Market Definition

Blue ammonia is produced from natural gas through processes such as steam methane reforming or autothermal reforming, with carbon capture and storage to reduce CO₂ emissions.

The market encompasses its production, storage, transportation, and utilization across power generation, shipping fuel, fertilizers, industrial feedstock, and hydrogen transport. It serves as a low-carbon alternative in global energy and industrial applications, aligning with decarbonization goals and supporting the development of sustainable fuel and chemical value chains.

Blue Ammonia Market Overview

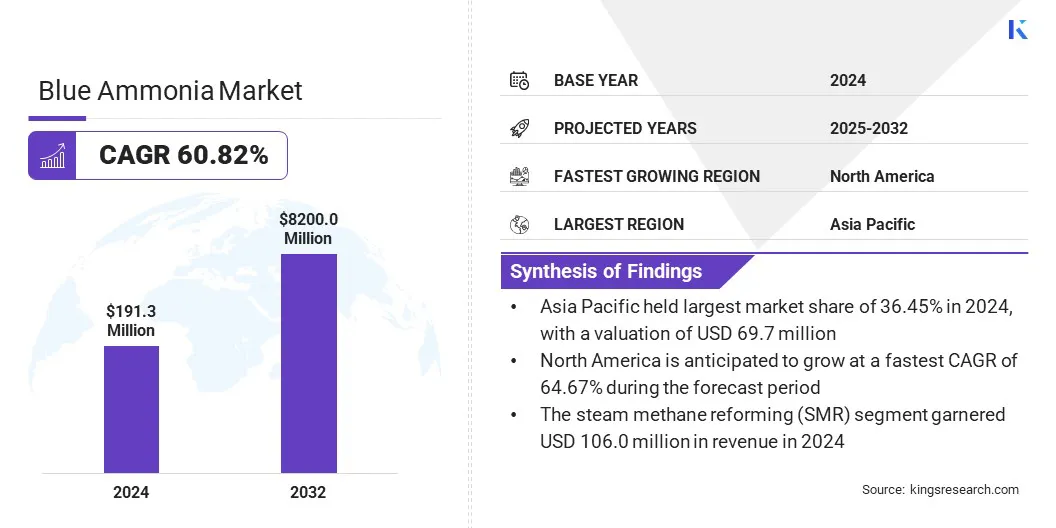

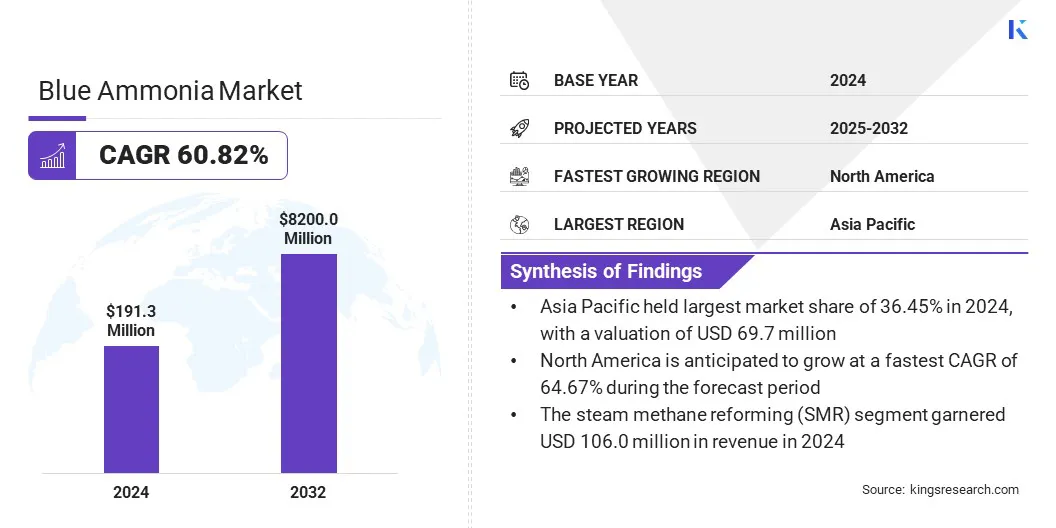

The global blue ammonia market size was valued at USD 191.3 million in 2024 and is projected to grow from USD 294.7 million in 2025 to USD 8,200.0 million by 2032, exhibiting a CAGR of 60.82% during the forecast period.

This rapid growth is driven by rising demand for low-carbon fuels, expansion of carbon capture and storage technology, and government policies supporting clean energy transitions. Increasing adoption in power generation, shipping, and fertilizer production, along with its role as a hydrogen carrier, further supports market expansion.

