Market Definition

Building integrated photovoltaics (BIPV) are photovoltaic materials that are incorporated into the structure of buildings, such as roofs, facades, windows, or skylights, where they serve as both building components and sources of solar power.

These systems replace conventional building materials in parts of the building envelope and generate renewable energy on-site, supporting energy efficiency, architectural design flexibility, and sustainability in modern construction.

The BIPV market is segmented by technology covering thin-film, crystalline silicon and emerging photovoltaic solutions, by end user comprising residential, commercial and industrial sectors, and by application spanning roofs, facades, glazing, shading and other architectural elements.

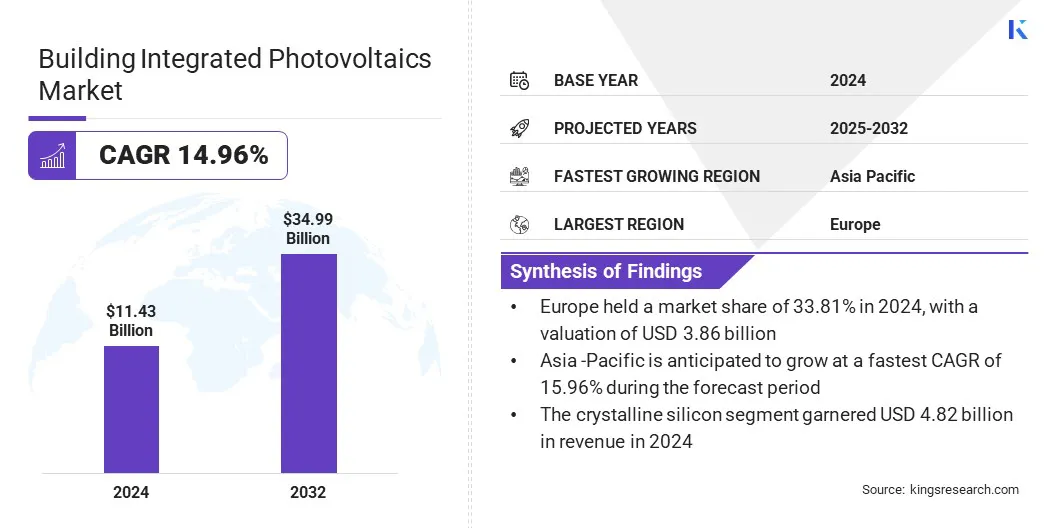

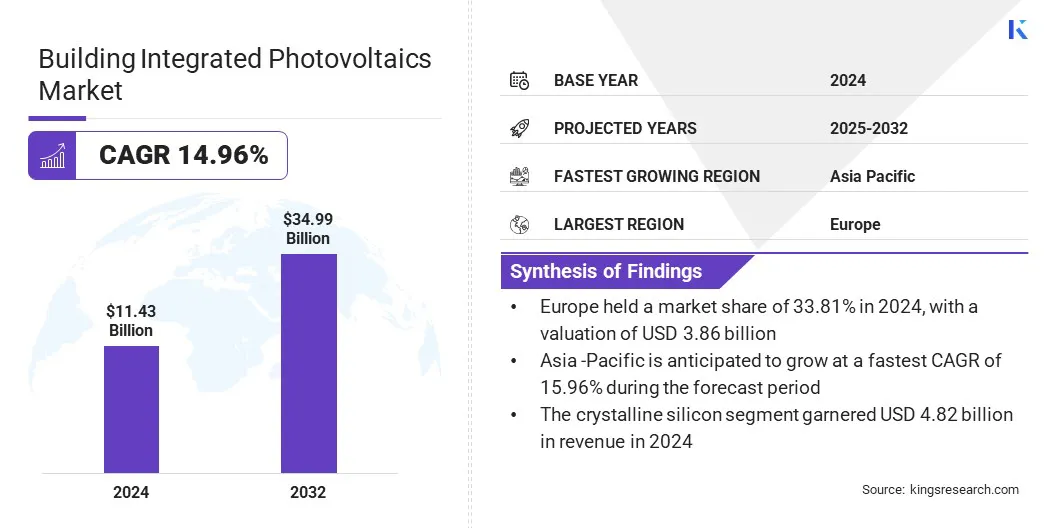

The global building integrated photovoltaics market size was valued at USD 11.43 billion in 2024 and is projected to grow from USD 13.11 billion in 2025 to USD 34.99 billion by 2032, exhibiting a CAGR of 14.96% during the forecast period.

