Market Definition

Catalyst handling services involve specialized processes to manage catalysts during loading, unloading, and transfer operations. These services ensure safe handling and accurate placement of catalysts to maintain reactor performance and operational efficiency.

They are essential to prevent contamination, reduce downtime, and maintain the activity of catalysts during replacement or maintenance cycles. These services are widely used in petroleum refining, petrochemicals, and chemical production to support continuous operations and optimize catalyst life cycles.

Catalyst Handling Services Market Overview

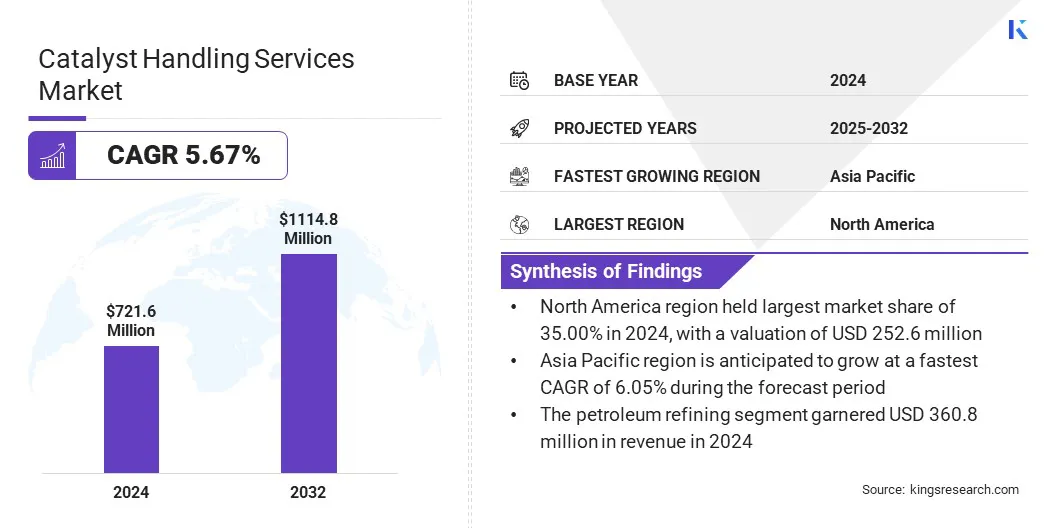

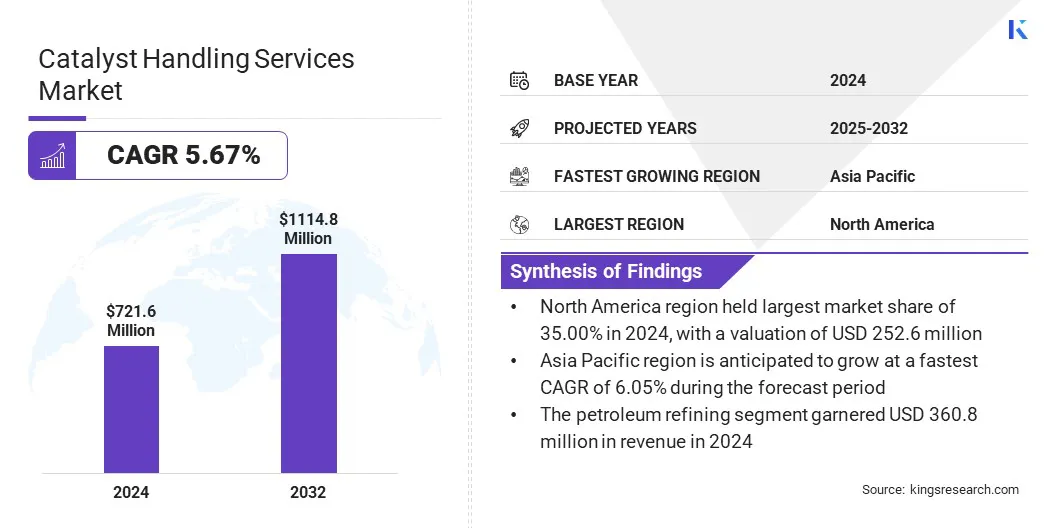

The global catalyst handling services market size was valued at USD 721.6 million in 2024 and is projected to grow from USD 757.8 million in 2025 to USD 1,114.8 million by 2032, exhibiting a CAGR of 5.67% over the forecast period.

The growth is driven by rising operational needs in refining and chemical industries. Expansion of petrochemical production capacity across major regions is driving greater demand for catalyst loading, unloading, and maintenance during plant operations. Moreover, the adoption of automated and robotic systems is reshaping handling processes by enhancing safety and minimizing downtime.

Key Highlights:

- The catalyst handling services industry size was recorded at USD 721.6 million in 2024.

- The market is projected to grow at a CAGR of 5.67% from 2025 to 2032.

- North America held a market share of 35.00% in 2024, with a valuation of USD 252.6 million.

- The catalyst loading/unloading segment garnered USD 288.6 million in revenue in 2024.

- The petroleum refining segment is expected to reach USD 546.0 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.05% over the forecast period.

Major companies operating in the catalyst handling services market are Mourik, ANABEEB, Dickinson Group of Companies, CR3 Group, Catalyst Handling Resources LLC, Technivac, REMONDIS SE & Co. KG, Cat Tech International Ltd, Contract Resources, Plant-Tech Services, Kanooz Contracting Est, TubeMaster, Drill & Drop, Veolia, and Maviro Inc.

Market growth is propelled by the integration of real-time tracking systems and advanced precision tools in catalyst handling operations. These technologies enable accurate monitoring of catalyst quantities and placement within reactors, ensuring optimal performance and reducing operational errors.

