Market Definition

The market involves technologies that enable direct communication between the human brain and external devices, bypassing traditional neuromuscular pathways. BCI systems generally consist of sensors, signal processors, and output mechanisms to interpret brain signals.

Uses range from restoring mobility in paralysis and treating neurological disorders to improving interaction in communication, gaming, prosthetics, and defense applications. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Brain Computer Interface Market Overview

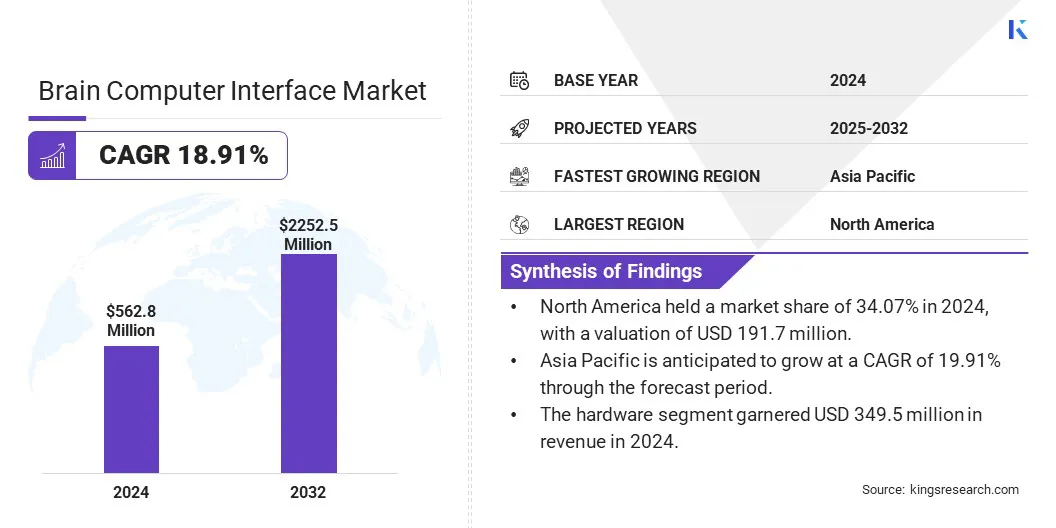

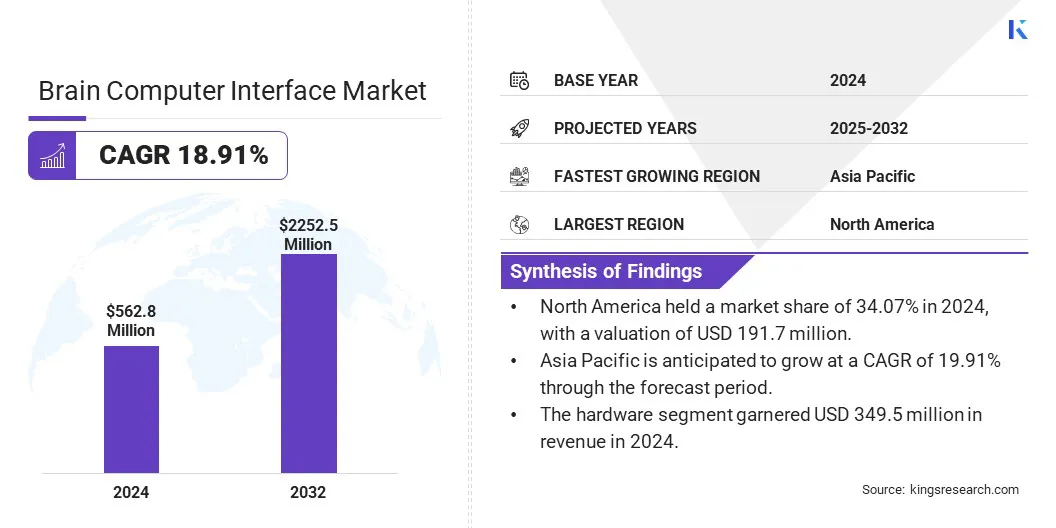

The global brain computer interface market size was valued at USD 562.8 million in 2024 and is projected to grow from USD 668.8 million in 2025 to USD 2252.5 million by 2032, exhibiting a CAGR of 18.91% during the forecast period.

The market is rapidly growing, driven by the increasing prevalence of neurodegenerative disorders and regulatory partnerships that boost neurorehabilitation advancements. Technological progresses in electroencephalography ( EEG ) systems, such as increased channel counts and enhanced usability, improve brain signal acquisition, facilitate advanced research, and expand applications in healthcare and neuroscience.

