Cattle Porcine Swine Reproductive Diseases Market Snapshot

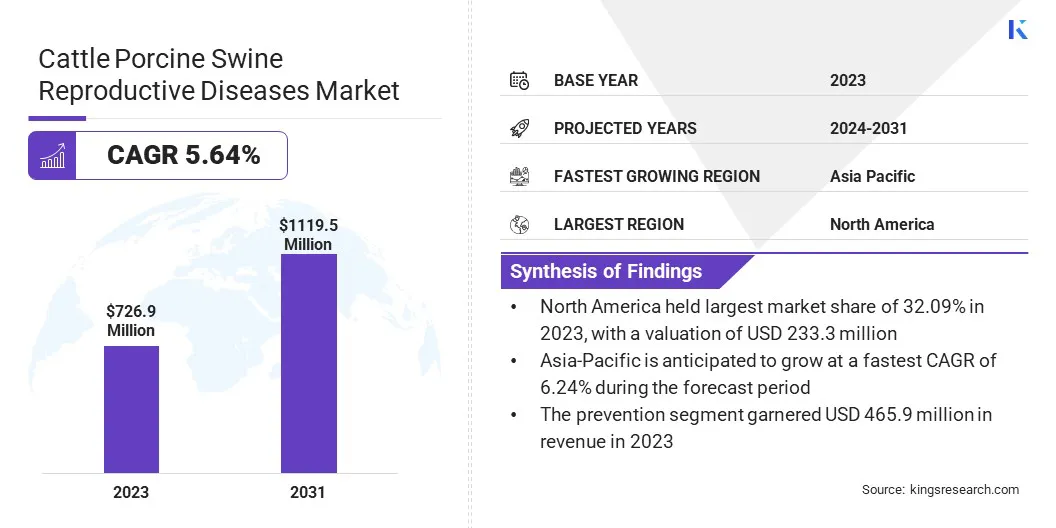

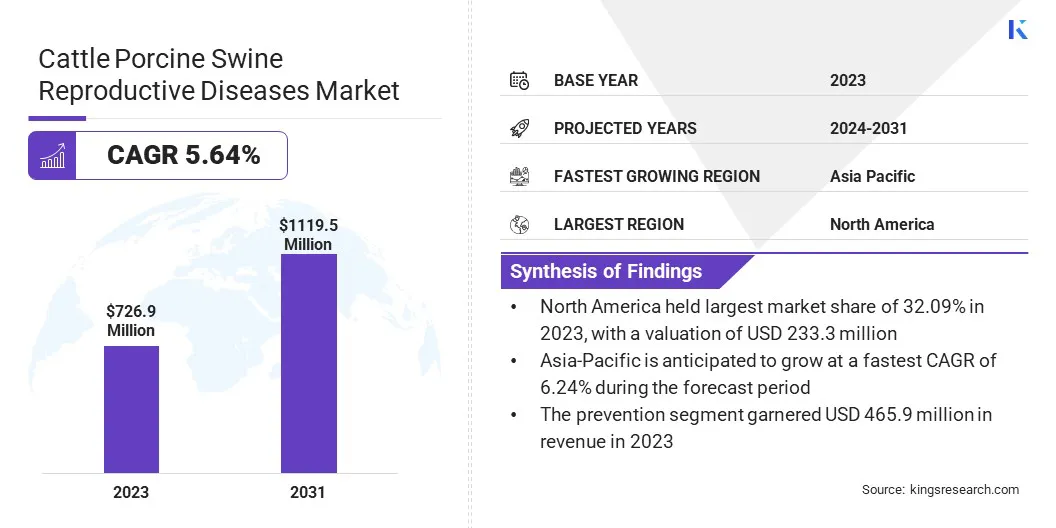

Global cattle porcine swine reproductive diseases market size was USD 726.9 million in 2023, which is estimated to be valued at USD 762.7 million in 2024 and reach USD 1,119.5 million by 2031, growing at a CAGR of 5.64% from 2024 to 2031.

The rising focus on animal welfare drives the market as consumers demand ethical farming practices and safer food products. Preventing reproductive diseases in livestock ensures healthier animals and better productivity. It also improves meat and dairy quality, aligning with food safety standards and ethical concerns.

Key Market Highlights:

- The global market size was recorded at USD 726.9 million in 2023.

- The market is projected to grow at a CAGR of 5.64% from 2024 to 2031.

