Market Definition

The market refers to the global industry of outsourcing partners that provide development and manufacturing services for biologic drugs. This market encompasses a broad range of capabilities, including cell line development, process optimization, analytical testing, clinical and commercial-scale production, and fill-finish operations.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the forecast period.

Biologics CDMO Market Overview

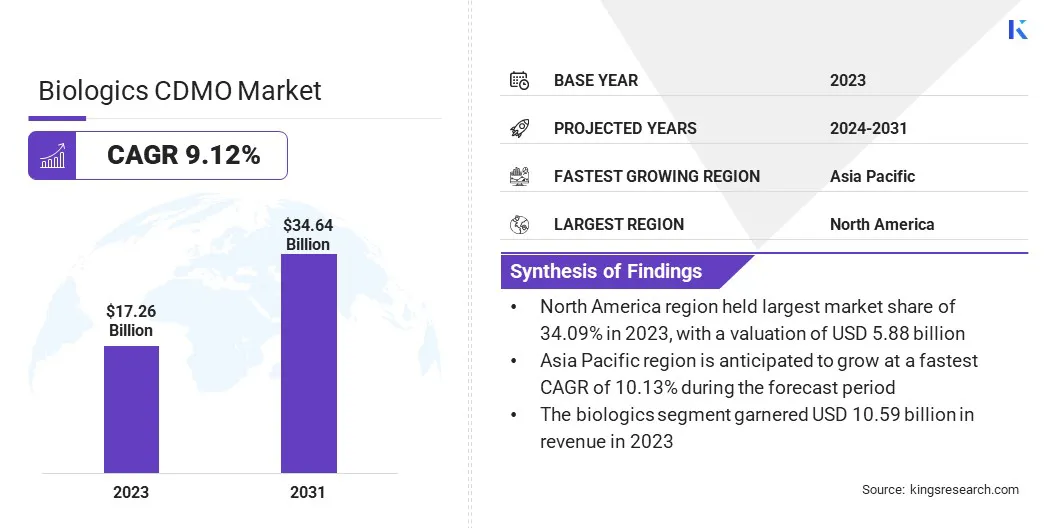

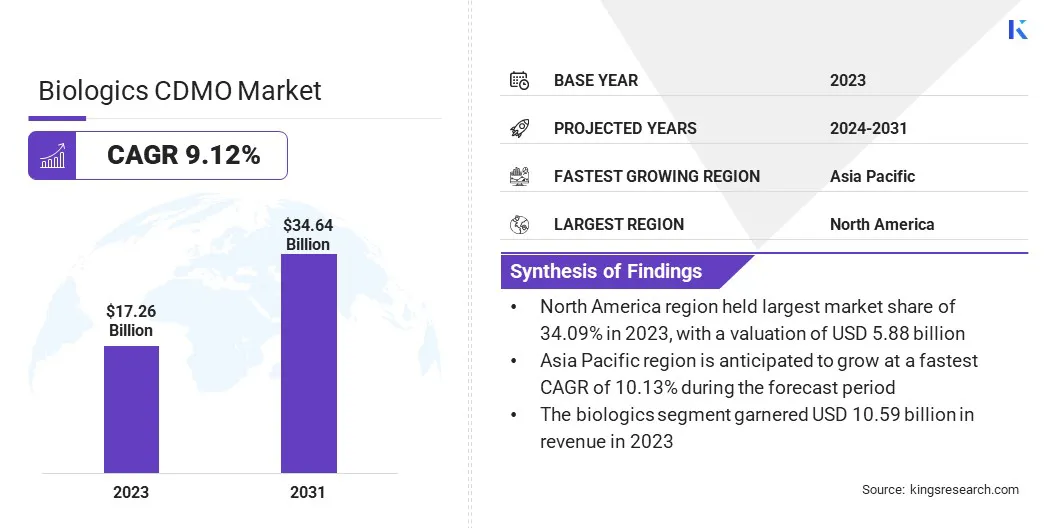

The global biologics CDMO market size was valued at USD 17.26 billion in 2023 and is projected to grow from USD 18.81 billion in 2024 to USD 34.64 billion by 2031, exhibiting a CAGR of 9.12% during the forecast period.

