Market Definition

Carbon footprint management is the process of measuring, monitoring, reducing, and reporting greenhouse gas (GHG) emissions generated by an organization, product, or activity.

It involves assessing emissions across operations, identifying reduction opportunities, implementing mitigation strategies, and ensuring compliance with environmental regulations and sustainability goals. This process helps businesses improve environmental performance, strengthen brand value, and align with global climate targets.

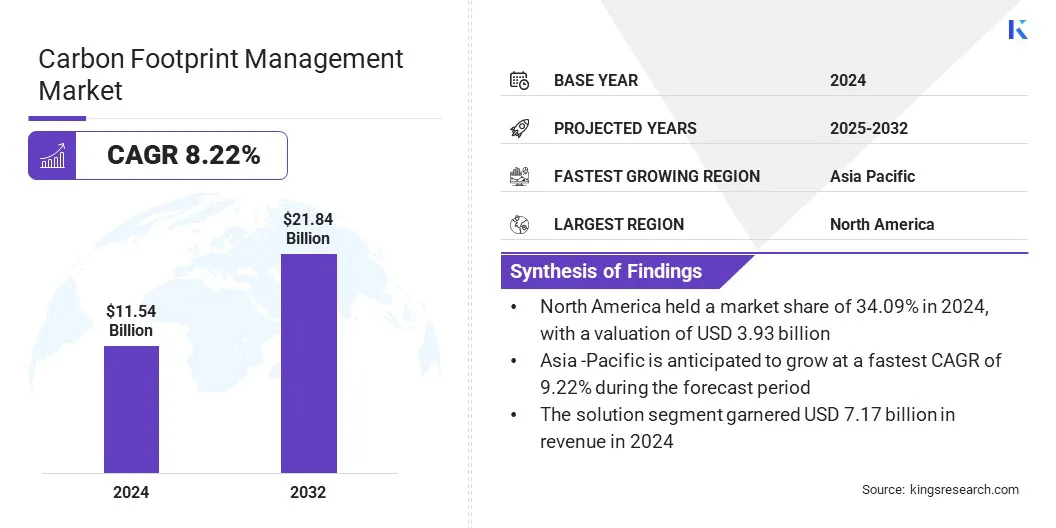

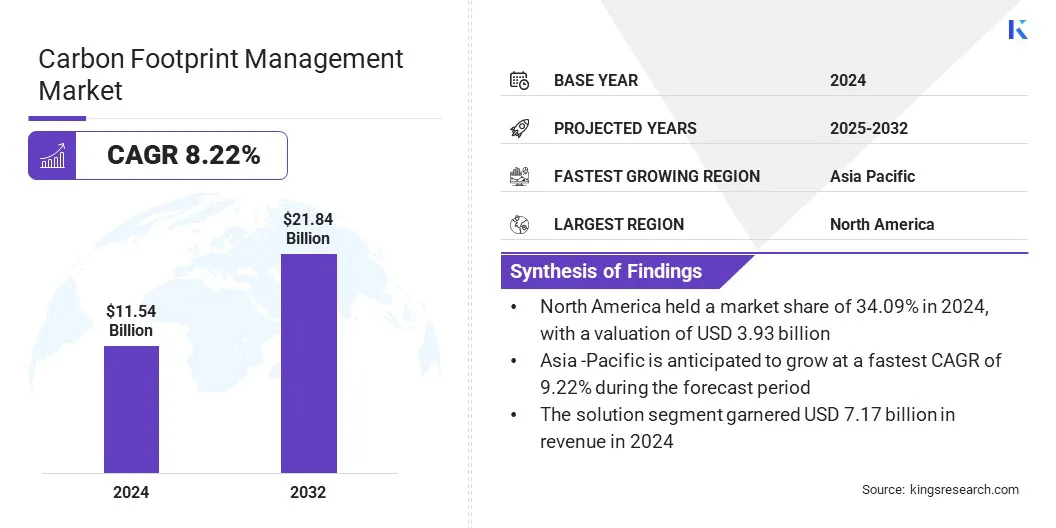

The global carbon footprint management market size was valued at USD 11.54 billion in 2024 and is projected to grow from USD 12.45 billion in 2025 to USD 21.84 billion by 2032, exhibiting a CAGR of 8.22% during the forecast period.

The market growth is attributed to increasing public and private investments aimed at scaling carbon capture and storage infrastructure to reduce industrial emissions. The market is further driven by the rising demand for tailored carbon management platforms that address the unique emission profiles of pharmaceuticals, logistics, and energy industries.

Key Highlights:

- The carbon footprint management industry size was valued at USD 11.54 billion in 2024.

- The market is projected to grow at a CAGR of 8.22% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 3.93 billion.

