Market Definition

A biological safety cabinet (BSC) is a ventilated, enclosed laboratory workspace designed to safely handle biohazardous materials by protecting personnel, the environment, and the samples. It utilizes controlled airflow and high-efficiency particulate air (HEPA) filtration, which prevents contamination.

Widely used in microbiology, biotechnology, and pharmaceutical research, BSCs are essential for maintaining biosafety standards in laboratories working with infectious or hazardous biological materials.

Biological Safety Cabinet Market Overview

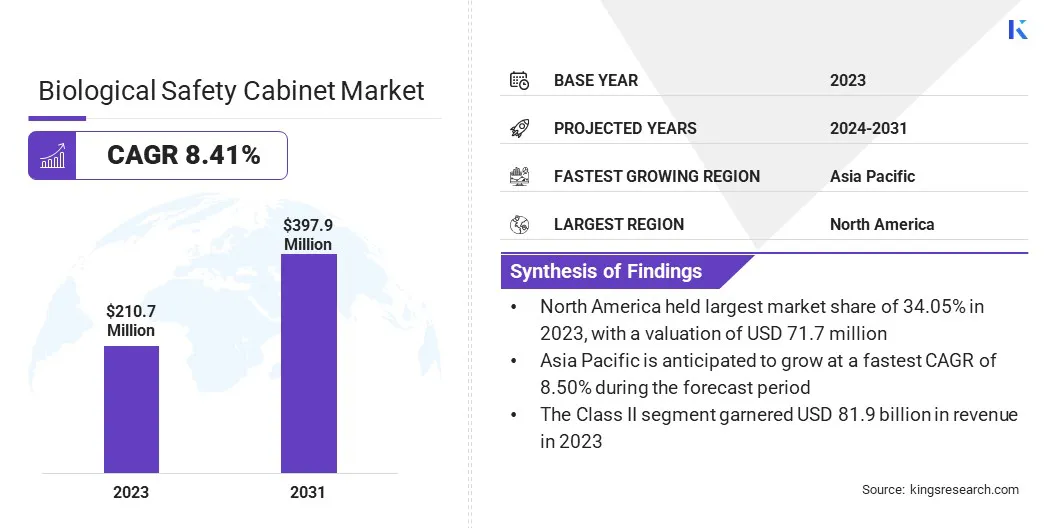

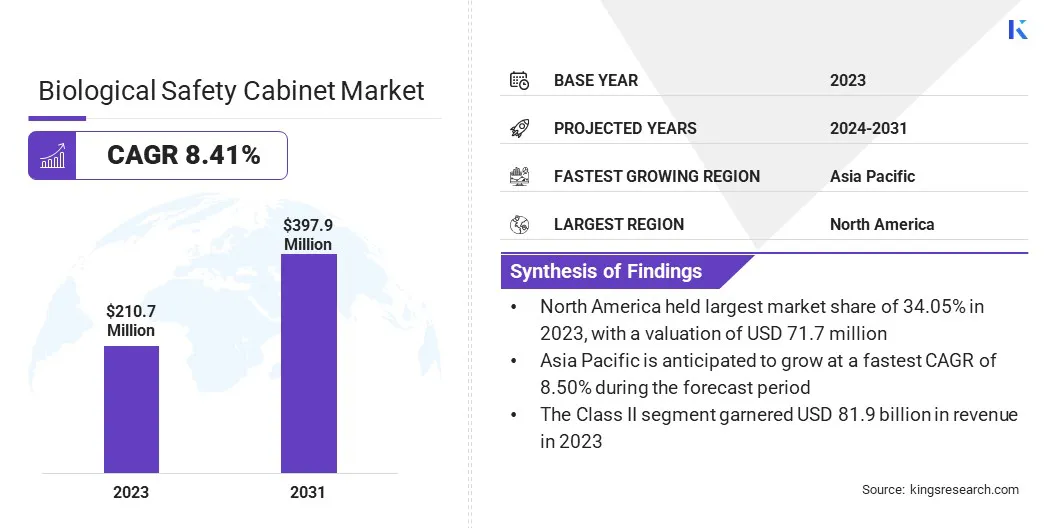

The global biological safety cabinet market size was valued at USD 210.7 million in 2023, which is estimated to be valued at USD 226.0 million in 2024 and reach USD 397.9 million by 2031, growing at a CAGR of 8.41% from 2024 to 2031.