This growth is attributed to the increasing demand for biologic therapies across various therapeutic areas, including oncology, immunology, and rare diseases. The market is being fueled by advancements in biologics such as monoclonal antibodies, cell and gene therapies, and biosimilars.

Major companies operating in the biologics CDMO industry are Abzena, Boehringer Ingelheim International GmbH, AGC Biologics, Samsung, Eurofins Scientific, WuXi Biologics, Almac Group, Lonza, Curia Global, Inc., Siegfried Holding AG, Thermo Fisher Scientific Inc., Rentschler Biopharma SE, Catalent, Inc., Recipharm AB, and FUJIFILM.

Technological advancements, including the adoption of single-use systems, continuous bioprocessing, and AI-driven manufacturing, are improving production efficiency and scalability. These factors, combined with an increase in strategic partnerships between biopharma companies and CDMOs, are contributing to the market's expansion.

- In November 2024, FUJIFILM announced the first phase of its global CDMO ecosystem expansion at the Hillerød site. The expansion includes six mammalian cell bioreactors and supports the company's strategy to enhance biologics production capacity.

Key Highlights:

- The biologics CDMO industry size was valued at USD 17.26 billion in 2023.

- The market is projected to grow at a CAGR of 9.12% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 5.88 billion.

- The mammalian segment garnered USD 9.25 billion in revenue in 2023.

- The biologics segment is expected to reach USD 20.79 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.13% during the forecast period.

Market Driver

"Growing Biopharmaceutical Pipelines"

The biologics CDMO market is driven by the growing biopharmaceutical pipelines across established and emerging biotech firms. Companies are relying on CDMOs to provide the specialized expertise, infrastructure, and regulatory support needed for biologics production as the number of biologic candidates in development increases.

CDMOs offer integrated services, from early-stage development to commercial-scale manufacturing, which reduces time-to-market and capital investment for biopharma companies.

This trend is particularly strong among small and mid-sized firms that lack in-house manufacturing capabilities, making outsourcing a critical strategy to advance clinical programs and meet commercial demand efficiently.

- In March 2024, Alcami Corporation partnered with Tanvex CDMO to offer a comprehensive solution for biologics developers. This partnership merges Alcami’s expertise in sterile fill-finish services, packaging, and labeling with Tanvex’s advanced bulk drug substance development and manufacturing capabilities.

Market Challenge

"High Capital Investment Required for Biologics Manufacturing"

One of the major challenges in the biologics CDMO market is the high capital investment required for biologics manufacturing infrastructure. Setting up advanced facilities with controlled environments, single-use systems, and large-scale bioreactors demands significant financial resources.

This can limit the ability of smaller CDMOs to scale operations or compete for large contracts, especially when demand fluctuates. A potential solution is to adopt modular and flexible manufacturing platforms.

These systems reduce upfront capital expenditure and enable faster deployment, while allowing CDMOs to adapt production lines for multiple products, improving capacity utilization and responsiveness to client needs.

Market Trend

"Adoption of Advanced Development Platforms"

The biologics CDMO market is registering a significant shift toward the adoption of advanced development platforms. CDMOs are increasingly investing in cutting-edge technologies such as cell line engineering, high-throughput screening, and AI-driven process optimization. These platforms enable the efficient development and optimization of biologics, which is crucial for enhancing therapeutic efficacy.

By integrating these technologies, CDMOs can reduce development timelines, improve yield consistency, and enhance overall product quality. This shift allows companies to stay competitive in a rapidly evolving market and meet the rising demand for more targeted and personalized therapies.

- In September 2024, Samsung Biologics launched two innovative development platforms, S-OptiCharge and S-AfuCHO. The platforms are designed to enhance therapeutic efficacy by improving antibody-dependent cellular cytotoxicity (ADCC) activity and optimizing charge variant distribution, ensuring high product quality and therapeutic safety.

Biologics CDMO Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Mammalian, Non-mammalian

|

|

By Product

|

Biologics, Biosimilars

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Mammalian, Non-mammalian): The mammalian segment earned USD 9.25 billion in 2023, due to its high compatibility with human proteins and increasing demand for monoclonal antibodies.

- By Product (Biologics, Biosimilars): The biologics segment held 61.38% share of the market in 2023, on account of its strong adoption in chronic disease treatment and a steady pipeline of innovative therapies.