- The solution segment garnered USD 7.17 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 12.43 billion by 2032.

- The small and medium enterprises segment is anticipated to grow at a CAGR of 8.54% over the forecast period.

- The transportation segment held a market share of 24.47% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.22% through the forecast period.

Major companies operating in the carbon footprint management market are Salesforce, Locus Technologies, Greenly, Microsoft, IBM Corporation, Sphera, Emitwise, Persefoni AI, PLANA.EARTH GmbH, ENGIE Impact, SAP SE, Schneider Electric, Coolset, Normative, and Ideagen.

International treaties such as the Paris Agreement, a legally binding treaty on climate change, are prompting governments to tighten climate policies and set more ambitious emission reduction targets, accelerating the need for robust carbon footprint management.

- The Emissions Gap Report 2024 reported that nations must pledge and deliver greenhouse gas cuts of 42% by 2030 and 57% by 2035 to stay on track for the internationally agreed goal of limiting global warming to 1.5°C.

Market Driver

Expansion of Carbon Capture and Storage Infrastructure

Expansion of carbon capture and storage infrastructure is accelerating the demand for precise carbon footprint management. Companies in the market are expanding their adoption of tools to monitor, track, and report captured emissions across facilities and supply chains as more carbon capture and storage projects move from planning to implementation.

This infrastructure growth is prompting industries to adopt digital platforms that ensure accurate emissions accounting and alignment with verification protocols. The need to validate emission reductions and participate in carbon offset markets is further driving the adoption of robust footprint management solutions.

- According to the International Energy Agency (IEA) in 2023, the global carbon capture capacity for 2030 rose by 35% and storage capacity by 70%, reaching 435 Mt and 615 Mt of CO₂ per year, respectively. These figures reflect the committed volumes from planned carbon capture and storage (CCS) projects.

Market Challenge

Lack of Standardized Methodologies

A key challenge in the carbon footprint management market is the lack of standardized methodologies for measuring and reporting GHG emissions. Various organizations and countries follow varying protocols, making it difficult to ensure consistency, transparency, and comparability in emission data. This inconsistency creates barriers for companies aiming to benchmark performance, achieve third-party certifications, or participate in the carbon trading schemes.

Market players are actively collaborating with international standard-setting bodies to develop unified carbon accounting frameworks. Players are investing in platforms that align with globally recognized protocols such as the GHG Protocol and ISO standards to ensure consistent reporting.

Additionally, industry associations are promoting knowledge-sharing initiatives and best practices to accelerate standards adoption and improve the credibility of emissions data across global supply chains.

Market Trend

Industry-specific Carbon Management Solutions

A key trend in the carbon footprint management market is the rise of industry-specific platforms tailored to the unique operational needs of high-emission sectors such as life sciences. Players in the market are prioritizing solutions that track emissions across manufacturing, R&D, and supply chains while supporting compliance with evolving environmental standards.

This trend is prompting technology providers to develop purpose-built tools that monitor Scope emissions and optimize energy use. These innovations help pharmaceutical firms advance decarbonization goals, streamline reporting, and strengthen sustainability performance across operations.

- In June 2024, Schneider Electric launched EcoStruxure for Life Sciences in India to support the pharmaceutical industry’s transition to sustainable operations. The platform enables pharma companies to reduce emissions, electrify processes, and digitize energy & water management, helping meet carbon reduction goals. This aligns with the growing demand for sector-specific carbon footprint management solutions in high-emission industries like pharmaceuticals.

|

Segmentation

|

Details

|

|

By Component

|

Solution, Services

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By Organization Size

|

Small and Medium Enterprises, Large Enterprises

|

|

By Application

|

Energy & Utilities, Manufacturing, Transportation, Government & Public Sector, IT & Telecommunications, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solution, and Services): The solution segment earned USD 7.17 billion in 2024, due to the rising demand for integrated emission tracking and reporting platform.

- By Deployment (On-premises, and Cloud-based): The on-premises segment held 57.70% share of the market in 2024, due to stronger data control and regulatory compliance needs among enterprises.

- By Organization Size (Small and Medium Enterprises, and Large Enterprises): The large enterprises segment is projected to reach USD 12.88 billion by 2032, owing to large-scale sustainability initiatives and increased ESG reporting obligations.

- By Application (Energy & Utilities, Manufacturing, Transportation, Government & Public Sector, IT & Telecommunications, Healthcare and Others): The transportation segment is anticipated to grow at a CAGR of 8.57% over the forecast period, due to the growing adoption of fleet emission monitoring and decarbonization solutions.

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America carbon footprint management market share stood at around 34.09% in 2024, with a valuation of USD 3.93 billion. This dominance is attributed to the strong policy support by government and continued investment in carbon removal initiatives across the region.

