Market Definition

Biomedical textiles refer to specially engineered fibrous structures and fabrics that are designed for medical and biological applications, ensuring compatibility with the human body.

These materials undergo processes such as weaving, knitting, braiding, or nonwoven fabrication using both natural fibers like cotton, silk, and collagen, as well as synthetic polymers including polyester, polytetrafluoroethylene (PTFE), and polylactic acid (PLA). Biomedical textiles perform a range of functions, ranging from temporary wound dressings to permanent implantable meshes and scaffolds that integrate with tissues.

Biomedical Textiles Market Overview

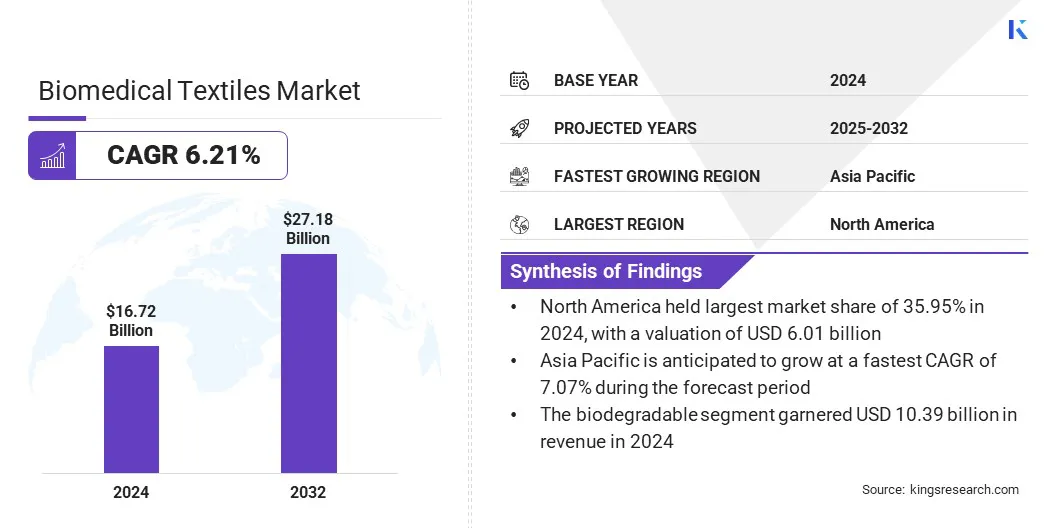

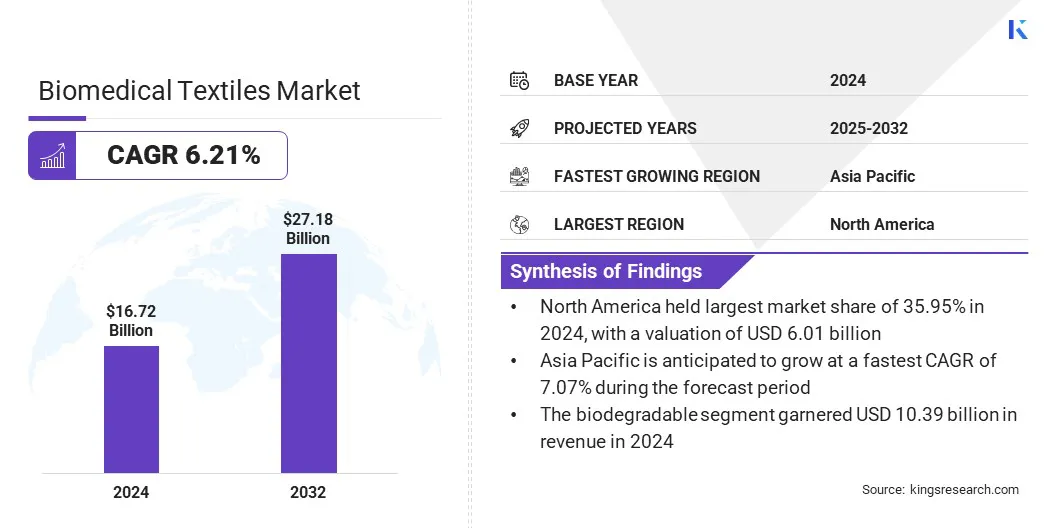

The global biomedical textiles market size was valued at USD 16.72 billion in 2024 and is projected to grow from USD 17.72 billion in 2025 to USD 27.18 billion by 2032, exhibiting a CAGR of 6.21% over the forecast period.

Adoption of biodegradable and eco-friendly fibers enhances sustainability, reduces medical waste, and improves patient compatibility. This strengthens the market by aligning with global healthcare and environmental priorities.

