Market Definition

The market encompasses the comprehensive value chain involved in the capture, transportation, and long-term geological storage of carbon dioxide (CO₂) emissions generated from industrial processes and fossil fuel-based power generation.

This market serves a critical function in advancing global decarbonization objectives by facilitating large-scale reductions in CO₂ emissions, thereby supporting the achievement of climate change mitigation goals.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Carbon Capture and Storage Market Overview

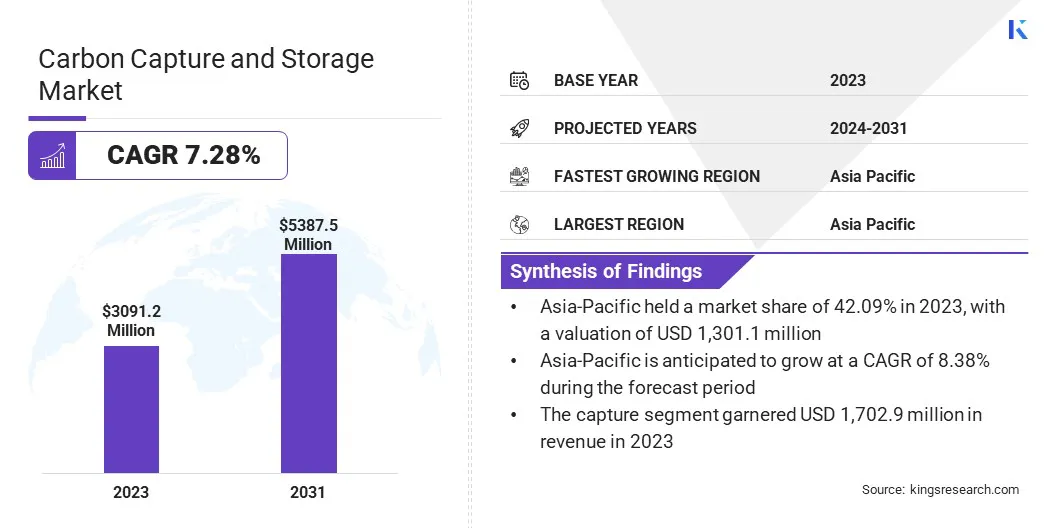

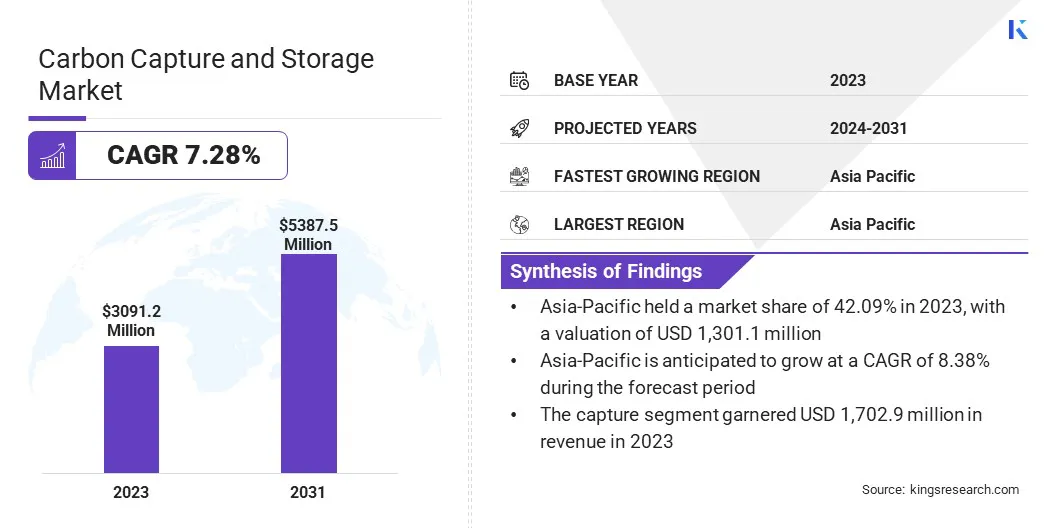

According to Kings Research, the global carbon capture and storage market size was valued at USD 3,091.2 million in 2023 and is projected to grow from USD 3,294.5 million in 2024 to USD 5,387.5 million by 2031, exhibiting a CAGR of 7.28% during the forecast period.

