Bridge Construction Market Overview

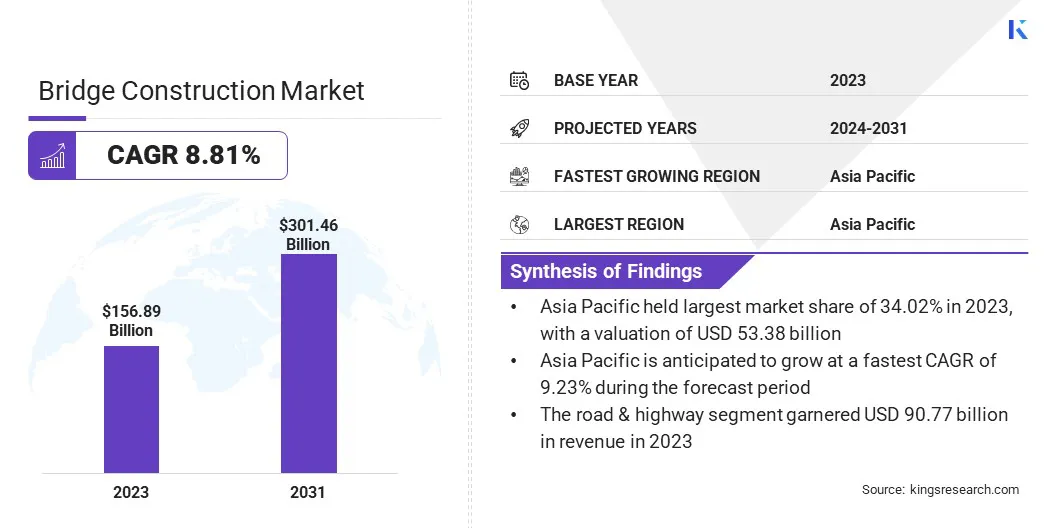

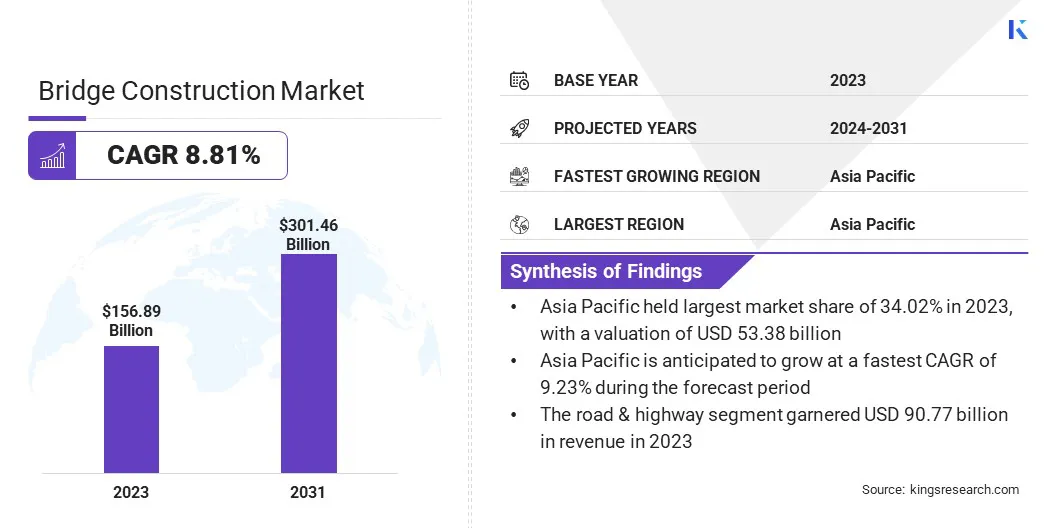

The global bridge construction market size was valued at USD 156.89 billion in 2023 and is projected to grow from USD 166.88 billion in 2024 to USD 301.46 billion by 2031, exhibiting a CAGR of 8.81% during the forecast period.

The market is experiencing steady growth, driven by the increasing urbanization, rising infrastructure investments, and the need for efficient transportation networks. Governments worldwide are prioritizing infrastructure modernization, leading to the increasing demand for bridge construction in developed and developing regions.

Technological advancements, such as modular bridge construction and the use of high-performance materials like carbon fiber composites and self-healing concrete, are further fueling the growth of the market.

Key Market Highlights

- The bridge construction industry size was valued at USD 156.89 billion in 2023.

- The market is projected to grow at a CAGR of 8.81% from 2024 to 2031.