The market is registering steady growth as federal agencies fund pilot-scale projects that advance atmospheric carbon dioxide removal and support the development of integrated low-carbon energy systems. These projects are aligning with national strategies aimed at accelerating clean hydrogen production and driving long-term industrial decarbonization.

Government initiatives promoting the use of biomass and carbon capture technologies to produce low-emission fuels are also expanding the market in the region. The presence of targeted public funding and innovation-led deployment strategies is positioning the region as a leader in applying advanced emission reduction methods across critical energy and manufacturing sectors, thereby supporting the market expansion in the region.

- In October 2024, the U.S. Department of Energy announced USD 58.5 million in funding for 11 pilot projects to advance carbon dioxide removal technologies. Among them, USD 7 million was awarded to Mote, Inc. to develop a system that produces carbon-negative hydrogen from biomass, integrating hydrogen production with CO₂ capture. This initiative supports the national clean hydrogen strategy and reflects the government’s broader effort to scale carbon removal solutions and accelerate decarbonization across energy and industrial sectors.

The carbon footprint management industry in Asia Pacific is set to grow at a robust CAGR of 9.22% over the forecast period. This growth is attributed to the increasing adoption of integrated carbon accounting platforms and the implementation of regulatory sustainability mandates across the region.

Governments and enterprises in the region are prioritizing emission tracking systems that enhance data accuracy, improve compliance, and support long-term climate goals. Companies are adopting automated, audit-ready reporting frameworks to align with net zero targets and meet evolving disclosure requirements.

The market is benefiting from the rising demand for advisory-led solutions that help organizations identify emission sources and develop targeted decarbonization strategies. Large enterprises are investing in unified platforms that integrate emissions management with broader environmental governance, thereby fueling the market in the region.

- In August 2024, Coforge partnered with Salesforce to launch Coforge ENZO, a carbon footprint management solution built on Salesforce’s Net Zero Cloud. ENZO enables enterprises to track, calculate, and report greenhouse gas emissions through real-time dashboards and audit-ready reporting tools. It supports regulatory compliance and integrates consulting services to guide businesses in achieving Net Zero targets through data-driven decarbonization strategies.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) oversees GHG emissions reporting under the Greenhouse Gas Reporting Program (GHGRP). It regulates emissions from large facilities and mandates accurate data collection, monitoring, and public disclosure.

- In China, the Ministry of Ecology and Environment (MEE) governs the national carbon trading system and monitors corporate carbon emissions. It mandates emission reporting from major polluters and enforces carbon intensity reduction targets.

- In India, the Central Pollution Control Board (CPCB) regulates industrial emissions and monitors air quality standards linked to carbon output.

- In the UK, the Environment Agency (EA) manages the UK Emissions Trading Scheme (UK ETS) and enforces mandatory carbon reporting for energy-intensive companies. It regulates emission allowances, monitors reductions, and ensures that companies meet net-zero commitments.

Competitive Landscape

Major players in the carbon footprint management industry are focusing on integrating advanced technologies to accelerate industrial decarbonization. Players are developing strategic partnerships to combine power generation systems with innovative thermal solutions that utilize waste heat to produce carbon-free energy. They are actively working to enhance energy efficiency and reduce emissions across high-demand sectors such as district heating and data centers.

Market players are expanding their presence in the low-carbon energy value chain by aligning with partners that offer complementary expertise and enabling the deployment of integrated solutions that optimize both power and heat generation.

These strategies are enabling the deployment of scalable, low-emission systems that support net-zero transition across industrial applications and strengthen the role of integrated energy solutions in long-term decarbonization goals.

- In October 2024, INNIO Group entered into a strategic partnership with Heaten, following the acquisition of Heaten by INNIO’s parent company, AI Alpine. The partnership focuses on accelerating industrial decarbonization by combining INNIO’s power generation technologies with Heaten’s high-temperature heat pumps, which generate CO₂-free heat from waste heat. This collaboration aims to strengthen its role in low-carbon energy systems and supports emissions reduction across district heating and data centers.

Key Companies in Carbon Footprint Management Market:

- Salesforce

- Locus Technologies

- Greenly

- Microsoft

- IBM Corporation

- Sphera

- Emitwise

- Persefoni AI

- EARTH GmbH

- ENGIE Impact

- SAP SE

- Schneider Electric

- Coolset

- Normative

- Ideagen

Recent Developments (Product Launch)

- In November 2024, Samsung Electronics partnered with the Carbon Trust and other tech firms to launch a standard methodology for measuring and reducing use-phase emissions of connected devices. The initiative enhances Scope 3 reporting and supports real-time carbon tracking through tools like SmartThings Energy and AI Energy Mode.