This growth is driven by the increasing global emphasis on reducing greenhouse gas emissions, stringent environmental regulations, and rising investments in clean energy technologies.

Key Market Highlights:

- The carbon capture and storage industry size was recorded at USD 3,091.2 million in 2023.

- The market is projected to grow at a CAGR of 7.28% from 2024 to 2031.

- Asia-Pacific held a market share of 42.09% in 2023, with a valuation of USD 1,301.1 million.

- The post-combustion capture segment garnered USD 1,549.0 million in revenue in 2023.

- The power generation segment is expected to reach USD 1,820.8 million by 2031.

- The geological storage segment is anticipated to witness the fastest CAGR of 7.88% during the forecast period.

- The capture segment garnered USD 1,702.9 million in revenue in 2023.

- The market in Europe is anticipated to grow at a CAGR of 7.26% during the forecast period.

Major companies operating in the carbon capture and storage industry are MITSUBISHI HEAVY INDUSTRIES, LTD., Aker Solutions, Exxon Mobil Corporation, Equinor ASA, Shell.com, Linde PLC, Occidental Petroleum Corporation, Fluor Corporation, TotalEnergies, JGC HOLDINGS CORPORATION, Air Products and Chemicals, Inc., SLB, Honeywell International Inc., Baker Hughes Company, and Dakota Gasification Company.

Furthermore, the increasing implementation of carbon capture and storage (CCS) technologies across high-emission industrie ssuch as power generation, cement, steel, and chemical manufacturing is driving the growth of the market.

Market expansion is further supported by technological progress, favorable regulatory frameworks, and the development of carbon credit mechanisms, which together enhance the commercial viability of CCS projects.

- In March 2025, Saudi Aramco and Siemens Energy launched the country’s first Direct Air Capture (DAC) test unit, designed to remove 12 tons of CO₂ annually. The pilot aims to advance region-specific DAC technologies and supports Aramco’s goal of net-zero emissions by 2050.

Rising Industrial and Power Sector Emissions

The carbon capture and storage (CCS) market is being driven by persistently high emissions from the industrial and power generation sectors. Industries such as cement, steel, chemicals, and fossil fuel-based power generation are among the largest contributors to global CO₂ emissions.

These sectors face structural challenges in transitioning to low-carbon alternatives due to process-specific emissions and high energy requirements. CCS offers a practical and scalable solution to reduce emissions without overhauling existing infrastructure.

- In March 2024, TechnipFMC plc was selected by the Northern Endurance Partnership (NEP) to deliver the world’s first all-electric iEPCI project for carbon capture and storage in the UK’s East Coast Cluster, aiming to streamline subsea infrastructure and reduce installation time.

Uncertainty Around Long-Term Storage Liability

Long-term storage liability is a key challenge in the carbon capture and storage (CCS) market. Once CO₂ is injected into geological formations, extended monitoring is required to verify storage permanence and prevent potential risks, such as leakage.

The absence of clearly defined legal, regulatory, and financial frameworks for long-term stewardship deters project developers and financial stakeholders from committing to large-scale initiatives.

Furthermore, the lack of harmonized international standards for post-closure obligations, liability transfer mechanisms, and risk mitigation protocols hinders the adoption of CCS.

To address these challenges, key players are collaborating with governments to establish clear liability transfer mechanisms, support long-term monitoring, and contribute to public stewardship funds. They are also investing in advanced MRV technologies and adopting international standards to ensure storage integrity and build investor confidence.