The market is driven by the rising energy demand and the consequent adoption of on-site renewable energy solutions. The market is further expanding, due to the growing use of semi-transparent and colored photovoltaic glass in modern architecture.

Key Market Highlights:

- The global building integrated photovoltaics industry size was valued at USD 11.43 billion in 2024.

- The market is projected to grow at a CAGR of 14.96% from 2025 to 2032.

- Europe held a market share of 33.81% in 2024, with a valuation of USD 3.86 billion.

- The crystalline silicon segment garnered USD 4.82 billion in revenue in 2024.

- The roofs segment is expected to reach USD 9.19 billion by 2032.

- The commercial segment held a market share of 38.61% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 15.96% during the forecast period.

Major companies operating in the building integrated photovoltaics market are SolarWindow Technologies, Inc, AGC Inc, Hanergy.GR, Maxeon Solar, Heliatek GmbH, Tesla, Ertex Solar, Solarday, Onyx Solar Group LLC, Ankara Solar AS, NanoPV Solar Inc, Hermans Techniek, ViaSolis, SOLTECH, and Sphelar Power Corporation.

Building Integrated Photovoltaics Market Report Snapshot

Building Integrated Photovoltaics Market Report Scope

|

Segmentation

|

Details

|

|

By Technology

|

Crystalline Silicon, Thin Film, Others

|

|

By Application

|

Roofs, Walls, Glass, Facade, Others

|

|

By End User

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Building Integrated Photovoltaics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The building integrated photovoltaics market in Europe accounted for a share of around 33.81% in 2024, with a valuation of USD 3.86 billion. This dominance is attributed to the region’s strong commitment to sustainable construction practices and the growing integration of recycling technologies in solar manufacturing.

The market is witnessing increased collaboration between glass manufacturers and PV recyclers to incorporate recycled photovoltaic materials into new building-integrated solutions. These efforts are helping reduce emissions and improve material efficiency, aligning with the region’s environmental goals.

The regulatory pressure to meet carbon neutrality targets and implement green building mandates is accelerating BIPV adoption across commercial and public infrastructure.

Manufacturers are introducing flat glass products that combine high energy efficiency with architectural versatility, meeting both design and environmental standards. These advancements are further contributing to the market expansion in the region.

- In September 2024, AGC Glass Europe partnered with photovoltaic recycling pioneer ROSI to incorporate recycled PV glass into flat glass production, supporting circularity and low-carbon practices that are increasingly important in the sustainable manufacturing of BIPV materials.

The building integrated photovoltaics industry in Asia Pacific is set to grow at a robust CAGR of 15.96% over the forecast period. This growth is attributed to the increasing collaboration between solar technology providers and building material manufacturers in the region.

Regional players are introducing integrated photovoltaic systems that comply with structural safety and energy efficiency standards, while supporting broader sustainability objectives. These developments are enabling the adoption of energy-generating building components in residential, commercial, and public infrastructure projects.

The regional focus on achieving net-zero construction and reducing grid dependency is accelerating the demand for BIPV solutions that merge functionality with renewable energy generation, further strengthening the market growth.

- In July 2024, Kingspan and LONGi formalized a strategic partnership to jointly develop and promote BIPV and BAPV solar systems, combining high-performance building materials with advanced solar technology to support net-zero energy targets in the construction sector.

Building Integrated Photovoltaics Market Overview

The implementation of large-scale rooftop solar initiatives is significantly supporting the growth of the market.

Easy financing options and rapid subsidy disbursal are enabling widespread adoption in urban and semi-urban areas. Moreover, the environmental benefits and financial savings are encouraging consumers to integrate solar solutions directly into building structures.

- In February 2024, the Indian government launched the PM Surya Ghar Muft Bijli Yojana with a budget allocation of approximately USD 9 billion to promote rooftop solar adoption through subsidies and collateral-free loans for residential households. The scheme is driving the demand for integrated solutions such as BIPV in the growing urban housing sector.

Market Driver

Rising Energy Demand

The rising demand for electricity across residential, commercial, and industrial sectors is driving the market. Increasing urbanization, electrification of mobility, and reliance on digital infrastructure are significantly boosting the global energy consumption.

BIPV offer an efficient solution by enabling on-site solar power generation through rooftops, facades, and other structural surfaces. These systems help reduce dependence on the grid while supporting sustainable development goals. Additionally, the growing government focus on decentralized energy is propelling the market.

- In 2024, the U.S. solar industry installed nearly 50 GWdc of capacity, a 21% increase from 2023. Increasing energy demand in urban areas drives the need for integrated renewable energy solutions like BIPV to meet electricity needs sustainably.

