Market Definition

The market involves the production and distribution of ammonia using renewable energy sources such as wind, solar, or hydropower to produce green hydrogen.

The growth of the market is supported by government incentives and technological advancements aimed at carbon reduction. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Green Ammonia Market Overview

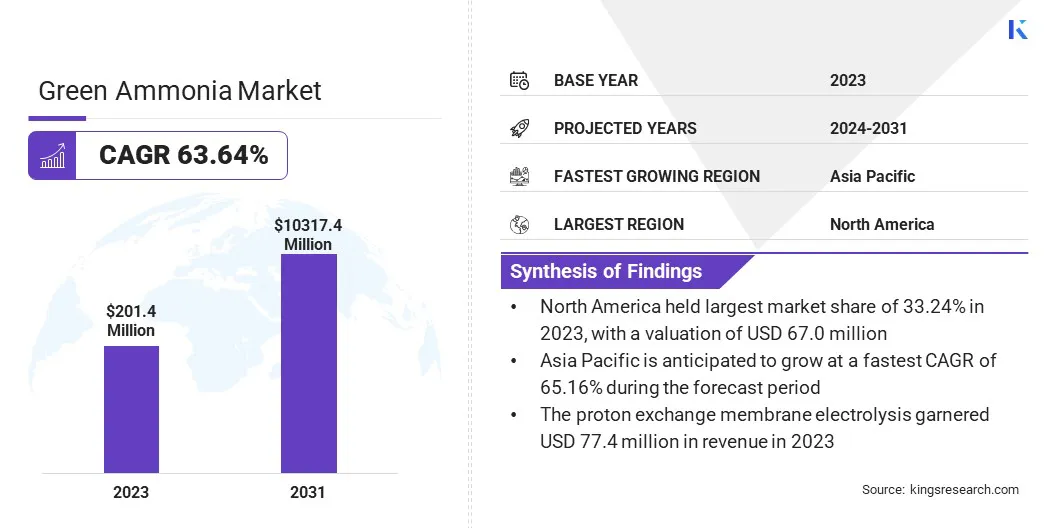

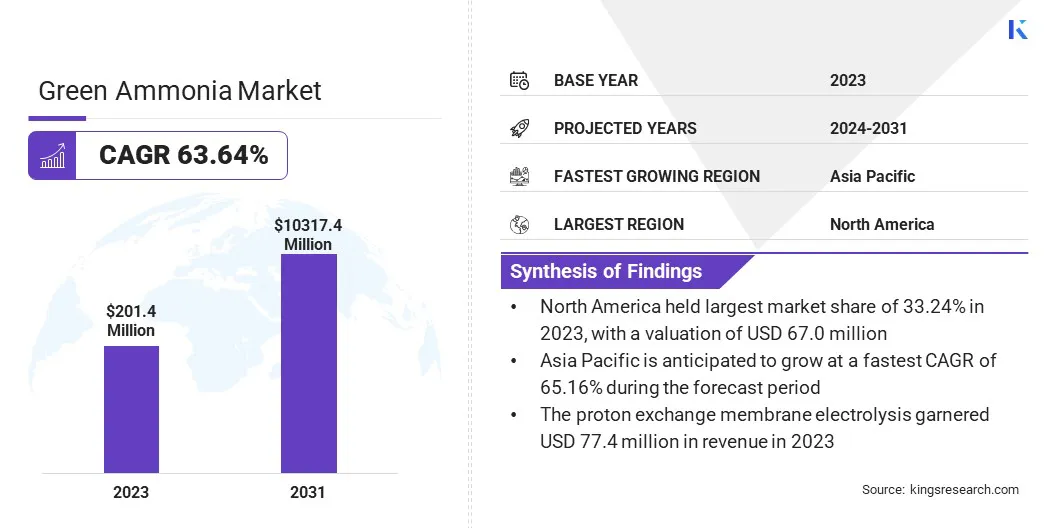

The global green ammonia market size was valued at USD 201.4 million in 2023 and is projected to grow from USD 328.3 million in 2024 to USD 10317.4 million by 2031, exhibiting a CAGR of 63.64% during the forecast period. Market growth is fueled by rising demand for sustainable agricultural solutions and robust government support, including incentives, policies, and investments that promote decarbonization and foster technological innovation.