Key Market Highlights:

- The brain computer interface industry size was valued at USD 562.8 million in 2024.

- The market is projected to grow at a CAGR of 18.91% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 191.7 million.

- The hardware segment garnered USD 349.5 million in revenue in 2024.

- The non-invasive segment is expected to reach USD 717.6 million by 2032.

- The disabilities & rehabilitation segment is anticipated to witness a CAGR of 19.03% over the forecast period.

- The hospitals & clinics segment is estimated to grow at a share of 36.13% by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 19.91% through the forecast period.

Major companies operating in the brain computer interface market are Advanced Brain Monitoring, Inc., Neuralink, Paradromics, g.tec medical engineering GmbH Austria, Brain Products GmbH, Neurable, Neurolutions, Inc., ANT Neuro, Brain Co Inc., EMOTIV, Muse, BirgerMind, AAVAA Inc., Bitbrain Technologies, and Synchron.

The growth of the market is propelled by increasing investments in neuroscience and neurotechnology, which accelerate innovation across implantable and non-invasive BCI systems. These investments are driving progress in integrating artificial intelligence into various technologies, real-time signal processing, and miniaturized hardware, enhancing BCI performance and usability.

Funding from the public and private sectors fosters research in neurological disorder treatment and human-machine interaction. The market is witnessing faster clinical translation of BCI technologies, expanding their applications in across medical, communication, and cognitive enhancement fields.

- In February 2025, Paradromics, a leader in high-data rate brain-computer interfaces, secured strategic investment from the NEOM Investment Fund to advance BCI-based therapies. The partnership will establish a BCI Center of Excellence in NEOM, focused on restoring neurological functions. Paradromics’ AI-enabled, implantable BCI platform supports real-time data processing for communication and mental health applications, aligning with NEOM’s vision for healthcare innovation.

Rising Neurodegenerative Diseases Boost Assistive Technology Demand

The expansion of the brain computer interface market is fueled by the rising prevalence of neurodegenerative disorders, which creates an urgent need for advanced assistive technologies. Initiatives such as the Implantable brain-computer interface collaborative community, which involve regulatory collaboration, accelerate innovation and safety in neurorehabilitation.

This progress supports the development of more effective and accessible solutions for restoring function, propelling market growth amid rising demand for cutting-edge interventions to improve quality of life.

- In March 2024, Mass General Brigham launched the Implantable Brain-Computer Interface Collaborative Community (iBCI-CC), the first neuroscience-focused initiative involving Food and Drug Administration (FDA). This effort unites researchers, clinicians, manufacturers, and patient advocates to accelerate iBCI innovation, safety, and accessibility through standardized development pathways, advancing neurorehabilitation and functional restoration for individuals with neurological conditions.

Complexity of Brain Signals

The complexity of brain signals presents a major challenge to the expansion of the brain computer interface (BCI) market. Brain activity is highly dynamic, varies between individuals, and is often mixed with noise, making it difficult to interpret accurately. This variability limits the reliability and precision of BCI systems.

To overcome this, companies are investing in advanced signal processing algorithms and machine learning models to decode neural data with precision. Firms such as Neuralink and Emotiv are improving data quality through higher-resolution sensors and AI-driven analytics. Some companies are exploring adaptive algorithms that learn from user behavior, enhancing accuracy and personalization in real-time brain signal interpretation.

Technological Advancement in Electroencephalography (EEG) Kits

The brain computer interface market is witnessing a notable trend toward rapid technological advancement in electroencephalography (EEG) kits. Modern EEG systems increasingly offer higher channel counts, improved comfort, and enhanced usability through features such as labeled headwear and easy electrode placement.

These innovations are enabling more precise and user-friendly brain signal acquisition. Researchers can conduct more complex studies, including full cortex monitoring and hyperscanning, supporting broader applications across healthcare, neuroscience, and cognitive research within the BCI landscape.

- In February 2024, Neurotechnology upgraded its BrainAccess EEG kits by introducing the new 32-channel Extended+ Kit for full brain cortex coverage, along with improved headwear and software. The updated EEG cap offers better comfort, clearer channel labeling, and easy electrode placement using snap connectors. These enhancements aim to streamline setup and improve EEG signal acquisition for research and hyperscanning applications.

Brain Computer Interface Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software

|

|

By Product

|

Non-invasive, Partially Invasive, Invasive

|

|

By Application

|

Assistive technologies, Disabilities & Rehabilitation, Others

|

|

By End User

|

Hospitals & Clinics, Rehabilitation Centers, Home Care Settings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware and Software): The hardware segment earned USD 349.5 million in 2024, due to rising demand for advanced EEG headsets, sensors, and amplifiers that enable accurate and real-time brain signal acquisition across clinical and research settings.