Key Highlights

- The blue ammonia industry size was USD 191.3 million in 2024.

- The market is projected to grow at a CAGR of 60.82% from 2025 to 2032.

- Asia Pacific held a share of 36.45% in 2024, valued at USD 69.7 million.

- The steam methane reforming (SMR) segment garnered USD 106.0 million in revenue in 2024.

- The fertilizers & chemicals segment is expected to reach USD 2,539.4 million by 2032.

- North America is anticipated to grow at a CAGR of 64.67% over the forecast period.

Major companies operating in the blue ammonia market are Giammarco-Vetrocoke, KAPSOM plc, Topsoe A/S, LSB Industries, Kellogg Brown & Root LLC, Johnson Matthey, Saudi Arabian Oil Co., OCI, Uniper SE, CF Industries Holdings, Inc., Qatar Fertiliser Company, Yara, Linde PLC, Exxon Mobil Corporation, and Casale SA.

Rising investments are facilitating the establishment of large-scale low-carbon ammonia production projects and the adoption of advanced technologies, including high-efficiency reforming and hybrid hydrogen integration.

Such funding supports research, modular infrastructure, and process optimization, improving scalability and cost efficiency. This enables faster commercialization, strengthens supply chains, and positions the industry to meet increasing demand across power generation, shipping, and industrial sectors while advancing decarbonization objectives.

Market Driver

Favorable Government Policies

The blue ammonia market is experiencing strong growth, mainly due to supportive government policies and carbon regulations that promote clean hydrogen production, carbon capture, and low-carbon energy projects. These policies reduce financial risks, improve project feasibility, and accelerate large-scale deployment of blue ammonia facilities.

Countries including the U.S., Canada, Japan, South Korea, Germany, the UK, and India have implemented regulatory frameworks that encourage investment in carbon capture and hydrogen-based fuels. Such government actions enhance blue ammonia’s role in decarbonizing power generation, shipping, and industrial sectors, thereby strengthening its position in the global energy transition.

Market Challenge

High Production Costs

A major challenge hindering the expansion of the blue ammonia market is the high production cost, driven by expensive hydrogen feedstocks, energy-intensive processes, and substantial capital investments in reforming technologies.

These factors make blue ammonia less price-competitive than conventional ammonia, which restricts adoption across power generation, shipping, and industrial sectors. Additionally, the limited availability of low-cost hydrogen and scale-up complexities constrain market expansion.

Manufacturers are addressing this challenge by investing in hybrid production methods that combine blue and green hydrogen, improving energy efficiency in reforming processes, and exploring alternative feedstocks. Additionally, companies are developing scalable electrolyzer technologies to gradually incorporate renewable hydrogen, reducing reliance on fossil-based inputs.

- In September 2024, Ohmium International partnered with Ten08 Energy to supply PEM electrolyzers for a 500MW clean ammonia project in Texas. The project will produce 1.4 million metric tons annually through both blue ammonia from natural gas with carbon capture and green ammonia from renewable energy.

Market Trend

Integration of CCS and Advanced Technologies

The blue ammonia market is witnessing a notable trend toward integrating carbon capture and storage (CCS) with advanced production technologies. This integration enables large-scale emission reduction while supporting energy security and industrial decarbonization. CCS effectively captures and stores carbon generated during production, making blue ammonia a reliable low-carbon fuel option.

Advanced technologies such as autothermal reforming and partial oxidation improve energy efficiency, reduce production costs, and expand scalability. These innovations reinforce its major role in clean energy transitions and support its growing adoption across power generation, shipping, and industrial applications.

- In September 2024, McDermott and BW Offshore collaborated to develop offshore blue ammonia production using a floating production storage and offloading (FPSO) facility. The partnership leverages BW Offshore’s FPSO expertise and McDermott’s engineering and project execution capabilities to advance sustainable blue ammonia solutions in the global energy transition.

Blue Ammonia Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Steam Methane Reforming (SMR), Autothermal Reforming (ATR), Gas Partial Oxidation

|

|

By Application

|

Power Generation, Shipping & Marine Fuel, Fertilizers & Chemicals, Industrial Feedstock, Hydrogen Carrier & Export, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Steam Methane Reforming (SMR), Autothermal Reforming (ATR), and Gas Partial Oxidation): The steam methane reforming (SMR) segment earned USD 106.0 million in 2024, mainly due to its established infrastructure and cost-effectiveness in large-scale ammonia production.

- By Application (Power Generation, Shipping & Marine Fuel, Fertilizers & Chemicals, Industrial Feedstock, Hydrogen Carrier & Export, and Others): The fertilizers & chemicals segment held a share of 34.56% in 2024, fueled by sustained demand for ammonia as a key feedstock in global fertilizer production.