The growth of the market is driven by increasing demand for laboratory safety in the research and healthcare sectors, particularly in the biotechnology and pharmaceutical industries.

Strict government regulations ensuring worker protection and contamination control further boost market expansion. Additionally, innovations in product design, such as enhanced user workspace and integrated safety features, are enhancing the appeal of BSCs.

Major companies operating in the biological safety cabinet industry are Thermo Fisher Scientific Inc., Kewaunee International Group, The Baker Company, Labconco, FASTER S.r.l., Syntegon Telstar, SLU, Air Science USA, Haier Biomedical, Cruma S.A., Berner International GmbH, Germfree, Esco Micro Pte. Ltd., Biolab Scientific, LaboGene, LAMSYSTEMS CC, and others.

Increasing financial support for life sciences and biotechnology research is contributing to the growth of the market. Pharmaceutical companies, research institutions, and government agencies are allocating substantial budgets to drug discovery, vaccine development, and microbiological studies.

Expanding R&D activities in molecular biology and cell culture research is fueling the demand for biosafety cabinets to maintain contamination-free environments. Investments in biotechnology startups and academic research facilities are further increasing the adoption of advanced laboratory equipment.

- In October 2024, the UK biotech sector secured an impressive USD 1.02 billion in Q3 2024, demonstrating strong investor confidence despite challenging global market conditions, according to the BioIndustry Association (BIA). Global venture capital investment in biotech surged to USD 8.77 billion during the quarter, reflecting a 90.2% increase from the previous year. The US led the market with USD 5.72 billion in investments, while the UK emerged as Europe's top performer, attracting USD 676 million in funding.

Key Highlights:

- The biological safety cabinet industry size was recorded at USD 210.7 million in 2023.

- The market is projected to grow at a CAGR of 8.41% from 2024 to 2031.

- North America held a share of 34.05% in 2023, valued at USD 71.7 million.

- The Class II segment garnered USD 81.9 million in revenue in 2023.

- The pharmaceutical and biotechnology companies segment is expected to reach USD 165.1 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 8.50% over the forecast period.

Market Driver

"Growing Focus on Laboratory Safety and Worker Protection"

Rising awareness of occupational safety in research and healthcare settings is propelling the growth of the biological safety cabinet market. Laboratory-acquired infections and exposure to hazardous biological agents pose significant health risks to researchers and technicians.

Institutions are prioritizing investments in biosafety cabinets to comply with workplace safety regulations and minimize contamination risks. The adoption of protective laboratory equipment in hospitals, pharmaceutical companies, and academic research centers is growing due to increased safety concerns.

- In August 2024, Molecular Devices unveiled its new Life Science facility, equipped with Monmouth Scientific Class 2 Biological Safety Cabinets. These advanced biosafety cabinets are designed to enhance sterility and efficiency in organoid manufacturing, crucial for maintaining the safe handling of biological materials.

The integration of these high-performance systems highlights the growing demand for biological safety cabinets, particularly in the biotechnology and pharmaceutical research sectors.

Expanding initiatives to improve laboratory protocols and training programs on biosafety measures are further highlighting the need for high-performance biosafety cabinets across various industries.

Market Challenge

"Supply Chain Disruptions"

A key challenge impeding the growth of the biological safety cabinet market is supply chain disruptions, which hinder the timely procurement of essential components. Global shortages in materials, including specialized filters and electronics, are resulting in production delays.

To mitigate this challenge, companies are diversifying their supplier base, strengthening local partnerships, and utilizing advanced manufacturing technologies to reduce dependence on external sources.