Key Highlights:

- The biomedical textiles industry was recorded at USD 16.72 billion in 2024.

- The market is projected to grow at a CAGR of 6.21% from 2025 to 2032.

- North America held a market of 35.95% in 2024, valued at USD 6.01 billion.

- The biodegradable segment garnered USD 10.39 billion in revenue in 2024.

- The non-implantable segment is expected to reach USD 15.47 billion by 2032.

- The woven segment is anticipated to witness the fastest CAGR of 6.45% over the forecast period.

- The hospitals segment is predicted to hold a market share of 32.93% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.07% through the projection period.

Major companies operating in the biomedical textiles market are Medtronic, DSM-Firmenich AG, Secant Group, LLC, Integer Holdings Corporation, Confluent Medical Technologies, CORTLAND BIOMEDICAL, ATEX Technologies, Inc., Poly-Med Incorporated, Corza Medical, Freudenberg SE, Medical Murray, and Bally Ribbon Mills.

The development of customized patient-specific textile structures is reshaping the market by providing solutions tailored to individual anatomical and therapeutic needs.

The use of advanced fabrication technologies such as 3D knitting, computer-aided weaving, and braiding is allowing manufacturers to create meshes, vascular grafts, or scaffolds that precisely match patient requirements. This is enhancing surgical outcomes by reducing complications and improving patient comfort with a better fit and biological integration.

- In March 2025, Cortland Biomedical, a full-service biomedical textile company, expanded its braiding capabilities by adding flat braiding and round-flat-round braiding equipment. This investment enhanced its OEM offerings with comprehensive braiding technologies, strengthening in advancing minimally invasive surgical medical devices.

Market Driver

Rapid Advancement in Resorbable Polymers

The rapid advancement in resorbable polymers is driving the biomedical textiles market. Polymers such as polylactic acid (PLA), polyglycolic acid (PGA), and polycaprolactone (PCL) are increasingly being used to create absorbable sutures, scaffolds, and wound care products. These polymers gradually degrade in the body, eliminating the need for secondary surgeries to remove implants and reducing long-term complications.

The ability to engineer degradation rates and mechanical properties enhances versatility for different medical applications. This advancement encourages adoption in regenerative medicine, cardiovascular implants, and surgical meshes, offering better healing outcomes.

- In June 2025, Ashland expanded its Viatel bioresorbable polymers portfolio with new high molecular weight grades for medical devices and aesthetic applications. This expansion addresses the evolving needs of medical device manufacturers and aesthetic medicine companies by providing advanced bioresorbable polymer solutions.

Market Challenge

High Manufacturing Costs for Advanced Biomedical Textiles

High manufacturing costs for advanced biomedical textiles are a significant challenge in the market, particularly due to the use of specialized polymers, precision fabrication methods, and stringent sterilization requirements.

Developing implantable or smart textile structures often involves high R&D investments and complex regulatory compliance, raising the overall cost burden for producers and limiting affordability for healthcare systems. This cost barrier hinders large-scale adoption in emerging economies and restricts the availability of next-generation biomedical textiles.

Companies are addressing cost challenges by investing in automated manufacturing and adopting scalable production technologies. They are also forming strategic partnerships to optimize material sourcing, reduce waste, and streamline compliance, thereby lowering costs and improving affordability.

Market Trend

Rising Integration with Smart and Electronic Textiles

The rising integration with smart and electronic textiles is driving a transformative trend in the biomedical textiles market. Manufacturers are enabling real-time monitoring of physiological parameters such as wound pH, strain, or temperature by embedding sensors, conductive yarns, and microelectronic devices into textile structures.

These innovations support personalized healthcare, enhance diagnostic capabilities, and improve post-surgical monitoring outside clinical settings. Moreover, these factors are boosting growth in wearable biomedical devices and expanding opportunities across remote patient care and home-based monitoring.

Healthcare systems’ growing focus on digital health solutions is driving the integration of smart technologies into biomedical textiles, creating a convergence of materials science and electronics that positions the market for sustained growth in the connected healthcare era.

- In March 2025, Deutsche Institute für Textil- und Faserforschung Denkendorf (DITF), a leading German textile and fiber research institute, announced the development of elastic, electrically conductive ink formulations. These innovations enable printed electronics on textiles to retain conductivity under mechanical stress, offering cost-effective and durable smart-textile solutions for industries including sports, fashion, and automotive.