Advancements in Capture and Storage Technologies

Advancements in capture and storage technology is one of the leading trends in the market, significantly enhancing the technical and economic viability of carbon capture and storage across various sectors.

Innovations such as metal-organic frameworks (MOFs) and covalent organic frameworks are enabling higher efficiency and selectivity in CO₂ capture, offering scalable solutions for emission-intensive industries like cement, steel, and energy-from-waste.

Furthermore, the modularization of capture systems is streamlining deployment by reducing spatial requirements, capital costs, and retrofitting timelines for existing facilities.

- In December 2024, SLB Capturi completed the construction of the world's first industrial-scale carbon capture plant at Heidelberg Materials' cement facility in Brevik, Norway. The plant is designed to capture up to 400,000 metric tons of CO₂ annually, enabling the production of net-zero cement.

Carbon Capture and Storage Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Pre-combustion Capture, Post-combustion Capture, Oxy-fuel Combustion, Direct Air Capture (DAC)

|

|

By Capture Source

|

Power Generation, Oil & Gas, Cement, Iron & Steel

|

|

By Application

|

EOR (Enhanced Oil Recovery), Geological Storage, Utilization (CCU)

|

|

By Service Type

|

Capture, Transportation, Storage

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Pre-combustion Capture, Post-combustion Capture, Oxy-fuel Combustion, Direct Air Capture (DAC)): The post-combustion capture segment earned USD 1,549.0 million in 2023 due to its widespread applicability in retrofitting existing power plants and industrial facilities.

- By Capture Source (Power Generation, Oil & Gas, Cement, Iron & Steel): The power generation segment held 39.12% of the market in 2023, due to its significant contribution to global CO₂ emissions and the increasing adoption of carbon capture technologies in fossil fuel-based power plants.

- By Application (EOR (Enhanced Oil Recovery), Geological Storage, Utilization (CCU)): The geological storage segment is projected to reach USD 2,726.5 million by 2031, owing to its long-term sequestration potential and growing regulatory support for permanent carbon dioxide storage in deep underground formations.

- By Service Type (Capture, Transportation, Storage): The transportation segment is anticipated to grow at a CAGR of 8.95% during the forecast period driven by the expansion of cross-regional CO₂ pipeline infrastructure and the increasing need for efficient logistics between capture sites and storage locations.