- North America held a market share of 32.09% in 2023, with a valuation of USD 233.3 million.

- The vaccines segment garnered USD 320.5 million in revenue in 2023.

- The cattle segment is expected to reach USD 454.3 million by 2031.

- The bacterial segment has a market share of 44.09% in 2023.

- The treatment segment is anticipated to have a CAGR of 7.38% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.24% during the forecast period.

Major companies operating in the global cattle porcine swine reproductive diseases industry are Zoetis Services LLC, Merck & Co., Inc., Virbac, Elanco, Vetoquinol, IDEXX, Thermo Fisher Scientific Inc, RINGBIO, HIPRA, S.A., Innovative Diagnostics, Indian Immunologicals Ltd, Biogénesis Bagó, AdvaCare Pharma, Bio-X Diagnostics, and Boehringer Ingelheim International GmbH.

Cattle Porcine Swine Reproductive Diseases Market Overview

The growing demand for vaccination programs tailored to reproductive health creates a significant opportunity in the cattle and swine reproductive diseases market. As farmers increasingly prioritize herd health and productivity, vaccines targeting diseases like Brucellosis, PRRS, and BVD offer a proactive approach to disease prevention.

This opportunity is particularly valuable in regions with high livestock populations, where widespread vaccination can significantly reduce the incidence of reproductive failures, leading to healthier herds, improved fertility rates, and enhanced overall farm profitability.

- In February 2025, Virbac introduced four new bovine vaccines in the USA, targeting respiratory and reproductive diseases like BVD and leptospirosis. These vaccines protect cattle at different growth stages, helping farmers and veterinarians improve herd health, reduce economic losses, and support sustainable farming.

Market Driver

"Increasing Demand for Animal Products"

The increasing global demand for animal products, such as meat and dairy, is a major growth driver for the cattle porcine swine reproductive diseases market. The United Nations Food and Agriculture Organization reports that pork is the most consumed meat globally, accounting for 36%, followed by poultry at 33%, beef at 24%, and goat/sheep meat at 5%.

As demand for high-quality, affordable animal products grows, maintaining healthy livestock is crucial for meeting production targets. In addition, preventing reproductive diseases in cattle and pigs is critical for improving fertility rates and to boost herd productivity. This demand encourages investment in vaccines, diagnostics, and treatments that support optimal livestock health and sustainable farming practices.

- In February 2023, The University of Queensland developed an experimental vaccine for bovine trichomoniasis, a disease causing infertility in cattle. This vaccine aims to reduce reproductive inefficiencies.

Market Challenge

"Vaccine Accessibility"

A key challenge in the cattle porcine swine reproductive diseases market is the limited accessibility of vaccines, especially in low-income regions. Vaccines for reproductive diseases are expensive and difficult to distribute.

A potential solution is the development of locally produced affordable vaccines tailored to regional strains of diseases. This approach ensures wider availability of vaccines and lowers the cost. As a result, farmers gain better access to vaccines, leading to improved herd health, lower disease transmission, and higher productivity.

Market Trend

"Integration of Digital Tools in Livestock Health Management"

The integration of digital tools like AI and data analytics has emerged as a significant trend in the cattle porcine swine reproductive diseases market. These technologies enable farmers to monitor herd health in real-time, predict disease outbreaks, and optimize breeding cycles.

AI-driven systems help in early disease detection and precise treatment, improving overall herd management. Data analytics helps forecast disease patterns, enabling farmers to make informed decisions and reduce risks. This enhances productivity and promotes more more efficient, sustainable livestock farming practices.

- In October 2024, Fast Forward launched a program to back up to 10 livestock-tech ventures in Nigeria. This program was supported by the German Agency for International Cooperation (GIZ) and focuses on technology products across the livestock value chain. This includes vaccines, health monitoring, and data analytics.

Cattle Porcine Swine Reproductive Diseases Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Vaccines, Pharmaceuticals, Diagnostics, Biologicals

|

|

By Animal Type

|

Cattle, Porcine, Swine

|

|

By Disease Type

|

Bacterial, Viral, Parasitic, Others

|

|

By Treatment Approach

|

Prevention, Treatment

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Vaccines, Pharmaceuticals, Diagnostics, Biologicals): The vaccines segment earned USD 320.5 million in 2023, due to increased vaccination programs and rising demand for disease prevention in emerging markets.