Biomedical Textiles Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fiber

|

Biodegradable, Non-biodegradable

|

|

By Product

|

Non-implantable, Implantable

|

|

By Fabric

|

Woven, Non-woven, Braided, Knitted

|

|

By End User

|

Hospitals, Clinics, Ambulatory surgical centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Fiber (Biodegradable and Non-biodegradable): The biodegradable segment captured the largest share of 62.15% in 2024, due to increasing demand for eco-friendly fibers, superior biocompatibility, and safer integration into wound healing and implantable medical applications.

- By Product (Non-implantable and Implantable): The implantable segment is poised to record the fastest CAGR of 6.45% through the forecast period, owing to the rising adoption of surgical meshes, vascular grafts, and tissue scaffolds that enhance patient outcomes and recovery.

- By Fabric (Woven, Non-woven, Braided, and Knitted): The woven segment is anticipated to grow at a CAGR of 6.45% over the forecast period, due to its structural durability, controlled porosity, and suitability in long-term implants and surgical reinforcement textiles.

- By End User (Hospitals, Clinics, Ambulatory surgical centers, and Others): The hospitals segment secured the largest revenue of USD 5.56 billion in 2024, propelled by the high surgical volumes, widespread use of biomedical textiles, and reliance on advanced wound care and implantable solutions.

Biomedical Textiles Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America biomedical textiles market accounted for 35.95% of the market, reaching a valuation of USD 6.01 billion. This dominance is attributed to a well-established healthcare infrastructure, high adoption of implantable devices, and a mature regulatory framework across the region that supports innovation in medical textiles.

Research institutions and manufacturers in North America are pioneering advancements in resorbable polymers, antimicrobial fabrics, and smart textiles, enabling broader clinical applications. Rising surgical procedures, coupled with growing emphasis on patient-specific implants, are further driving the demand for biomedical textiles.

Asia Pacific is projected to expand at a CAGR of 7.07% over the forecast period. This growth is driven by rising government healthcare investments, expanding hospital infrastructure, and increasing demand for affordable wound care and surgical textiles. The region’s large patient pool, coupled with a rising incidence of chronic diseases and surgical interventions, is fueling the consumption of biomedical fabrics.

Additionally, manufacturers are increasingly setting up production units across countries in the Asia Pacific to benefit from cost efficiencies and local demand. Government initiatives promoting medical device manufacturing, coupled with efforts to align regulations with global standards, are boosting regional production capabilities, thereby driving market growth across the Asia Pacific.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates medical textiles under the Federal Food, Drug, and Cosmetic Act. It ensures that implantable and non-implantable biomedical textiles meet biocompatibility, safety, and performance standards before commercialization.

- In the European Union, the Medical Device Regulation (MDR 2017/745) regulates biomedical textiles. It outlines conformity assessment, clinical evaluation, and CE marking requirements for medical textile devices used in surgical and therapeutic applications.

- In Japan, the Pharmaceuticals and Medical Devices Act (PMD Act) regulates biomedical textiles. It governs quality assurance, safety testing, and approval procedures for textile-based medical devices to safeguard patient health.

- In China, the National Medical Products Administration (NMPA) regulates biomedical textiles. It requires pre-market approval, clinical trials, and adherence to Good Manufacturing Practices (GMP) for textile-based implants and wound care products.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates biomedical textiles. It classifies biomedical textiles within medical devices and mandates licensing, quality certifications, and compliance with safety standards before distribution.

- In Canada, the Medical Devices Regulations under the Food and Drugs Act regulate biomedical textiles. It sets licensing requirements, post-market surveillance, and labeling standards for textile-based medical products.

Competitive Landscape

Key players in the biomedical textiles industry are focusing on multi-pronged strategies to strengthen their competitive edge and capture emerging opportunities. Companies are investing heavily in R&D to develop advanced fibers with enhanced biocompatibility, durability, and biodegradability tailored for implantable and non-implantable uses. Moreover, market players are prioritizing automation and scalable manufacturing to reduce costs and meet rising global demand.

- In February 2024, Solesis announced plans to establish a new manufacturing site in Costa Rica, its first dedicated facility for implantable textile components, polymer-based devices, and single-use technologies. The site will enhance the company’s portfolio for next-generation patient care.

Key Companies in Biomedical Textiles Market:

- Merck KGaA

- Cibus Inc.

- Recombinetics

- Sangamo Therapeutics

- Editas Medicine

- Precision BioSciences

- Therapeutics

- Intellia Therapeutics, Inc.

- Caribou Biosciences, Inc.

- Cellectis S.A.

Recent Developments (Launch)

- In August 2025, Corza Medical launched its Biomedical Textiles Innovation Lab in Taunton, UK. This new facility will allow OEM partners to rapidly prototype, test, and optimize advanced textile-based medical materials.