Market Definition

The market focuses on reducing and offsetting carbon emissions to achieve net-zero targets. It includes renewable energy, carbon capture, and offset initiatives, involving collaboration among governments, businesses, environmental organizations, and individuals.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Carbon Neutrality Market Overview

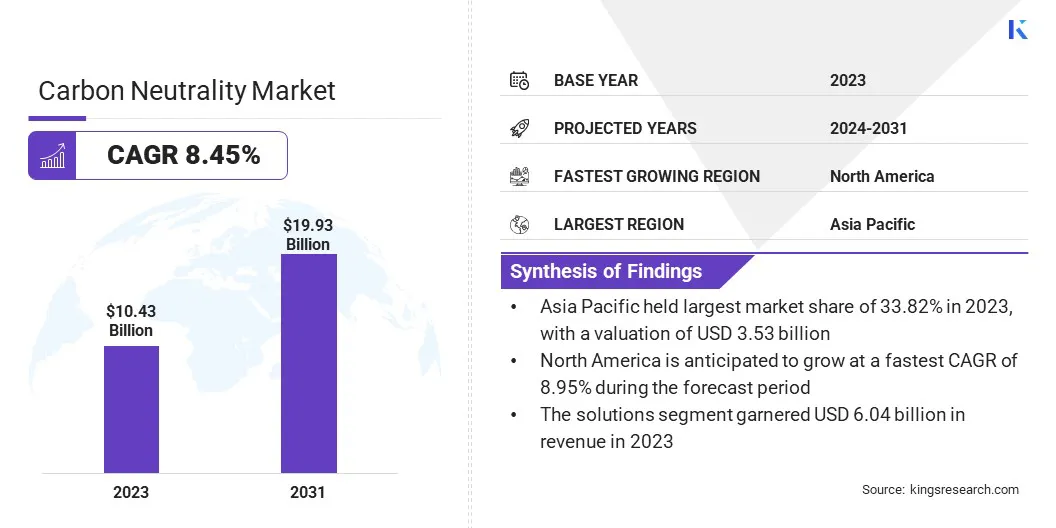

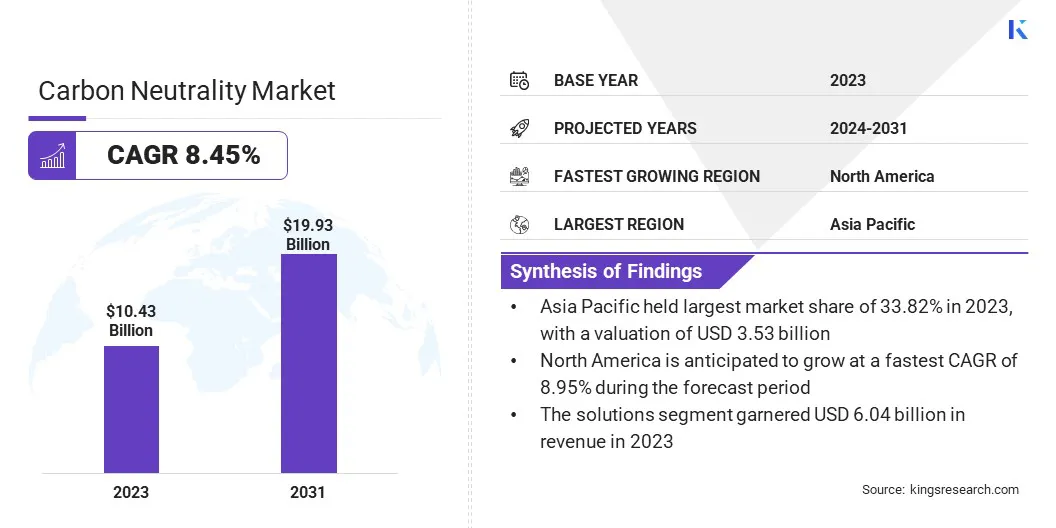

The global carbon neutrality market size was valued at USD 10.43 billion in 2023 and is projected to grow from USD 11.29 billion in 2024 to USD 19.93 billion by 2031, exhibiting a CAGR of 8.45% during the forecast period.

The market is expanding as the world shifts toward greener solutions to combat climate change. This growth is supported by the growing emphasis on sustainability, with more companies and governments setting ambitious carbon reduction targets. Rising consumer demand for eco-friendly practices further accelerates market expansion.

Major companies operating in the carbon neutrality industry are South Pole, EcoAct, ClimatePartner GmbH, Carbon Footprint Ltd, Green Mountain Energy Company, Climate Impact Partners, 3Degrees Group, Inc., Climeworks, Saudi Arabian Oil Co., SGS Société Générale de Surveillance SA, MITCON Consultancy & Engineering Services Limited, Robert Bosch GmbH, GreenSutra, LG Energy Solution, and Shell plc.

Additionally, the emergence of technologies such as carbon capture and storage is enhancing emission management. Growing support from governments through policies and incentives are supporting businesses to to achieve carbon neutrality. Investments in renewable energy, such as solar and wind power, are increasing, along with innovations in energy-efficient technologies.