Major companies operating in the green ammonia industry are ACME Group, BASF, ENGIE, Uniper SE, Allied Green Ammonia, Nel, Cummins Inc, Topsoe A/S, Hiringa Energy Ltd, hygenco, Siemens Energy, Enapter S.r.l., FuelPositive Corporation,t hyssenkrupp Uhde GmbH, Iberdrola, S.A., and others.

Green ammonia's versatility as both a low-emission fuel and sustainable fertilizer is accelerating market expansion. Its ability to decarbonize key sectors such as agriculture, maritime and energy is attracting strategic investments and policy support. As industries pursue net-zero goals, green ammonia is emerging as a commercially viable solution and a key driver of market growth.

- In November 2023, the World Economic Forum recognized the Kenya Nut Company as the first farm globally to produce its own sustainable, fossil fuel-free fertilizer on-site. Powered by solar energy, the facility will generate one ton of green ammonia daily by extracting hydrogen from water. In contrast to traditional ammonia production, which uses hydrogen derived from natural gas and produces significant CO2 emissions, green ammonia provides a more eco-friendly solution. With global ammonia production accounting for 1.3% of energy-related CO2 emissions, green ammonia presents a promising alternative for reducing environmental impact.

Key Highlights:

- The green ammonia market size was recorded at USD 201.4 million in 2023.

- The market is projected to grow at a CAGR of 63.64% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 67.0 million.

- The proton exchange membrane electrolysis segment garnered USD 77.4 million in revenue in 2023.

- The power generation segment is expected to reach USD 2820.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 65.16% over the forecast period.

Market Driver

Growing Adoption of Sustainable Solutions in Agriculture

The market is experiencing significant growth as industries seek sustainable alternatives to traditional ammonia production. With increasing pressure on the agricultural sector to reduce carbon footprints and chemical dependencies, green ammonia offers an eco-friendly solution. Its potential to decarbonize agriculture and serve as a clean fuel alternative is leading to increased demand.

- In March 2025, a report published by RMI (Rocky Mountain Institute) highlighted the potential of green ammonia as a sustainable alternative to traditional ammonia production. With conventional methods accounting for 84% of fertilizer-related emissions, green ammonia provides a solution to reduce carbon footprints. As the U.S. consumes 11% of global synthetic nitrogen, emerging technologies and state incentives are fostering the adoption of fertilizers.

Market Challenge

High Production Costs

The global green ammonia market faces significant challenges due to high production costs, which are primarily driven by the reliance on expensive renewable electricity and the high cost of electrolysis technology. These factors make green ammonia less economically viable compared to traditional ammonia production methods.

To overcome these challenges, stakeholders must focus on scaling up renewable energy infrastructure, investing in advanced electrolysis technologies, and reducing the cost of key components such as electrolyzers. Achieving economies of scale and improving efficiency will be critical to making green ammonia more competitive in the global market.

Market Trend

Government Incentives and Regulatory Support

The market is experiencing significant growth driven by government incentives, subsidies, and favorable policies aimed at reducing greenhouse gas emissions and advancing the transition to sustainable energy.

These initiatives are fostering investment, supporting technological innovation, and creating a favorable business environment, which is crucial for scaling production and enhancing the commercial viability of green ammonia.

- In June 2024, the Government of India, as reported by the Press Information Bureau, announced that under the National Green Hydrogen Mission, the Ministry of New and Renewable Energy (MNRE) launched the SIGHT Programme Component II to incentivize the production of green ammonia, specifically for the fertilizer sector. The MNRE also raised the annual allocation for green ammonia production from 550,000 to 750,000 tonnes, reinforcing its commitment to boosting domestic demand for green hydrogen and its derivatives.