Biologics CDMO Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America biologics CDMO market share stood at around 34.09% in 2023, with a valuation of USD 5.88 billion. The market dominance is attributed to strong R&D investments, early adoption of advanced biomanufacturing technologies, and the presence of leading biotech and pharmaceutical companies in the region.

North America biologics CDMO market share stood at around 34.09% in 2023, with a valuation of USD 5.88 billion. The market dominance is attributed to strong R&D investments, early adoption of advanced biomanufacturing technologies, and the presence of leading biotech and pharmaceutical companies in the region.

The region is backed by its well-established regulatory systems and streamlined approval processes, which accelerate project timelines. The market is also driven by the rising demand for monoclonal antibodies and cell and gene therapies. Long-term outsourcing partnerships and continuous innovation in biologics manufacturing continue to strengthen the market position of North America.

- In June 2024, Bionova Scientific, a U.S. biologics CDMO of the Asahi Kasei Group, announced plans to establish a new facility in The Woodlands, Texas. The facility will focus on process development and GMP manufacturing of plasmid DNA, aiming to support the growth of cell and gene therapies and other new therapeutic modalities.

The biologics CDMO industry in Asia Pacific is poised to grow at a significant CAGR of 10.13% over the forecast period. The market is driven by the increasing demand for biologics, expanding biopharma infrastructure, and rising outsourcing activities across emerging economies.

Governments in countries like China, India, and South Korea are investing in biologics manufacturing hubs and offering policy support to attract global CDMO partnerships.

Lower production costs, growing clinical trial activity, and a rising focus on biosimilars in the region are encouraging multinational firms to collaborate with regional service providers.

Regulatory Frameworks

- In the U.S., biologics CDMOs operate under the U.S. Food and Drug Administration (FDA), specifically through the Center for Biologics Evaluation and Research (CBER), which enforces the Public Health Service Act and the Federal Food, Drug, and Cosmetic Act.

- In Europe, biologics CDMOs follow the European Medicines Agency (EMA) guidelines that govern the development, manufacturing, and marketing of biologics. The centralized marketing authorization procedure managed by the EMA is mandatory for most biologics, ensuring a single approval valid across all EU member states.

Competitive Landscape

Companies are increasing capacity through facility upgrades and plant developments to meet the growing demands for large-molecule biologics. These expansions include building dedicated biologics manufacturing units equipped with advanced bioprocessing systems, high-capacity bioreactors, and integrated fill-finish lines.

Some facilities are being designed to support clinical and commercial-scale production, allowing flexible responses to client needs. These agreements often include multi-product, multi-year arrangements that provide CDMOs with stable order volumes, while giving biopharma clients guaranteed access to critical manufacturing capacities.

CDMOs can co-develop scalable processes for innovative therapeutics such as gene therapies, bispecific antibodies, and recombinant vaccines by partnering during the early discovery or preclinical stages.

- In April 2025, AGC Biologics launched its new Cell and Gene Technologies Division to enhance existing capabilities and support developers. The division will leverage proprietary platforms and a global development network, with the Milan site serving as the central hub for cell and gene therapy services.

List of Key Companies in Biologics CDMO Market:

- Abzena

- Boehringer Ingelheim International GmbH

- AGC Biologics

- Samsung

- Eurofins Scientific

- WuXi Biologics

- Almac Group

- Lonza

- Curia Global, Inc.

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

- Rentschler Biopharma SE

- Catalent, Inc.

- Recipharm AB

- FUJIFILM

Recent Development

- In April 2025, LOTTE BIOLOGICS launched its full-scale antibody-drug conjugate (ADC) manufacturing facility at the Syracuse Bio Campus. This marks the official launch of its ADC CDMO services, following a contract with an Asia-based biotech company for manufacturing a clinical-stage ADC candidate.

North America biologics CDMO market share stood at around 34.09% in 2023, with a valuation of USD 5.88 billion. The market dominance is attributed to strong R&D investments, early adoption of advanced biomanufacturing technologies, and the presence of leading biotech and pharmaceutical companies in the region.

North America biologics CDMO market share stood at around 34.09% in 2023, with a valuation of USD 5.88 billion. The market dominance is attributed to strong R&D investments, early adoption of advanced biomanufacturing technologies, and the presence of leading biotech and pharmaceutical companies in the region.