- In August 2024, International Finance Corporation (IFC), Asian Development Bank (ADB), and Deutsche Investitions- und Entwicklungsgesellschaft (DEG) announced a USD 275 million equity investment in Fourth Partner Energy (FPEL). The investment aims to support FPEL's expansion plans, including a target portfolio of 3.5 GW of renewable energy assets by 2026.

Key Highlights

Key Highlights

- The carbon neutrality industry size was valued at USD 10.43 billion in 2023.

- The market is projected to grow at a CAGR of 8.45% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 3.53 billion.

- The biodiesel segment garnered USD 3.72 billion in revenue in 2023.

- The solutions segment is expected to reach USD 11.52 billion by 2031.

- The manufacturing segment is projected to generate a revenue of USD 4.90 billion by 2031.

- North America is anticipated to grow at a CAGR of 8.95% over the forecast period.

Market Driver

"Corporate Net-Zero Commitments"

The carbon neutrality market is growing as more companies commit to net-zero emissions targets, fueled by growing climate change concerns. increasingly responding to pressure from investors, consumers, and regulators by adopting sustainable practices and enhancing transparency in their environmental strategies.

This shift has led to increased investments in technologies such as renewable energy, carbon capture, and green hydrogen, which help businesses reduce their environmental impact. As corporate commitments to carbon neutrality rise, the demand for carbon-neutral solutions is rising.

- In October 2024, JSW Steel, Carbon Clean, and BHP signed a joint study agreement to explore the feasibility of Carbon Clean’s CycloneCC technology for carbon capture in steelmaking. The collaboration aims to capture up to 100,000 tonnes of CO₂ per year, supporting decarbonization efforts in the steel industry.

Market Challenge

"High Capital and Operational Costs"

A major challenge hampering the expansion of the carbon neutrality market is the high capital and operational costs associated with implementing carbon reduction technologies.

It involves transitioning to renewable energy sources, adopting carbon capture, utilization, and storage systems, or upgrading industrial infrastructure. The costs of developing, installing, and maintaining these systems can be prohibitive, particularly for smaller companies or industries with lower profit margins.

In many cases, these high upfront costs can delay the adoption of carbon-neutral technologies and slow progress toward global carbon reduction goals. To overcome this challenge, this challenge can be addressed through targeted financial incentives such as subsidies, tax credits, and low-interest loans, prompting companies to invest in carbon-neutral technologies.

Additionally, public-private partnerships and collaborations can help share the financial risks associated with these investments, making it easier for companies to implement carbon reduction strategies.

Market Trend

"Advancements in Carbon Capture, Utilization, and Storage Technologies"

The carbon neutrality market is experiencing significant growth due to advancements in carbon capture, utilization, and storage (CCUS) technologies. As industries face challenges in reducing emissions from hard-to-abate sectors such as cement, steel, and power generation, CCUS emerges as a viable solution.

By capturing carbon dioxide from industrial processes or the atmosphere for storage or reuse, CCUS supports carbon neutrality goals. Advancements in efficiency, cost reduction, and scalability have enhanced its appeal. The continuous evolution of CCUS technologies is vital to achieving global climate targets and is fueling the growth of the market.

- In April 2025, the Ministry of Science and ICT (MSIT) launched the Carbon Capture and Utilization (CCU) Initiative in Seoul to advance CCU technologies through collaboration with industry, academia, and research institutions. The initiative targets CO₂ reduction in hard-to-abate sectors such as cement and petrochemicals, supporting national carbon neutrality goals.

Carbon Neutrality Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fuel

|

Biodiesel, Bio-ethanol, Bio-butanol, Others

|

|

By Component

|

Solutions, Services

|

|

By Vertical

|

Manufacturing, Shipping & Logistics, Energy & Utilities, Construction, Automotive, Food & Beverages, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Fuel (Biodiesel, Bio-ethanol, Bio-butanol, and Others): The biodiesel segment earned USD 3.72 billion in 2023 due to its increasing use as a sustainable alternative to traditional diesel fuels and rising demand for cleaner transportation options.

- By Component (Solutions and Services): The solutions segment held a share of 57.87% in 2023, fueled by the growing need for comprehensive, scalable carbon neutrality technologies and systems that support businesses in achieving emission reduction goals.

- By Vertical (Manufacturing, Shipping & Logistics, Energy & Utilities, Construction, Automotive, Food & Beverages, and Others): The manufacturing segment is projected to reach USD 4.90 billion by 2031, propelled by the industry’s high carbon footprint and increasing focus on sustainable production and energy efficiency.

Carbon Neutrality Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific carbon neutrality market accounted for a substantial share of 33.82% in 2023, valued at USD 3.53 billion. This dominance is reinforced by the region’s strong industrial growth and demand for energy-efficient solutions.