Additionally, strategic inventory management practices, such as just-in-time systems, are being employed to optimize product availability and minimize delays in delivering critical laboratory equipment.

Market Trend

"Expansion of Biopharmaceutical and Vaccine Development"

The biological safety cabinet market is expanding due to increasing R&D activities in biopharmaceuticals and vaccine production. Rising demand for monoclonal antibodies, gene therapies, and cell-based treatments is increasing investments in laboratory infrastructure.

Vaccine manufacturers are deploying biosafety cabinets to ensure aseptic conditions during formulation and quality control processes. Biopharmaceutical firms involved in recombinant DNA technology and protein synthesis are integrating advanced containment solutions to maintain biosafety standards.

Growth in global immunization programs and strategic collaborations in vaccine research are further reflecting the need for high-efficiency biological safety cabinets in pharmaceutical manufacturing and clinical testing environments.

- In August 2024, the U.S. Food and Drug Administration granted Emergency Use Authorization (EUA) for updated mRNA COVID-19 vaccines featuring a monovalent component targeting the Omicron variant KP.2 strain of SARS-CoV-2. The revised Moderna and Pfizer vaccines are designed to address this specific strain, while the Novavax vaccine focuses on the JN.1 variant. These updates aim to enhance protection against evolving virus strains during the 2024-2025 flu season.

Biological Safety Cabinet Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Class I, Class II, Class III

|

|

By End User

|

Pharmaceutical and Biotechnology Companies, Academic and Research Laboratories, Diagnostics Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Class I, Class II, and Class III): The Class II segment earned USD 81.9 million in 2023 due to its ability to offer superior protection against hazardous biological agents while providing a controlled environment.

- By End User (Pharmaceutical and Biotechnology Companies, Academic and Research Laboratories, and Diagnostics Laboratories): The pharmaceutical and biotechnology companies segment held a share of 41.32% in 2023, attributed to the high demand for stringent safety measures and advanced equipment required for research, development, and production of pharmaceuticals and biologics.