Green Ammonia Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Proton Exchange Membrane Electrolysis, Alkaline Electrolysis, Solid Oxide Electrolysis

|

|

By End-Use

|

Power Generation, Transportation, Agricultural, Refrigeration, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Proton Exchange Membrane Electrolysis, Alkaline Electrolysis, and Solid Oxide Electrolysis): The proton exchange membrane electrolysis segment earned USD 77.4 million in 2023 due to its high efficiency, scalability, and ability to produce hydrogen using renewable energy sources, which is essential for sustainable ammonia production.

- By End-Use (Power Generation, Transportation, Agricultural, and Refrigeration): The power generation segment held a share of 27.30% in 2023, propelled by the increasing demand for clean, renewable energy solutions, where ammonia serves as a viable energy carrier and storage medium for power plants.

Green Ammonia Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America green ammonia market share stood at around 33.24% in 2023, with a valuation of USD 67.0 million. This dominance is attributed to strong government funding and initiatives that have accelerated clean energy innovation. Federal and state support, including grants, tax, incentives, and regulatory frameworks, has mobilized substantial private investment.

These efforts have enabled rapid development of decarbonized ammonia projects, positioning the region as a global leader in sustainable ammonia production.

- In January 2025, the Ammonia Energy Association announced U.S. funding for decarbonized ammonia production. A feasibility study, funded at USD 1.5 million, will be conducted by GTI Energy, Blue Sky Infrastructure, and Aker Carbon Capture to integrate carbon capture and storage (CCS) with ammonia production via steam methane reforming (SMR) at the Mosaic Faustina site in Louisiana.

Asia Pacific green ammonia industry is set to grow at a staggering CAGR of 65.16% over the forecast period. This growth is bolstered by significant government investments in decarbonized ammonia production across the countries.

They are prioritizing green hydrogen and ammonia initiatives to reduce emissions and promote sustainable energy. These investments in technologies and incentives are fueling regional market expansion.

- In November 2023, Allied Green Ammonia Pty Ltd entered into an agreement with Topsoe to deploy its green ammonia technology at a planned facility in Gove, Northern Territory, Australia. The plant is scheduled to begin green ammonia production in Q4 2028 or Q1 2029, with an expected capacity of 2,500 metric tons per day (MTPD).

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) requires ammonia manufacturers to report their greenhouse gas emissions under Subpart G of the Greenhouse Gas Reporting Program. This regulation mandates that facilities measure and disclose emissions from ammonia production, fostering transparency and accountability in managing their environmental impact.

Competitive Landscape

The green ammonia market is increasingly competitive, with key players leveraging strategic acquisitions to enhance technological capabilities, secure renewable energy sources, and scale production.

Mergers and acquisitions are central to accelerating commercialization, expanding global footprints, and strengthening market positioning amid growing demand driven by decarbonization efforts and the global energy transition.

- In September 2024, Woodside finalized the full acquisition of OCI Clean Ammonia Holding B.V. from OCI N.V. and its affiliates. This includes OCI’s lower carbon ammonia project in Texas (Project). As a global energy provider, Woodside is committed to advancing lower carbon ammonia and recognizes its growing significance in the global energy landscape. The company sees strong potential for its use in power generation, marine fuels and as an industrial feedstock, offering a cleaner alternative to more carbon-intensive fuels.

List of Key Companies in Green Ammonia Market:

- ACME Group

- BASF

- ENGIE

- Uniper SE

- Allied Green Ammonia

- Nel

- Cummins Inc

- Topsoe A/S

- Hiringa Energy Ltd

- hygenco

- Siemens Energy

- Enapter S.r.l.

- FuelPositive Corporation

- thyssenkrupp Uhde GmbH

- Iberdrola, S.A.

Recent Developments (Partnerships)

- In November 2024, Lloyd’s Register (LR) partnered with Samsung Heavy Industries (SHI) to jointly develop a floating production, storage, and offloading (FPSO) system for green ammonia. The collaboration was formalized through the signing of a Memorandum of Understanding (MoU).