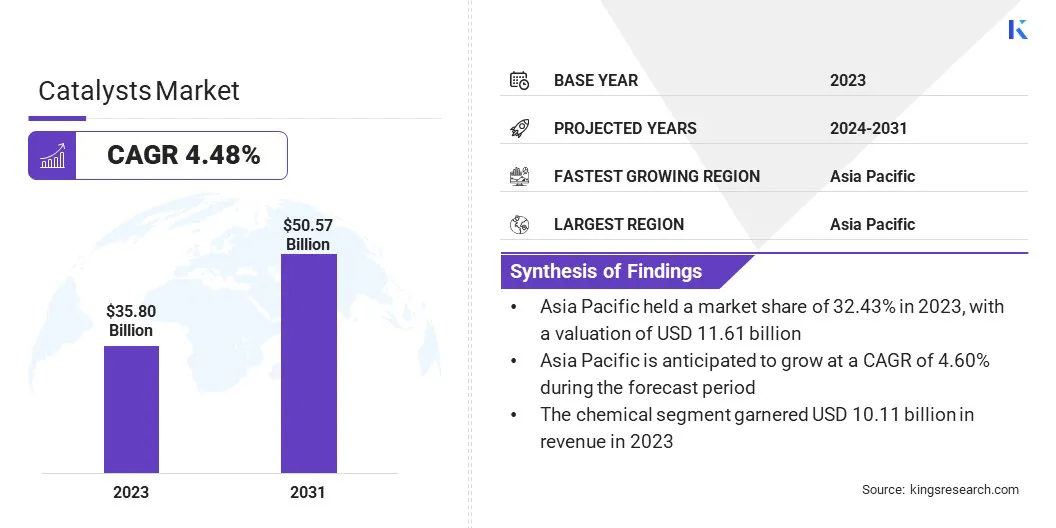

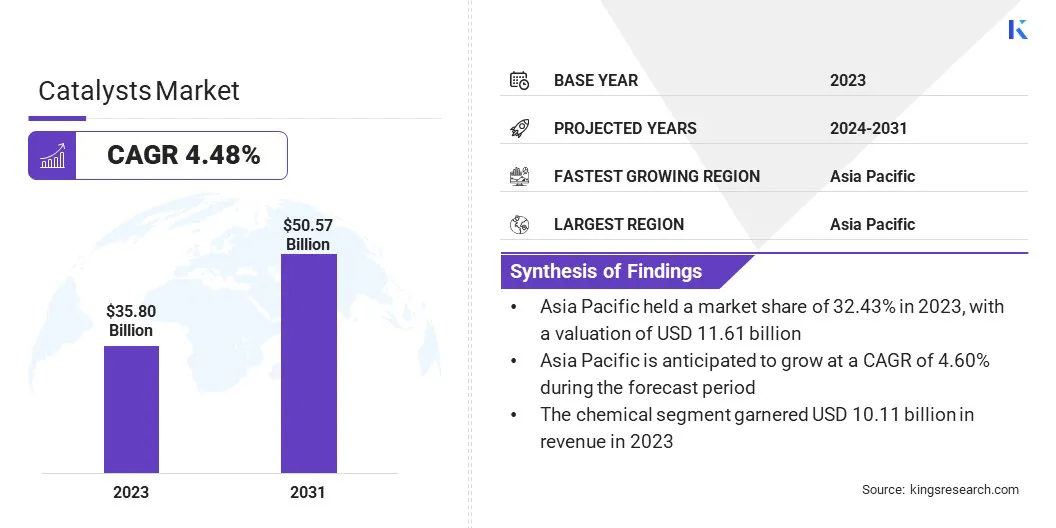

Catalysts Market size

The global Catalysts Market size was valued at USD 35.80 billion in 2023 and is projected to grow from USD 37.22 billion in 2024 to USD 50.57 billion by 2031, exhibiting a CAGR of 4.48% during the forecast period. The global emphasis on reducing greenhouse gas emissions has boosted the adoption of catalysts in energy refining and production processes.

Catalysts are extensively utilized in hydrocracking and desulfurization, which are essential for producing low-sulfur fuels that comply with stringent environmental regulations. The increasing focus on cleaner fuels for sustainable development continues to bolster the growth of the catalysts market.

In the scope of work, the report includes products offered by companies such as BASF, Dow, Evonik Industries AG, Arkema, CLARIANT, Exxon Mobil Corporation, LyondellBasell Industries Holdings B.V., Albemarle Corporation, Honeywell International Inc., Shell plc, and others.

The growing need to address air and water pollution has increased the adoption of catalysts in environmental applications. Catalysts are instrumental in processes such as wastewater treatment, air purification, and industrial gas cleaning, ensuring compliance with environmental regulations. Industries are leveraging catalytic technologies to mitigate pollutants and achieve sustainability goals.