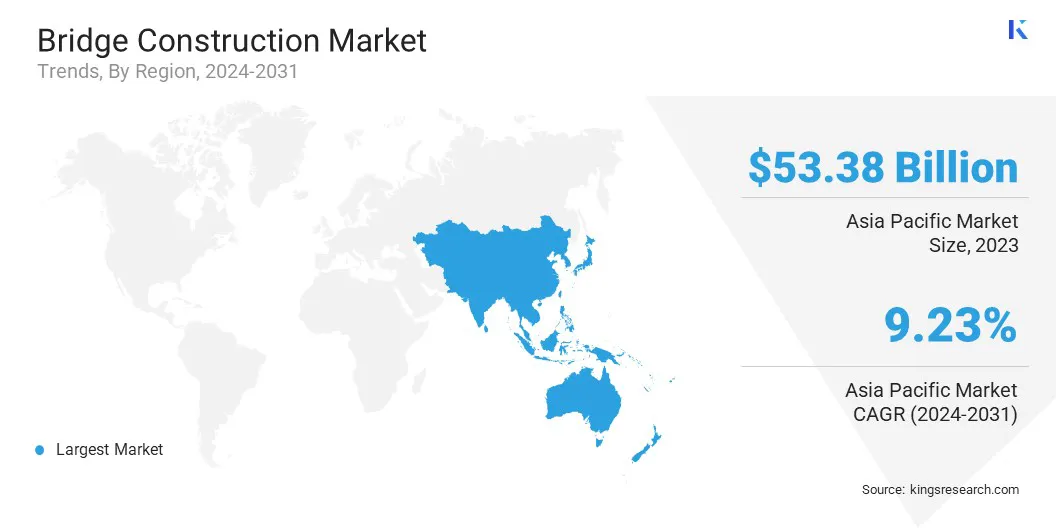

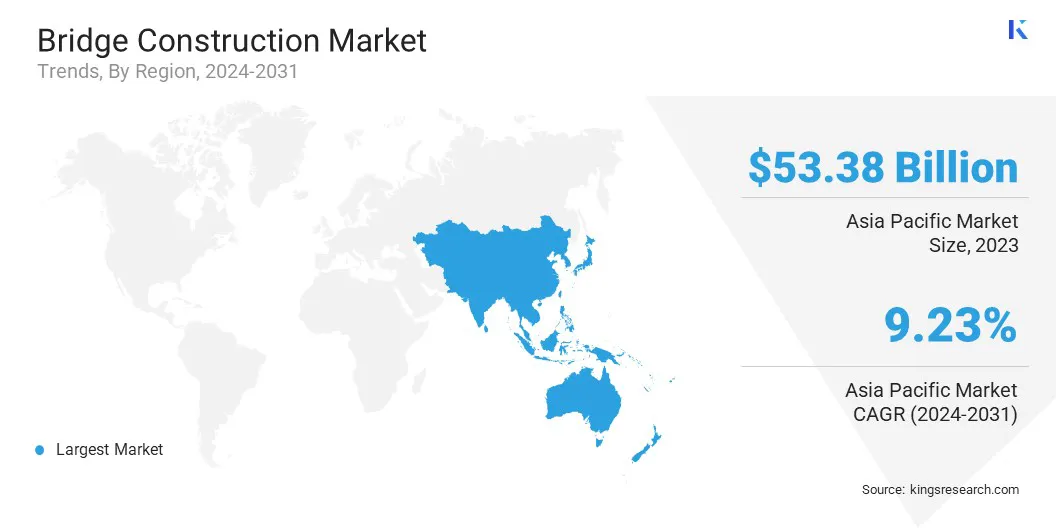

- Asia Pacific held a market share of 34.02% in 2023, with a valuation of USD 53.38 billion.

- The beam bridge segment garnered USD 46.91 billion in revenue in 2023.

- The steel segment is expected to reach USD 125.78 billion by 2031.

- The road & highway segment is expected to reach USD 174.03 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 8.82% during the forecast period.

Major companies operating in the bridge construction market are VINCI Construction, Bechtel Corporation, Skanska, Bouygues Construction, PowerChina, LARSEN & TOUBRO LIMITED, ACS, Balfour Beatty, Inc., China Communications Construction Company Limited, Kiewit Corporation, PCL Constructors Inc., AECOM, SHIMIZU CORPORATION, Ferrovial, and Fluor Corporation.

The expansion of highway and railway networks, coupled with the growing public-private partnerships in infrastructure development, is fueling market growth. In addition, the integration of digital technologies and automated construction techniques is improving project efficiency and structural precision.

