocation and promoting cross-border collaboration. The "5G Action Plan" facilitates 5G deployment across member states, and the "Cybersecurity Act" establishes a framework for certifying ICT products and services to ensure network security.

- China's "Plan for Promoting 5G+ Industrial Internet 512 Program" (2019) and the "Circular on Accelerating 5G Development" (2020) direct the country's economy toward 5G advancement. The "Cybersecurity Law" regulates cybersecurity practices and ensures the protection of critical information infrastructure.

- Japan promotes 5G innovation through investment-friendly regulations and global collaboration. Its "Society 5.0" initiative integrates digital technologies to create a super-smart society. In May 2019, Japan introduced regulations allowing the government to block foreign investments in sensitive sectors, including telecom, for security reasons.

Competitive Landscape:

The 5G edge computing industry has several market players forming strategic partnerships with telecom providers to enhance their 5G edge computing capabilities. These collaborations focus on integrating advanced network solutions, optimizing cloud-native architectures, and expanding edge computing applications across industries.

By leveraging telecom infrastructure and expertise, companies can improve network performance, scalability, and real-time data processing, addressing the growing demand for low-latency computing.

Such alliances enable businesses to accelerate innovation, develop tailored solutions, and support the deployment of next-generation connectivity, strengthening their position in the evolving 5G edge computing landscape.

- In March 2025, Telkomsel, Indonesia’s leading digital telecommunications provider, partnered with Ericsson to deploy Far Edge Core Solutions and strengthen talent development in 5G advanced technology, AI-driven networks, and cloud-native architecture. This collaboration focuses on exploring and implementing Far Edge Core Solutions utilizing Cloud Native Infrastructure (CNIS) to enhance network performance, flexibility, and scalability. The initiative aims to support future applications of 5G and edge computing while driving innovation in digital connectivity and intelligent network solutions.

List of Key Companies in 5G Edge Computing Market:

- Ericsson

- Nokia

- Samsung Electronics

- Huawei Technologies

- Cisco

- Qualcomm

- Intel Corporation

- ZTE Corporation

- Microsoft

- Amazon Web Services

- IBM

- Google

- AT&T

- Fujitsu Limited

- Hewlett Packard Enterprise Company

Recent Developments (Partnerships/Product Launch)

- In March 2025, Nokia introduced Industrial 5G fieldrouters to help industrial enterprises manage complex multi-connectivity environments, while enhancing edge computing capabilities. Equipped with dual cellular and dual Wi-Fi modules, these routers support seamless integration with both public and private networks. Featuring high Ethernet port density and a CANbus interface, they enable connectivity for a wide range of industrial assets, meeting the growing need for real-time operational data and enhanced network reliability in industrial settings.

- In March 2025, Vodafone Spain partnered with Ericsson to deploy a standalone 5G Core network for residential customers. This collaboration enables Vodafone Spain to establish a fully independent 5G mobile network, utilizing Ericsson's latest technology and advanced solutions to deliver enhanced services. The deployment is based on Ericsson's dual-mode 5G Core technology, optimizing the existing 5G infrastructure and coverage to provide a seamless and differentiated user experience.

- In February 2025, Telstra collaborated with Ericsson to introduce a cutting-edge programmable 5G Advanced network with integrated edge computing capabilities. This upgrade integrates Ericsson’s next-generation Open RAN-ready hardware, 5G Advanced software, and AI-driven automation. These advancements enable the network to self-diagnose and self-repair, enhancing operational efficiency while ensuring superior reliability and performance.