Catalysts are substances speed up chemical reactions without undergoing permanent change. By lowering the activation energy, they facilitate faster conversion of reactants to products without affecting reaction equilibrium. They are widely used in industries such as chemical manufacturing, petroleum refining, and pharmaceuticals to optimize processes and reduce energy consumption.

Examples include enzymes in biological systems and platinum in automotive converters. Catalysts are essential for promoting sustainable and efficient industrial practices.3

Analyst’s Review

The catalysts market is witnessing substantial growth, propelled by strategic efforts from corporations, governments, and non-governmental organizations to decarbonize the chemical sector. The International Energy Agency highlighted that The First Movers Coalition, a global initiative for emissions-intensive industries, has announced a program to address chemical sector emissions.

This initiative, launched at the Clean Energy Ministerial 2023 in India, underscores the increasing collaboration to advance sustainable technologies.

Furthermore, the growth of the market is bolstered by the establishment of the Global Impact Coalition (GIC) in November 2023, an evolution of the World Economic Forum's Low-Carbon Emitting Technologies (LCET) initiative.

Comprising leading companies such as BASF, SABIC, Covestro, Mitsubishi Chemical Group, and Solvay, the GIC focuses on scaling innovative low-carbon technologies in chemical production and its value chains. This CEO-led coalition is dedicated to fostering net-zero progress through cutting-edge projects and partnerships, reflecting its commitment to sustainable industrial growth.

Additionally, leading chemical companies are integrating science-based targets into their sustainability frameworks to align with global carbon neutrality goals. This emhasizes the sector's reliance on advanced catalysts for cleaner and more efficient production processes. This adoption of sustainable practices and technologies is fueling the growth of the market, fostering innovation and expansion.

Catalysts Market Growth Factors

Rapid industrialization and urbanization in developing economies have led to increased chemical production, fueling demand for catalysts to optimize processes.

- The United Nations Human Settlements Programme reports that Asia accounts for over 54% of the global urban population, with more than 2.2 billion people. By 2050, this figure is projected to rise by1.2 billion, marking a 50% increase.

From fertilizers to specialty chemicals, the manufacturing sector relies heavily on catalysts to enhance production efficiency and reduce energy consumption. Governments’ investments in industrial infrastructure and growing chemical exports are reshaping market dynamics.

The rising adoption of emission control systems in vehicles has significantly contributed to the expansion of the catalysts market. Automotive catalysts, particularly in catalytic converters, are crucial for reducing harmful emissions such as carbon monoxide, nitrogen oxides, and hydrocarbons.

Stringent global vehicle emission regulations have compelled automakers to integrate advanced catalytic technologies to meet compliance standards. Additionally, the rise in electric vehicle production has spurred demand for catalysts used in battery production and energy storage systems.

A key factor limiting the growth of the catalysts market is the high cost of advanced catalyst technologies. While these catalysts offer improved performance and efficiency, they require substantial initial investment and maintenance, posing a challenge for smaller companies with limited budgets.

To address this challenge, several companies are investing in research and development to create more cost-effective catalytic solutions. Additionally, industry players are forming strategic partnerships to share resources and reduce the financial burden, while exploring recycling and regeneration technologies to extend catalyst life and reduce costs.

Catalysts Industry Trends

Innovative breakthroughs in catalysis technology, including the development of nanostructured catalysts and bio-based alternatives, are significantly driving market growth. These advancements enhance the selectivity, efficiency, and recyclability of catalysts, reducing process costs and environmental impact.

Research and development in areas such as green catalysis and photocatalysis are fostering the adoption of sustainable practices across industries. Companies leveraging these innovations are well-positioned to meet evolving regulatory requirements and customer preferences.

- In August 2024, Clariant announced that its EnviCat Green deoxygenation catalyst has been chosen for a significant green ammonia project in China. The catalyst will remove trace oxygen from green hydrogen produced at the facility before it is converted into green ammonia. This carbon-free production of ammonia is anticipated to minimize the environmental impact of this essential base chemical, which is crucial for applications such as fertilizer production.

The global transition toward renewable energy sources has increased the use of catalysts in areas such as hydrogen production, biofuel processing, and fuel cell technologies. Catalysts are essential for improving the efficiency of these processes, supporting the rising demand for cleaner energy alternatives. Investments from governments and the private sector in green energy projects have further highlighted the need for advanced catalytic solutions.

Segmentation Analysis

The global market has been segmented based on type, material, application, and geography.

By Type

Based on type, the market has been segmented into homogeneous and heterogeneous. The heterogeneous segment led the catalysts market in 2023, reaching a valuation of USD 22.31 billion, due to their widespread application across various industries, including petrochemicals, refining, and environmental management.