Rapid industrialization and urban expansion in emerging economies, particularly in Asia-Pacific, are creating significant opportunities for construction companies and infrastructure developers involved in new bridge projects.

Furthermore, with a strong focus on sustainability, the adoption of eco-friendly construction practices, such as recycled materials and energy-efficient designs, is also shaping the future of the market.

- In December 2024, Amtrak achieved a significant milestone in the Susquehanna River Bridge Project by successfully removing the final remnant pier from the river. This accomplishment clears the way for the construction of two new bridges with four tracks, which will enhance rail connectivity along the Northeast Corridor. The project focuses on improving infrastructure and incorporates historical preservation efforts and environmental protection measures, ensuring that the development aligns with sustainability and heritage preservation goals.

Government Investments and Urbanization

The increasing government infrastructure investments and the rapid expansion of transportation networks are driving the global market. Governments worldwide are allocating substantial funds to modernize aging infrastructure and develop new transportation projects. These investments prioritize the construction of durable and sustainable bridges, ensuring long-term operational efficiency and reduced maintenance costs.

Additionally, stringent regulatory requirements for infrastructure safety and modernization are further driving investments in advanced bridge engineering and materials. In addition, rapid urbanization and population growth are increasing the demand for efficient mobility solutions, in turn, further driving the growth of the market.

- In July 2024, the U.S. government allocated USD 5 billion through the Bridge Investment Program to restore, reconstruct, and repair 13 major bridges across 16 states. The funding will facilitate the replacement of aging bridge structures, improve resilience against extreme weather, and ensure long-term infrastructure reliability.

Cost Overruns and Project Delays

One of the most significant challenges in the bridge construction market is cost overruns and project delays. Supply chain disruptions, including shortages of essential materials like steel and concrete, contribute to price volatility and delayed project timelines.

Additionally, a shortage of skilled professionals, such as engineers, welders, and heavy equipment operators, further escalates costs and slows down construction processes. Regulatory complexities, including prolonged permit approvals and stringent environmental assessments further hinder the growth of the market.

Furthermore, geological and environmental uncertainties, like unstable terrain, extreme weather events, and seismic risks, can necessitate modifications in design, increasing time and financial investments.

To mitigate these risks, industry leaders are using advanced project management technologies, prefabrication techniques, and digital modeling tools. Building Information Modeling (BIM) enhances project accuracy by identifying potential design flaws, and reducing rework and cost inefficiencies.

Innovative Construction and Smart Technologies

The adoption of innovative building techniques and smart infrastructure solutions is a key trend in the global market. Prefabricated and modular bridge construction is gaining traction due to its ability to streamline project execution.

These techniques improve quality control, reduce material waste, and minimize construction delays. Prefabrication also accelerates installation and reduces on-site disruptions, making it beneficial for urban infrastructure projects and highway expansions.

Additionally, modular construction allows scalability, enabling engineers to design and assemble bridges more efficiently while maintaining structural integrity and safety. Simultaneously, smart technologies are transforming bridge infrastructure management. The digital twin technology creates a virtual bridge model for real-time simulations and performance analysis.

IoT-based monitoring systems are also getting used to track stress, temperature, and vibrations, providing early warnings of potential weaknesses. This data-driven approach improves safety, enabling engineers to address minor issues before they escalate into major structural failures.

Bridge Construction Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Beam Bridge, Truss Bridge, Arch Bridge, Suspension Bridge, Cable-stayed Bridge, Others

|

|

By Material

|

Steel, Concrete, Composite

|

|

By Application

|

Road & Highway, Railway

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Beam Bridge, Truss Bridge, Arch Bridge, Suspension Bridge, Cable-stayed Bridge, Others): The beam bridge segment earned USD 46.91 billion in 2023 due to its cost-effectiveness, ease of construction, and widespread use.

- By Material (Steel, Concrete, and Composite): The steel segment held 42.17% of the market in 2023, due to its high strength-to-weight ratio, durability, and ability to support long-span bridge structures.

- By Application (Road & Highway, Railway): The road & highway segment is projected to reach USD 174.03 billion by 2031, owing to increasing government investments in transportation infrastructure and rising demand for efficient road networks.

Bridge Construction Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a substantial market share of 34.02% in 2023 in the global bridge construction market, with a valuation of USD 53.38 billion. The region’s dominance is attributed to the large-scale infrastructure projects in China, India, and Southeast Asian countries. As part of its Belt and Road Initiative (BRI), China continues to invest heavily in bridge construction to enhance domestic and cross-border connectivity.

