Breast Cancer Drugs Market Size

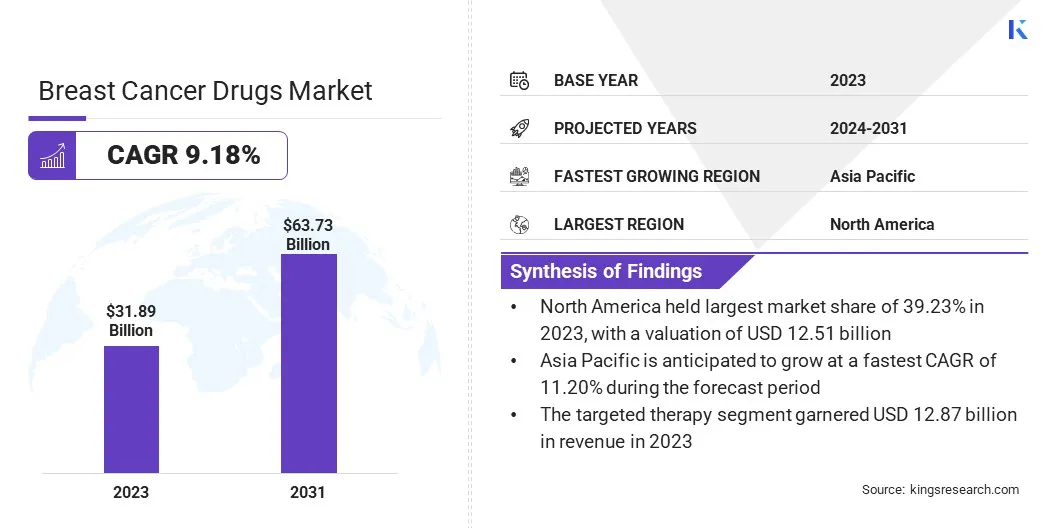

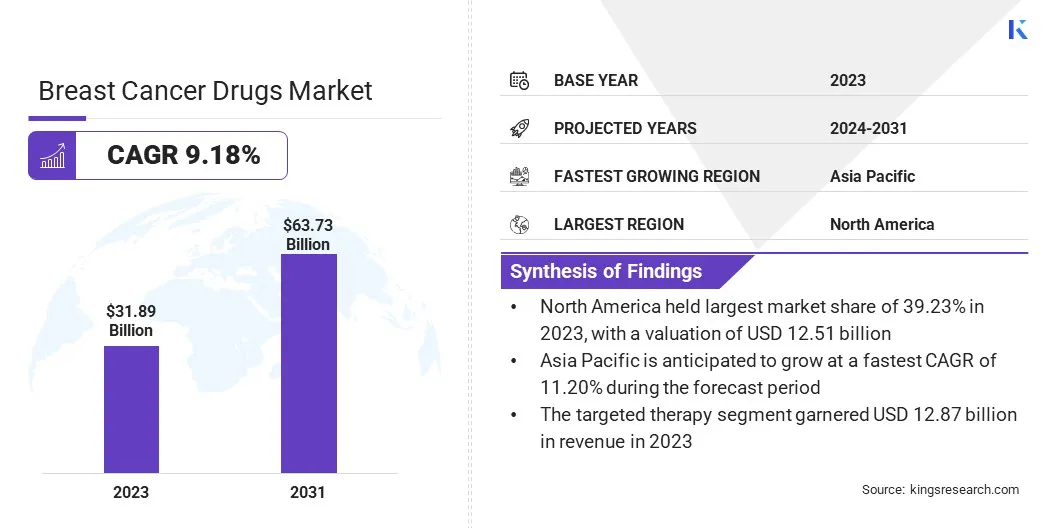

The global breast cancer drugs market size was valued at USD 31.89 billion in 2023 and is projected to grow from USD 34.46 billion in 2024 to USD 63.73 billion by 2031, exhibiting a CAGR of 9.18% during the forecast period.

The global rise in breast cancer incidences is a driving the growth of the market. The increased prevalence has fueled the demand for effective treatment solutions, prompting pharmaceutical companies to invest in developing advanced therapeutic options.

In the scope of work, the report includes products and services offered by companies such as F. Hoffmann-La Roche Ltd, Pfizer Inc., AstraZeneca, Novartis AG, Merck & Co., Inc, Bristol-Myers Squibb Company, Mylan N.V., Teva Pharmaceutical Industries Ltd, Lilly, Cipla, and others.

Increasing awareness of breast cancer and the importance of early detection is a key factor boosting the growth of the breast cancer drugs market. Governments, healthcare organizations, and NGOs are actively promoting breast cancer awareness campaigns to encourage regular screenings and early diagnosis.

- For instance, the World Health Organization (WHO) launched the Global Breast Cancer Initiative (GBCI) in 2021, with the goal of reducing mortality rates by 2.5% annually by 2040 and save 2.5 million lives. This initiative has led to earlier identification, improving treatment outcomes and increasing demand for effective medications.