Carbon Capture and Storage Market Regional Analysis

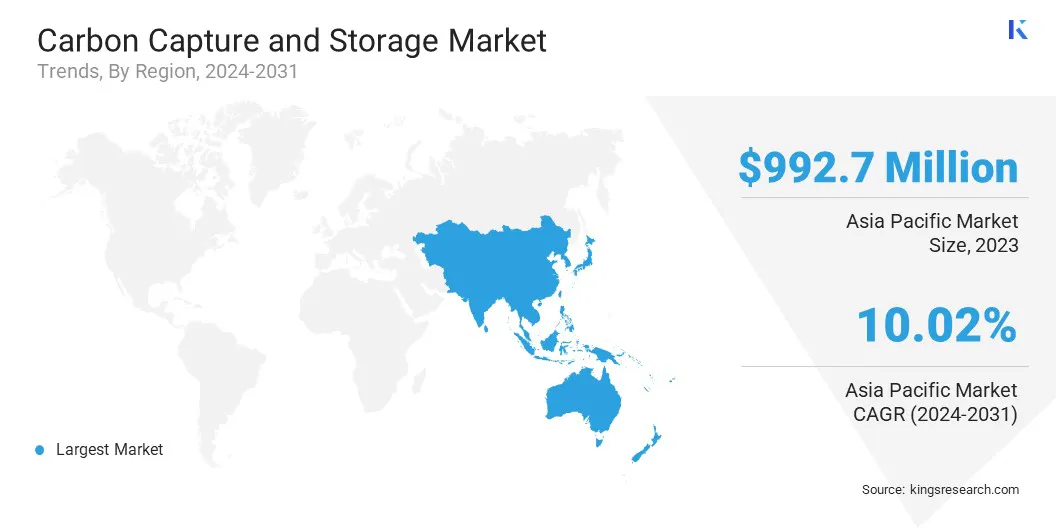

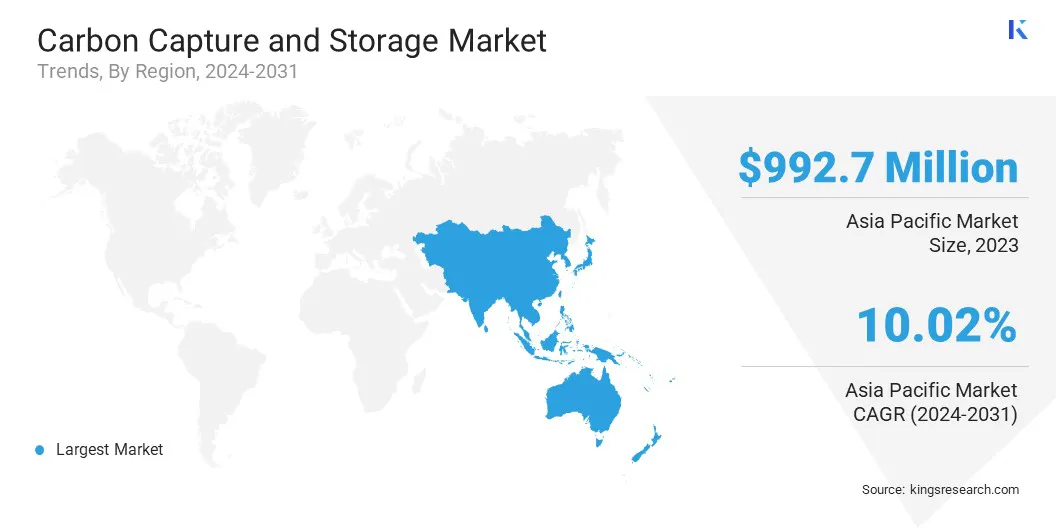

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific carbon capture and storage market share stood around 42.09% in 2023 in the global market, with a valuation of USD 1,301.1 million. This dominance is attributed to rapid industrialization and increasing government initiatives in decarbonization technologies across major economies such as China, India, and Japan.

The region is witnessing a surge in large-scale CCS projects, particularly in the power generation, steel, and chemical manufacturing sectors. National commitments to carbon neutrality, along with supportive regulatory frameworks such as carbon pricing mechanisms and emission reduction mandates.

They are driving the accelerated deployment of carbon capture and storage technologies across the region. The availability of suitable geological formations for CO₂ storage further enhances the region's capacity for long-term carbon sequestration.

- In March 2024, ExxonMobil Corporation and Shell announced their selection by the Singapore government to lead the development of a cross-border carbon capture and storage (CCS) project. The S-Hub consortium aims to capture and permanently store at least 2.5 million tonnes of CO₂ annually by 2030, focusing on reducing emissions from hard-to-decarbonize industries.

Europe carbon capture and storage industry is poised to grow at a CAGR of 7.26% over the forecast period, supported by stringent climate policies, emission reduction targets under the European Green Deal, and substantial public and private investments in low-carbon technologies.

The region is placing a strategic focus on developing carbon management hubs that integrate capture, transport, and storage infrastructure to serve multiple emitters. Furthermore, funding programs under the EU Innovation Fund and Horizon Europe are accelerating the commercialization of CCS technologies.

The harmonization of regulatory frameworks across European member states is streamlining project approval processes and enhancing investor confidence, thereby reinforcing Europe’s position as a global leader in carbon capture and storage deployment.