These catalysts are preferred for their ability to facilitate reactions between different phases, such as solid catalysts interacting with gases or liquids, making them effective in large-scale industrial processes.

Their efficiency in catalytic cracking, hydrogenation, and gas-to-liquid conversion boosts demand. Additionally, heterogeneous catalysts offer enhanced stability, longer life cycles, and easier separation, ensures cost-effectiveness and operational efficiency.

By Material

Based on material, the market has been classified into metals, chemical compounds, organometallic, and zeolites. The chemical compounds segment secured the largest revenue share of 34.98% in 2023. This growth is largely attributed to the extensive use of metal-based and metal oxide catalysts in various industrial processes.

These materials are preferred for their high efficiency, stability, and ability to withstand extreme reaction conditions. Metal catalysts, such as platinum, palladium, and nickel, are critical in refining processes, hydrogenation, and petrochemical production, supporting the growth of the segment.

Furthermore, advancements in chemical compound formulations are enhancing catalyst performance, leading to reduced production costs and improved process yields.

By Application

Based on application, the market has been divided into petroleum refining, environmental, chemical, food processing, and others. The petroleum refining segment is poised to witness significant growth, registering a CAGR of 4.85% through the forecast period.

This growth is due to the critical role catalysts play in enhancing the efficiency and output of refining processes. Refining processes such as catalytic cracking, hydrocracking, and desulfurization rely heavily on advanced catalysts to optimize fuel production, reduce impurities, and improve overall process yields.

The growing demand for high-quality fuels, coupled with stringent environmental regulations on emissions and sulfur content, fuels the need for advanced catalytic solutions.

Catalysts Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

The Asia Pacific catalysts market accounted for a substantial share of around 32.43% in 2023, with a valuation of USD 11.61 billion. The rapidly expanding petrochemical industry in Asia-Pacific contributing significnalty to regional market expansion. Countries such as China, India, and South Korea are investing heavily in petrochemical complexes to meet the surging demand for plastics, polymers, and specialty chemicals.

- As per estimates from the Ministry of Petroleum in January 2024, India’s chemical and petrochemical industry is projected to reach approximately USD 300 billion by 2025. Additionally, the demand for petrochemicals is anticipated to triple by 2040, reaching USD 1 trillion.

Asia-Pacific has emerged as a global hub for refining and petrochemical activities due to rising energy needs and expanding downstream operations. Investments in refining capacity expansions, including India's large-scale petrochemical complexes and China’s mega-refineries, are leading to the increased demand for advanced refinery catalysts, thereby boosting domestic market growth.

Europe catalysts market is set to experience grow at a CAGR of 4.51% over the forecast period. The European Union’s commitment to achieving carbon neutrality by 2050 has spurred significant investments in renewable energy and biofuel production.

- The 2023 Renewable Energy Directive has raised the EU's binding renewable energy target for 2030 to at least 42.5%, up from the earlier goal of 32%, with a goal of 45%. This represents nearly a doubling of the EU's current renewable energy share. The directive came into effect across all EU member states on November 20, 2023.

Catalysts are essential in processes such as biomass conversion and biofuel production, supporting the shift toward cleaner energy sources. This transition contributes to the region’s sustainability goals, highlighting the pressing need for innovative catalytic solutions in bio-based fuel production, hydrogen economy initiatives, and renewable energy technologies.

Europe’s significant investments in research and development have fostered innovation in catalytic technologies. Collaborative efforts between companies and academic institutions are advancing next-generation catalysts, enhancing performance, efficiency, and sustainability. This focus on R&D is improving the catalytic processes across industries and aiding the growth of the Europe market.

Competitive Landscape

The global catalysts market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Catalysts Market

- BASF

- Dow

- Evonik Industries AG

- Arkema

- CLARIANT

- Exxon Mobil Corporation

- LyondellBasell Industries Holdings B.V.

- Albemarle Corporation

- Honeywell International Inc.

- Shell plc.

Key Industry Developments

- December 2024 (Expansion): BASF inaugurated its new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. This innovative research facility will act as a hub for pilot-scale synthesis of chemical catalysts, allowing BASF to provide its global customers with quicker access to innovative technologies.

- November 2024 (Launch): Clariant introduced its Plus series syngas catalysts, designed to enhance plant economics and reduce carbon emissions. The ReforMax LDP Plus series is a next-generation steam reforming catalysts aimed at improving the production of hydrogen, ammonia, and methanol.

The global catalysts market has been segmented as:

By Type

By Material

- Metals

- Chemical Compounds

- Organometallic

- Zeolites

By Application

- Petroleum Refining

- Environmental

- Chemical

- Food Processing

- Others

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America