- By Product (Non-invasive, Partially Invasive, and Invasive): The partially invasive segment held a share of 37.70%in 2024, largely attributed to its optimal balance between signal accuracy and reduced surgical risk, making it a preferred choice for long-term neurological monitoring and therapeutic applications.

- By Application (Assistive technologies, Disabilities & Rehabilitation, and Others): The assistive technologies segment is projected to reach USD 939.8 million by 2032, propelled by increasing adoption of BCI-enabled solutions for enhancing communication and mobility among individuals with severe motor impairments and neurological disorders.

- By End Use (Hospitals & Clinics, Rehabilitation Centers, Home Care Settings, and Others): The hospitals & clinics segment held a share of 36.13% in 2032, propelled by the widespread integration of BCI systems in advanced neurological diagnostics, patient monitoring, and post-surgical rehabilitation within clinical environments.

Brain Computer Interface Market Regional Analysis

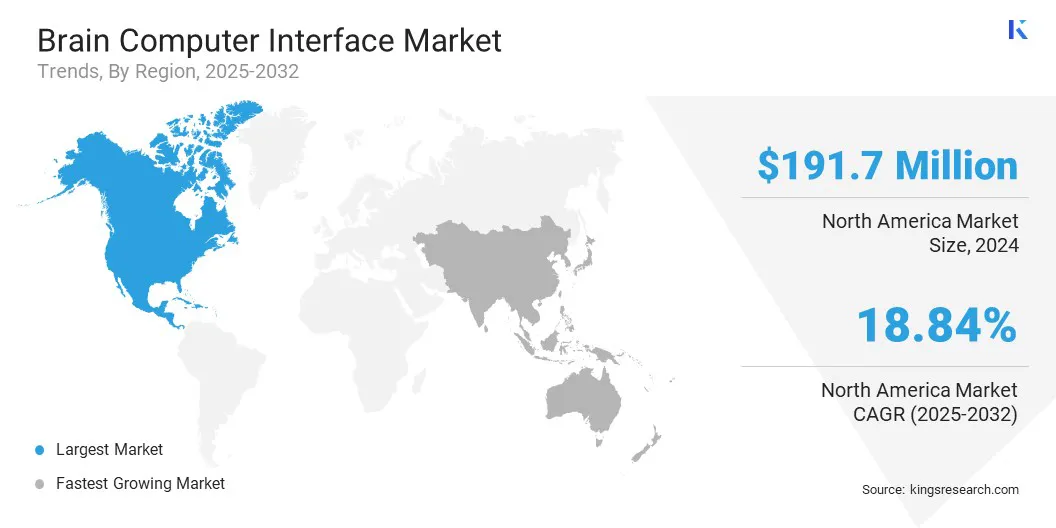

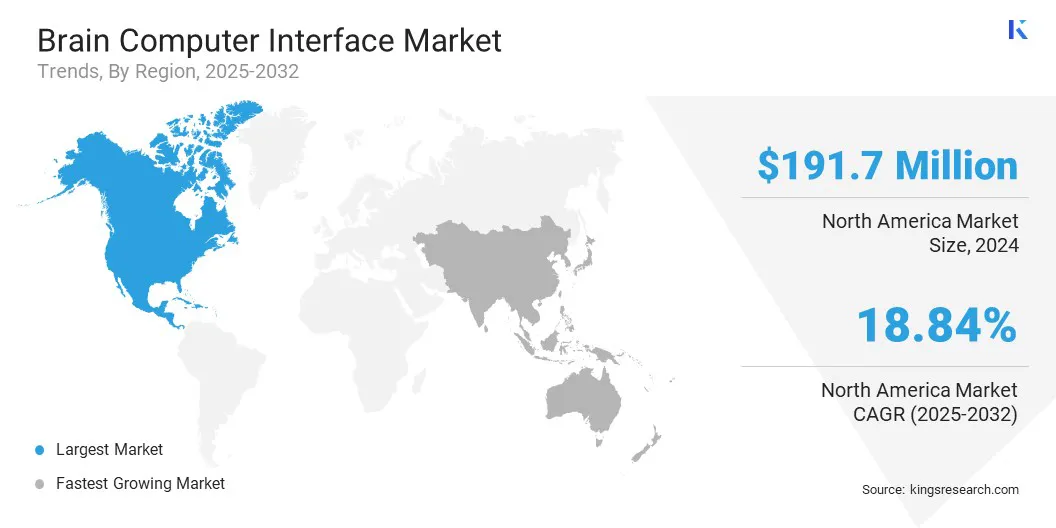

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America brain computer interface market share stood at around 34.07% in 2024, valued at USD 191.7 million. This dominance is reinforced by significant investments in advanced BCI technologies, including high-resolution EEG systems with enhanced usability and comfort.