Additionally, Japan and South Korea are investing in advanced bridge construction technologies, including earthquake-resistant designs, to improve structural resilience in seismic-prone areas. The presence of major steel and concrete manufacturers in the region further strengthens supply chains, reducing construction costs and accelerating project completion.

The North America market is expected to register the fastest growth, with a projected CAGR of 8.82% over the forecast period. The growth is fueled by federal and state investments in infrastructure modernization, particularly in the United States and Canada. The U.S. Infrastructure Investment and Jobs Act (IIJA) has allocated substantial funding for bridge rehabilitation, addressing aging infrastructure across the country.

The demand for sustainable and smart bridge solutions such as real-time structural health monitoring and corrosion-resistant materials, is also rising. Canada’s National Trade Corridors Fund is supporting bridge projects that enhance freight movement efficiency, boosting regional economic growth.

The widespread adoption of prefabricated and modular bridge components to streamline construction processes, and reduce labor costs, is further driving the market in this region.

- In March 2025, the U.S. Department of Transportation finalized a USD 221 million grant for Rhode Island’s Washington Bridge reconstruction.

Regulatory Frameworks

- In the United States, bridge construction is regulated by the Federal Highway Administration (FHWA) under the National Bridge Inspection Standards (NBIS), ensuring structural safety and maintenance.

- In the European Union, bridge construction follows the Eurocodes, a set of structural design standards. Compliance with the Construction Products Regulation (CPR) ensures the quality and safety of materials.

- In China, bridge construction is governed by the Ministry of Transport (MOT) and the Ministry of Housing and Urban-Rural Development (MOHURD), following standards set by the China National Standards (GB Codes).

- In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) oversees bridge construction under the Building Standards Act and the Highway Bridge Specifications (JHBS), ensuring structural integrity and earthquake resistance.

- In India, the Indian Roads Congress (IRC) sets technical standards for bridge construction under the Ministry of Road Transport and Highways (MoRTH). The Bureau of Indian Standards (BIS) regulates material quality, while the National Highways Authority of India (NHAI) supervises large-scale bridge projects.

Competitive Landscape

The bridge construction industry is characterized by key players focusing on innovation, strategic partnerships, and advanced construction techniques to strengthen their market presence. Companies are increasingly investing in research and development to enhance bridge durability, sustainability, and cost-efficiency.

The adoption of prefabrication and modular construction methods is a key strategy utilized by market players to reduce project timelines and minimize labor costs. To expand their market reach, firms are creating partnerships with government agencies and private investors, securing large-scale infrastructure contracts across multiple regions.

Technological advancements, such as 3D printing for bridge components and digital twin simulations for structural analysis, are being used to improve precision and efficiency in construction. Sustainability has also become a competitive differentiator, with companies incorporating eco-friendly materials, low-carbon concrete and energy-efficient processes to comply with environmental regulations and reduce long-term maintenance costs.

- In January 2025, Long Bridge Rail Partners was selected by the Virginia Passenger Rail Authority for the construction of a new two-track rail bridge over the Potomac River and a bicycle/pedestrian bridge. Part of the Transforming Rail in Virginia initiative, the project aims to reduce rail congestion and improve connectivity between Arlington, VA, and Washington, DC.

Key Companies in Bridge Construction Market:

- VINCI Construction

- Bechtel Corporation

- Skanska

- Bouygues Construction

- PowerChina

- LARSEN & TOUBRO LIMITED

- ACS

- Balfour Beatty, Inc.

- China Communications Construction Company Limited

- Kiewit Corporation

- PCL Constructors Inc

- AECOM

- SHIMIZU CORPORATION

- Ferrovial

- Fluor Corporation

Recent Developments (Merger/Acquisition/Partnership/Investment)

- In January 2025, STRABAG and PORR partnered for the reconstruction of the Lueg Bridge on Austria’s Brenner motorway, a USD 225 million project set to be completed by 2030.

- In October 2024, Bowman Consulting Group Ltd. acquired Exeltech Consulting, Inc., a firm specializing in designing bridges, structural engineering, and transportation infrastructure. This acquisition expands Bowman's expertise in bridge inspection, repair, retrofit, and construction, strengthening its presence in the Pacific Northwest and enhancing its national transportation and infrastructure services.

- In August 2024, Gannett Fleming and TranSystems announced the completion of their strategic merger to strengthen its presence across North America.