- By Animal Type (Cattle, Porcine, Swine): The cattle segment held 42.09% of the market in 2023, due to the growing demand for meat and dairy products globally.

- By Disease Type (Bacterial, Viral, Parasitic, Others): The bacterial segment is projected to reach USD 451.1 million by 2031, owing to the increasing prevalence of bacterial infections in livestock populations worldwide.

- By Treatment Approach (Prevention, Treatment): The treatment segment is anticipated to have a CAGR of 7.38% during the forecast period, driven by advancements in therapeutic solutions and rising disease in livestock.

Cattle Porcine Swine Reproductive Diseases Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America cattle porcine swine reproductive diseases market share stood around 32.09% in 2023 in the global market, with a valuation of USD 233.3 million. North America dominates the market due to its advanced agricultural practices and well-established animal health infrastructure.

The region benefits from high demand for livestock products, coupled with stringent regulatory standards and technological advancements in disease diagnostics and treatment.

North America’s veterinary services, research capabilities, and large-scale farming operations ensure its continued leadership in addressing reproductive health challenges in cattle, porcine, and swine populations, driving the market’s growth. In February 2024, the National Association of State Departments of Agriculture (NASDA) passed a policy supporting farmers’ and ranchers' access to approved vaccine technologies, emphasizing the importance of scientifically reviewed vaccines for safeguarding animal health and ensuring food supply resilience.

The cattle porcine swine reproductive diseases market in Asia-Pacific is poised for significant growth at a robust CAGR of 6.24% over the forecast period. Asia-Pacific is the fastest-growing region in the market, driven by rapid industrialization of the livestock sector, increasing demand for animal products, and growing awareness of reproductive health management.

Countries like China and India are investing in veterinary care and animal health technologies, improving disease prevention and treatment strategies. The region’s expanding livestock population, coupled with government initiatives to boost food security, propels the growth of the reproductive diseases market in cattle, porcine, and swine industries.

- In December 2024, the Asian Development Bank (ADB) approved a USD 42.9 million project in Lao PDR to enhance livestock health and value chains. The initiative aims to improve productivity, disease control, and cross-border trade, benefiting 30,000 households.

Regulatory Frameworks

- The Animal and Plant Health Inspection Service (APHIS) protects and promotes U.S. agricultural health, regulates genetically engineered organisms, administers the Animal Welfare Act, and manages wildlife damage.

- EMA protects public and animal health in EU Member States, as well as the countries of the European Economic Area, by ensuring that all medicines available on the EU market are safe, effective and of high quality.

Competitive Landscape

The global cattle porcine swine reproductive diseases market is characterized by a large number of participants. Companies in the market are launching innovative products aimed at improving livestock health. These include vaccines, diagnostics, and treatments for reproductive diseases, as well as advanced herd management solutions.

Such solutions are designed to enhance animal fertility, prevent disease outbreaks, and optimize farm productivity, supporting the growth of sustainable and healthy livestock farming practices.

- In October 2024, Merck Animal Health launched SENSEHUB Cow Calf, a remote monitoring technology to optimize breeding results. The system tracks estrus behavior, detects reproductive issues, and alerts producers via smartphones or tablets, improving herd productivity and minimizing labor while ensuring timely intervention.

List of Key Companies in Cattle Porcine Swine Reproductive Diseases Market:

- Zoetis Services LLC

- Merck & Co., Inc.

- Virbac

- Elanco

- Vetoquinol

- IDEXX

- Thermo Fisher Scientific Inc

- RINGBIO

- HIPRA, S.A.

- Innovative Diagnostics

- Indian Immunologicals Ltd

- Biogénesis Bagó

- AdvaCare Pharma

- Bio-X Diagnostics

- Boehringer Ingelheim International GmbH

Recent Developments (Funding/Approval)

- In January 2023, The Pirbright Institute secured funding through the UKRI Horizon Europe Guarantee Scheme to develop next-generation vaccines and diagnostics for livestock reproductive diseases. The project, REPRODIVAC, focuses on diseases impacting pigs, sheep, and goats globally.

- In September 2024, Merck Animal Health received European Medicines Agency approval for PORCILIS PCV M Hyo ID, an intradermal vaccine for swine. This innovative vaccine protects against PCV2 and Mycoplasma hyopneumoniae, enhancing efficiency and animal welfare in swine reproductive disease management.