Biological Safety Cabinet Market Regional Analysis

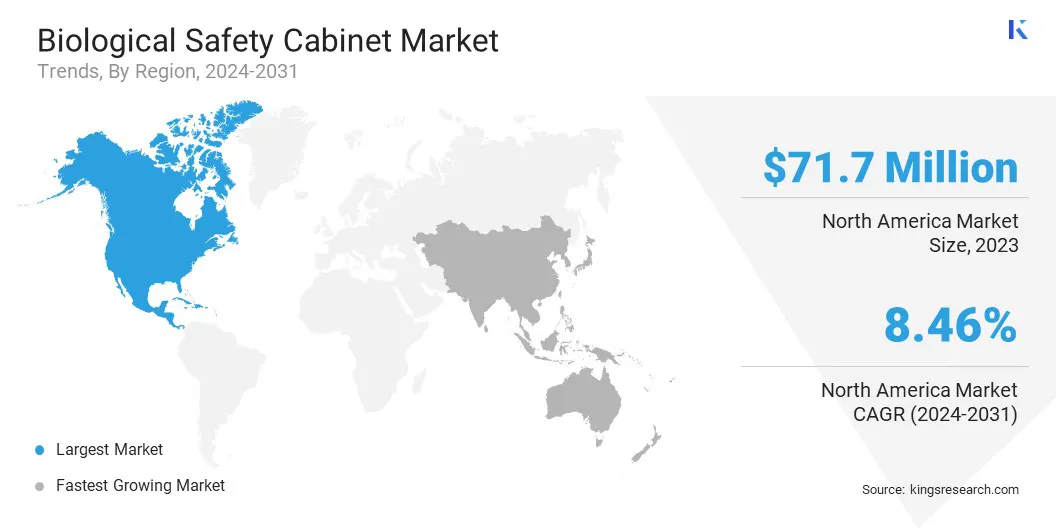

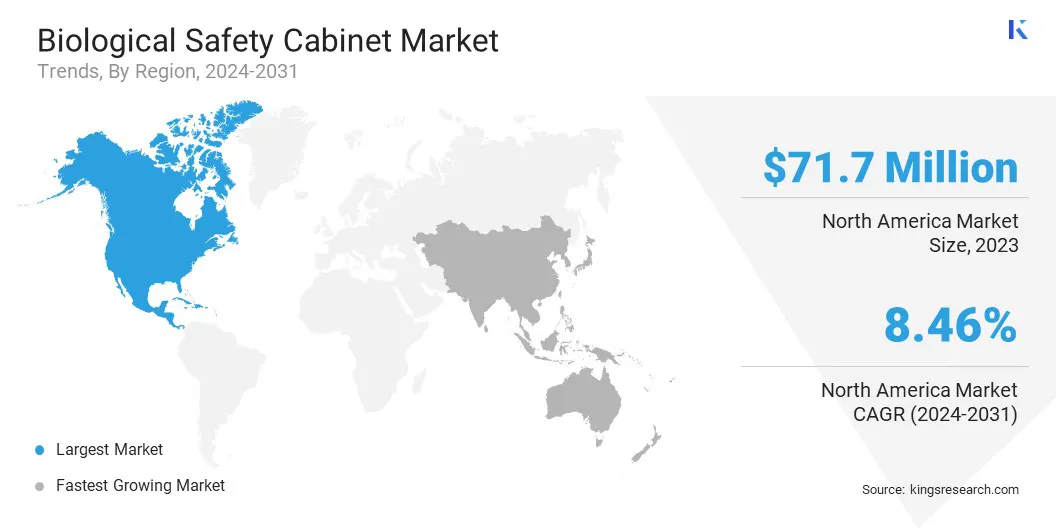

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America biological safety cabinet market captured a substantial share of around 34.05% in 2023, valued at USD 71.7 million. North America, particularly the United States, is witnessing increased investments in healthcare infrastructure, including the expansion of biotechnology and pharmaceutical research facilities.

These investments support the need for high-quality lab equipment, including biological safety cabinets, to maintain safety standards in laboratories and healthcare environments, aiding regional market growth.

Additionally, a surge in biotechnology investments, particularly within research and development, is boosting this expansion. As companies focus on innovations in genomics, cell biology, and personalized medicine, significant funding is being allocated to advanced research labs. This investment is expected to fuel sustained market growth in the region.

- Goldman Sachs is entering the biotech sector with a USD 650 million investment raised to fund privately held startups. The firm has launched its inaugural life sciences fund, West Street Life Sciences I, targeting companies in areas such as genetic medicine, cell therapies, immunotherapies, synthetic biology, artificial intelligence, and life science tools.

Asia Pacific biological safety cabinet industry is set to grow at a CAGR of 8.50% over the forecast period. The region is witnessing a surge in biotech startups and expanding life sciences research initiatives.

- The India Brand Equity Foundation report from November 2024 highlights that the biotechnology sector in India has seen a significant surge in startup activity, with around 6,000 new startups registered by 2023. India is home to 665 FDA-approved plants in the U.S. and contributes to 44% of global Abbreviated New Drug Applications (ANDA). Additionally, the country boasts over 1,400 manufacturing plants that meet WHO compliance standards, solidifying its position as a key player in the global pharmaceutical and biotechnology markets.

With the rise in venture capital funding and collaborations, there is an increasing demand for high-quality laboratory equipment, including biological safety cabinets, to ensure the safe handling of biological substances. This trend is particularly evident in China, South Korea, and India, where government policies and global partnerships are promoting growth in biotech and pharmaceuticals

Regulatory Frameworks

- In the U.S., the Centers for Disease Control and Prevention (CDC) and the Occupational Safety and Health Administration (OSHA) govern the use of BSCs. The CDC’s Biosafety in Microbiological and Biomedical Laboratories (BMBL) provides safety guidelines, while OSHA enforces workplace safety standards, ensuring proper use and installation of BSCs.