The regional market benefits from robust research infrastructure and the integration of AI-driven signal processing, facilitating innovation in both medical and consumer applications. Additionally, the increasing adoption of non-invasive and partially invasive BCI devices in clinical and home care settings positions North America as a leading market for neurotechnology advancements and commercialization.

- In August 2024, EMOTIV, a global leader in brain-computer interface technology, played a key role in the Prometheus BCI Project by enabling individuals with paralysis to control an exoskeleton arm through thought alone. Debuted at the Paralympic torch relay, this milestone showcased neurotechnology’s transformative impact on mobility and empowerment for people with motor disabilities.

The Asia Pacific brain computer interface industry is estimated to grow at a robust CAGR of 19.91% over the forecast period. Rapid industrialization and urbanization across the Asia Pacific are creating a robust demand across multiple sectors, creating substantial growth opportunities.

The region is witnessing significant investments and rapid technology adoption, supported by favorable government policies and incentives that prioritize innovation and infrastructure development. Strategic focus on regulatory frameworks and economic reforms further supports this expansion.

- In December 2024, the Press Information Bureau of India reported the creation of a detailed cell-resolution atlas of the human fetal brain during the second trimester by the Sudha Gopalakrishnan Brain Centre at IIT Madras. Mapping over 500 brain regions, this atlas provides a vital reference for advancing brain-computer interface research and positions India as a key contributor to global neuroscience and brain mapping initiatives.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates brain-computer interfaces (BCIs) by ensuring their safety and efficacy through clinical trials and device approvals. The Federal Trade Commission (FTC) oversees marketing practices and consumer data protection and addresses any deceptive or unfair activities related to BCI products.

- In China, the BCI is regulated by the Ministry of Science and Technology (MoST), with the National Science and Technology Ethics Committee and its AI Ethics Subcommittee overseeing ethical guidelines to ensure responsible development and application of brain-computer interface technologies.

- In Europe, brain-computer interfaces (BCIs) are regulated under the EU Medical Devices Regulation (MDR), which governs medical-purpose devices and specific non-medical BCIs, including non-invasive brain stimulation devices listed in Annex XVI, ensuring compliance and safety across the market.

Competitive Landscape

Key players in the brain computer interface industry are actively employing strategies such as mergers and acquisitions to expand their technological capabilities and market reach. Additionally, companies are focusing on launching new and innovative BCI products to strengthen their competitive positions.

These strategic moves aim to enhance their portfolios, enter new geographic markets, and leverage emerging technologies. The competitive landscape is marked by continuous collaborations, partnerships, and product diversifications to capture a greater market share and address evolving customer needs.

- In May 2024, AAVAA launched a new consumer line of patented non-invasive brain-computer interface (BCI) wearable devices, including smart glasses and headbands. These products enable users to control digital keyboards and gaming consoles through head movements and blinks. The devices are designed for individuals with mobility and speech impairments, as well as researchers and general consumers seeking enhanced device interaction.

Key Companies in Brain Computer Interface Market:

- Advanced Brain Monitoring, Inc.

- Neuralink

- Paradromics

- tec medical engineering GmbH Austria

- Brain Products GmbH

- Neurable

- Neurolutions, Inc.

- ANT Neuro

- Brain Co Inc.

- EMOTIV

- Muse

- BirgerMind

- AAVAA Inc.

- Bitbrain Technologies

- Synchron

Recent Developments (Product Launch)

- In May 2024, Neurotechnology announced an upgrade to its BrainAccess HALO headband, a dry-contact EEG solution for brain-computer interface applications. The improved device features a compact, lightweight design with a 4-channel system and semi-flexible electrodes for enhanced comfort and adaptability. Integrated Bluetooth connectivity supports advanced brainwave monitoring and event-related potential measurement, advancing BCI capabilities in diverse research and practical settings.

- In December 2023, AAVAA is showcasing its innovative brain-computer interface (BCI) technology at CES 2024, featuring three products: a Headband Accessibility Kit enabling device control via subtle facial and eye movements, BCI-powered Smart Glasses for enhanced device management and hearing, and AI-enabled Earbuds that monitor ear biopotentials to assist users with disabilities and improve auditory experiences across applications.