Asia Pacific carbon neutrality market accounted for a substantial share of 33.82% in 2023, valued at USD 3.53 billion. This dominance is reinforced by the region’s strong industrial growth and demand for energy-efficient solutions.

Countries such as China and India play a major role, propelled by large manufacturing sectors seeking to reduce emissions. China’s focus on solar energy and India’s shift toward renewable power are supporting regional market expansion.

In addition, Southeast Asia’s growing use of biofuels and more sustainable practices in agriculture and transport are boosting the demand for carbon-neutral solutions across the region, positioning Asia Pacific as a key market for carbon neutrality.

- In February 2025, Toyota Motor Corporation partnered with the Shanghai municipal government to support carbon neutrality efforts. The collaboration aims to develop and produce BEVs and batteries in a new company established in Shanghai, with plans to manufacture a new Lexus BEV starting in 2027.

North America carbon neutrality industry is expected to register the fastest CAGR of 8.95% over the forecast period. The region's rapid adoption of renewable energy technologies, particularly in the United States and Canada, has contributed significantly to this growth.

The increased focus on energy storage solutions, electric vehicles, and sustainable manufacturing processes is fostering this expansion. Moreover, the growing interest in corporate sustainability among North American companies, bolstered by consumer preferences for eco-friendly products, is prompting businesses to invest in carbon neutrality initiatives. The availability of advanced carbon capture and storage technologies in the region is further supporting regional market growth.

Regulatory Frameworks

- In the United States, carbon neutrality is primarily guided by the Greenhouse Gas (GHG) Reporting Program under the Environmental Protection Agency (EPA), which requires large emitters to monitor and report their carbon emissions.

- In the European Union, the European Green Deal targets climate neutrality by 2050, supported by the European Climate Law, which sets legally binding goals, including a 55% reduction in GHG emissions by 2030 (compared to 1990 levels). The EU Emissions Trading System (ETS) serves as a key carbon pricing mechanism, promoting emission reductions across industries.

- In Japan, the Green Growth Strategy guides the transition to a carbon-neutral economy by 2050. The amended Japan Climate Change Law (2021) outlines more ambitious emission reduction targets to achieve net-zero GHG emissions by 2050.

Competitive Landscape

The carbon neutrality industry is characterized by a variety of strategies employed by key players to strengthen their positions. Many companies focus on expanding their portfolios of renewable energy solutions, such as solar, wind, and bioenergy, to meet the increasing demand for clean energy alternatives.

Partnerships and collaborations with other industry leaders, technology providers, and research institutions are common strategies to leverage innovative solutions and accelerate the development of carbon capture and storage technologies.

- In May 2024, Dow Chemical International Private Limited (Dow India) and Glass Wall Systems India signed a collaboration agreement for Dow to supply carbon-neutral silicone sealants from its Decarbia portfolio. The partnership focuses on supporting carbon-neutral silicone solutions, setting a global benchmark in reducing embodied carbon in construction materials.

Additionally, mergers and acquisitions are often adopted to access new markets and enhance technological capabilities. Another prominent strategy involves investing in R&D to develop advanced, efficient technologies, gaining a competitive edge.

Key players are also focusing on offering comprehensive carbon management services, including carbon offset programs, to help businesses and industries meet their sustainability goals.

Furthermore, businesses are integrating sustainability into their core operations by aligning their processes with global carbon neutrality standards and enhancing their sustainability branding to attract eco-conscious consumers.

List of Key Companies in Carbon Neutrality Market:

- South Pole

- EcoAct

- ClimatePartner GmbH

- Carbon Footprint Ltd

- Green Mountain Energy Company

- Climate Impact Partners

- 3Degrees Group, Inc.

- Climeworks

- Saudi Arabian Oil Co.

- SGS Société Générale de Surveillance SA

- MITCON Consultancy & Engineering Services Limited

- Robert Bosch GmbH

- GreenSutra

- LG Energy Solution

- Shell plc

Recent Developments (New Product Launch/Investment)

- In October 2024, Toshiba Corporation and Toshiba Energy Systems & Solutions Corporation showcased SCiB and AEROXIA at COP29 as key technologies contributing to carbon neutrality. SCiB enhances battery systems for a circular economy, while AEROXIA offers an SF6 alternative for power grids to reduce environmental impact.

- In September 2024, Hitachi Energy invested in a new renewable energy generation plant near its Figeholm, Sweden factory. The initiative aims to reduce the factory’s carbon footprint and achieve carbon neutrality by 2030. The plant will utilize sustainable wood pellets to replace heavy oil, significantly reducing Scope 1 GHG emissions in line with the company’s sustainability strategy.

Key Highlights

Key Highlights Asia Pacific carbon neutrality market accounted for a substantial share of 33.82% in 2023, valued at USD 3.53 billion. This dominance is reinforced by the region’s strong industrial growth and demand for energy-efficient solutions.

Asia Pacific carbon neutrality market accounted for a substantial share of 33.82% in 2023, valued at USD 3.53 billion. This dominance is reinforced by the region’s strong industrial growth and demand for energy-efficient solutions.