- In March 2025, ORLEN and Equinor signed a collaboration agreement to explore carbon capture and storage (CCS) opportunities in Poland. The partnership aims to identify potential CO₂ storage sites, including onshore locations and areas within the Polish section of the Baltic Sea.

Regulatory Frameworks

- In the European Union, Directive 2009/31/EC on the Geological Storage of Carbon Dioxide regulates carbon capture and storage. It ensures the safe geological storage of CO₂ to prevent environmental harm and support EU climate targets.

- In the United Kingdom, The Storage of Carbon Dioxide (Licensing etc.) Regulations 2010 regulate carbon capture and storage. It provides the legal framework for licensing, operation, and monitoring of CO₂ storage activities, ensuring environmental protection and long-term containment in line with national climate objectives.

- In Canada, the Carbon Sequestration Tenure Regulation (Alberta Regulation 68/2011) regulates carbon capture and storage by outlining the permitting and leasing process for CO₂ sequestration, ensuring projects comply with provincial standards.

- In Australia, the Offshore Petroleum and Greenhouse Gas Storage Act 2006 governs the exploration and development of offshore petroleum resources and the injection and storage of greenhouse gases in Commonwealth waters.

Competitive Landscape

The carbon capture and storage industry is highly competitive with established multinational energy corporations, specialized technology developers, and emerging innovators. Market participants are actively pursuing strategic collaborations, mergers, and acquisitions to expand their technological capabilities and geographic footprint.

Significant investments in research and development are aimed at enhancing capture efficiency, reducing operational costs, and accelerating the commercialization of advanced storage solutions.

Companies are increasingly adopting integrated decarbonization strategies, such as carbon dioxide utilization and low-carbon hydrogen production, to enhance their market value and competitiveness in the energy transition.

- In June 2024, Shell Canada revealed plans to advance two carbon capture and storage initiatives: The Polaris project, targeting the capture of 650,000 tonnes of CO₂ annually at its Scotford facility, and the Atlas Carbon Storage Hub, developed in collaboration with ATCO EnPower, to enable permanent underground storage. Both projects are scheduled to begin operations by 2028.

Key Companies in Carbon Capture and Storage Market:

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Aker Solutions

- Exxon Mobil Corporation

- Equinor ASA

- Shell.com

- Linde PLC

- Occidental Petroleum Corporation

- Fluor Corporation

- TotalEnergies

- JGC HOLDINGS CORPORATION

- Air Products and Chemicals, Inc.

- SLB

- Honeywell International Inc.

- Baker Hughes Company

- Dakota Gasification Company

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, Baker Hughes and Frontier Carbon Solutions, LLC. formed a partnership to advance large-scale carbon capture and storage and power solutions in the U.S. Under this partnership, Baker Hughes will deliver technology for CO₂ compression, well design, and monitoring to support Frontier's Sweetwater Carbon Storage Hub in Wyoming.

- In September 2024, Eni S.p.A. and Snam SPA Ravenna CCS, Italy’s first carbon capture and storage project. Phase 1 captures 25,000 tonnes of CO₂ annually from a gas plant and stores it in a depleted offshore gas field. Powered entirely by renewables, the project aims to become a major CO₂ storage hub for Southern Europe.

- In June 2024, Verra introduced VM0049, a new methodology under its Verified Carbon Standard for carbon capture and storage. The framework supports CO₂ removals and reductions through modular components for capture, transport, and storage, enabling flexible and scalable project development.

- In October 2023, SLB launched a carbon storage screening and ranking solution to help assess site suitability for carbon capture, utilization, and storage projects by evaluating technical, economic, and risk-related factors.

- In September 2023, ADNOC announced a final investment decision to develop the Habshan carbon capture, utilization, and storage (CCUS) project, aiming to capture and permanently store 1.5 million tonnes of CO₂ annually. This initiative aims to increase ADNOC's carbon capture capacity to 2.3 million tonnes per year, supporting the company's goal of achieving net-zero emissions by 2045.