Breast cancer drugs are pharmaceutical treatments designed to prevent, treat, or manage breast cancer. They target cancerous cells by inhibiting tumor growth, blocking hormonal influences, or stimulating the immune system. These treatments include chemotherapy, targeted therapies, hormone therapies, immunotherapies, and combination treatments.

The choice of drug depends on the cancer's subtype, genetic mutations, and the patient's overall health, and is used across various stages of breast cancer.

Analyst’s Review

A critical factor contributing to the growth of the breast cancer drugs industry is the strategic focus of research institutions on developing new therapies for advanced, hard-to-treat breast cancers. These institutions are supporting market expansion by intensifying R&D efforts to address the increasing demand for effective treatments for aggressive and metastatic forms of breast cancer.

- In January 2023, the Food and Drug Administration approved a novel targeted therapy for advanced hard-to-treat breast cancers. This is the first treatment designed specifically for breast cancers with ESR1 mutations, which cause resistance to standard endocrine therapies. These mutations occur in up to 40% of advanced or metastatic estrogen receptor-positive, and HER2-negative breast cancers.

By investing in the development of novel therapies such as targeted treatments, immunotherapies, and combination therapies, these institutions are addressing the limitations of current treatments.

Furthermore, collaborative efforts between academic institutions, pharmaceutical companies, and biotech firms are accelerating the development and testing of new therapies.

This approach is broadening treatment options, addrssing unmet patient needs, and improving overall clinical outcomes. As these strategies advance, the demand for innovative breast cancer drugs is expected to increase, contributing to sustained industry growth.

Breast Cancer Drugs Market Growth Factors

Increased global healthcare expenditure is propelling the growth of the breast cancer drugs market. Both governments and private sectors are investing heavily to enhance healthcare infrastructure and improve access to advanced treatments for breast cancer.

- In October 2024, researchers at the University of Arizona Health Sciences commenced testing an innovative breast cancer detection imaging technique, supported by a USD 3.3 million grant from the National Cancer Institute, part of the National Institutes of Health.

These investments are enabling hospitals and clinics to adopt latest screening techniques, innovative drugs, and therapies to meet the rising demand for effective solutions. Increased funding for cancer research and drug development is further supporting the introduction of novel treatment options.

Additionally, the increasing collaboration between pharmaceutical companies and biotechnology firms is fueling the growth of the breast cancer drugs market. These partnerships combine pharmaceutical expertise with cutting-edge biotechnology innovations, facilitating the development of novel treatments, including gene therapies, immunotherapies, and advanced biologics.

By sharing resources and knowledge, these partnerships accelerate drug development, leading to the introduction of more effective therapies.

Breast Cancer Drugs Industry Trends

Advancements in combination therapies for advanced breast cancer are influencing the market. By combining chemotherapy, targeted therapies, and immunotherapy, these treatments offer greater effectiveness in managing complex and metastatic breast cancer.

Through multiple mechanisms, combination therapies improve treatment outcomes and address resistance to single-agent therapies. The continuous development and approval are expanding options for advanced-stage breast cancer patients.

- In July 2024, the Medicines & Healthcare products Regulatory Agency (MHRA) approved capivasertib, a new targeted therapy for the most common type of advanced breast cancer. This first-in-class drug that operates through a novel mechanism by inhibiting the activity of AKT, a protein molecule that drives cancer progression.

Furthermore, the development of personalized cancer vaccines is contributing to the expansion of the breast cancer drugs market. These vaccines are tailored to individual tumor characteristics, stimulating the immune system to target and destroy cancer cells.

- In October 2024, the FDA approved Itovebi for individuals with hormone-sensitive breast cancer that recurred during or after endocrine therapy, including tamoxifen. Itovebi is specifically for patients with the PIK3CA genetic mutation and HER2-negative cancer. Additionally, the FDA authorized the FoundationOne Liquid CDx genetic test to identify patients with the PIK3CA mutation.

Research and clinical trials in personalized medical field are progressing rapidly, with early results indicating strong potential for personalized vaccines in breast cancer treatment.

Segmentation Analysis

The global market has been segmented based on drug class, disease type, distribution channel, and geography.

By Drug Class

Based on drug class, the market has been segmented into hormonal therapy, targeted therapy, chemotherapy, immunotherapy, and others. The targeted therapy segment led the breast cancer drugs market in 2023, reaching a valuation of USD 12.87 billion.

This growth is attributed to their precision in addressing specific genetic and molecular drivers of breast cancer. Unlike traditional chemotherapy, targeted therapies focus on unique biomarkers such as HER2, PIK3CA mutations, and ESR1, allowing for personalized treatments that minimize damage to healthy cells.

This specificity reduces adverse effects, improving patient compliance and outcomes. Moreover, the rising prevalence of HER2-positive and triple-negative breast cancer cases has fueled the demand for innovative therapies.