Market Challenge

High Initial Installation Costs

A key challenge in the building integrated photovoltaics market is the high initial installation cost compared to conventional construction materials and traditional solar panels.

Integrating PV components into building facades, roofs, or windows requires custom designs, advanced materials, and skilled labor, which significantly increases upfront expenses. Limited availability of standardized BIPV products further raises the complexity of procurement and installation.

Market players are investing in cost optimization through modular BIPV designs and prefabricated components that simplify installation and reduce labor requirements. They are partnering with construction firms and architects early in the design phase to streamline integration and lower engineering costs.

Additionally, players are offering financing models and leasing options to make BIPV systems more accessible to cost-sensitive residential and commercial customers.

Market Trend

Growing Use of Semi-transparent and Colored Photovoltaic Glass

A key trend in the market is the growing use of semi-transparent and colored photovoltaic glass in modern architecture. Developers and architects are increasingly favoring these materials for facades, canopies, and skylights, due to their ability to seamlessly integrate energy generation with architectural design.

This trend prompts manufacturers to offer customizable colors, textures, and transparency levels and enable greater design flexibility. This growing preference is leading to the increased adoption of BIPV in commercial, public, and institutional projects for functional energy performance.

- In October 2024, Trinasolar Evergreen, a BIPV unit of Trina Solar, launched four new integrated solar products for public, industrial, and infrastructure applications. Featuring advanced TOPCon technology, the new solutions such as solar tiles, industrial walls, PV noise barriers, and colored PV glass demonstrate growing innovation and diversification in the BIPV market to meet evolving architectural and energy needs.

Market Segmentation:

- By Technology (Crystalline Silicon, Thin Film, and Others): The crystalline silicon segment earned USD 4.82 billion in 2024, due to its high efficiency, durability, and widespread availability for building applications.

- By Application (Roofs, Walls, Glass, Façade and Others): The roofs segment held 26.23% share of the market in 2024, due to the ease of integration with existing structures and strong demand in solar-enabled roofing systems.

- By End User (Residential, Commercial, and Industrial): The commercial segment is projected to reach USD 13.37 billion by 2032, owing to increased investment in green buildings and sustainable infrastructure development.

Regulatory Frameworks

- In the U.S., the Department of Energy (DOE) oversees the regulation and development of BIPV through initiatives supporting solar innovation, building codes, and energy efficiency standards.

- In China, the Ministry of Housing and Urban-Rural Development (MOHURD) regulates BIPV by enforcing green building standards, energy-efficient construction codes, and solar installation guidelines.

- In India, the Ministry of New and Renewable Energy (MNRE) oversees BIPV regulations and promotes the adoption through policy frameworks, financial incentives, and national solar missions.

Competitive Landscape

Major players in the building integrated photovoltaics market are forming strategic joint ventures to accelerate the commercialization of integrated solar technologies tailored for building envelopes. They are developing multifunctional photovoltaic systems that combine energy generation with architectural elements such as walls and windows.

The players are actively expanding the adoption of BIPV in both new construction and renovation projects by offering solutions that fulfill both functional and esthetic purposes. Market participants target environmentally conscious sectors by promoting technologies that support decarbonization goals.

Additionally, they are strengthening distribution networks and enhancing product visibility to increase the market penetration across residential, commercial, and public infrastructure segments.

- In April 2024, Kaneka and Taisei established a joint venture, G.G. Energy Corporation, to commercialize Green Multi Solar, an integrated PV system for building walls and windows, supporting BIPV adoption in new and retrofit projects aimed at carbon neutrality.

Key Companies in Building Integrated Photovoltaics Market:

- SolarWindow Technologies, Inc

- AGC Inc

- Hanergy.GR

- Maxeon Solar

- Heliatek GmbH

- Tesla

- Ertex Solar

- Solarday

- Onyx Solar Group LLC

- Ankara Solar AS

- NanoPV Solar Inc

- Hermans Techniek

- ViaSolis

- SOLTECH

- Sphelar Power Corporation

Recent Developments (M&A/Partnerships/Product Launch)

- In January 2025, Swiss startup Climacy launched a 400 W semi-transparent glass-glass BIPV panel with 20% light transmission, designed for use in roofs and facades of residential, commercial, and industrial buildings.

- In July 2024, JinkoSolar entered a joint venture with RELC and Vision Industries to build a USD 1 billion facility in Saudi Arabia. This facility has an annual capacity of 10 GW for producing high‑efficiency solar cells and modules and aims to strengthen the regional solar supply chain.