Real-time tracking improves process transparency, while precision tools minimize material losses and enhance reactor efficiency. This technological advancement supports safer operations and consistent quality standards across refineries and petrochemical plants.

Market Driver

Expansion of Petrochemical Production Capacity

The catalyst handling services market is driven by the expansion of global petrochemical production capacity. Increasing investments in new plants and upgrades of existing facilities have resulted in higher catalyst consumption across refining and chemical processes. This expansion is increasing the demand for frequent catalyst replacement, handling, and maintenance to maintain performance in continuous operations.

Moreover, the rise in production capabilities is driving the demand for specialized handling services to maintain efficiency and safety in large-scale industrial environments.

- In October 2024, the Indian Ministry of Petroleum and Natural Gas announced plans under the new PCPIR policy to boost the petrochemical sector. The initiative aims to increase India’s petrochemical capacity from 29.62 million tonnes to 46 million tonnes by 2030. It also targets significant expansion in refining capabilities, with major investments from public and private players to support projected demand growth and enhance cost competitiveness.

Market Challenge

High Safety Risks During Catalyst Handling Operations

A major challenge in the catalyst handling services market is the high safety risk associated with handling hazardous catalysts during loading and unloading. Exposure to toxic substances and the possibility of accidents during confined space operations increase operational hazards and compliance requirements.

These risks lead to higher training costs and potential downtime, which impact overall efficiency. To address this, companies are adopting robotic catalyst handling systems, implementing advanced safety protocols, and providing specialized workforce training to minimize exposure and improve operational safety.

Market Trend

Growing Adoption of Automated and Robotic Systems

The catalyst handling services market is witnessing a growing adoption of automated and robotic systems for catalyst loading and unloading. These technologies reduce human intervention, minimize exposure to hazardous materials, and enhance operational safety.

Automation improves precision in catalyst placement, which helps maintain reactor efficiency and reduces downtime during maintenance. Companies are investing in advanced robotic solutions to meet strict safety requirements and achieve consistent handling performance across refineries and petrochemical plants.

Catalyst Handling Services Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service Type

|

Catalyst Loading/Unloading, Catalyst Screening, Segregation & Storage, Catalyst Transport & Handling, Spent Catalyst Handling

|

|

By End-Use Industry

|

Petroleum Refining, Chemicals & Fertilizers, Petrochemicals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Service Type (Catalyst Loading/Unloading, Catalyst Screening, Segregation & Storage, Catalyst Transport & Handling, and Spent Catalyst Handling): The catalyst loading/unloading segment earned USD 288.6 million in 2024, due to frequent catalyst replacement needs in refineries and petrochemical plants.

- By End-Use Industry (Petroleum Refining, Chemicals & Fertilizers, Petrochemicals, and Others): The petroleum refining segment held 50.00% of the market in 2024, due to extensive use of catalysts in hydroprocessing and fluid catalytic cracking units.

Catalyst Handling Services Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America catalyst handling services market share stood at 35.00% in 2024 in the global market, with a valuation of USD 252.6 million. This dominance is due to the presence of a large number of petroleum refining and petrochemical facilities in the region that require frequent catalyst changeouts. High operational standards and strict safety regulations further drive demand for specialized catalyst handling services across refineries and chemical plants in this region.

- In January 2025, the U.S. Energy Information Administration reported that the U.S had 132 operable petroleum refineries with an atmospheric crude oil distillation capacity of 18,423,493 barrels per calendar day. This expansion in refining capacity is increasing the need for catalysts, which in turn is boosting demand for catalyst handling services in maintenance and turnaround operations across the U.S. refining sector.

Asia Pacific is poised to grow at a CAGR of 6.05% over the forecast period. This growth is primarily driven by the commissioning of new petrochemical complexes and large-scale refinery projects led by national oil companies and integrated energy firms across China, India, and Southeast Asia.

This requires extensive catalyst handling for installation and initial loading, along with periodic replacement during scheduled maintenance. Moreover, increasing investments in the energy and chemical sectors further enhance the demand for specialized catalyst handling services in the region.

Regulatory Frameworks

- In the U.S, catalyst handling services must follow Occupational Safety and Health Administration (OSHA) regulations, including standards for hazardous materials handling under 29 CFR 1910.

- In Europe, the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation governs catalyst materials, storage, and disposal practices.

- In India, the Manufacture, Storage and Import of Hazardous Chemicals Rules under the Environment Protection Act apply to catalyst handling and disposal.

Competitive Landscape

Key players in the catalyst handling services industry are expanding their regional footprint through acquisitions and joint ventures to access high-demand industrial hubs.

Companies are building specialized service centers near major refineries and petrochemical complexes to provide timely turnaround support. Moreover, market players are establishing long-term maintenance contracts with industrial clients to ensure consistent service engagement and operational reliability.

Key Companies in Catalyst Handling Services Market:

- Mourik

- ANABEEB

- Dickinson Group of Companies

- CR3 Group

- Catalyst Handling Resources LLC

- Technivac

- REMONDIS SE & Co. KG

- Cat Tech International Ltd

- Contract Resources

- Plant-Tech Services

- Kanooz Contracting Est

- TubeMaster

- Drill & Drop

- Veolia

- Maviro Inc.

Recent Developments (Launch)

- In December 2024, BASF inaugurated its new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. The facility serves as a hub for pilot-scale synthesis of chemical catalysts and supports the development of innovative solids processing technologies. It features advanced process equipment to accelerate the transition from lab-developed catalysts to production scale, enabling faster delivery of high-quality pilot samples.

advancement