Blue Ammonia Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific blue ammonia market accounted for a substantial share of 36.45% in 2024, valued at USD 69.7 million. This dominance is supported by the region’s strong decarbonization goals and growing emphasis on clean energy solutions.

Governments and industries are increasingly investing in low-carbon ammonia and hydrogen infrastructure, including advanced ammonia-to-hydrogen conversion technologies, to meet rising energy demand while reducing greenhouse gas emissions. The region’s focus on using ammonia as a versatile energy carrier in power generation and industrial applications supports regional market growth, fostering large-scale adoption and technological advancement.

- In February 2024, Approtium partnered with Topsoe to build an ammonia cracking plant in Ulsan, South Korea, using Topsoe’s H2RETAKE technology. The facility will convert low-carbon ammonia into 75,000 metric tons of hydrogen annually, with production expected to begin in 2027 to support South Korea’s decarbonization goals.

The North America blue ammonia industry is expected to register the fastest CAGR of 64.67% over the forecast period. This growth is fueled by strategic collaborations focused on developing large-scale low-carbon ammonia production facilities. By leveraging combined expertise in ammonia synthesis, carbon capture, and infrastructure management, these partnerships enhance operational efficiency and enable high-capacity production.

Such initiatives support significant CO₂ emission reductions, reinforce regional energy transition objectives, and position North America as a key market for clean ammonia and hydrogen supply, catering to growing industrial and power-generation demand.

- In April 2025, CF Industries formed a joint venture with JERA Co., Inc. and Mitsui & Co., Ltd. to construct, produce, and offtake low-carbon ammonia at the Blue Point Complex in Louisiana. The facility will capture over 95% of CO₂, with production expected to begin in 2029 and an annual capacity of 1.4 million tons.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates emissions, air quality, and environmental compliance for ammonia production facilities, ensuring adherence to national environmental standards.

- In Europe, the European Chemicals Agency (ECHA) and the European Commission oversee chemical safety, emissions, and sustainability compliance across ammonia and related chemical industries.

- In China, the Ministry of Ecology and Environment (MEE) governs industrial emissions, chemical safety, and environmental monitoring.

- In Japan, the Ministry of Economy, Trade and Industry (METI) and the Ministry of the Environment (MOE) enforce production standards, chemical handling, and environmental impact.

- In India, the Central Pollution Control Board (CPCB) sets emission norms, monitors industrial operations, and ensures ammonia manufacturing aligns with environmental regulations.

Competitive Landscape

Key players in the blue ammonia industry are actively strengthening their market positions through strategic partnerships and acquisitions. Companies are collaborating with energy, chemical, and technology partners to co-develop low-carbon ammonia production facilities and expand technological capabilities.

Additionally, acquisitions of existing clean ammonia projects and technology platforms enable rapid scale-up, enhance production capacity, and secure access to advanced carbon capture and low-emission solutions. These strategies allow key players to consolidate resources, optimize operations, and accelerate market penetration globally.

- In September 2024, Woodside acquired OCI Clean Ammonia Holding B.V., a lower-carbon ammonia project in Texas. The project will produce ammonia with less than 35% lifecycle emissions of conventional ammonia, targeting first production in 2025 and lower-carbon ammonia in 2026, supporting power, marine, and industrial applications.

Key Companies in Blue Ammonia Market:

- Giammarco-Vetrocoke

- KAPSOM plc

- Topsoe A/S

- LSB Industries

- Kellogg Brown & Root LLC

- Johnson Matthey

- Saudi Arabian Oil Co.

- OCI

- Uniper SE

- CF Industries Holdings, Inc.

- Qatar Fertiliser Company

- Yara

- Linde PLC

- Exxon Mobil Corporation

- Casale SA

Recent Developments (Agreement/Partnership)

- In May 2025, Marubeni and ExxonMobil signed a long-term offtake agreement for 250,000 tonnes of low-carbon ammonia annually from ExxonMobil’s Baytown facility in Texas. Marubeni will primarily supply the ammonia mainly to Kobe Power Plant and acquire an equity stake in the facility, supporting Japan’s decarbonization and global low-carbon ammonia supply chain.

- In May 2024, thyssenkrupp Uhde and Johnson Matthey signed a Memorandum of Understanding to offer an integrated solution for blue ammonia production. The partnership combines thyssenkrupp Uhde’s uhde ammonia process with Johnson Matthey’s LCH technology, enabling up to 99% CO₂ capture and supporting global decarbonization efforts.