- In the UK, the Health and Safety Executive (HSE) regulates laboratory safety, including the use of BSCs. The Control of Substances Hazardous to Health (COSHH) regulations ensure the safe handling of hazardous biological materials, while HSE guidelines focus on maintaining a secure environment through appropriate BSC usage.

- In Germany, the Federal Institute for Occupational Safety and Health (BAuA) sets guidelines for laboratory safety, including BSCs. The German Work Safety Act outlines regulations for handling hazardous materials, while standards from the German Institute for Standardization (DIN) ensure that BSCs meet necessary safety and performance criteria.

- In China, the National Health Commission (NHC) regulates laboratory biosafety, including Biological Safety Cabinets (BSCs), ensuring safe handling of biological materials. The General Administration of Quality Supervision, Inspection, and Quarantine (AQSIQ) oversees the safety and quality of laboratory equipment, enforcing stringent standards for BSCs and their compliance.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) governs laboratory safety, including the use of BSCs. The Industrial Safety and Health Act provides guidelines for safe biological material handling, while the Japan Industrial Standards Committee (JISC) establishes safety and performance standards for BSCs.

- In India, the Department of Biotechnology (DBT) sets regulations for laboratory biosafety, including the use of BSCs. The Bureau of Indian Standards (BIS) develops standards for laboratory equipment, including BSCs, ensuring they meet safety and performance criteria for effective use in research and healthcare environments.

Competitive Landscape

The biological safety cabinets industry is characterized by a large number of participants, including both established corporations and emerging players. Several market participants are incorporating advanced technologies such as HEPA filtration systems, UV sterilization, and touchless controls to improve the cabinet's performance, ensuring higher protection against biological contaminants.

In addition, the designs are being optimized to offer a more efficient workspace, with increased internal volumes and ergonomic features that allow better movement and functionality for users. These innovations are boosting the growth of the BSC market by meeting the evolving needs of research, healthcare, and biotech industries.

- In October 2024, Telstar introduced the Telstar BioMax, a large-scale Class II biological safety cabinet designed to accommodate objects over 500mm in height or depth, such as cytometers and robots, which require user protection during operation. This new series of extra-large cabinets provides triple protection while maximizing available workspace for users.

List of Key Companies in Biological Safety Cabinet Market:

- Thermo Fisher Scientific Inc.

- Kewaunee International Group

- The Baker Company

- Labconco

- FASTER S.r.l.

- Syntegon Telstar, SLU

- Air Science USA

- Haier Biomedical

- Cruma S.A.

- Berner International GmbH

- Germfree

- Esco Micro Pte. Ltd.

- Biolab Scientific

- LaboGene

- LAMSYSTEMS CC

Recent Developments (M&A/New Product Launch)

- In November 2024, Kewaunee Scientific Corporation successfully acquired Nu Aire, a Minneapolis-based company, for USD 55 million, subject to adjustments for debt, cash, transaction expenses, and net working capital. This acquisition supports Kewaunee’s strategy to accelerate its goal of becoming the market leader in the design and manufacturing of laboratory furniture and essential technical products for laboratory setups.

- In August 2024, Labconco unveiled its redesigned Logic Biosafety Cabinet (BSC), combining over 50 years of biosafety expertise with cutting-edge technology to meet the evolving needs of modern laboratories. Central to this innovation is the Logic OS, which can be accessed via a user-friendly 5” touchscreen interface inside the cabinet. This updated system enhances safety and convenience while also reducing energy consumption by up to 30% and extending filter life.

- In June 2024, Telstar introduced its latest innovations and services aimed at improving efficiency and ensuring compliance within the pharmaceutical industry. The new offerings include advanced process equipment and technologies for pharmaceutical manufacturing and research & development, highlighted by the BioMax biological safety cabinet, which provides additional space to accommodate specific procedures.