By Disease Type

Based on disease type, the market has been classified into hormone receptor-positive (HR+), HER2-positive, and triple-negative breast cancer (TNBC). The hormone receptor-positive (HR+) segment secured the largest revenue share of 52.34% in 2023.

HR+ breast cancer represent a significant portion of breast cancer diagnoses, driven by hormonal imbalances and lifestyle changes. This segment benefits from advancements in endocrine therapies, which are highly effective in managing HR+ breast cancer by targeting hormone-driven tumor growth.

The introduction of innovative drugs, including selective estrogen receptor degraders (SERDs) and CDK4/6 inhibitors, has further strengthened the segment's position by improving survival rates and reducing disease recurrence.

By Distribution Channel

Based on distribution channel, the market has been divided into hospital pharmacies, retail pharmacies, and online pharmacies. The online pharmacies segment is projected to witness significant growth, recording a robust CAGR of 11.20% through the forecast period.

Patients are increasingly opting for online platforms due to their seamless access to a wide range of medications, including targeted therapies and advanced treatments, without the need for physical store visits.

Additionally, competitive pricing, subscription models, and digital prescription management tools further attract cost-conscious consumers. As telemedicine and e-prescriptions gain traction, online pharmacies are well-positioned to meet evolving consumer demands.

Breast Cancer Drugs Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America breast cancer drugs market accounted for a substantial share of around 39.23% in 2023, valued at USD 12.51 billion. The rising incidence of breast cancer, particularly in the U.S. and Canada, is creating demand for effective treatments. Growing awareness has led to more patients seeking early detection and treatment, further expanding the market for breast cancer drugs.

- According to a 2024 report from Breastcancer.org, breast cancer is the most commonly diagnosed cancer among women in the U.S., accounting for approximately 30% of all new cancer diagnoses in women each year. Around 1 in 8 women (13%) in the U.S. will be diagnosed with invasive breast cancer during their lifetime.

Government organizations, such as the U.S. National Cancer Institute (NCI), are significantly funding breast cancer research and initiatives to reduce mortality rates. In addition, regulatory bodies such as the FDA are expediting approvals for novel treatments, thereby enhancing market access and growth.

The Asia Pacific breast cancer drugs market is anticipated to witness significant growth, registering a robust CAGR of 11.20% over the forecast period. Governments in the region are increasingly focusing on cancer control programs and research funding, particularly for breast cancer.

In countries such as India, China, and Japan, public health initiatives and financial support for cancer research and treatment have enhnaced the availability of breast cancer medications, thereby propelling regional market growth.

- In January 2024, researchers at the National University of Singapore (NUS) developed a non-invasive technique to improve the effectiveness of chemotherapy while minimizing side effects. The team demonstrated that applying brief, localized magnetic field pulses significantly increased the adoption of doxorubicin (DOX), a common chemotherapy drug, in breast cancer cells, with minimal impact on surrounding healthy tissues.

Additionally, the public awareness campaigns and government-sponsored breast cancer screening programs are gaining traction in the region. As awareness of the importance of early detection grows, more individuals are seeking regular screenings, leading to increased demand for breast cancer drugs, particularly for early-stage treatments and targeted therapies.

Competitive Landscape

The global breast cancer drugs market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Breast Cancer Drugs Market

- Hoffmann-La Roche Ltd

- Pfizer Inc.

- AstraZeneca

- Novartis AG

- Merck & Co., Inc

- Bristol-Myers Squibb Company

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd

- Lilly

- Cipla

Key Industry Developments

- September 2024 (Launch): Novartis announced Food and Drug Administration (FDA) approval for Kisqali, in combination with an aromatase inhibitor (AI), for the adjuvant treatment of high-risk, hormone receptor-positive/human epidermal growth factor receptor 2-negative stage II and III early breast cancer, including node-negative (N0) disease.

- September 2024 (Partnership): Roche finalized an agreement to acquire two investigational breast cancer drugs from the China-based biotechnology startup Regor Therapeutics for USD 850 million. One drug is in early-stage clinical testing, while the other is set to commence human trials.

The global breast cancer drugs market has been segmented as:

By Drug Class

- Hormonal Therapy

- Tamoxifen

- Aromatase Inhibitors (Letrozole, Anastrozole)

- Fulvestrant

- Others

- Targeted Therapy

- HER2 Inhibitors (Trastuzumab, Pertuzumab)

- CDK4/6 Inhibitors (Palbociclib, Ribociclib)

- PARP Inhibitors (Olaparib, Talazoparib)

- Others

- Chemotherapy

- Anthracyclines

- Taxanes (Paclitaxel, Docetaxel)

- Capecitabine

- Immunotherapy

- Others

By Disease Type

- Hormone Receptor-Positive (HR+)

- HER2-Positive

- Triple-Negative Breast Cancer (TNBC)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America